2022 Form 720

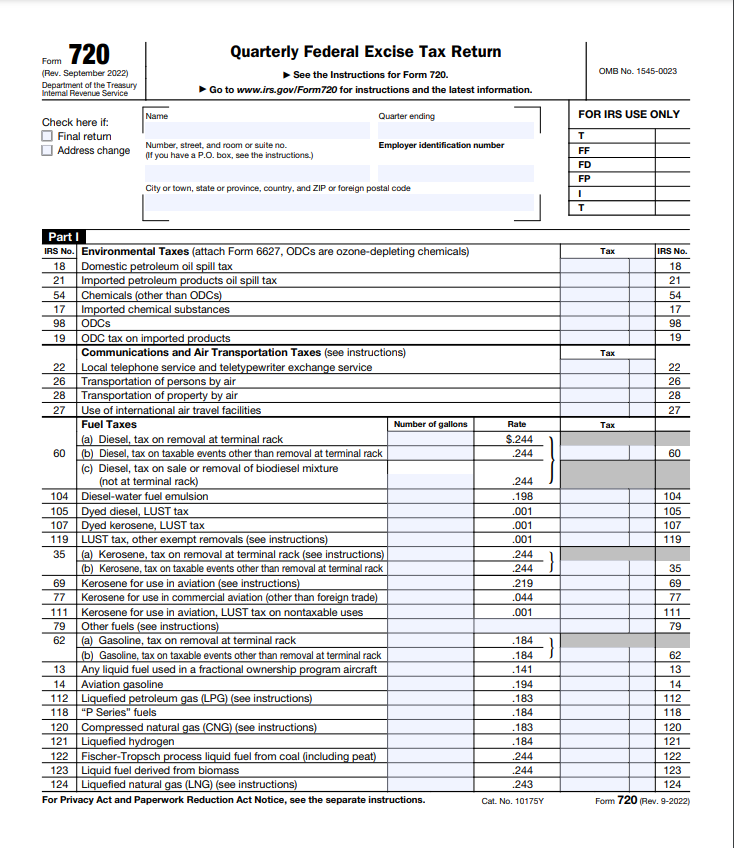

2022 Form 720 - Don’t complete schedule a for part ii taxes or for a. You must file form 720 if: You must complete schedule a if you have a liability for any tax in part i of form 720. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. January 2018) department of the treasury internal revenue service check here if: Quarterly federal excise tax return keywords \r\n created date: 720 quarterly federal excise tax return form (rev. Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022.

Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022. January 2018) department of the treasury internal revenue service check here if: • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Quarterly federal excise tax return keywords \r\n created date: You must complete schedule a if you have a liability for any tax in part i of form 720. You must file form 720 if: Don’t complete schedule a for part ii taxes or for a. 720 quarterly federal excise tax return form (rev.

Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. January 2018) department of the treasury internal revenue service check here if: You must file form 720 if: You must complete schedule a if you have a liability for any tax in part i of form 720. Don’t complete schedule a for part ii taxes or for a. 720 quarterly federal excise tax return form (rev. Quarterly federal excise tax return keywords \r\n created date:

Form 720 for the third quarter is due on October 31. Efile form 720

Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. Quarterly federal excise tax return keywords \r\n created date: 720 quarterly federal excise tax return form (rev. Don’t complete schedule a for part ii taxes or for a. You must complete schedule a if you have a liability for any.

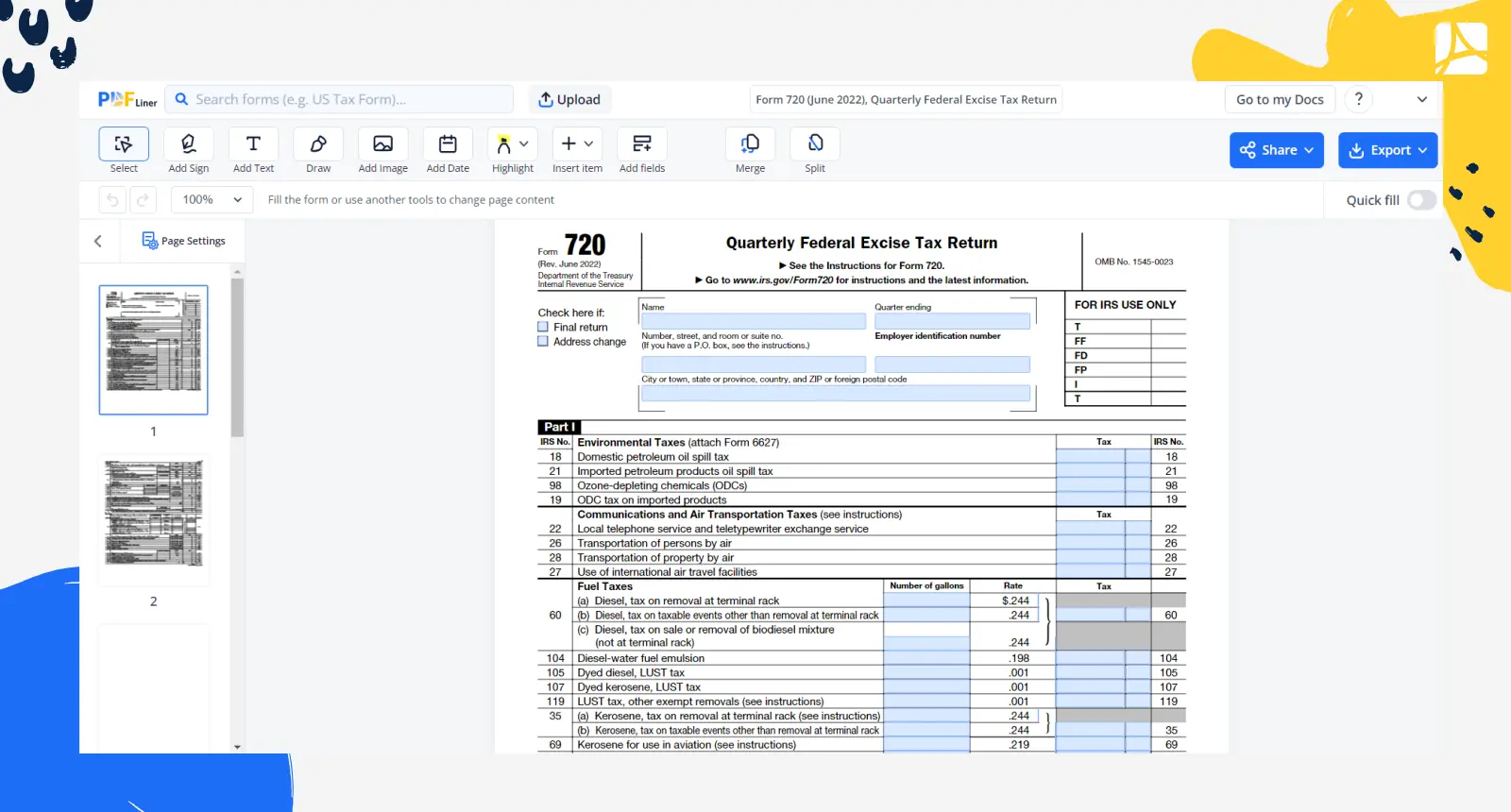

2022 Form IRS 720 Fill Online, Printable, Fillable, Blank pdfFiller

Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. 720 quarterly federal excise tax return form (rev. You must complete schedule a if you have a liability for any tax in part i of form 720. You must file form 720 if: January 2018) department of the treasury internal.

Federal Excise Taxes How Much You Owe And How To Pay Them Bench

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. January 2018) department of the treasury internal revenue service check here if: You must complete schedule a.

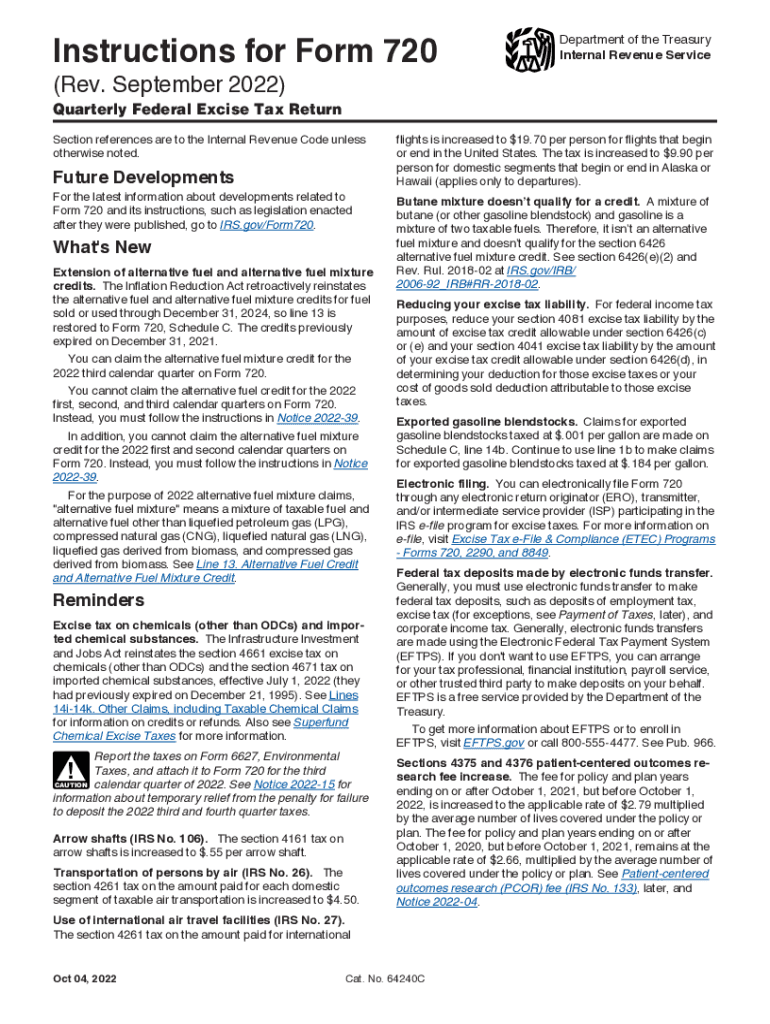

Form 720 Instructions 2024 2025

You must complete schedule a if you have a liability for any tax in part i of form 720. You must file form 720 if: Quarterly federal excise tax return keywords \r\n created date: 720 quarterly federal excise tax return form (rev. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form.

Form 720 (June 2022), Quarterly Federal Excise Tax Return — PDFliner

Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. January 2018) department of the treasury internal revenue service check here if: Quarterly federal excise tax return keywords \r\n created date: You must file form 720 if: Therefore, you must file form 720 quarterly excise taxes to the irs on.

2022 Form IRS Instructions 720 Fill Online, Printable, Fillable, Blank

720 quarterly federal excise tax return form (rev. January 2018) department of the treasury internal revenue service check here if: Don’t complete schedule a for part ii taxes or for a. Quarterly federal excise tax return keywords \r\n created date: Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022.

FORM 720 EFILING IN 2022. FORM 720 EFILING by Simple720 Medium

Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022. Don’t complete schedule a for part ii taxes or for a. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. You must complete schedule a if you have.

IRS Form 720 What Is It & Who Is Required To File? SuperMoney

You must complete schedule a if you have a liability for any tax in part i of form 720. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022..

2022 Form IRS Instructions 720 Fill Online, Printable, Fillable, Blank

• you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. You must complete schedule a if you have a liability for any tax in part i of form 720. 720 quarterly federal excise tax return form (rev. Don’t complete schedule a for part ii taxes or for.

HOW TO EFILE FORM 720 IN THE USA by Simple720 Medium

You must file form 720 if: Don’t complete schedule a for part ii taxes or for a. • you were liable for, or responsible for collecting, any of the federal excise taxes listed on form 720, parts i and ii,. 720 quarterly federal excise tax return form (rev. Therefore, you must file form 720 quarterly excise taxes to the irs.

• You Were Liable For, Or Responsible For Collecting, Any Of The Federal Excise Taxes Listed On Form 720, Parts I And Ii,.

You must complete schedule a if you have a liability for any tax in part i of form 720. You must file form 720 if: Therefore, you must file form 720 quarterly excise taxes to the irs on or before august 1, 2022. January 2018) department of the treasury internal revenue service check here if:

Don’t Complete Schedule A For Part Ii Taxes Or For A.

Information about form 720, quarterly federal excise tax return, including recent updates, related forms, and instructions on how to file. 720 quarterly federal excise tax return form (rev. Quarterly federal excise tax return keywords \r\n created date: