8594 Tax Form

8594 Tax Form - Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches.

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches.

Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or.

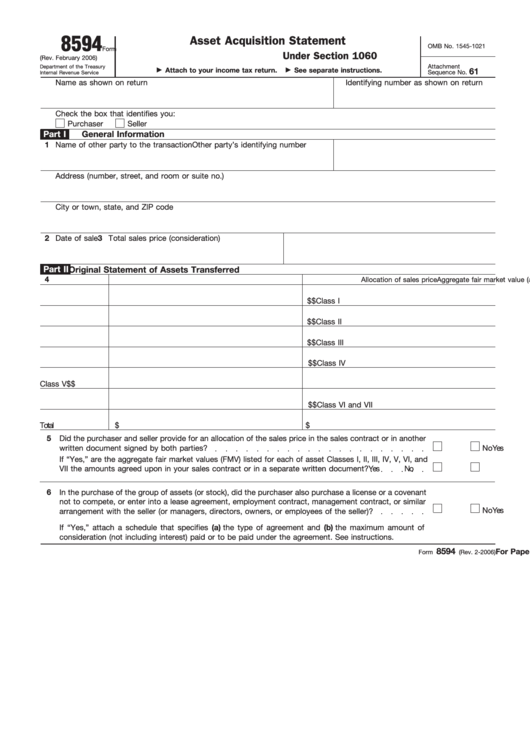

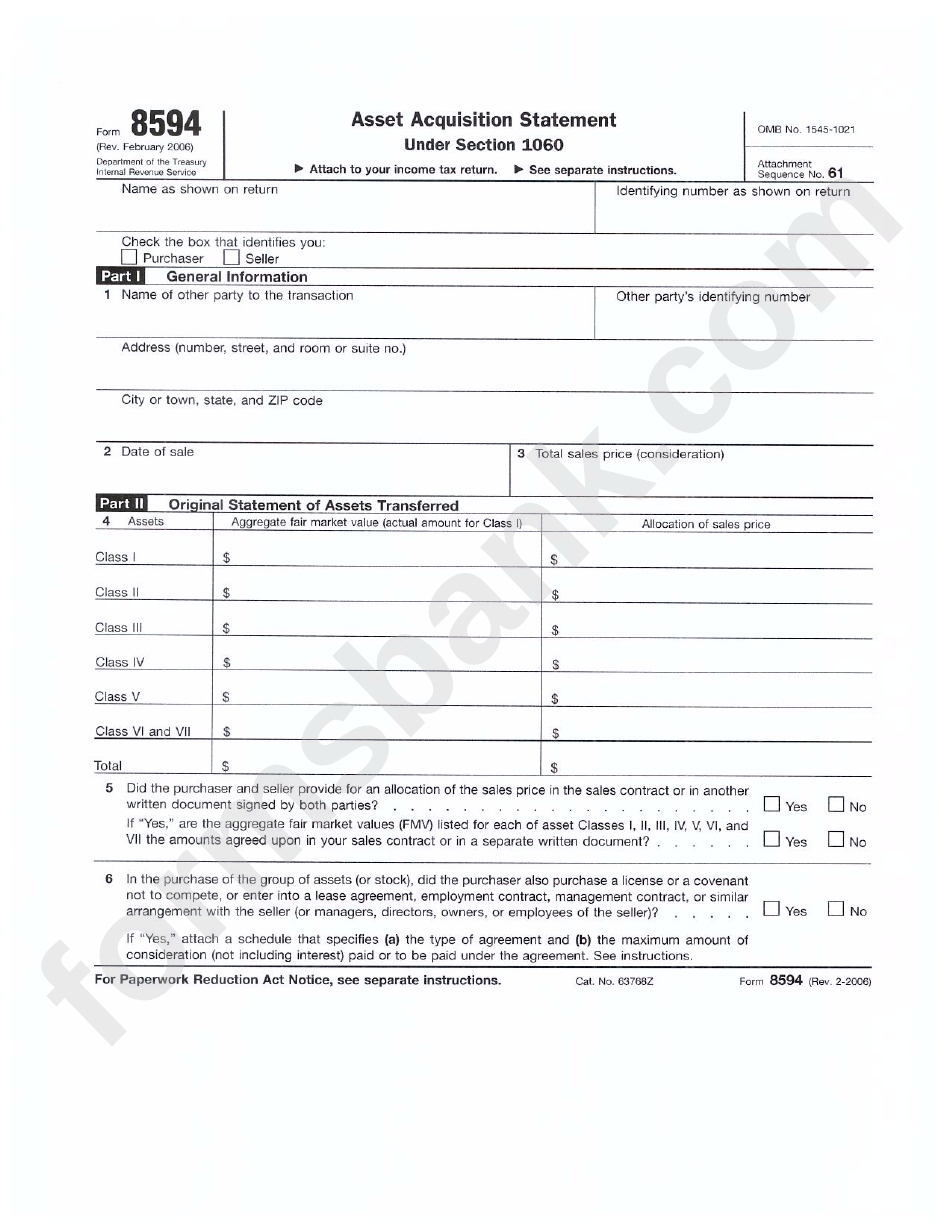

Fillable Form 8594 (Rev. February 2006) Asset Acquisition Statement

The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers.

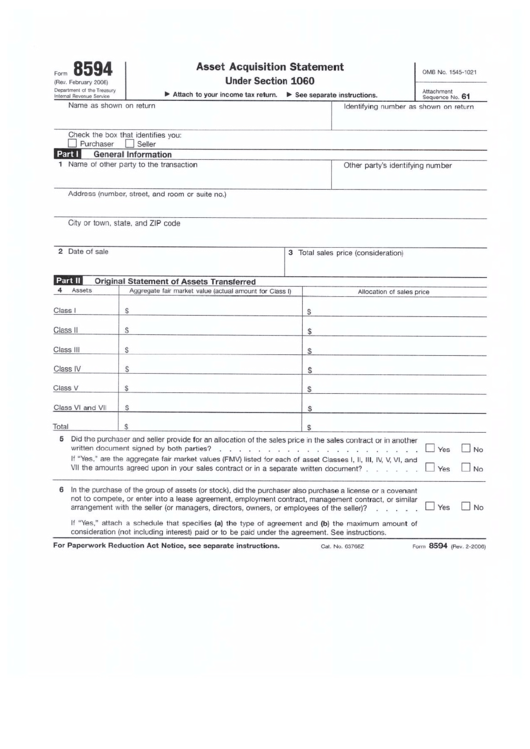

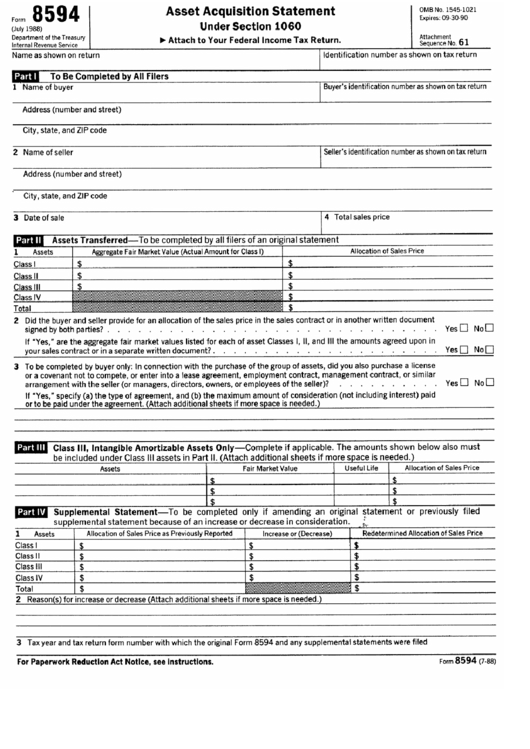

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Form 8594, asset acquisition statement under section 1060, is.

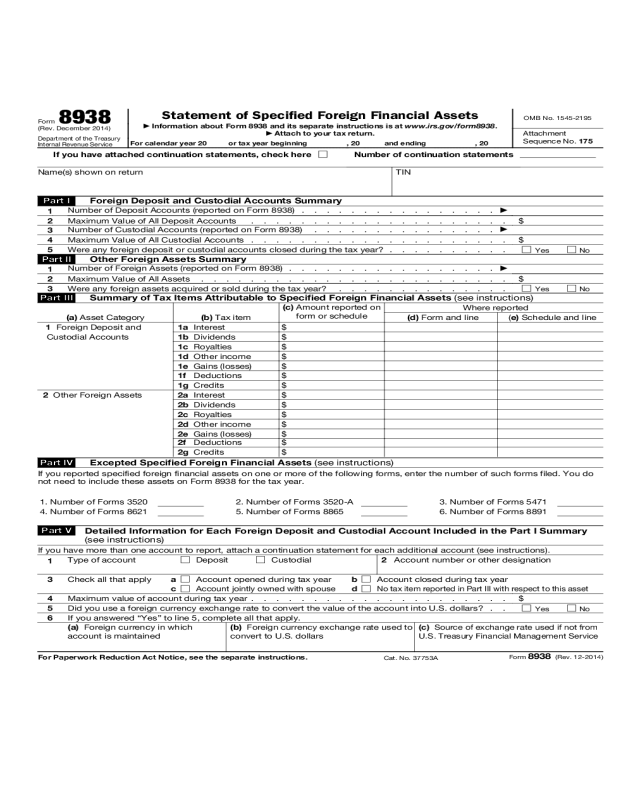

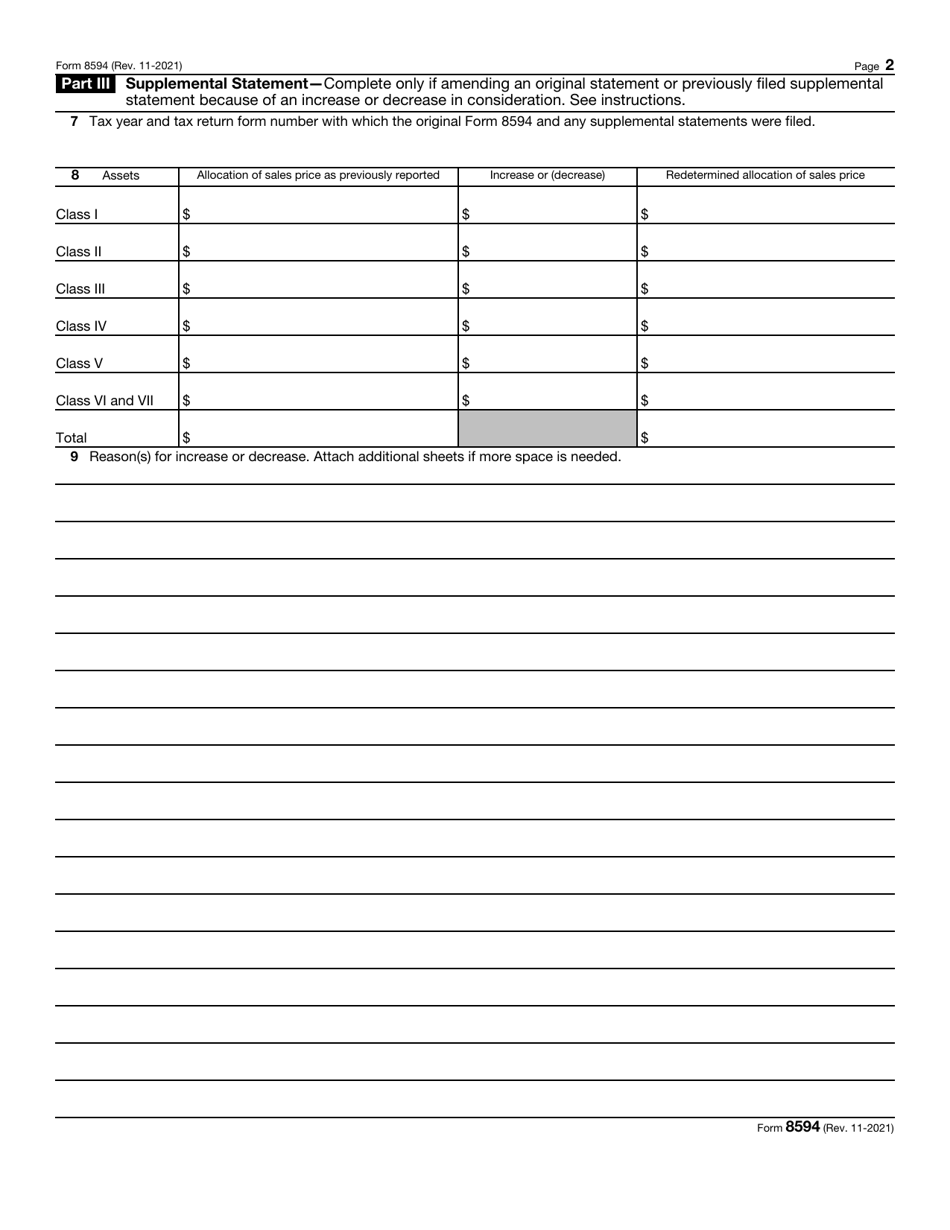

2024 Asset Statement Form Fillable, Printable PDF & Forms Handypdf

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. The buyers and sellers of a group of assets.

Fill Free fillable form 8594 asset acquisition statement PDF form

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. The buyers and sellers of a group of assets.

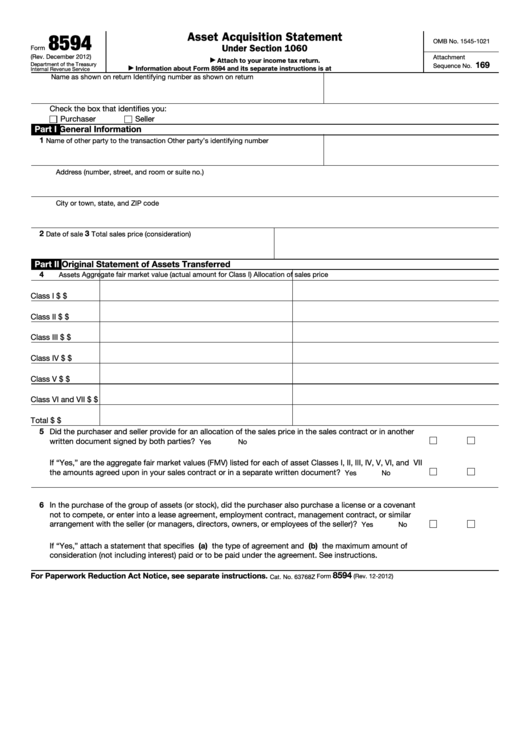

Irs Form 8594 Fillable Printable Forms Free Online

Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Form 8594 is a tax document.

When to File Form 8594 Asset Acquisition

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Form 8594, asset acquisition statement under.

Instructions for Form 8594 2024 2025

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or. Form 8594 is a tax document required in.

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches. Form 8594, asset acquisition statement under.

IRS Form 8594 Download Fillable PDF or Fill Online Asset Acquisition

Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or. Form 8594 is a tax document required in certain business sales where the buyer acquires assets rather than stock or equity. Both the seller and purchaser of a group of assets that makes up a trade or business.

Form 8594 Is A Tax Document Required In Certain Business Sales Where The Buyer Acquires Assets Rather Than Stock Or Equity.

Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going. Form 8594, asset acquisition statement under section 1060, is an essential document for both buyers and sellers involved in the purchase or. The buyers and sellers of a group of assets that make up a business use form 8594 when goodwill or going concern value attaches.