Refunds Received For State/Local Tax Returns Turbotax

Refunds Received For State/Local Tax Returns Turbotax - If all three of the following are true, your refund counts as. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the.

Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. If all three of the following are true, your refund counts as. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the.

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If all three of the following are true, your refund counts as. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not.

File Federal Tax On Turbotax

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. If all three of the.

Turbotax transmit my returns now pjawetel

If all three of the following are true, your refund counts as. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you.

TurboTax Customer Support Tips For Getting The Help You Need During

Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year.

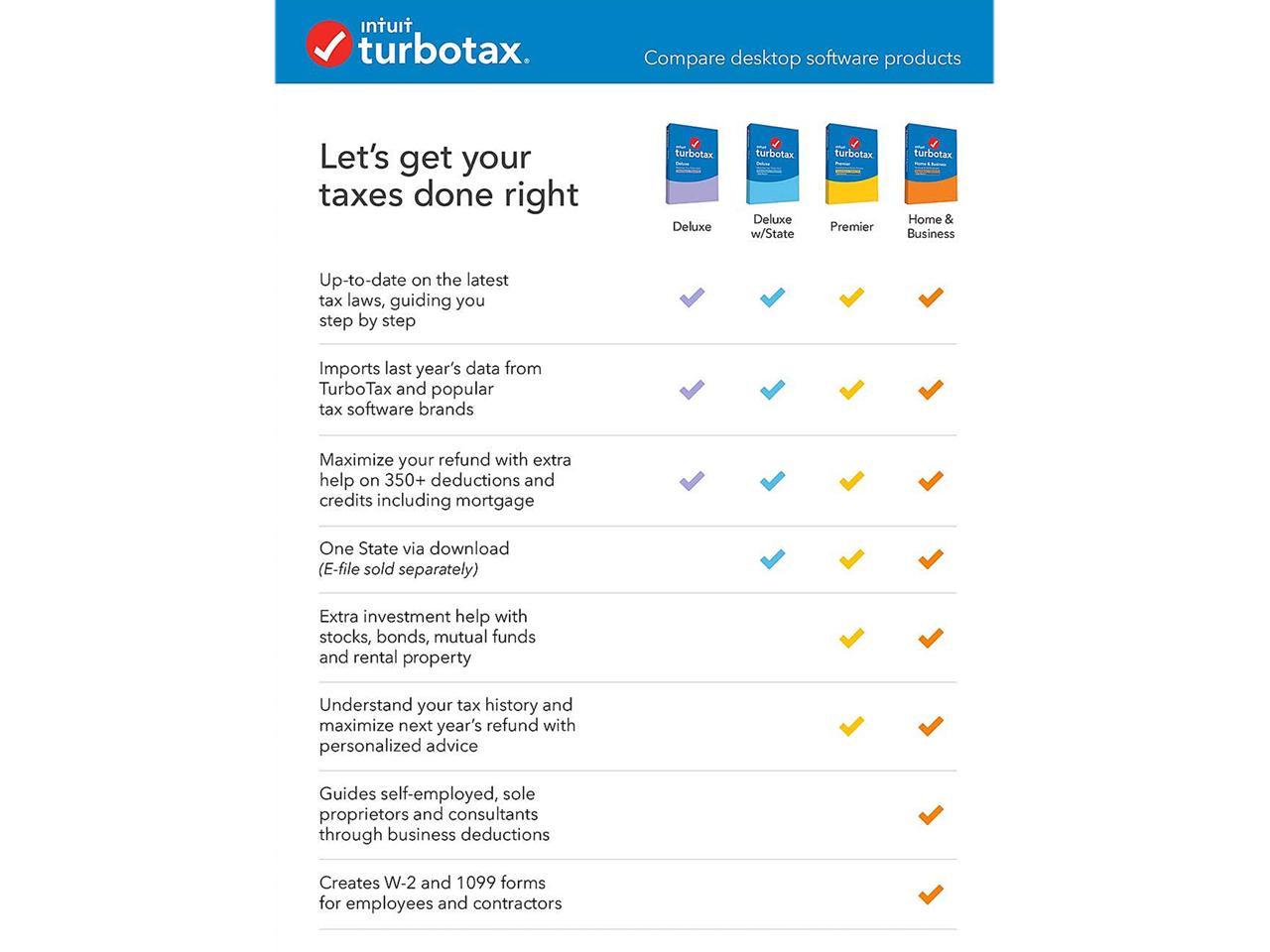

TurboTax Deluxe 2022 Tax Software, Federal and State Tax Return

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. If all three of the following are true, your refund counts as. If you receive a refund.

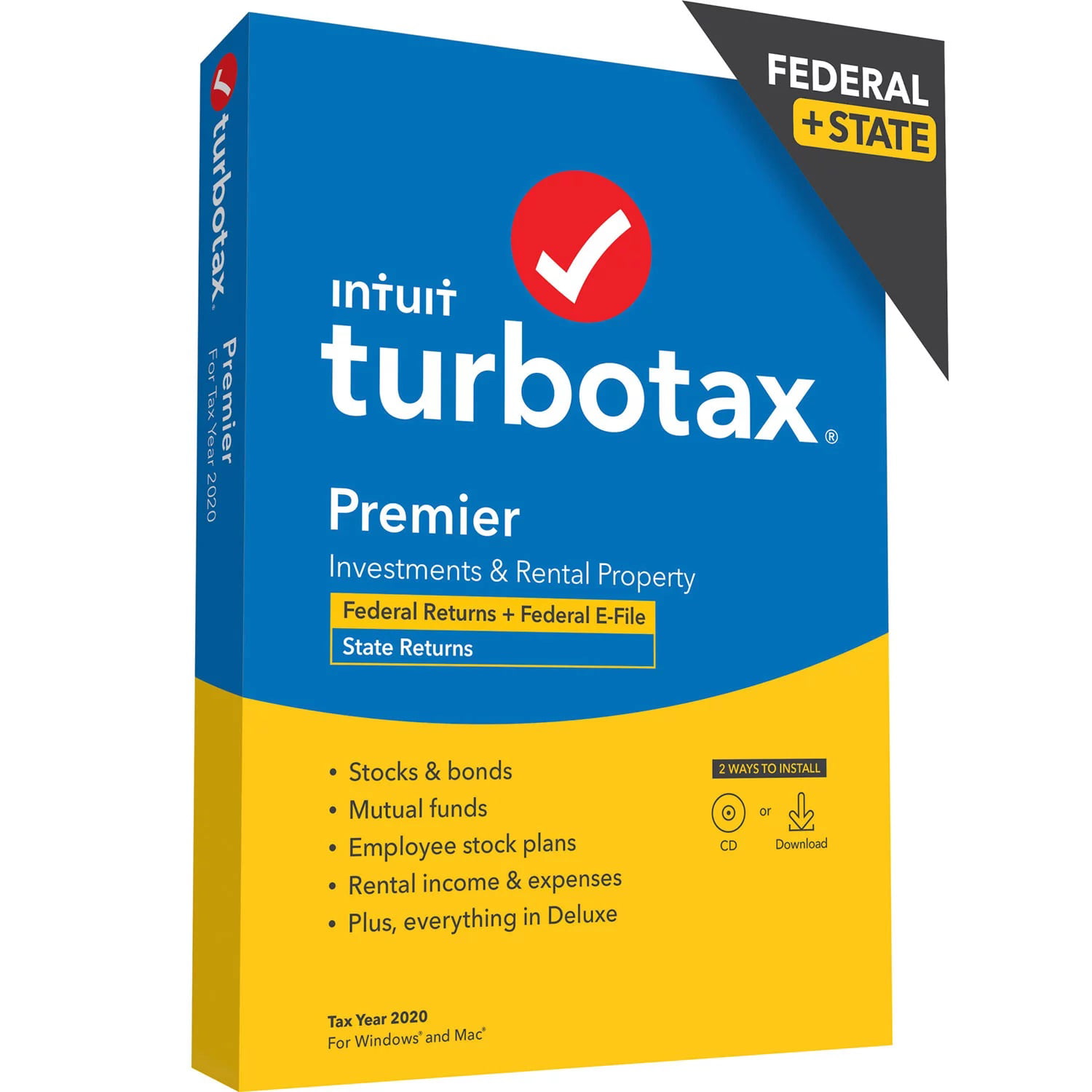

TurboTax is Open and Accepting Tax Returns Now!

If all three of the following are true, your refund counts as. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you.

TurboTax Review 2023 This Online Tax Software Still Dominates

Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If all three of the following are true, your refund counts as. If you receive a refund.

How Do I Get A Copy Of My 2020 Tax Return From Turbotax Printable Online

If all three of the following are true, your refund counts as. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund.

TurboTax Deluxe 2023 Tax Software Federal State Tax Return, 41 OFF

If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. Yes, report last year’s state.

State continues to investigate TurboTax returns

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not. If you receive a refund of (or credit for) state or local income taxes in a year.

How Do I Get A Copy Of My 2020 Tax Return From Turbotax Printable Online

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If you receive a refund of (or credit for) state or local income taxes in a year after the year in which you paid them, you may have to include. Yes, report last year’s state.

If You Receive A Refund Of (Or Credit For) State Or Local Income Taxes In A Year After The Year In Which You Paid Them, You May Have To Include.

The state and local income tax refund can be overridden both in the original joint return and in the separate split returns to achieve the. If all three of the following are true, your refund counts as. Yes, report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not.