Are Local Political Campaigns Tax Exempt In Iowa

Are Local Political Campaigns Tax Exempt In Iowa - Campaign committees for candidates for federal, state or local office; And political action committees are all political. Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. Nonprofit entities may request exemption from income tax from the internal revenue service (irs). A campaign committee for those running for state,. Iowa code chapter 68a sets forth two kinds of campaign committees: Does iowa have campaign contribution limits? Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Current laws put no limits on the amounts that an individual can contribution to a candidate.

Campaign committees for candidates for federal, state or local office; Current laws put no limits on the amounts that an individual can contribution to a candidate. Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Nonprofit entities may request exemption from income tax from the internal revenue service (irs). Does iowa have campaign contribution limits? And political action committees are all political. Iowa code chapter 68a sets forth two kinds of campaign committees: A campaign committee for those running for state,. Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the.

And political action committees are all political. Current laws put no limits on the amounts that an individual can contribution to a candidate. Iowa code chapter 68a sets forth two kinds of campaign committees: Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Does iowa have campaign contribution limits? A campaign committee for those running for state,. Campaign committees for candidates for federal, state or local office; Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. Nonprofit entities may request exemption from income tax from the internal revenue service (irs).

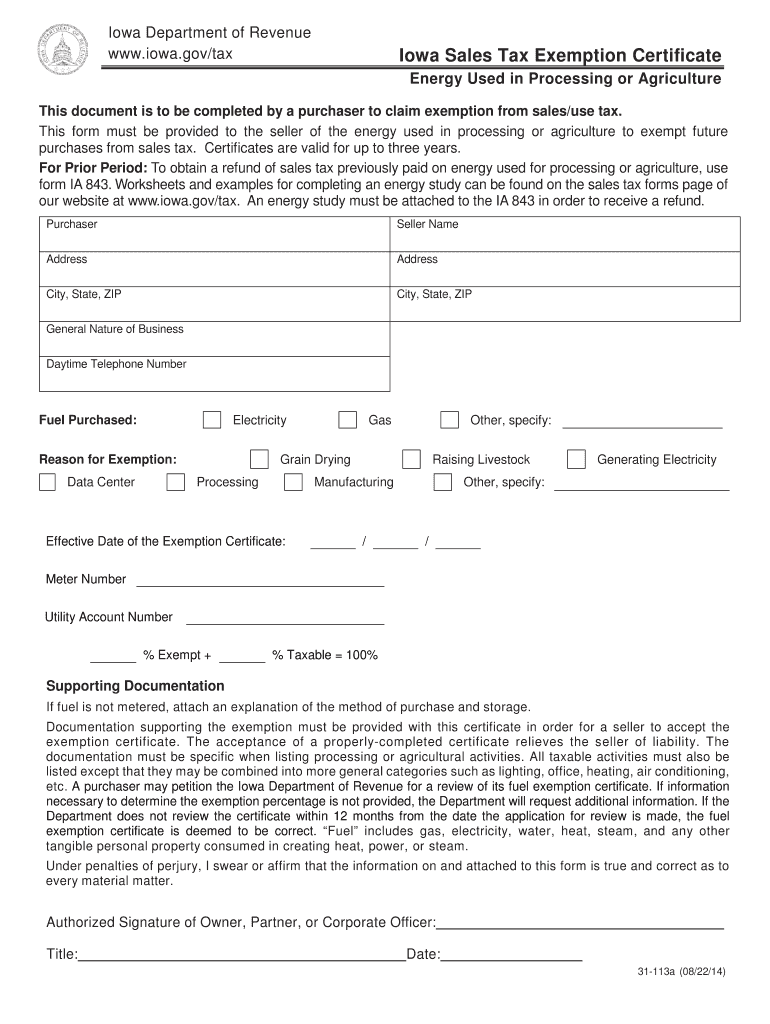

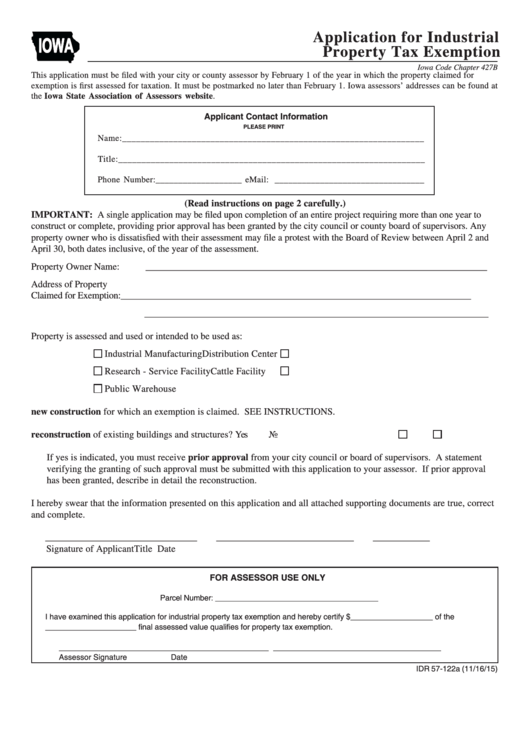

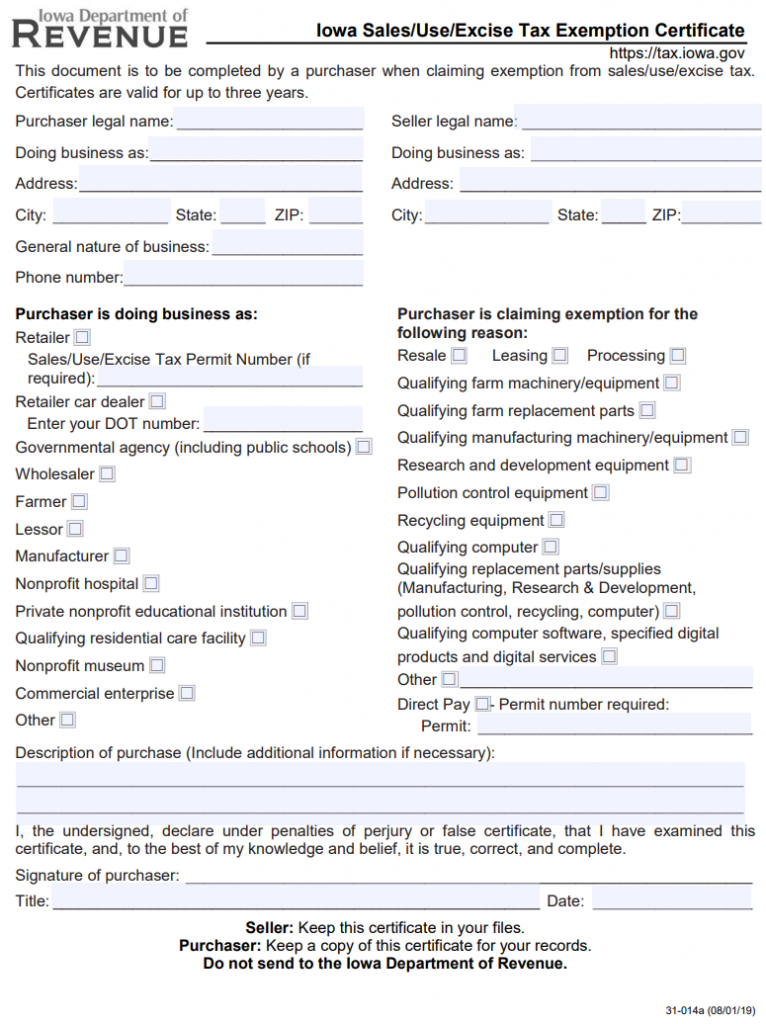

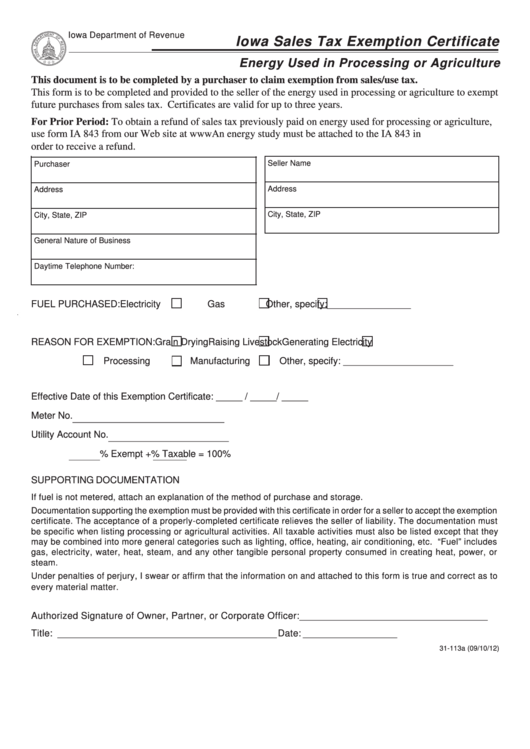

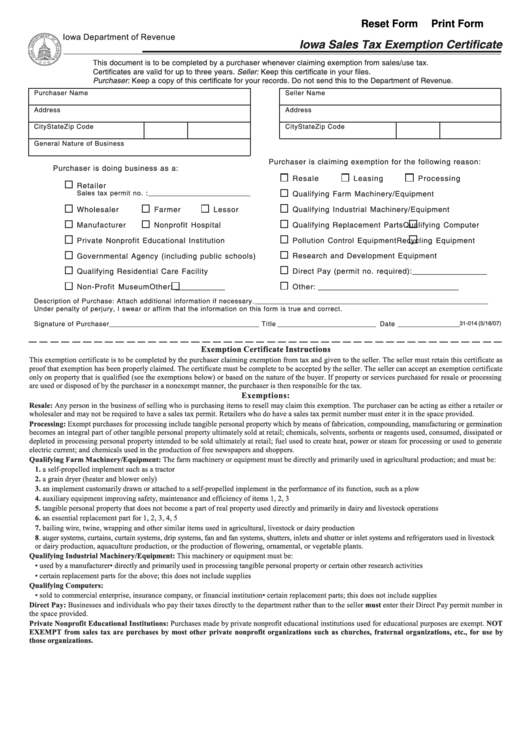

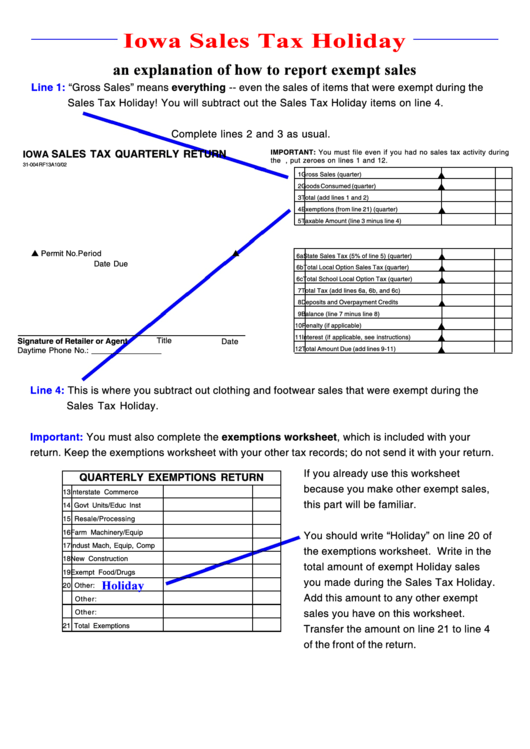

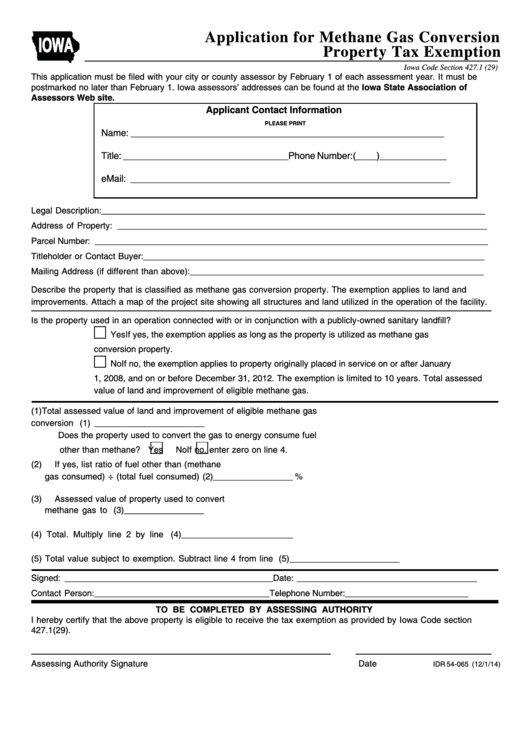

Tax Exempt Form Iowa

Nonprofit entities may request exemption from income tax from the internal revenue service (irs). Campaign committees for candidates for federal, state or local office; A campaign committee for those running for state,. Iowa code chapter 68a sets forth two kinds of campaign committees: Every candidate in iowa for state or local office is subject to the campaign finance laws in.

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

Nonprofit entities may request exemption from income tax from the internal revenue service (irs). Iowa code chapter 68a sets forth two kinds of campaign committees: A campaign committee for those running for state,. Campaign committees for candidates for federal, state or local office; Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution.

Iowa Construction Sales Tax Exemption Form

Does iowa have campaign contribution limits? And political action committees are all political. A campaign committee for those running for state,. Current laws put no limits on the amounts that an individual can contribution to a candidate. Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of.

Fillable Form 31 014 Iowa Sales Tax Exemption Certificate 2007

Does iowa have campaign contribution limits? Current laws put no limits on the amounts that an individual can contribution to a candidate. Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Campaign committees for candidates for federal, state or local office; Nonprofit entities may request exemption from income tax from the internal revenue service (irs).

Iowa Construction Sales Tax Exemption Form

Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. A campaign committee for those running for state,. Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Does iowa have campaign contribution limits? And political action committees are.

Iowa Department Of Revenue Tax Exempt Form

Campaign committees for candidates for federal, state or local office; And political action committees are all political. Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. A campaign committee for those running for state,. Does iowa have campaign contribution limits?

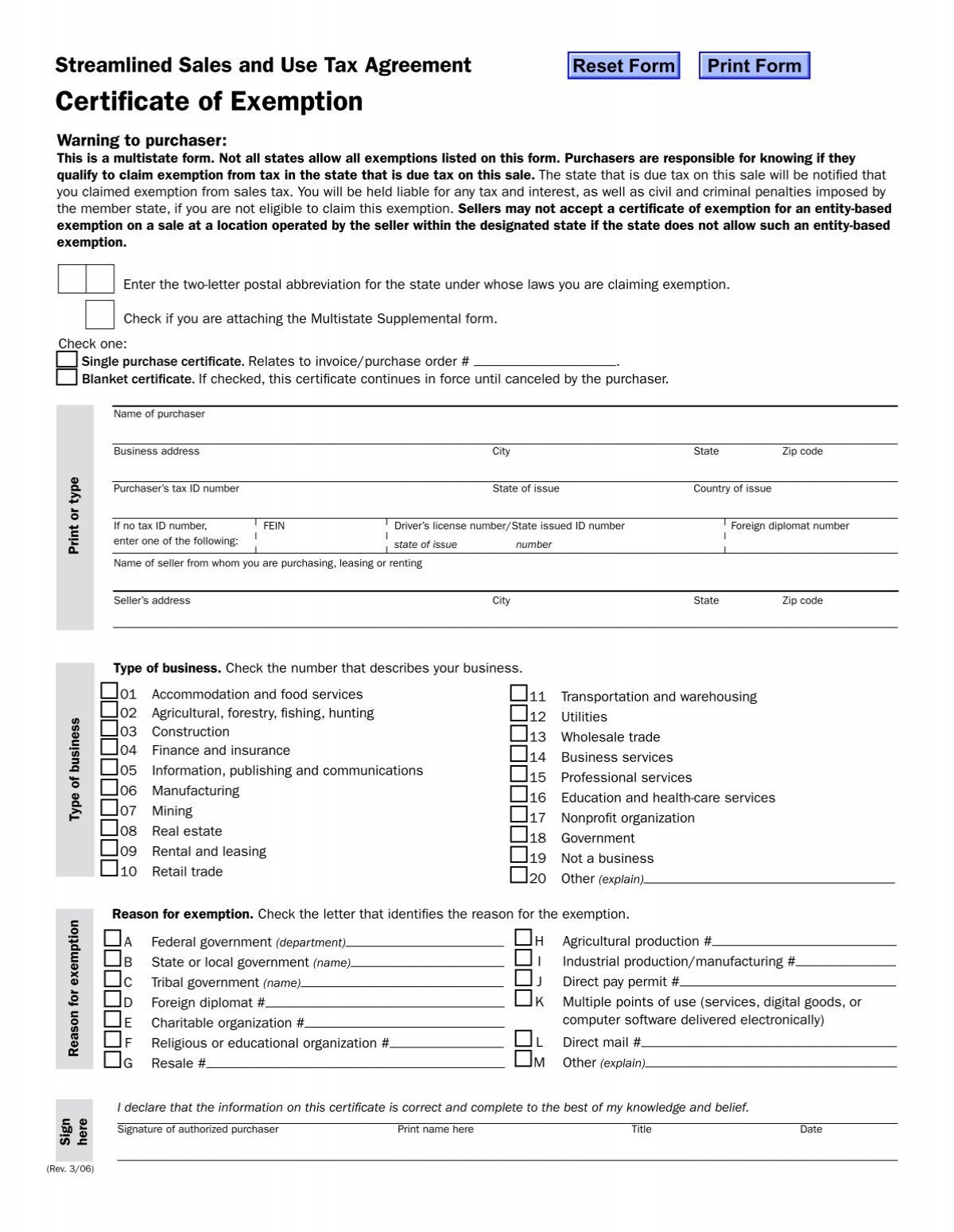

Top 27 Iowa Tax Exempt Form Templates free to download in PDF, Word and

Iowa code chapter 68a sets forth two kinds of campaign committees: Campaign committees for candidates for federal, state or local office; Nonprofit entities may request exemption from income tax from the internal revenue service (irs). Current laws put no limits on the amounts that an individual can contribution to a candidate. Does iowa have campaign contribution limits?

Streamlined Sales Tax Certificate of Exemption State of Iowa

Iowa code chapter 68a sets forth two kinds of campaign committees: Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Does iowa have campaign contribution limits? Campaign committees for candidates for federal, state or local office; And political action committees are all political.

Taxexempt charities allegedly contributed donations to political campaigns

And political action committees are all political. Campaign committees for candidates for federal, state or local office; Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. Does iowa.

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

Unlike many other jurisdictions (including federal campaigns), iowa does not have contribution. And political action committees are all political. Does iowa have campaign contribution limits? A campaign committee for those running for state,. Current laws put no limits on the amounts that an individual can contribution to a candidate.

Unlike Many Other Jurisdictions (Including Federal Campaigns), Iowa Does Not Have Contribution.

Every candidate in iowa for state or local office is subject to the campaign finance laws in chapter 68a of the code of iowa, which are administered by the. Campaign committees for candidates for federal, state or local office; Current laws put no limits on the amounts that an individual can contribution to a candidate. Does iowa have campaign contribution limits?

And Political Action Committees Are All Political.

Iowa code chapter 68a sets forth two kinds of campaign committees: Nonprofit entities may request exemption from income tax from the internal revenue service (irs). A campaign committee for those running for state,.