Bir Form 1700

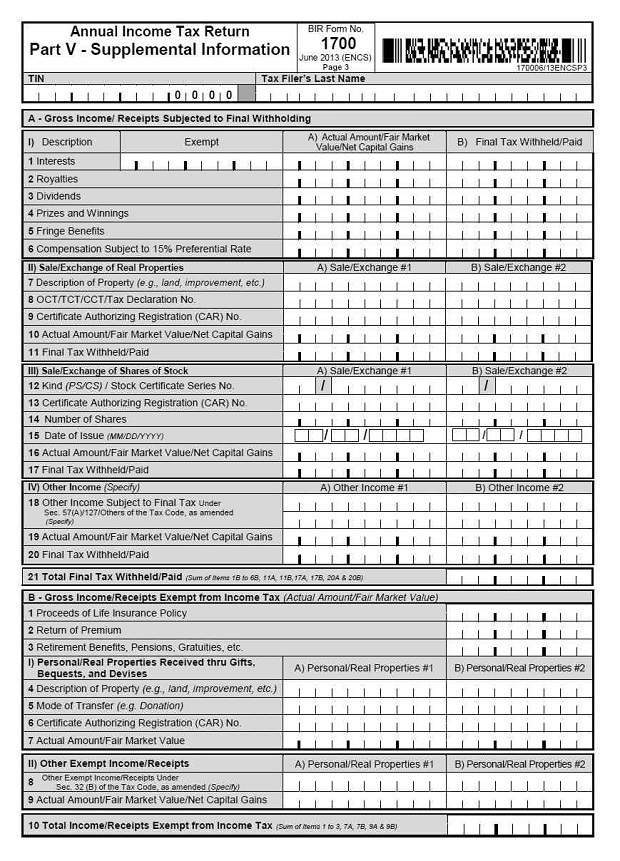

Bir Form 1700 - The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non.

1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue.

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non.

Bir form 1700

The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of.

BIR Form 1700 Tax Return Filing Public Finance Economy Of

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can.

Guide on How to FillUp BIR Form No. 1700 YouTube

Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non. Learn how to file form.

New BIR Forms 1700, 1701A, and 1701 for Individual Taxpayers 😊 YouTube

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline.

20182024 Form PH BIR 1700 Fill Online, Printable, Fillable, Blank

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline.

BIR FORM 1700 EPUB DOWNLOAD

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline.

Bir Form 1706 Printable Printable Forms Free Online

Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non. Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue..

(PDF) Bir form 1700 DOKUMEN.TIPS

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. Learn how to fill up the bir form 1700 for individual income tax return using the offline.

What Is 2316 From Previous Employer

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non..

BIR Tax Information, Business Solutions and Professional System Free

The bureau of internal revenue (bir) website (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non. Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue..

The Bureau Of Internal Revenue (Bir) Website (Www.bir.gov.ph) Is A Transaction Hub Where The Taxpaying Public Can Conveniently Access.

Learn how to file form 1700, the annual income tax return, online or offline using the efps system of the bureau of internal revenue. 1700 january 2018 (encs) page 1 annual income tax return individuals earning purely compensation income (including non. Learn how to fill up the bir form 1700 for individual income tax return using the offline ebirforms application.