Arkansas Tax Forms

Arkansas Tax Forms - Withholding tax forms and instructions notice: Direct deposit will be offered on electronically filed arkansas individual income tax returns. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 7 rows state tax forms. File this form with your employer. The arkansas department of finance and administration distributes arkansas tax forms. This is restricted to taxpayers who will receive a. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Adobe reader may be required for your browser or you may need to download the form to complete it properly.

7 rows state tax forms. Direct deposit will be offered on electronically filed arkansas individual income tax returns. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Withholding tax forms and instructions notice: File this form with your employer. This is restricted to taxpayers who will receive a. The arkansas department of finance and administration distributes arkansas tax forms. Adobe reader may be required for your browser or you may need to download the form to complete it properly.

7 rows state tax forms. File this form with your employer. Adobe reader may be required for your browser or you may need to download the form to complete it properly. The arkansas department of finance and administration distributes arkansas tax forms. This is restricted to taxpayers who will receive a. Direct deposit will be offered on electronically filed arkansas individual income tax returns. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Withholding tax forms and instructions notice: Some internet browsers have a built in pdf viewer that may not be compatible with our forms.

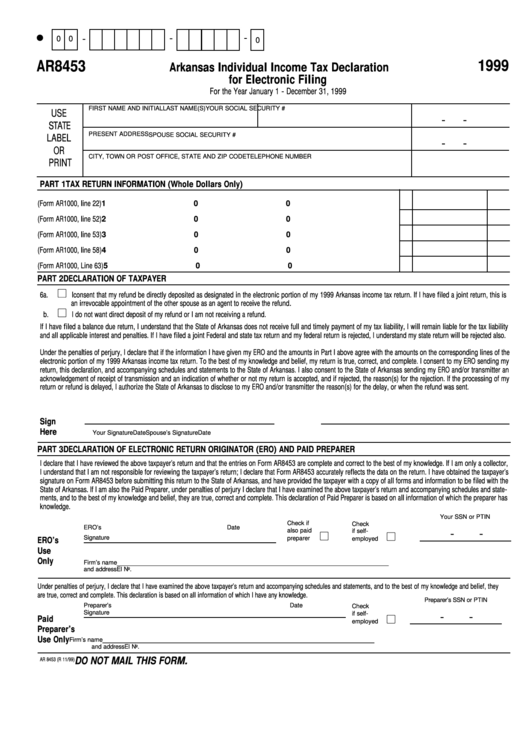

Form Ar8453 Arkansas Individual Tax Declaration 1999

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. File this form with your employer. This is restricted to taxpayers who will receive a. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Adobe reader may be required for your browser or you may need to.

2023 Form Canada TD1 E Fill Online, Printable, Fillable, Blank pdfFiller

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 7 rows state tax forms. Withholding tax forms and instructions notice: File this form with your employer. Adobe reader may be required for your browser or you may need to download the form to complete it properly.

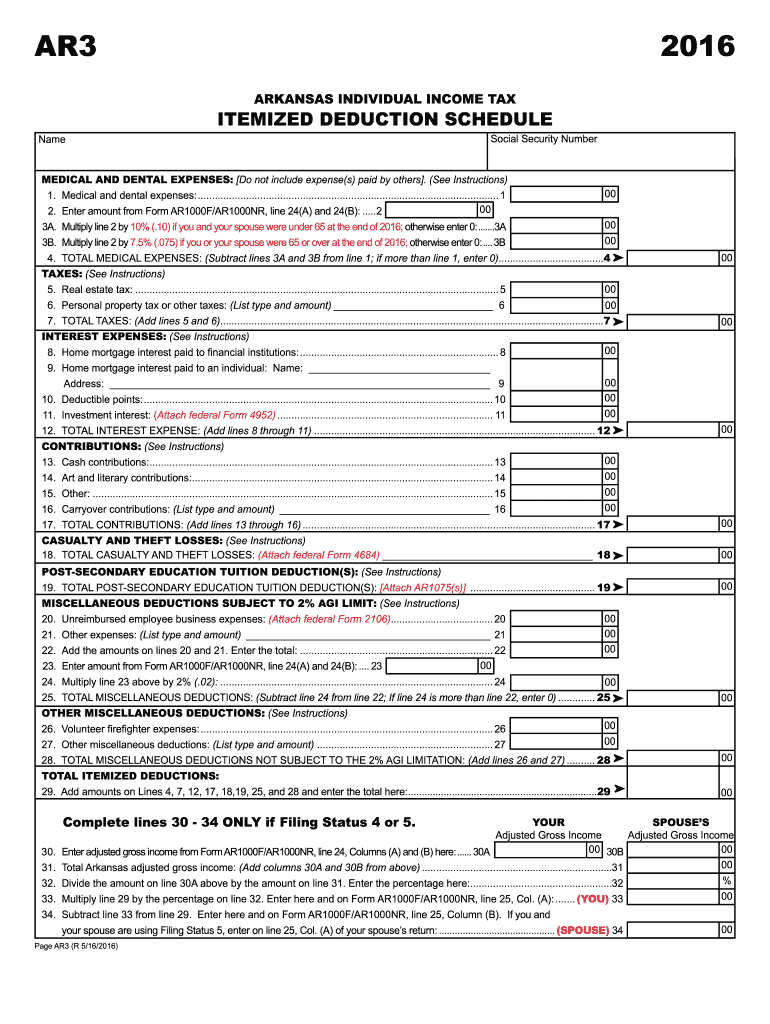

Arkansas Tax Forms Fillable Printable Forms Free Online

File this form with your employer. Adobe reader may be required for your browser or you may need to download the form to complete it properly. Withholding tax forms and instructions notice: 7 rows state tax forms. Direct deposit will be offered on electronically filed arkansas individual income tax returns.

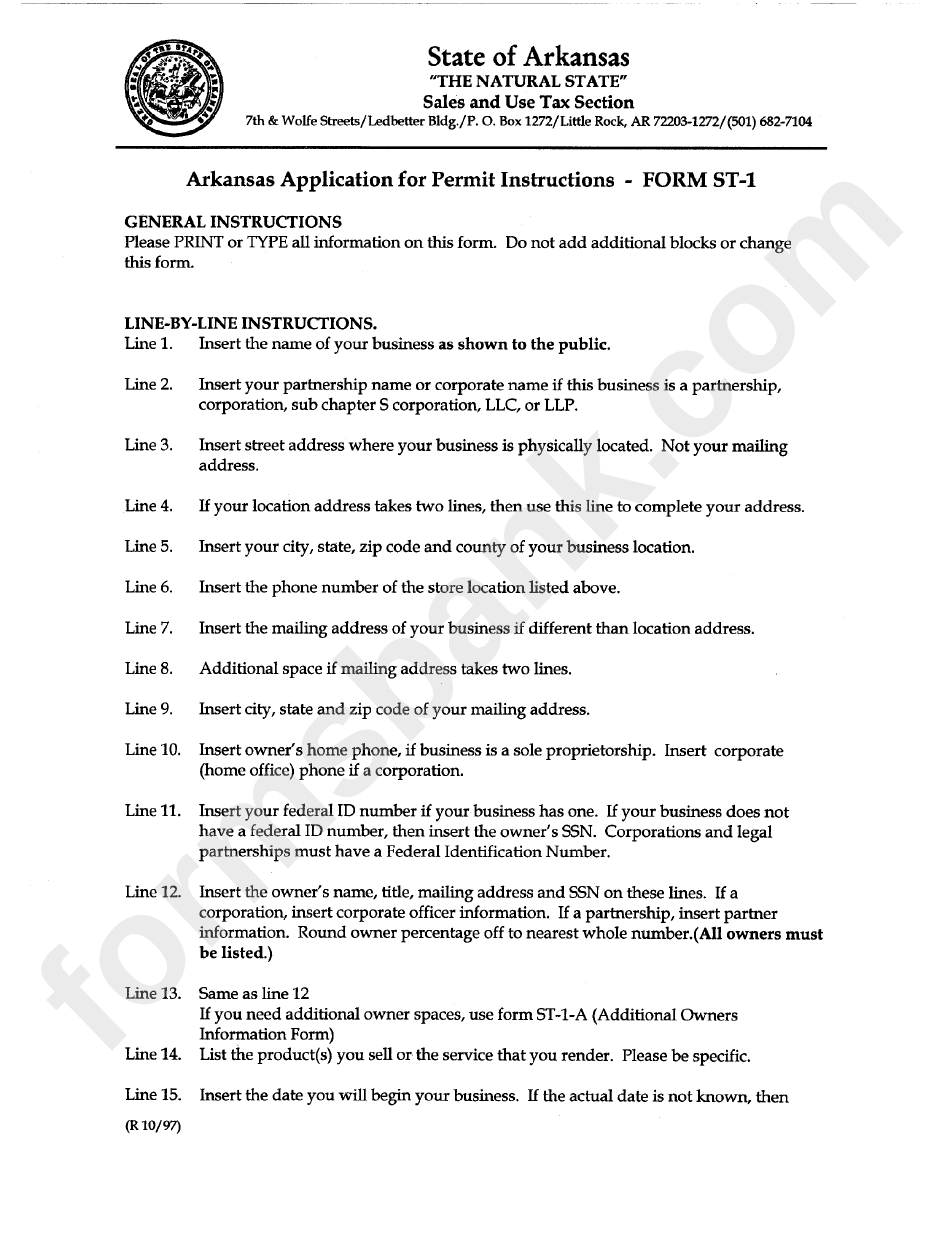

Form St1 Arkansas Application For Permit Instructions printable pdf

Adobe reader may be required for your browser or you may need to download the form to complete it properly. The arkansas department of finance and administration distributes arkansas tax forms. This is restricted to taxpayers who will receive a. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. File this form.

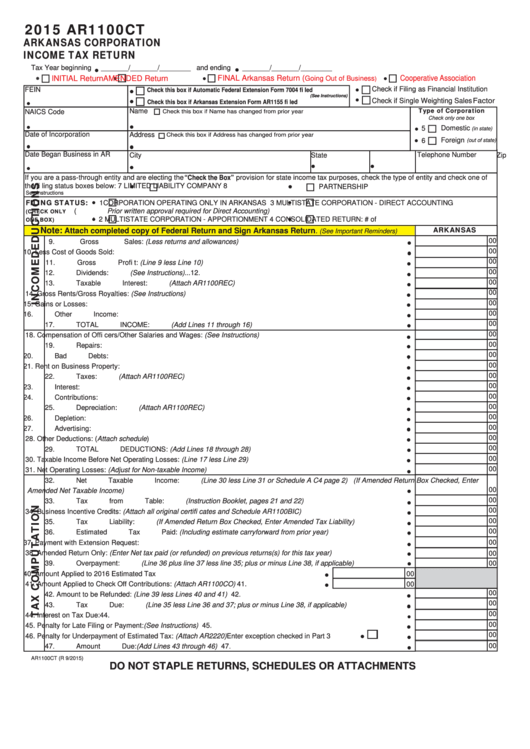

Form Ar1100ct Arkansas Corporation Tax Return 2015 printable

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 7 rows state tax forms. Direct deposit will be offered on electronically filed arkansas individual income tax returns. The arkansas department of finance and administration distributes arkansas tax.

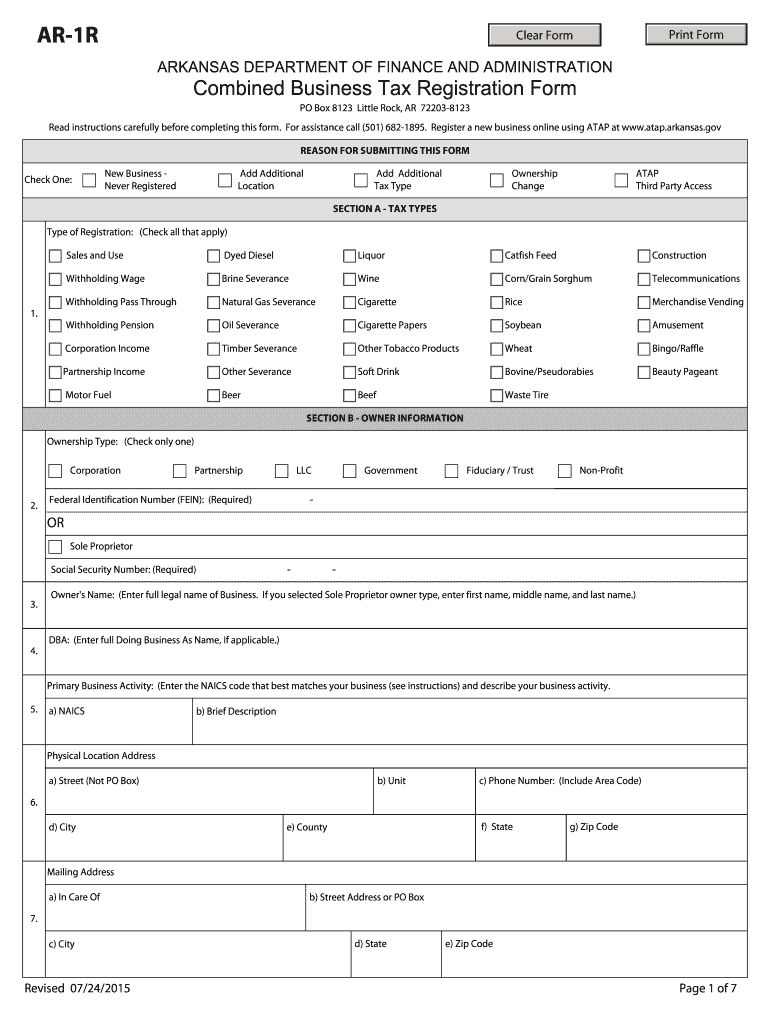

Ar Arkansas PDF 20152024 Form Fill Out and Sign Printable PDF

File this form with your employer. The arkansas department of finance and administration distributes arkansas tax forms. Adobe reader may be required for your browser or you may need to download the form to complete it properly. Withholding tax forms and instructions notice: Some internet browsers have a built in pdf viewer that may not be compatible with our forms.

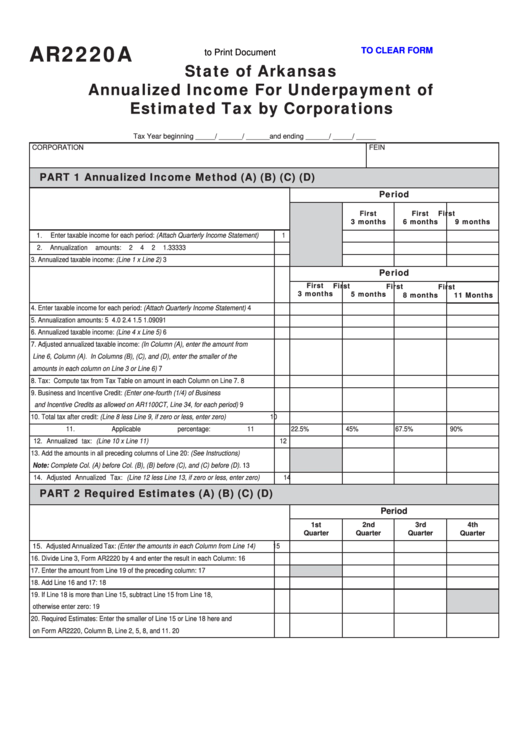

Fillable Form Ar2220a State Of Arkansas Annualized For

Withholding tax forms and instructions notice: This is restricted to taxpayers who will receive a. Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Direct deposit will be offered on electronically filed arkansas individual income tax returns. Adobe reader may be required for your browser or you may need to download the.

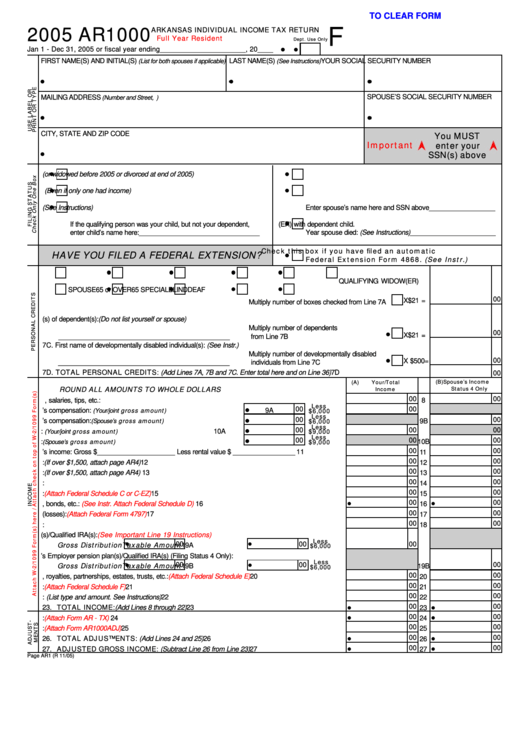

Fillable Form Ar1000 Arkansas Individual Tax Return 2005

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Withholding tax forms and instructions notice: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. This is restricted to taxpayers who will receive a. File this form with your employer.

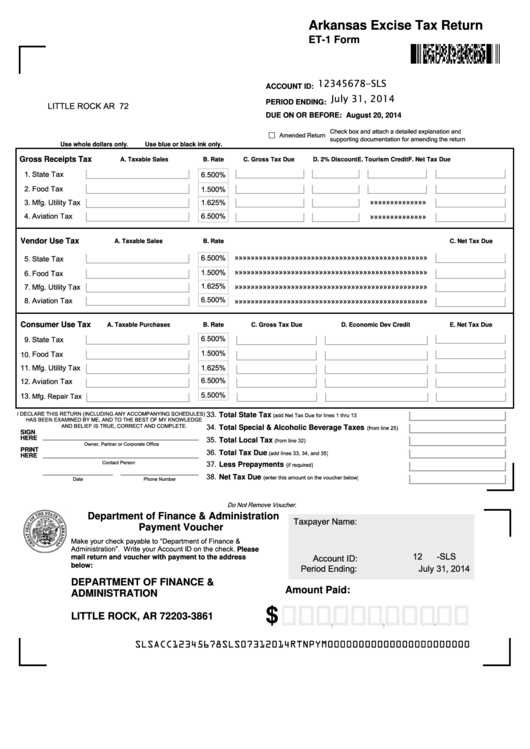

AR Instructions ET1 20202022 Fill out Tax Template Online US

Direct deposit will be offered on electronically filed arkansas individual income tax returns. This is restricted to taxpayers who will receive a. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. 7 rows state tax forms. Withholding tax forms and instructions notice:

Arkansas Printable Free Tax Forms Printable Forms Free Online

Adobe reader may be required for your browser or you may need to download the form to complete it properly. Withholding tax forms and instructions notice: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Direct deposit will be offered on electronically filed arkansas individual income tax returns. File this form with your employer.

File This Form With Your Employer.

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. 7 rows state tax forms. This is restricted to taxpayers who will receive a. The arkansas department of finance and administration distributes arkansas tax forms.

Adobe Reader May Be Required For Your Browser Or You May Need To Download The Form To Complete It Properly.

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Withholding tax forms and instructions notice: Direct deposit will be offered on electronically filed arkansas individual income tax returns.