Arizona Withholding Tax Form

Arizona Withholding Tax Form - Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. An employer must withhold arizona income tax from wages paid for services performed in arizona. 100 n 15th ave, #301. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. The amount withheld is applied. Income tax must be withheld, unless. Tax must be withheld, unless those. An employer must withhold arizona income tax from wages paid for services performed in arizona.

The amount withheld is applied. An employer must withhold arizona income tax from wages paid for services performed in arizona. Tax must be withheld, unless those. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. An employer must withhold arizona income tax from wages paid for services performed in arizona. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Income tax must be withheld, unless. 100 n 15th ave, #301.

An employer must withhold arizona income tax from wages paid for services performed in arizona. The amount withheld is applied. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. An employer must withhold arizona income tax from wages paid for services performed in arizona. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Income tax must be withheld, unless. Tax must be withheld, unless those. 100 n 15th ave, #301.

Arizona State Tax Withholding Form

Tax must be withheld, unless those. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. The amount withheld is applied. An employer must withhold arizona income tax from wages paid for services performed in arizona. Income tax must be withheld, unless.

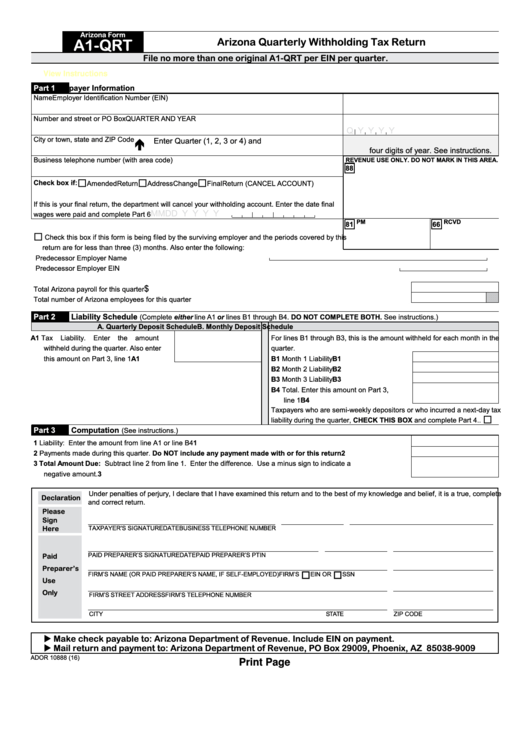

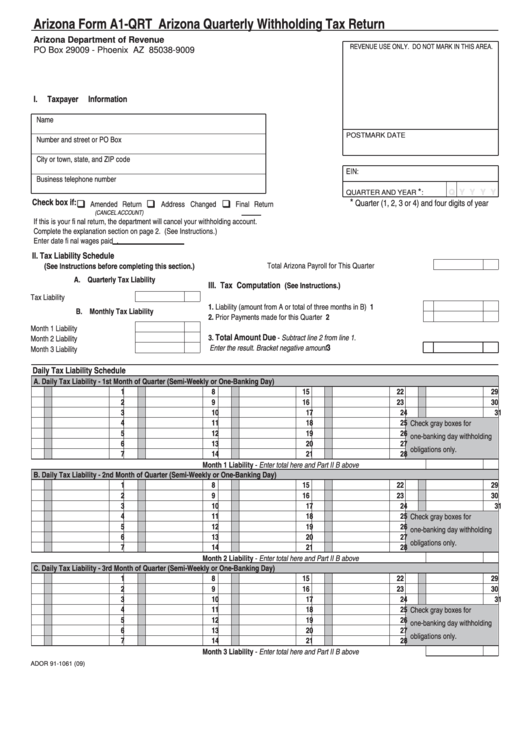

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

An employer must withhold arizona income tax from wages paid for services performed in arizona. Income tax must be withheld, unless. 100 n 15th ave, #301. An employer must withhold arizona income tax from wages paid for services performed in arizona. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona.

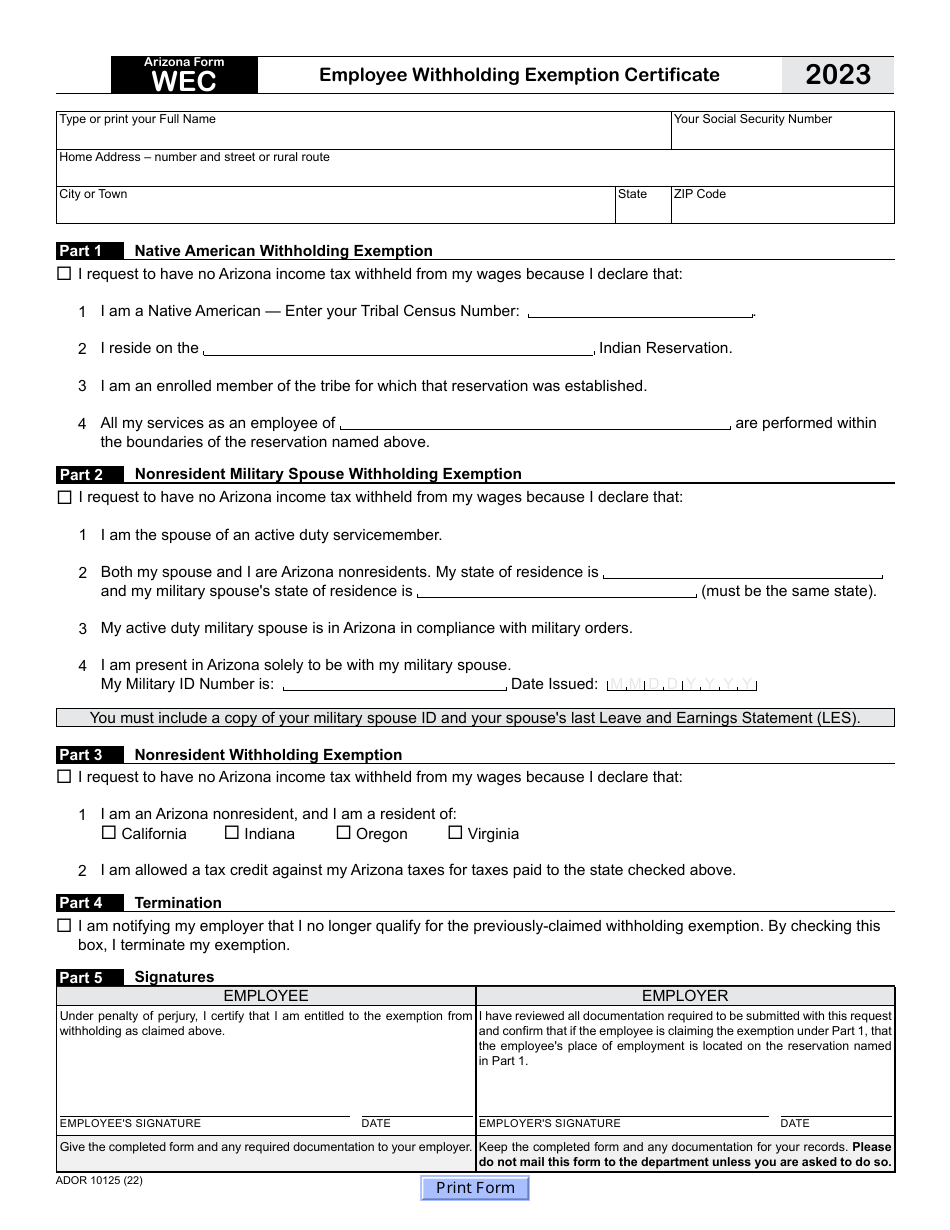

Arizona Form WEC (ADOR10125) Download Fillable PDF or Fill Online

100 n 15th ave, #301. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Income tax must be withheld, unless. The amount withheld is applied. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona.

Arizona State Tax Withholding Form 2023 Printable Forms Free Online

Tax must be withheld, unless those. The amount withheld is applied. Income tax must be withheld, unless. 100 n 15th ave, #301. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019.

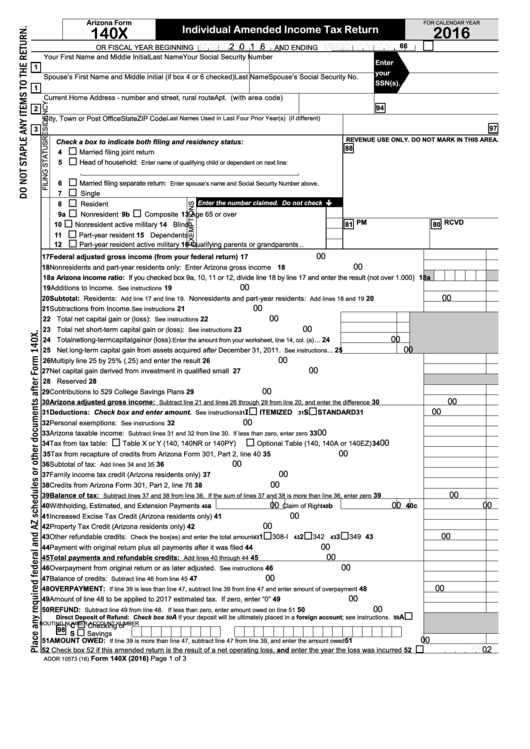

Arizona Fillable Tax Form 140a Printable Forms Free Online

Income tax must be withheld, unless. Tax must be withheld, unless those. An employer must withhold arizona income tax from wages paid for services performed in arizona. The amount withheld is applied. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona.

Arizona State Withholding 2024 Teddy Gennifer

100 n 15th ave, #301. Income tax must be withheld, unless. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. An employer must withhold arizona income tax from wages paid for services performed in arizona. Tax must be withheld, unless those.

Fillable Arizona Form A1Qrt Arizona Quarterly Withholding Tax Return

An employer must withhold arizona income tax from wages paid for services performed in arizona. An employer must withhold arizona income tax from wages paid for services performed in arizona. Tax must be withheld, unless those. 100 n 15th ave, #301. Income tax must be withheld, unless.

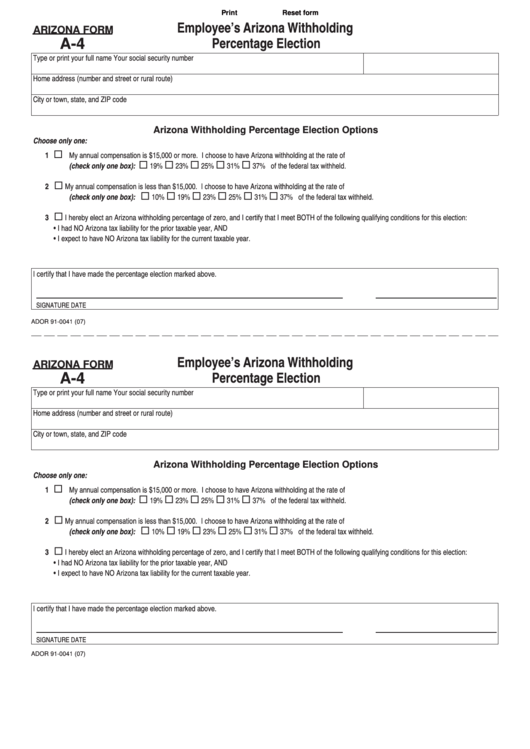

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Tax must be withheld, unless those. Income tax must be withheld, unless. An employer must withhold arizona income tax from wages paid for services performed in arizona. 100 n 15th ave, #301.

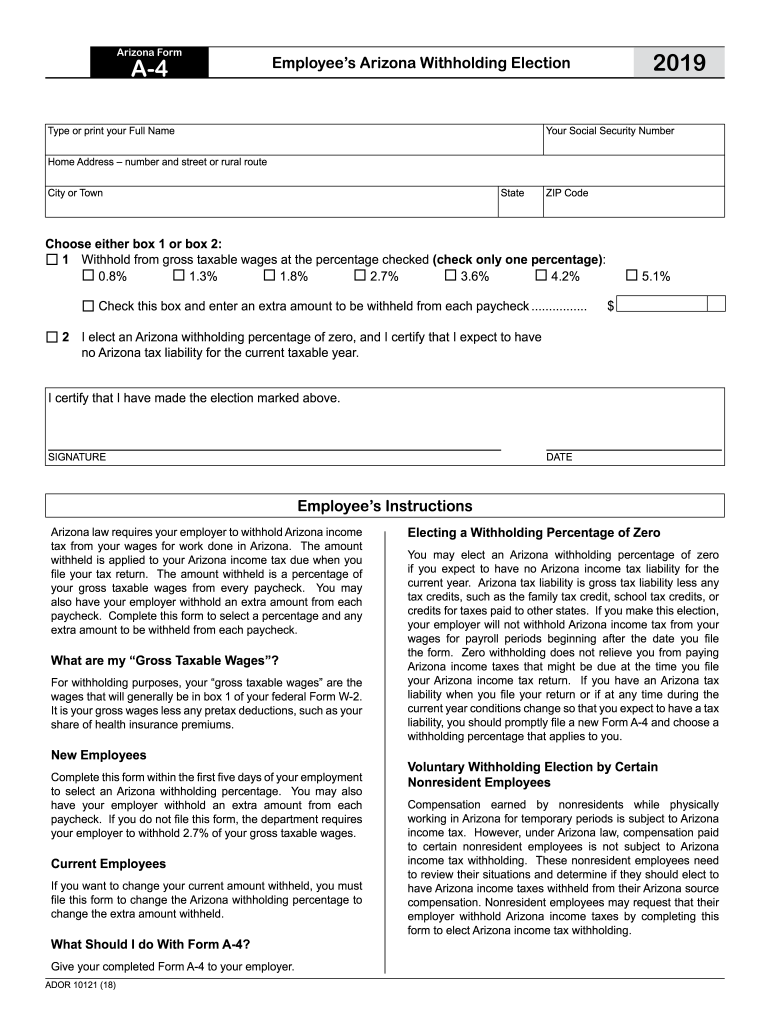

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

The amount withheld is applied. An employer must withhold arizona income tax from wages paid for services performed in arizona. Income tax must be withheld, unless. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. 100 n 15th ave, #301.

Arizona Employee Withholding Form 2023 Printable Forms Free Online

100 n 15th ave, #301. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. The amount withheld is applied. An employer must withhold arizona income tax from wages paid for services performed in.

Arizona Law Requires Your Employer To Withhold Arizona Income Tax From Your Wages For Work Done In Arizona.

Tax must be withheld, unless those. Income tax must be withheld, unless. 20 rows withholding returns must be filed electronically for taxable years beginning from and after december 31, 2019. An employer must withhold arizona income tax from wages paid for services performed in arizona.

The Amount Withheld Is Applied.

100 n 15th ave, #301. An employer must withhold arizona income tax from wages paid for services performed in arizona.