Bonhoeffer Capital Letters

Bonhoeffer Capital Letters - The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. What are the opportunities that. The fund's objective is to grow capital at a faster rate than market indices. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. Click here to read the full fund letter. Bonhoeffer fund released it q1 2023 letter recently. The dfa international small cap value fund.

The fund's objective is to grow capital at a faster rate than market indices. The dfa international small cap value fund. Bonhoeffer fund released it q1 2023 letter recently. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. Click here to read the full fund letter. What are the opportunities that.

The dfa international small cap value fund. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. What are the opportunities that. Bonhoeffer fund released it q1 2023 letter recently. The fund's objective is to grow capital at a faster rate than market indices. Click here to read the full fund letter.

Adding Value to Grace Inspire A Fire

The fund's objective is to grow capital at a faster rate than market indices. The dfa international small cap value fund. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. Bonhoeffer fund released it q1 2023 letter recently. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of.

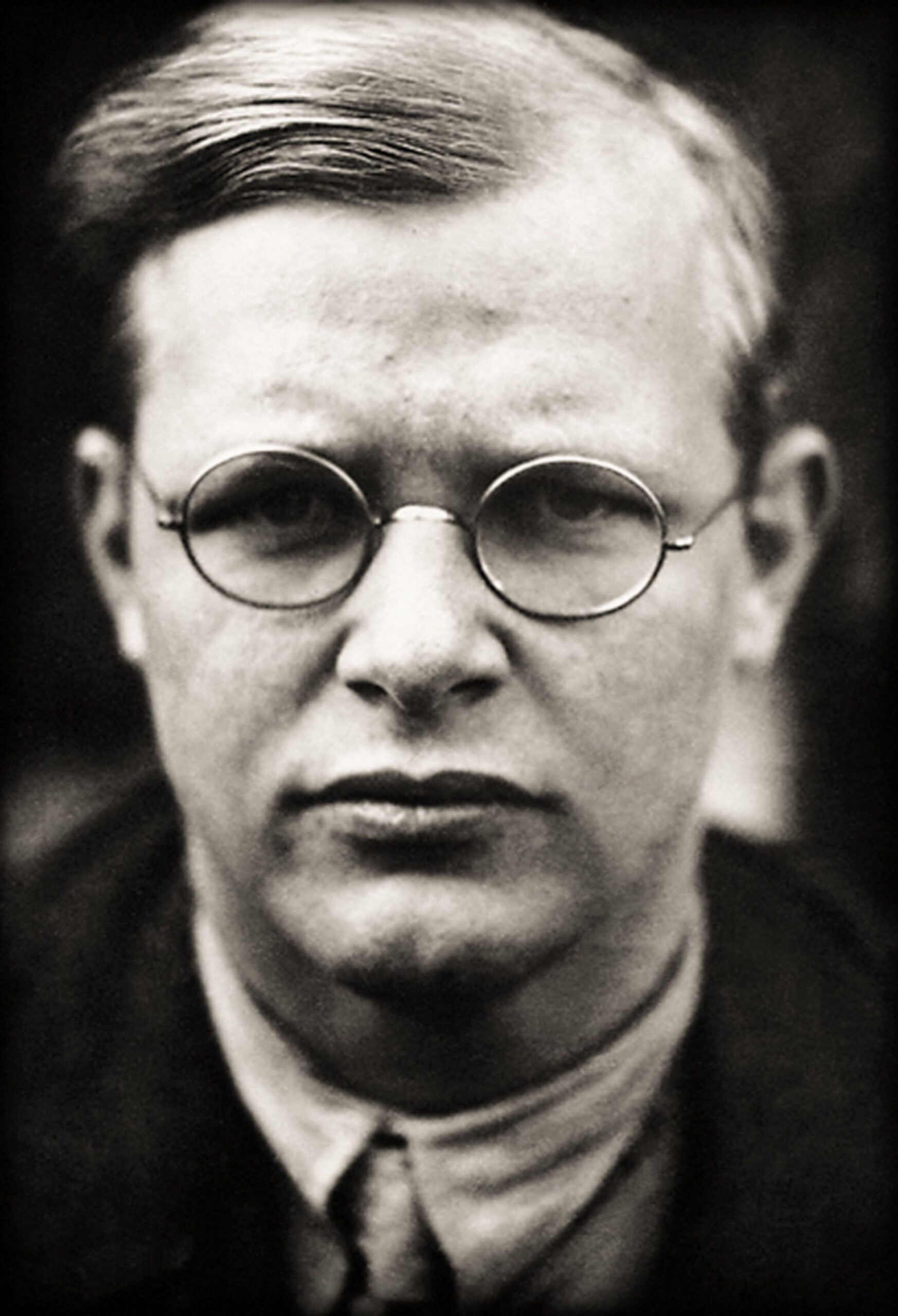

Dietrich Bonhoeffer's Letters and Papers from Prison Princeton

Click here to read the full fund letter. The dfa international small cap value fund. The fund's objective is to grow capital at a faster rate than market indices. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. Bonhoeffer fund released it q1 2023 letter recently.

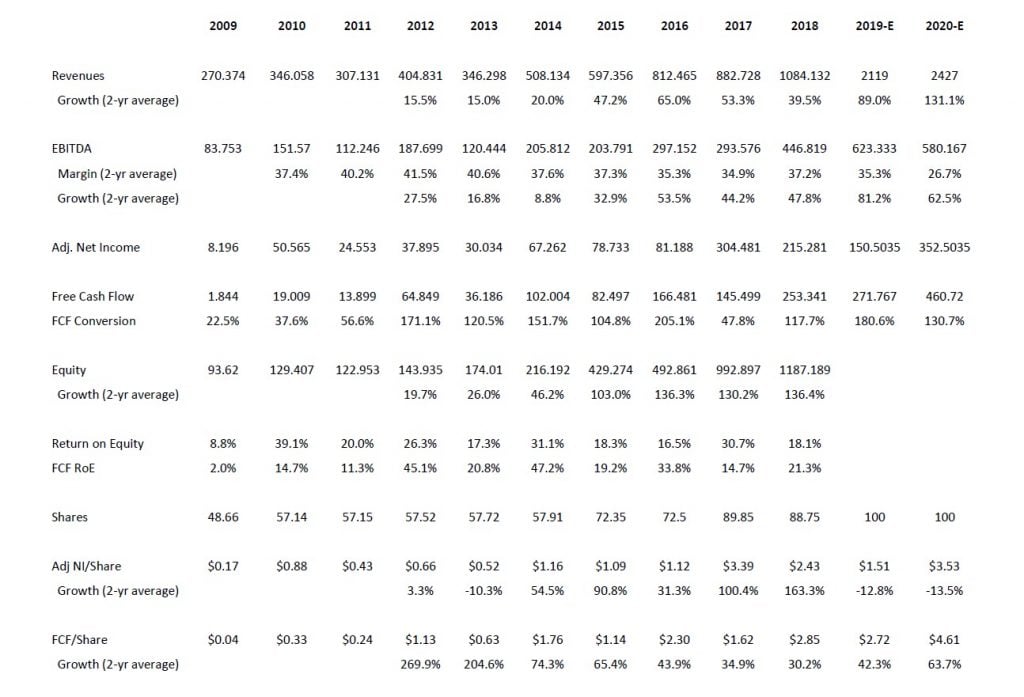

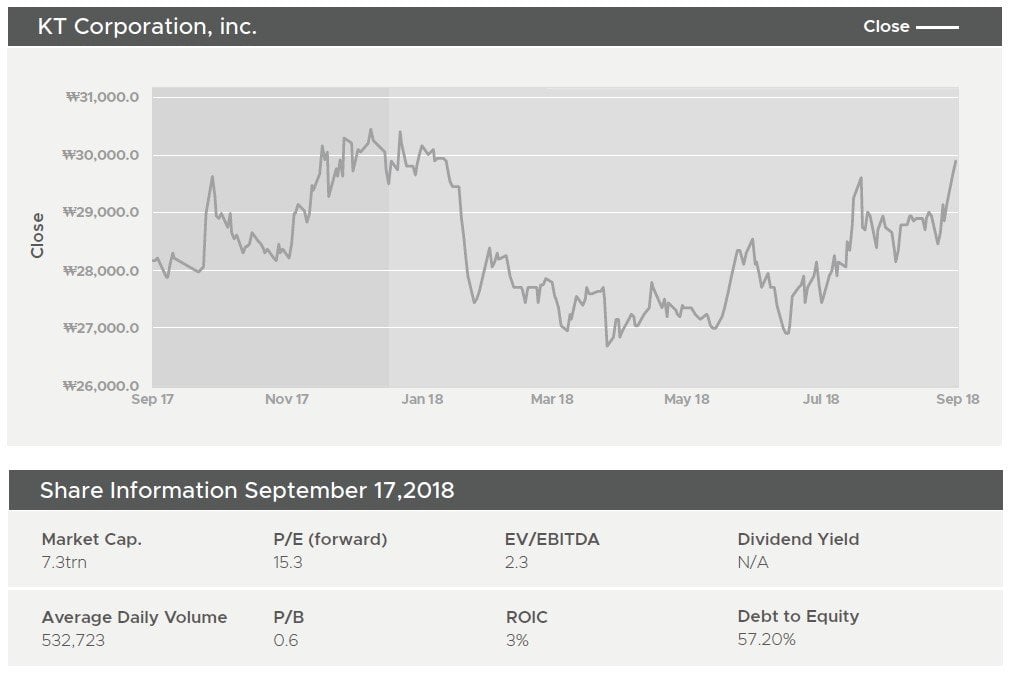

Bonhoeffer 2Q19 Commentary Case Study Gray Television, Inc. (GTN)

The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. Click here to read the full fund letter. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. The dfa international small cap value fund. The fund's objective is to grow capital at a.

Bonhoeffer Capital Management’s Q1 2023 Presentation and Q&A — Willow

The dfa international small cap value fund. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. What are the opportunities that. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4.

Bonhoeffer Fund Partner Letter Q1 2018 (OTCMKTSTIIAY) Seeking Alpha

27, 2023 10:45 am et | wllsf, bldr, ndbkf. Bonhoeffer fund released it q1 2023 letter recently. Click here to read the full fund letter. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. What are the opportunities that.

Five problems with the martyrdom of Dietrich Bonhoeffer John15.Rocks

Click here to read the full fund letter. The fund's objective is to grow capital at a faster rate than market indices. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. What are.

Bonhoeffer Fund Partner Letter Q4 2017 (OTCMKTSAACEYDEFUNCT19642

The dfa international small cap value fund. The fund's objective is to grow capital at a faster rate than market indices. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. What are the opportunities that.

Bonhoeffer Capital Management Q2 2022 Letter Seeking Alpha

The dfa international small cap value fund. The fund's objective is to grow capital at a faster rate than market indices. What are the opportunities that. Bonhoeffer fund released it q1 2023 letter recently. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%.

Bonhoeffer Capital 3Q18 Partner Letter

The fund's objective is to grow capital at a faster rate than market indices. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. The dfa international small cap value fund. What are the opportunities that. As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda.

"Are We Still of Any Use?" Dietrich Bonhoeffer on Christian Witness in

As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. The fund's objective is to grow capital at a faster rate than market indices. 27, 2023 10:45 am et | wllsf, bldr, ndbkf. What are the opportunities that. Click here to read the full fund letter.

Bonhoeffer Fund Released It Q1 2023 Letter Recently.

As of september 30, 2022, our securities have a weighted average earnings/free cash flow yield of 19.7% and an average ev/ebitda of 3.4. What are the opportunities that. The current bonhoeffer portfolio has projected earnings/free cash flow growth of about 12.5%. Click here to read the full fund letter.

The Dfa International Small Cap Value Fund.

27, 2023 10:45 am et | wllsf, bldr, ndbkf. The fund's objective is to grow capital at a faster rate than market indices.