Tax Foreclosure Settlement.com

Tax Foreclosure Settlement.com - You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement. Please read for a full explanation of the settlement and your options and all applicable timelines. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You may do so online at www.taxforeclosuresettlement.com. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may file your claim online or.

You may file your claim online or. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You must complete and submit a claim to qualify for a payment under the settlement. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. Please read for a full explanation of the settlement and your options and all applicable timelines. You may do so online at www.taxforeclosuresettlement.com.

You may do so online at www.taxforeclosuresettlement.com. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may file your claim online or. Please read for a full explanation of the settlement and your options and all applicable timelines. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You must complete and submit a claim to qualify for a payment under the settlement. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com.

Tax Foreclosure Process in Michigan. YouTube

You may file your claim online or. You may do so online at www.taxforeclosuresettlement.com. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. Please read for a full explanation of the settlement and your options and all applicable timelines. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to.

Tax Foreclosure Digital Course

If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may do so online at www.taxforeclosuresettlement.com. Please read for a full explanation of the settlement and your options and all applicable timelines. You must complete and submit a claim to qualify for a payment under the.

Breaking Down The Nationwide Foreclosure Settlement In One Infographic

Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You may do so online at www.taxforeclosuresettlement.com. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. Please read for a full explanation of the settlement and your options and all applicable timelines. You must complete and.

Texas Foreclosure Process And Timeline.

Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. You may do so online at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement. Please read for a full.

What to Know About Tax Lien Foreclosure in Texas Johnson & Starr

You may do so online at www.taxforeclosuresettlement.com. You may file your claim online or. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by failing to give plaintiffs the. You must complete.

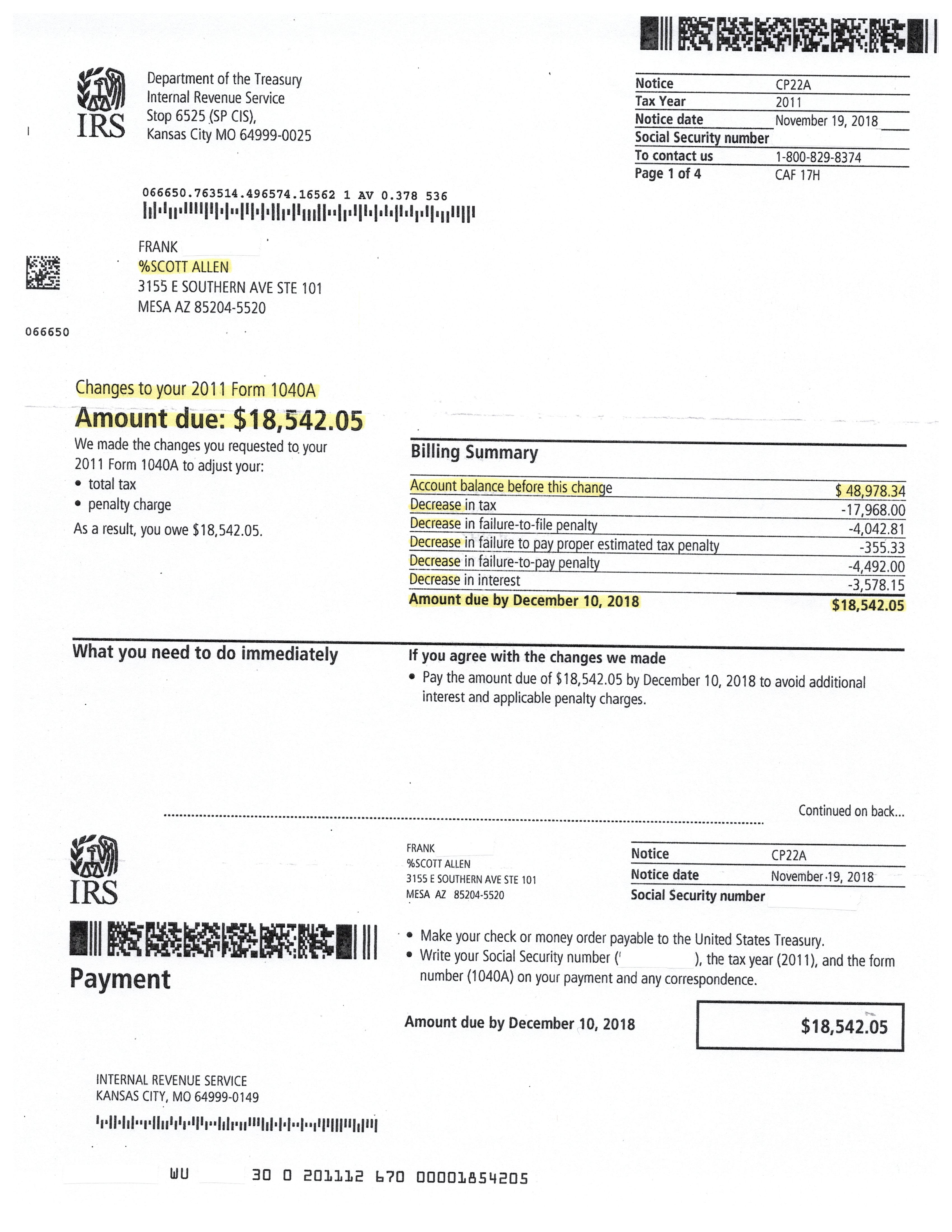

Successful IRS Settlement by Tax Debt Advisors Tax Debt Advisors

If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement. You may file your claim online or. You may.

Breaking Down a Tax Settlement

Please read for a full explanation of the settlement and your options and all applicable timelines. You must complete and submit a claim to qualify for a payment under the settlement. You may file your claim online or. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the.

The Tax Foreclosure Process Quick Start Training YouTube

You may file your claim online or. You may do so online at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement. Please read for a full explanation of the settlement and your options and all applicable timelines. Wayside church, henderson hodgens, and others (the “plaintiffs”) allege that defendants violated their rights by.

How A 390,459 IRS Debt Reached A 94 Settlement Landmark Tax Group

You may file your claim online or. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement. You may do so online at www.taxforeclosuresettlement.com. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to.

Tax Lien Foreclosure Attorney In Ohio?

You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. Please read for a full explanation of the settlement and your options and all applicable timelines. You may file your claim online or. You may do so online at www.taxforeclosuresettlement.com. You must complete and submit a claim to qualify for a payment under the settlement.

You Must Complete And Submit A Claim To Qualify For A Payment Under The Settlement.

Please read for a full explanation of the settlement and your options and all applicable timelines. If you lost your home to foreclosure in michigan between 2013 and 2020, you may be entitled to a payment from the settlement. You may file your claim online or download a claim form at www.taxforeclosuresettlement.com. You may file your claim online or.

Wayside Church, Henderson Hodgens, And Others (The “Plaintiffs”) Allege That Defendants Violated Their Rights By Failing To Give Plaintiffs The.

You may do so online at www.taxforeclosuresettlement.com.