50/50 Shared Ownership Property

50/50 Shared Ownership Property - Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. If you both have a 50% equal ownership, you each have equal access to the property. If their interests are unequal then. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. They can depart from the standard 50/50 split for tax purposes only where: Neither of you could realistically deny access to the. Can i complete the tax return (100%) for. Therefore, if there are two owners they must hold the property 50/50. My husband works and i don't. Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for.

They can depart from the standard 50/50 split for tax purposes only where: If their interests are unequal then. Therefore, if there are two owners they must hold the property 50/50. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. Can i complete the tax return (100%) for. We (husband and wife) jointly own a property (50/50) for rent. Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for. Neither of you could realistically deny access to the. My husband works and i don't.

We (husband and wife) jointly own a property (50/50) for rent. If there are three owners then it must be a third each. Neither of you could realistically deny access to the. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. My husband works and i don't. They can depart from the standard 50/50 split for tax purposes only where: Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. If you both have a 50% equal ownership, you each have equal access to the property. Therefore, if there are two owners they must hold the property 50/50. Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for.

Shared Ownership Chesire Onward Living

If their interests are unequal then. If there are three owners then it must be a third each. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. Therefore, if there are two owners they must hold the property 50/50. They can depart from the standard 50/50 split for tax purposes only where:

Your Guide to Shared Ownership Property

Neither of you could realistically deny access to the. Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. We (husband and wife) jointly own a property (50/50) for rent. Each spouse or civil partner is in fact entitled to a share other than 50/50 in.

Shared Ownership Harbour Mortgage Solutions Ltd

If you both have a 50% equal ownership, you each have equal access to the property. They can depart from the standard 50/50 split for tax purposes only where: If their interests are unequal then. Can i complete the tax return (100%) for. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the.

Shared Ownership Ticketing Appy Pie's Best Free Help Desk Software

Can i complete the tax return (100%) for. My husband works and i don't. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. Therefore, if there are two owners they must hold the property 50/50. They can depart from the standard 50/50 split for tax purposes only where:

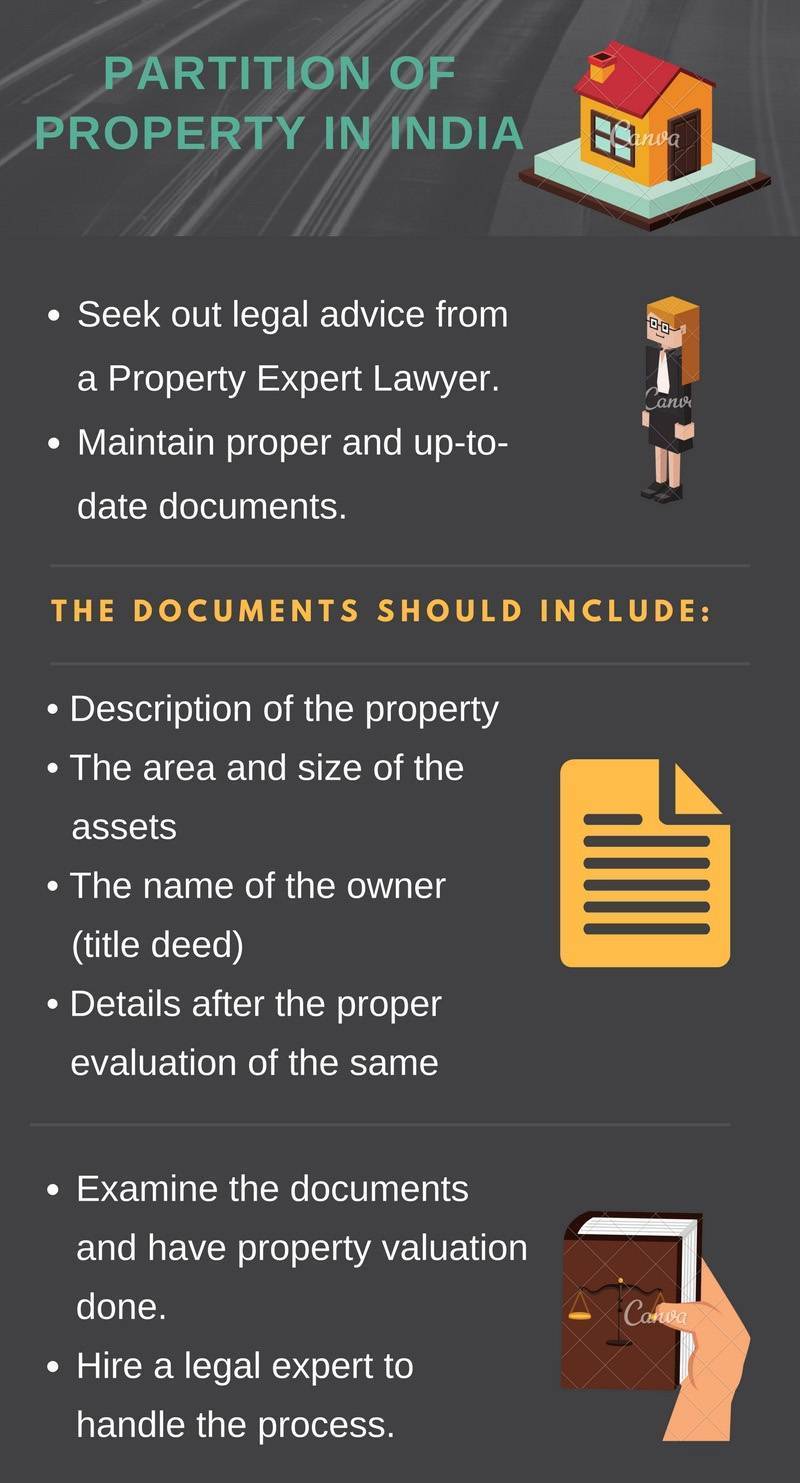

Partition of shared ownership of property travel to India not mandatory

Neither of you could realistically deny access to the. Can i complete the tax return (100%) for. If you both have a 50% equal ownership, you each have equal access to the property. If their interests are unequal then. Therefore, if there are two owners they must hold the property 50/50.

Pros And Cons Of Shared Ownership On A Property Find Dir

Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. Neither of you could realistically deny access to the. They can depart from the standard 50/50 split for tax purposes only where: Each spouse or civil partner is in fact entitled to a share other than.

Shared Ownership Property Insurance A Comprehensive Guide Metaverse

If their interests are unequal then. My husband works and i don't. We (husband and wife) jointly own a property (50/50) for rent. If you both have a 50% equal ownership, you each have equal access to the property. Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether.

Available shared ownership properties from Advance Housing

Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836. We (husband and wife) jointly own a property (50/50) for rent. Therefore, if there are two owners they must.

Shared Ownership Explained Property Booking

Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for. Neither of you could realistically deny access to the. My husband works and i don't. We (husband and wife) jointly own a property (50/50) for rent. Income from property held jointly by married couples and.

Shared ownership homes Vivla

My husband works and i don't. We (husband and wife) jointly own a property (50/50) for rent. Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for. Can i complete the tax return (100%) for. If there are three owners then it must be a.

Neither Of You Could Realistically Deny Access To The.

Married couple and civil partners who live together and who jointly own a rental property in unequal shares should assess whether it is preferable for. If you both have a 50% equal ownership, you each have equal access to the property. Each spouse or civil partner is in fact entitled to a share other than 50/50 in the. Income from property held jointly by married couples and civil partners is treated as beneficially owned by the individuals in equal shares under ita/s836.

If There Are Three Owners Then It Must Be A Third Each.

We (husband and wife) jointly own a property (50/50) for rent. If their interests are unequal then. They can depart from the standard 50/50 split for tax purposes only where: Therefore, if there are two owners they must hold the property 50/50.

Can I Complete The Tax Return (100%) For.

My husband works and i don't.