Ca Inheritance Tax Waiver Form

Ca Inheritance Tax Waiver Form - California does not have an estate tax or an inheritance tax. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. If you received a gift or inheritance, do not include it in your income. If an estate is worth more than $12.06 million dollars for single individuals and. In california, there is no requirement for an inheritance tax waiver form, a legal. Is there a california inheritance tax waiver form? Federal inheritance tax only applies to estates exceeding $11,4 million. However, if the gift or inheritance later produces income, you will. No form exists or needed. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state.

Is there a california inheritance tax waiver form? No form exists or needed. In california, there is no requirement for an inheritance tax waiver form, a legal. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. California has no inheritance tax. Federal inheritance tax only applies to estates exceeding $11,4 million. If an estate is worth more than $12.06 million dollars for single individuals and. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. If you received a gift or inheritance, do not include it in your income. However, if the gift or inheritance later produces income, you will.

The return is due and. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. If an estate is worth more than $12.06 million dollars for single individuals and. If you received a gift or inheritance, do not include it in your income. California has no inheritance tax. Federal inheritance tax only applies to estates exceeding $11,4 million. California does not have an estate tax or an inheritance tax. Is there a california inheritance tax waiver form? However, if the gift or inheritance later produces income, you will.

Illinois Inheritance Tax Waiver Form Form Resume Examples v19xN16AV7

California does not have an estate tax or an inheritance tax. However, if the gift or inheritance later produces income, you will. In california, there is no requirement for an inheritance tax waiver form, a legal. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be.

19+ California inheritance tax waiver form download ideas in 2021

No form exists or needed. If an estate is worth more than $12.06 million dollars for single individuals and. California has no inheritance tax. However, if the gift or inheritance later produces income, you will. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005.

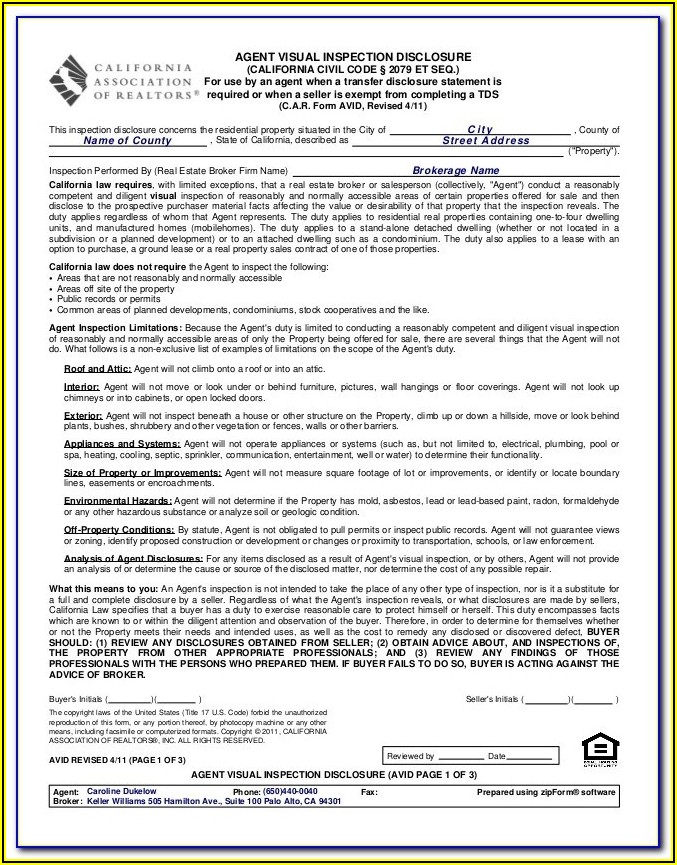

20072024 Form CA Conditional Waiver and Release Upon Final Payment

However, if the gift or inheritance later produces income, you will. Federal inheritance tax only applies to estates exceeding $11,4 million. The return is due and. If an estate is worth more than $12.06 million dollars for single individuals and. California has no inheritance tax.

Wisconsin Inheritance Tax Waiver Form » Veche.info 5

The return is due and. If an estate is worth more than $12.06 million dollars for single individuals and. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. California does not have an estate tax or an inheritance tax. This form.

Tennessee inheritance tax waiver form Fill out & sign online DocHub

However, if the gift or inheritance later produces income, you will. Federal inheritance tax only applies to estates exceeding $11,4 million. Is there a california inheritance tax waiver form? If you received a gift or inheritance, do not include it in your income. This form is to be used only for estates of decedents who died on or after june.

California ag tax exemption form Fill out & sign online DocHub

If you received a gift or inheritance, do not include it in your income. In california, there is no requirement for an inheritance tax waiver form, a legal. The return is due and. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

California has no inheritance tax. If you received a gift or inheritance, do not include it in your income. Is there a california inheritance tax waiver form? This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. No form exists or needed.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. The return is due and. Is there a california inheritance tax waiver form? If an estate is worth more than $12.06 million dollars for single individuals and. This form is to be.

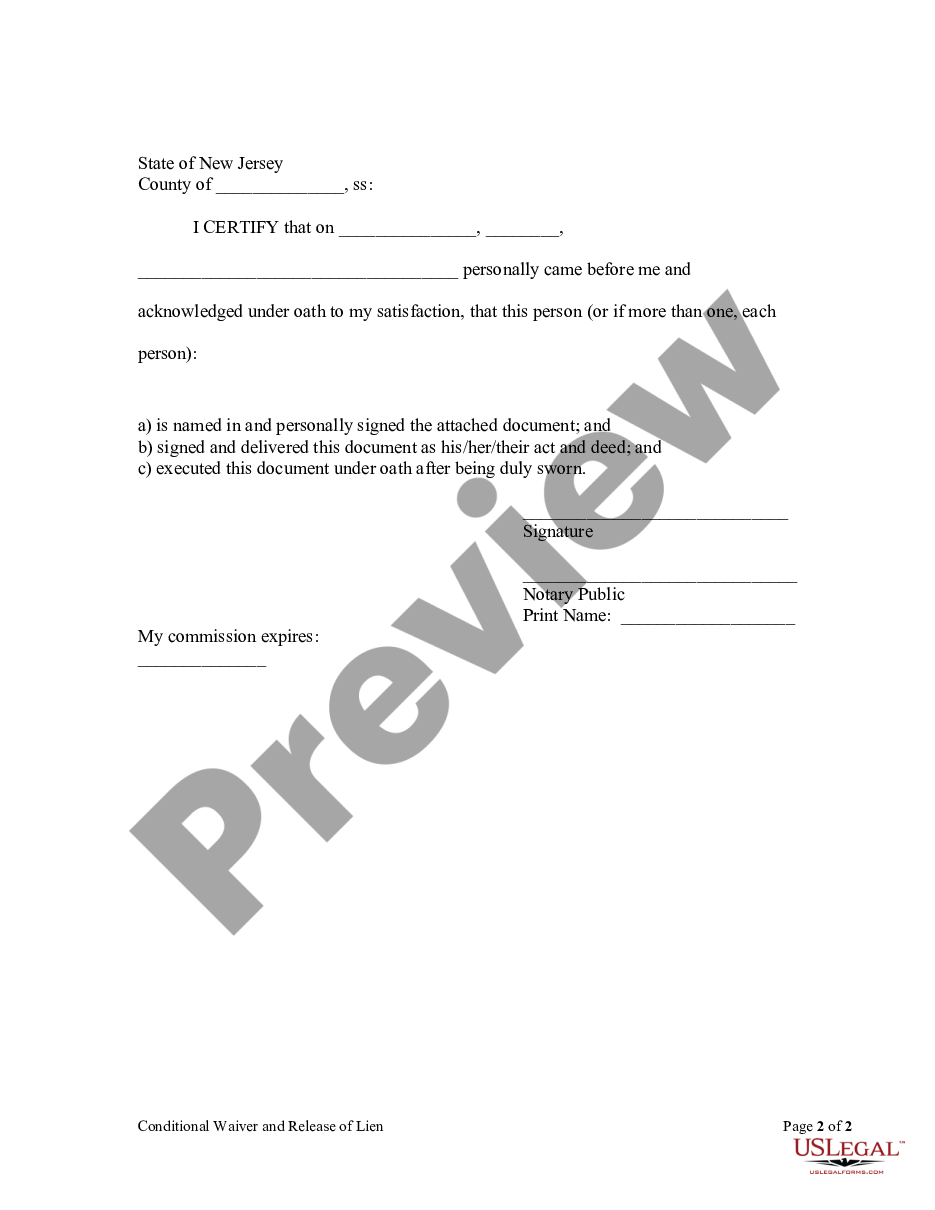

New Jersey Inheritance Tax Waiver Form Form O1 US Legal Forms

However, if the gift or inheritance later produces income, you will. If you received a gift or inheritance, do not include it in your income. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. Is there a california inheritance tax waiver.

Inheritance Tax Waiver Form Form Resume Examples XV8o6xo3zD

California does not have an estate tax or an inheritance tax. For decedents that die on or after june 8, 1982, and before january 1, 2005, a california estate tax return is required to be filed with the state. In california, there is no requirement for an inheritance tax waiver form, a legal. California has no inheritance tax. This form.

This Form Is To Be Used Only For Estates Of Decedents Who Died On Or After June 8, 1982 And Before January 1, 2005.

If you received a gift or inheritance, do not include it in your income. California does not have an estate tax or an inheritance tax. In california, there is no requirement for an inheritance tax waiver form, a legal. If an estate is worth more than $12.06 million dollars for single individuals and.

Federal Inheritance Tax Only Applies To Estates Exceeding $11,4 Million.

No form exists or needed. The return is due and. However, if the gift or inheritance later produces income, you will. California has no inheritance tax.

For Decedents That Die On Or After June 8, 1982, And Before January 1, 2005, A California Estate Tax Return Is Required To Be Filed With The State.

Is there a california inheritance tax waiver form?