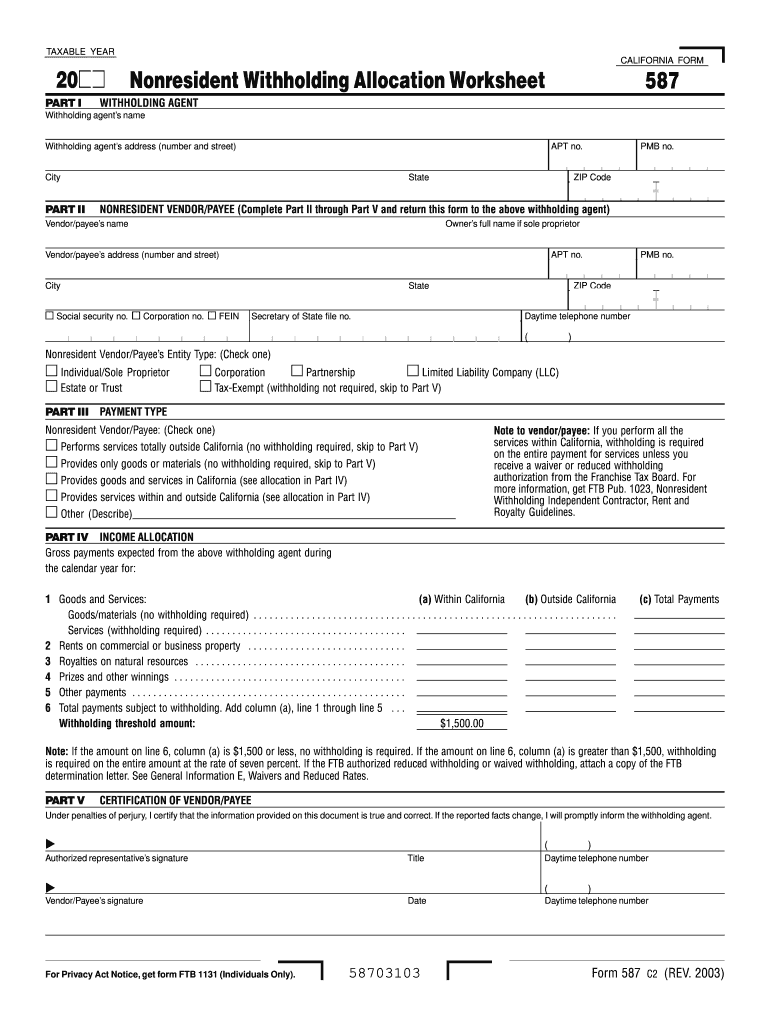

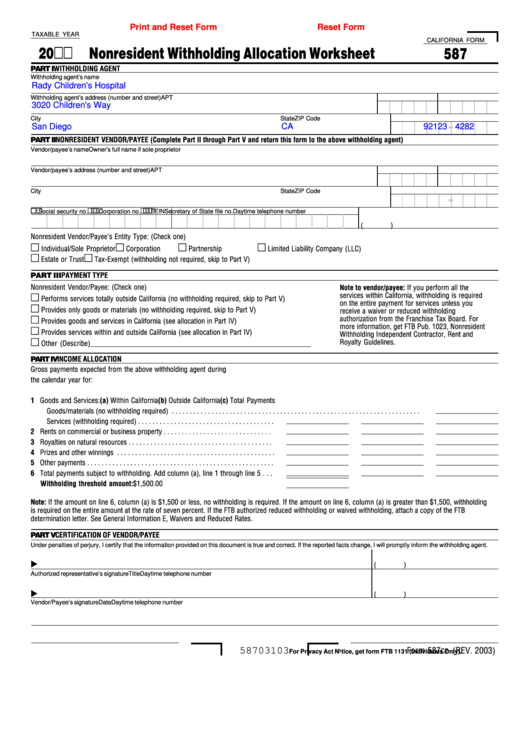

Ca Form 587

Ca Form 587 - Signed form 587 is accepted in good faith. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Find out who is a. # the payee is a. Use form 593, real estate withholding statement. Use form 587 if any of the following apply: Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb.

Signed form 587 is accepted in good faith. # you sold california real estate. Find out who is a. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. # the payee is a. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Use form 593, real estate withholding statement. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Use form 587 if any of the following apply:

Use form 587 if any of the following apply: # the payee is a. Use form 593, real estate withholding statement. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Signed form 587 is accepted in good faith. # you sold california real estate. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes.

A Complete Overview of SMTP Port 25, Port 465, and Port 587 How To

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Find out who is a. Use form 593, real estate withholding statement. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. This form is used by nonresident payees and withholding agents.

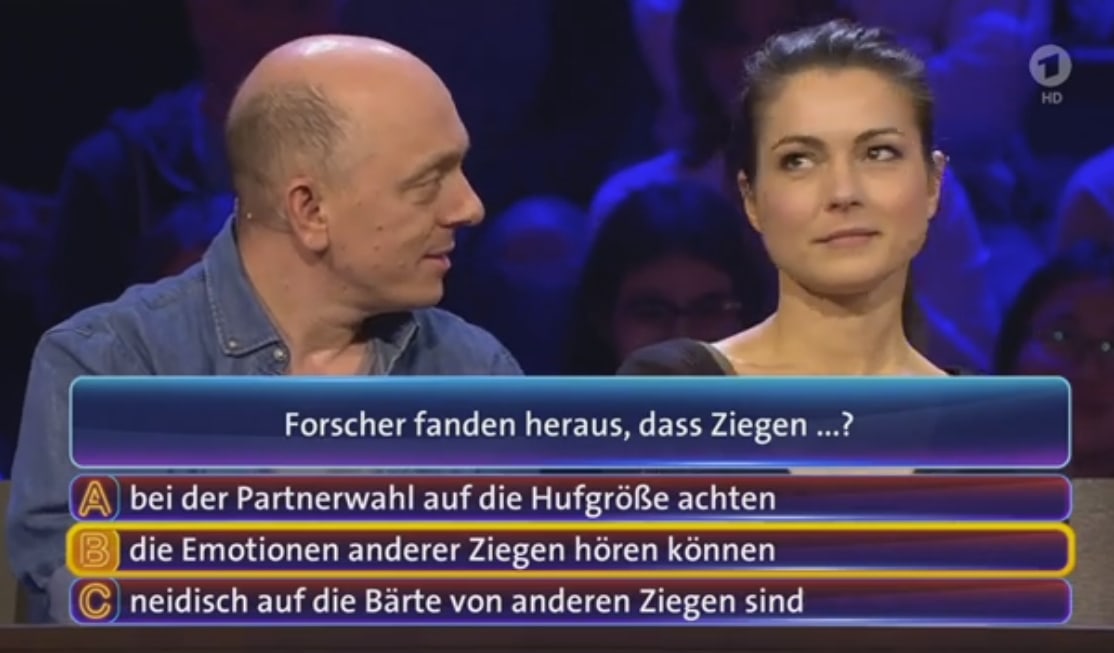

Picture of Folge 587

Find out who is a. Use form 587 if any of the following apply: Signed form 587 is accepted in good faith. Use form 593, real estate withholding statement. # you sold california real estate.

FT 587

Signed form 587 is accepted in good faith. # the payee is a. # you sold california real estate. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb.

2023 Form 587 Printable Forms Free Online

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. # the payee is a. Find out who is a. Signed form 587 is accepted in good faith.

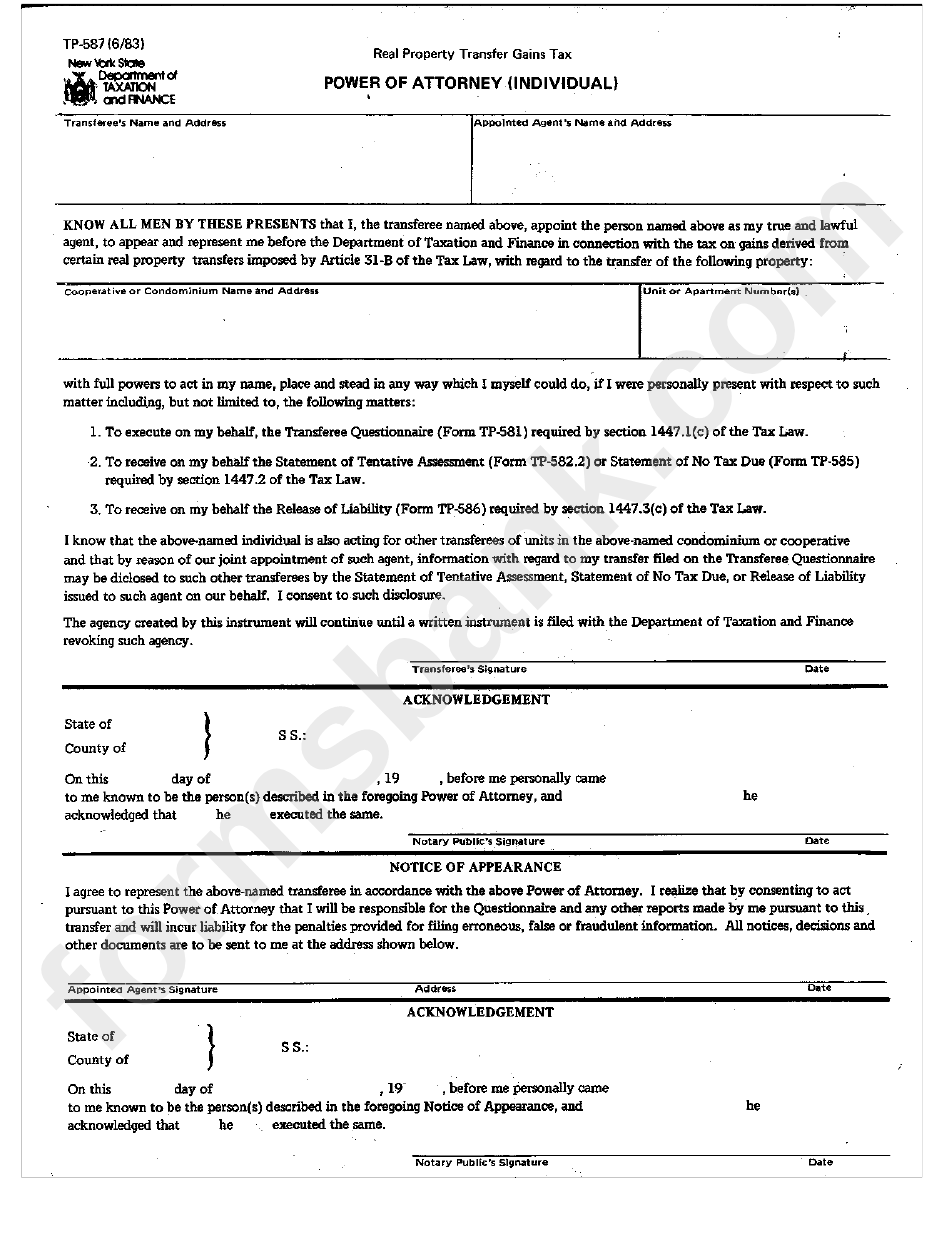

Form Tp587 Real Property Transfer Gains Tax Power Of Attorney

# the payee is a. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Find out who is a. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Retain the completed form 587 for your records for a minimum of.

Picture of Folge 587

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. # the payee is a. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. Find out who is a. Use form 593, real estate withholding statement.

Form Pc 587 ≡ Fill Out Printable PDF Forms Online

Use form 587 if any of the following apply: This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Find out who is a. This form is used by nonresident payees and.

Fillable Form 587 Nonresident Withholding Allocation Worksheet

This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Find out who is a. Use form 593, real estate withholding statement. Signed form 587 is accepted in good faith.

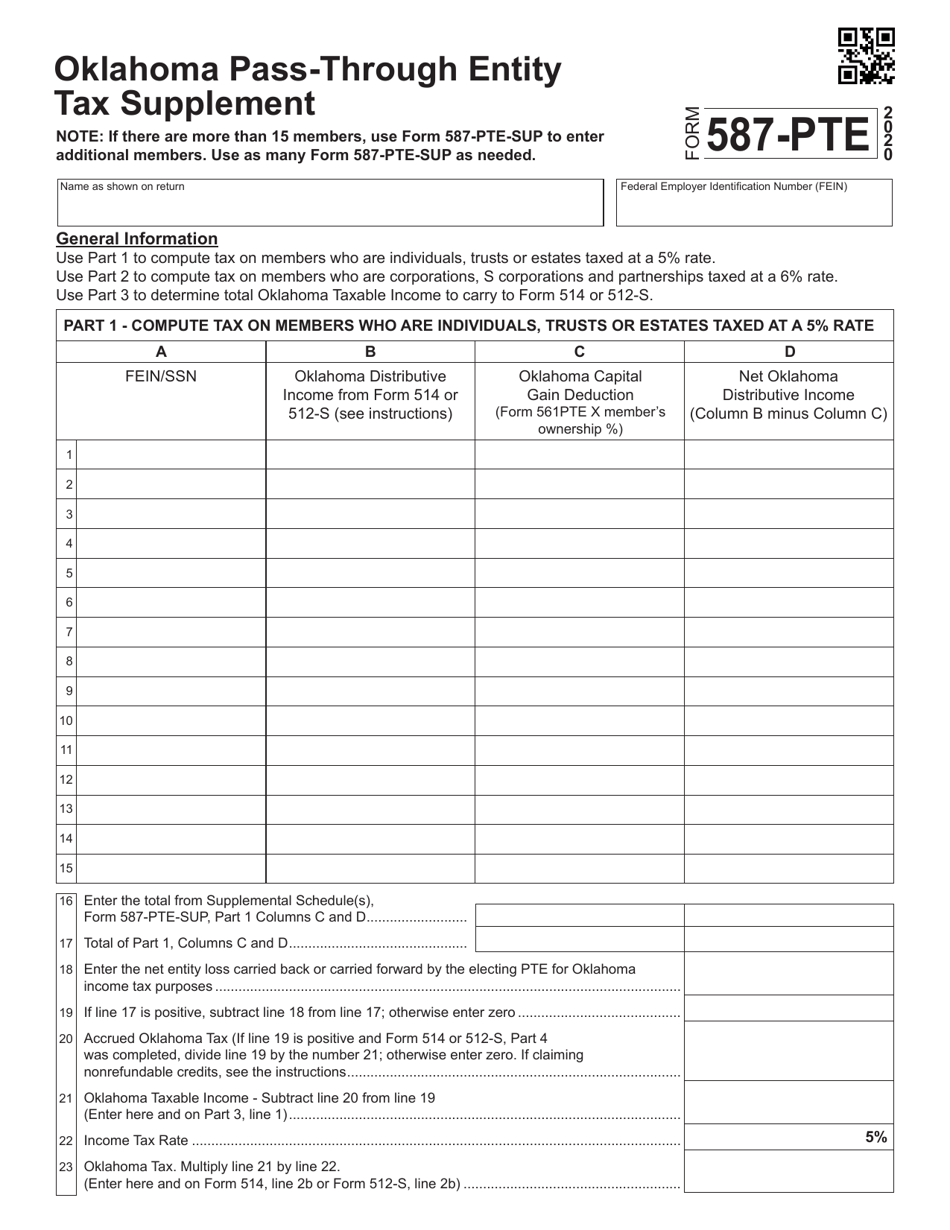

Form 587PTE Download Fillable PDF or Fill Online Oklahoma PassThrough

# you sold california real estate. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. # the payee is a. Use form 593, real estate withholding statement. Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board.

2011 CA Form 587 Fill Online, Printable, Fillable, Blank pdfFiller

Signed form 587 is accepted in good faith. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587 if any of the following apply: # the payee is a.

This Form Is Used By Nonresident Payees And Withholding Agents In California To Calculate And Report Withholding Taxes.

Signed form 587 is accepted in good faith. Retain the completed form 587 for your records for a minimum of four years and provide it to the ftb. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income. Find out who is a.

Use Form 593, Real Estate Withholding Statement.

Download or print the 2023 california form 587 (nonresident withholding allocation worksheet) for free from the california franchise tax board. This form is used by nonresident payees and withholding agents in california to calculate and report withholding taxes. Use form 587 if any of the following apply: # you sold california real estate.