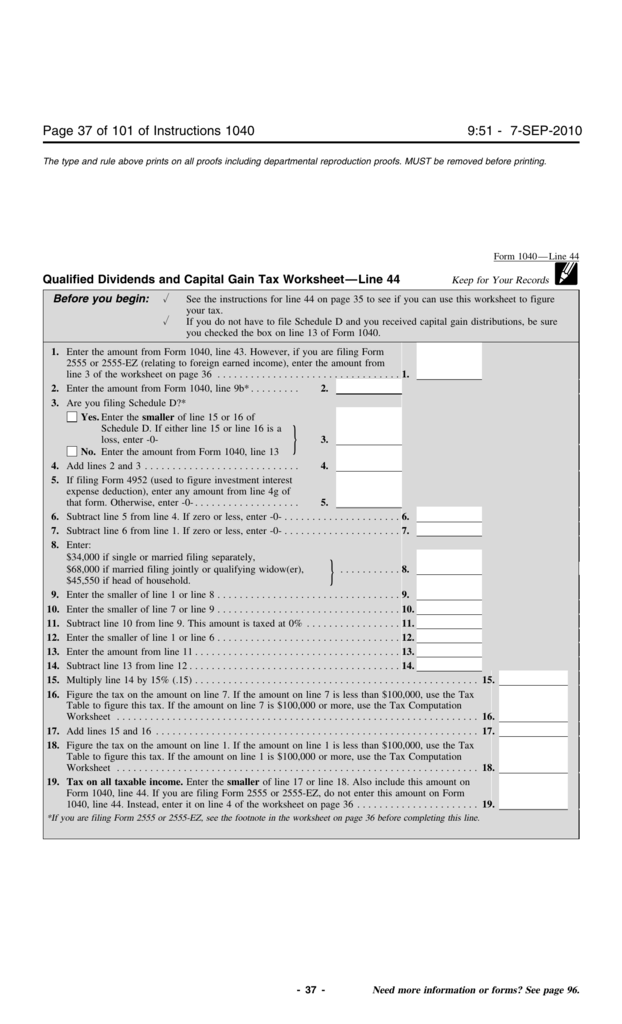

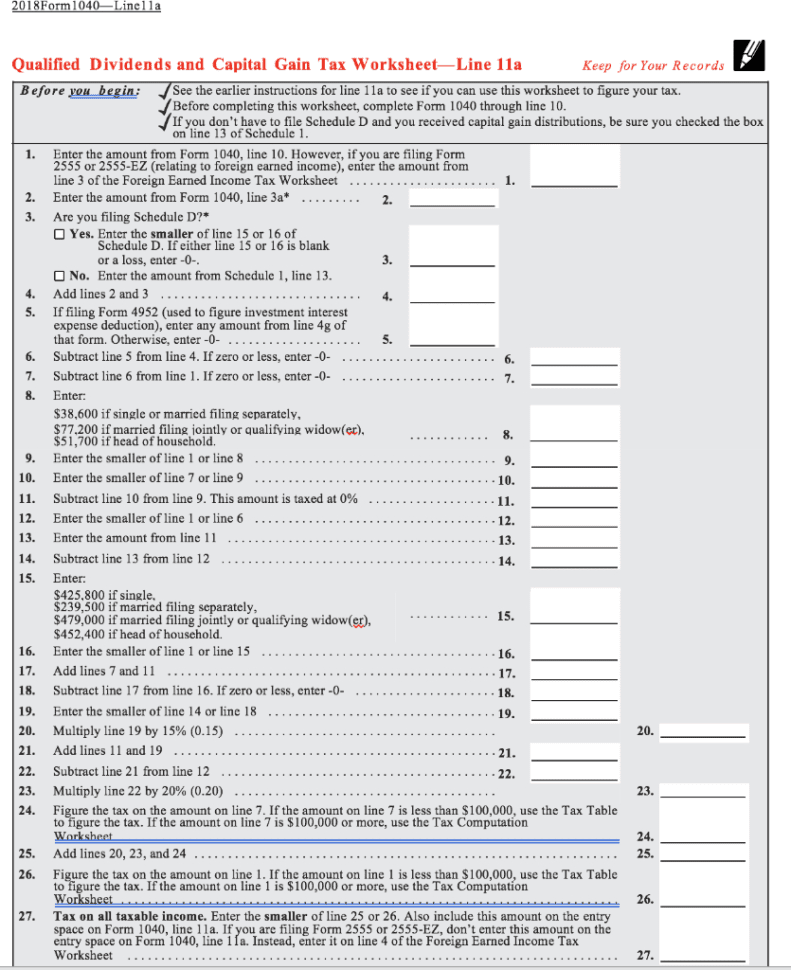

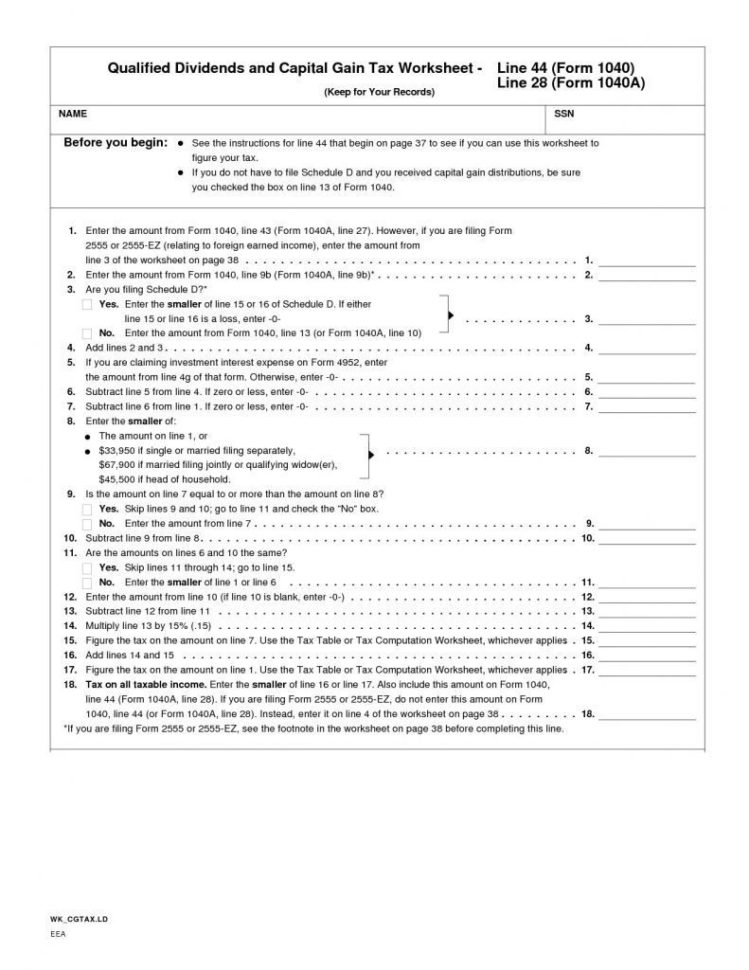

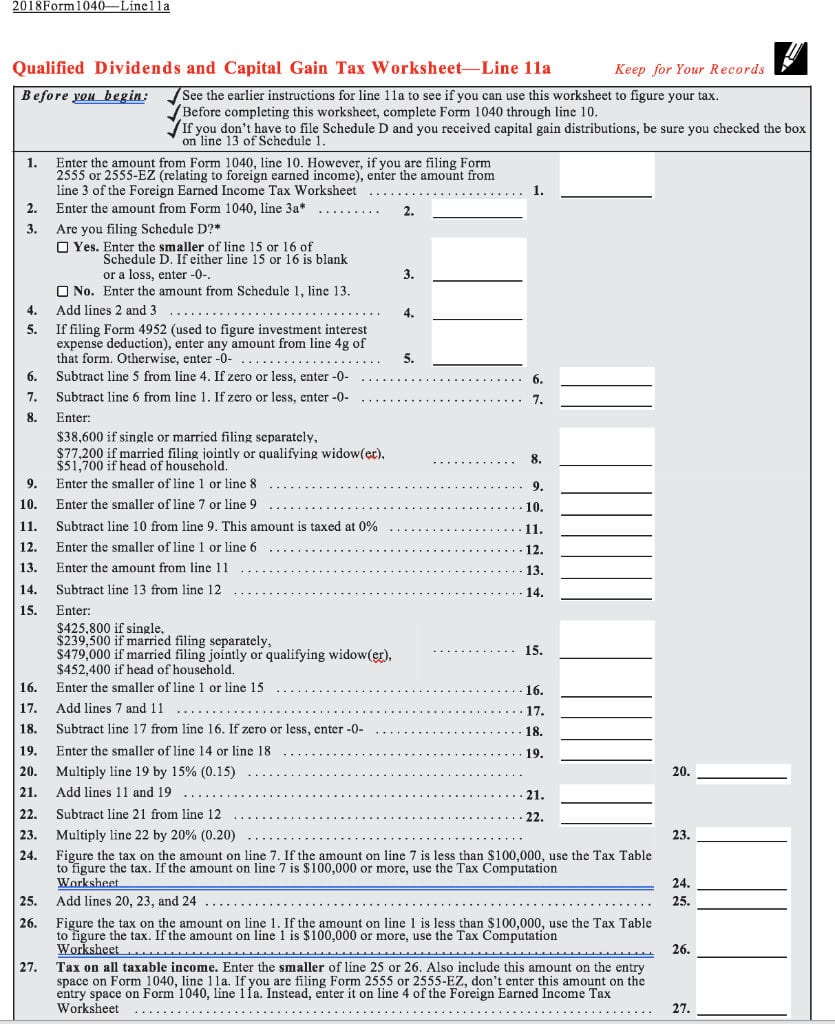

2022 Qualified Dividend And Capital Gain Tax Worksheet

2022 Qualified Dividend And Capital Gain Tax Worksheet - Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. If “yes,” attach form 8949 and see its. Dividends are generally taxed at your ordinary income tax rates. V/ see the instructions for. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. These instructions explain how to complete schedule d (form 1040). However, some dividends are special. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. However, some dividends are special. If “yes,” attach form 8949 and see its. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. V/ see the instructions for. These instructions explain how to complete schedule d (form 1040). Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

These instructions explain how to complete schedule d (form 1040). However, some dividends are special. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. V/ see the instructions for. If “yes,” attach form 8949 and see its.

Qualified Dividends And Capital Gains

However, some dividends are special. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? If “yes,” attach form 8949 and.

Dividend And Capital Gains Tax Worksheet 2022

V/ see the instructions for. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. However, some dividends are special. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Complete form 8949 before you complete line 1b, 2, 3, 8b,.

Capital Gain Worksheet 2024

However, some dividends are special. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. If “yes,” attach form 8949 and see its. Dividends are generally taxed at your ordinary income tax rates. These instructions explain how to complete schedule d (form 1040).

Qualified Dividends And Capital Gains Tax

If “yes,” attach form 8949 and see its. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. These instructions explain how to complete schedule d (form 1040). V/ see the instructions for. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Qualified Dividends And Capital Gains Tax Worksheet 2022

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Dividends are generally taxed at your ordinary income tax rates. If “yes,” attach form 8949 and see its. V/ see the instructions for. Did you dispose of any investment(s) in a qualified opportunity fund during the.

Qualified Dividend And Capital Gain Tax Worksheet 2022

V/ see the instructions for. If “yes,” attach form 8949 and see its. However, some dividends are special. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Dividends are generally taxed at your ordinary income tax rates.

2022 Qualified Dividend And Capital Gain Tax Worksheet

V/ see the instructions for. If “yes,” attach form 8949 and see its. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Dividends are generally taxed at your ordinary income.

Capital Gains Tax Worksheet 2024

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. If “yes,” attach form 8949 and see its. Dividends are generally taxed at your ordinary income tax rates. These instructions explain how to complete schedule d (form 1040). However, some dividends are special.

Qualified Dividends And Capital Gain Tax Irs

If “yes,” attach form 8949 and see its. V/ see the instructions for. Dividends are generally taxed at your ordinary income tax rates. However, some dividends are special. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Qualified Dividends And Capital Gains Tax

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? However, some dividends are special. If “yes,” attach form 8949 and see its. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Complete form 8949 before you complete line 1b,.

If “Yes,” Attach Form 8949 And See Its.

However, some dividends are special. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Use The Qualified Dividends And Capital Gain Tax Worksheet To Figure Your Tax If You Do Not Have To Use The Schedule D Tax.

V/ see the instructions for. Dividends are generally taxed at your ordinary income tax rates.