Can A Holding Company Own An S Corp

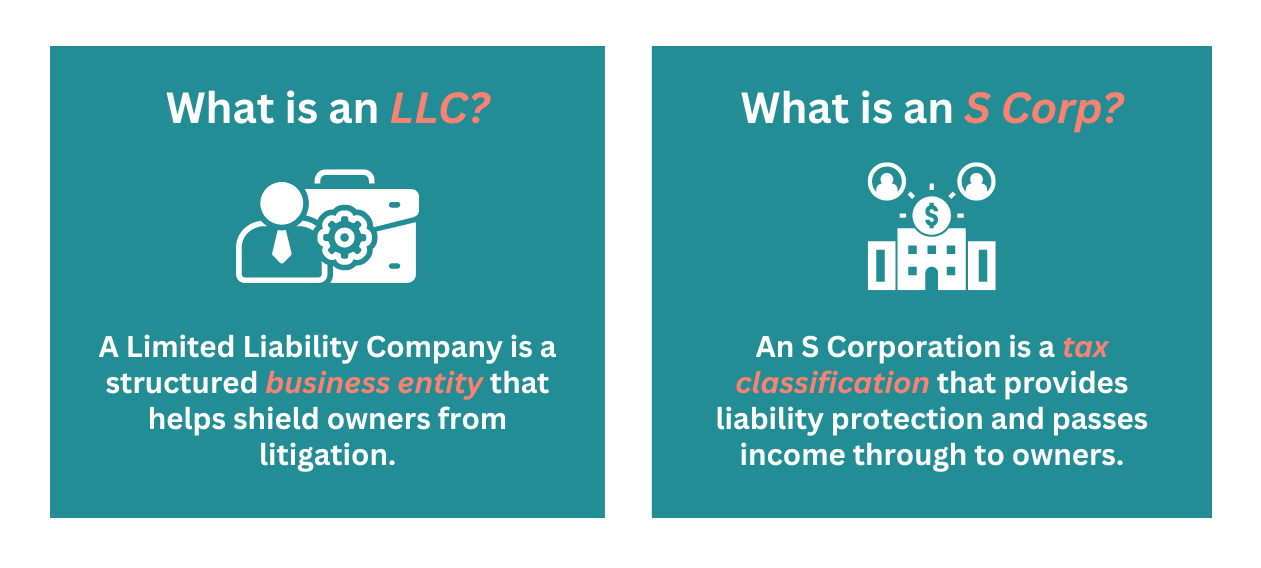

Can A Holding Company Own An S Corp - An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

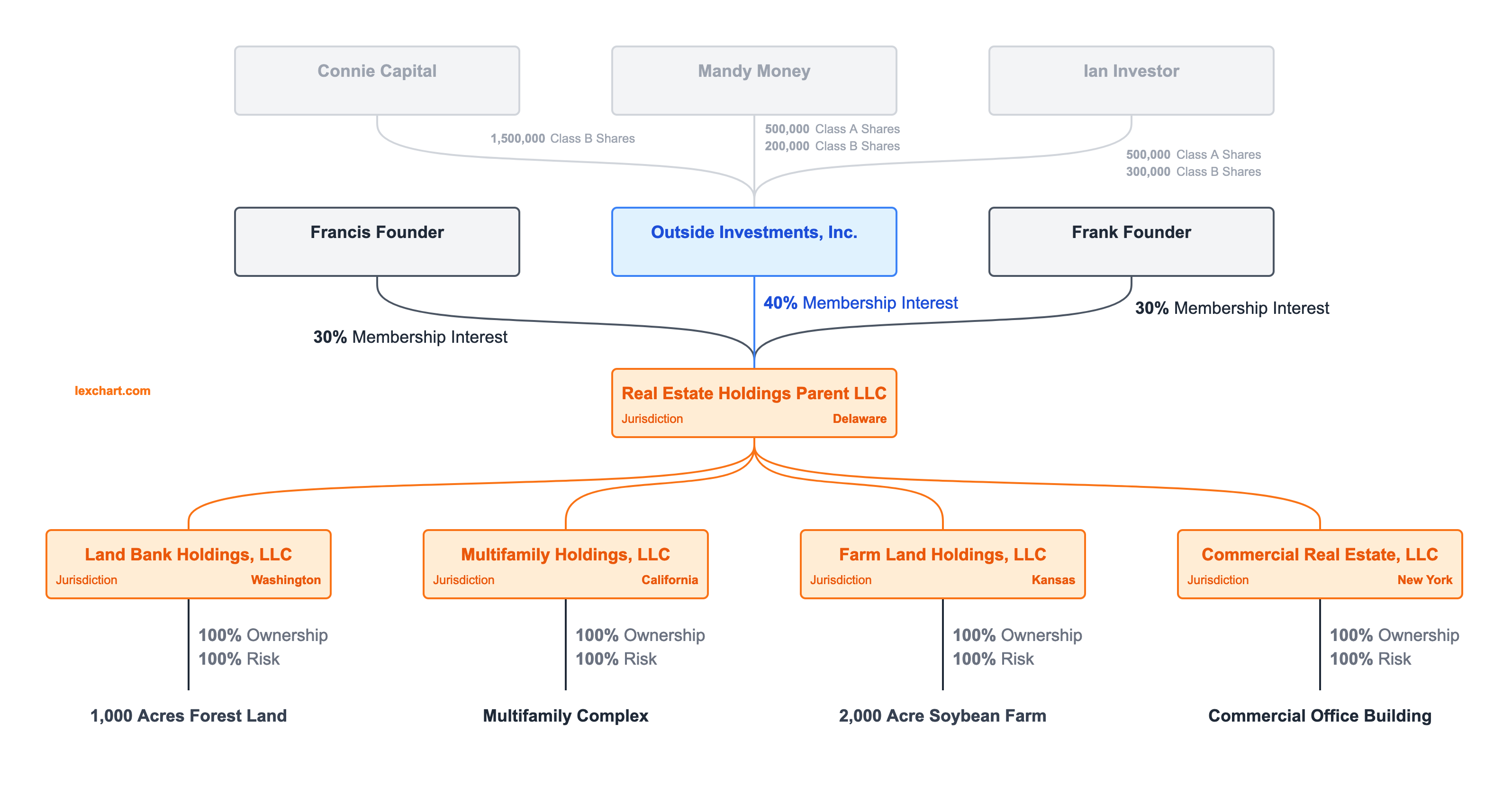

Llc Holding Company Structure Diagram

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

Can an S Corp Own an LLC? Here’s Everything You Need to Know Acumen

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

Holding Company Definition, Explained, Examples, Vs, 55 OFF

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

What is a holding company? Market Business News

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

Understanding a Holding Company

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

Holding Company Features and Types of Holding Company with Example

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

Holding Company With Bearer Shares

An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney. An s corporation can indeed own other corporations, making it possible to function as a holding company.

Benefits of a Holding Company Structure in Florida

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

Setting up a Holding Company Essential Advice Shorts

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

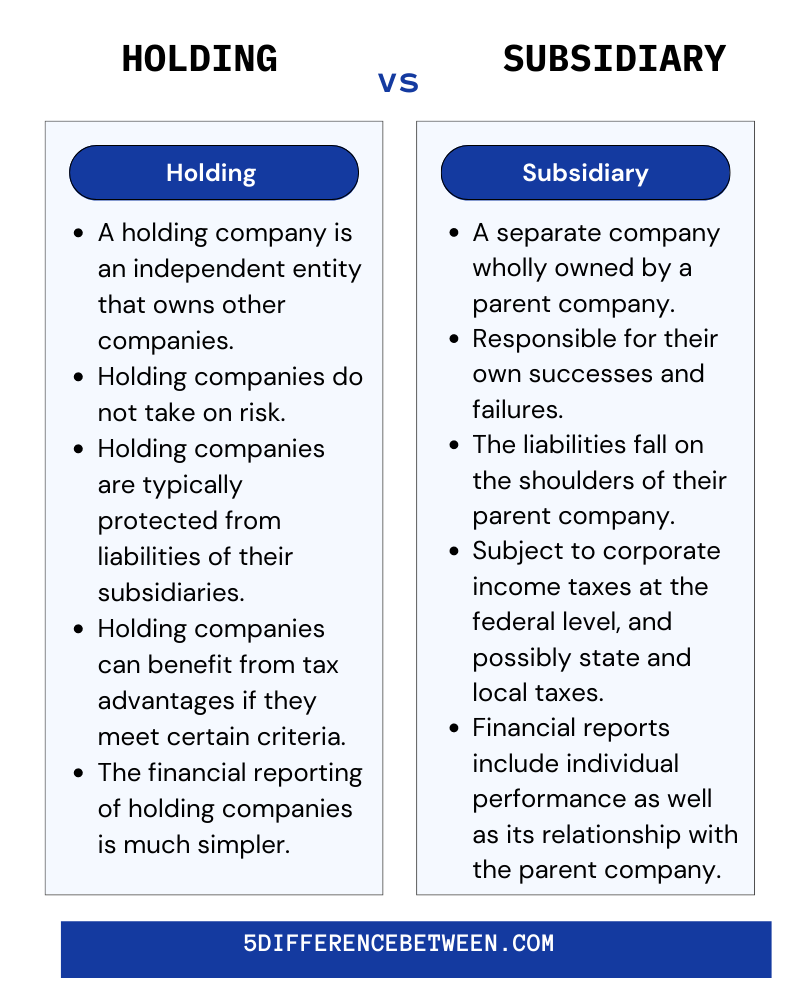

5 Difference Between Holding and Subsidiary Company Holding Vs Subsidiary

An s corporation can indeed own other corporations, making it possible to function as a holding company. An s corp can be a member of an llc that has elected to be taxed as a partnership, but you should discuss this with your business attorney.

An S Corp Can Be A Member Of An Llc That Has Elected To Be Taxed As A Partnership, But You Should Discuss This With Your Business Attorney.

An s corporation can indeed own other corporations, making it possible to function as a holding company.

:max_bytes(150000):strip_icc()/understanding-a-holding-company-357341-v2-5bc64801c9e77c005190650d.png)