Canada Income Tax Forms

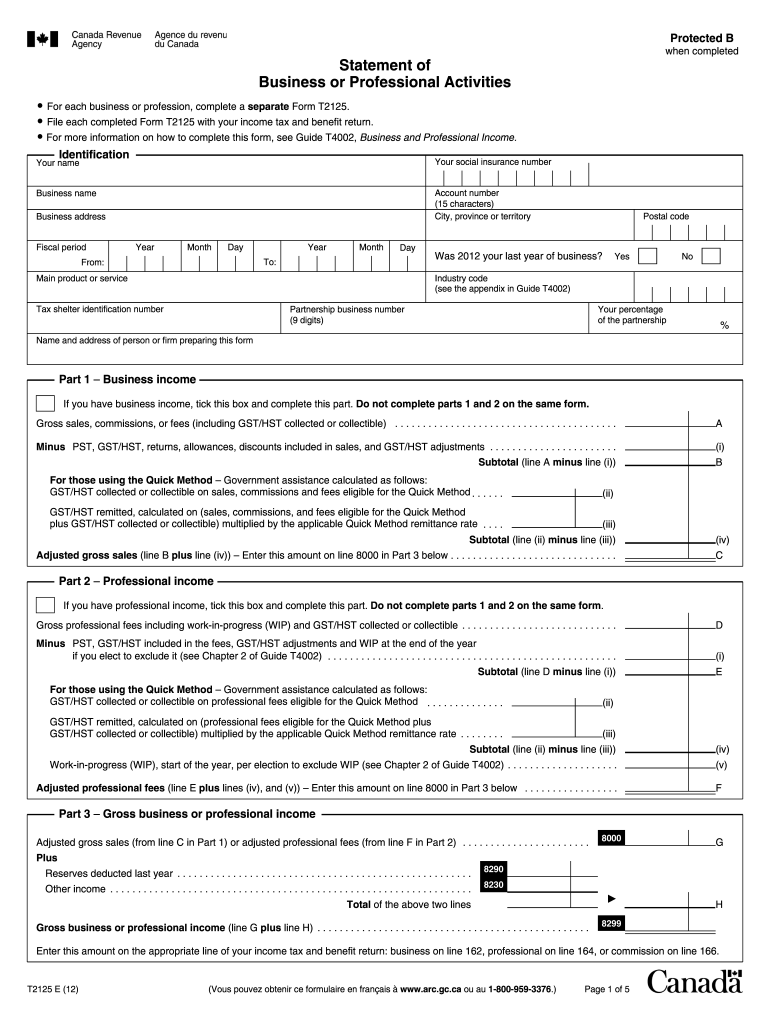

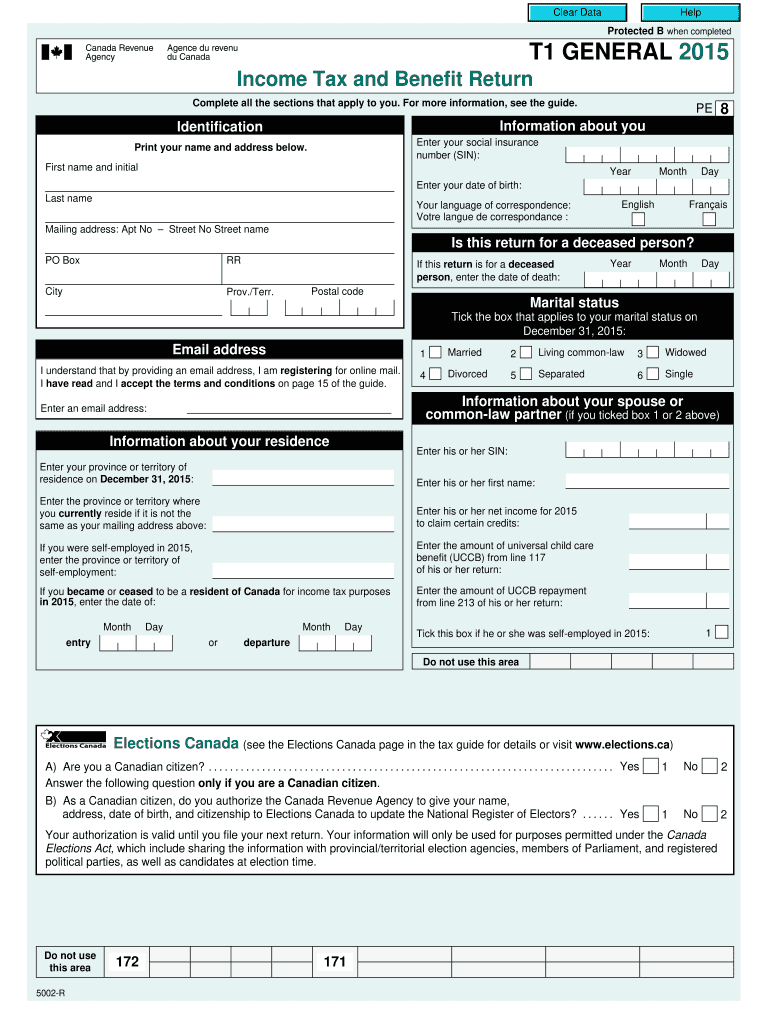

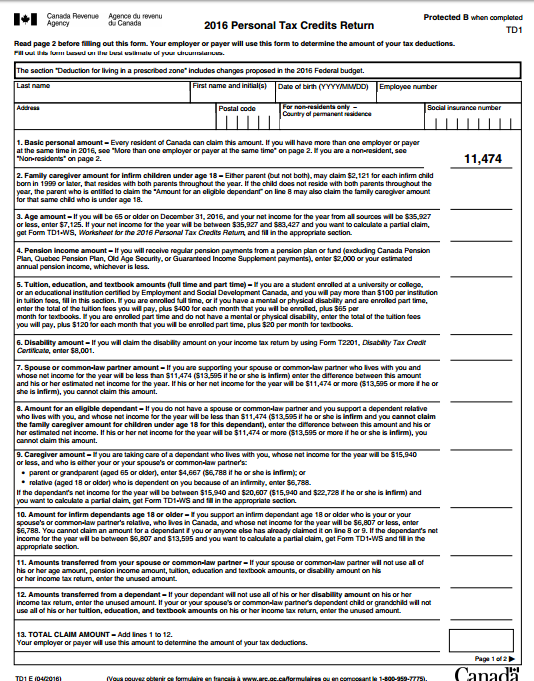

Canada Income Tax Forms - Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals. These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. Certain tax situations may require a specific return or form. You can get an income tax package online or by mail. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. Turbotax® provides all the tax forms you need, based on your tax situation. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Find all the canadian federal and provincial 2023 tax forms.

Certain tax situations may require a specific return or form. Find all the canadian federal and provincial 2023 tax forms. Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals. These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Turbotax® provides all the tax forms you need, based on your tax situation. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. You can get an income tax package online or by mail.

These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. Certain tax situations may require a specific return or form. Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals. Turbotax® provides all the tax forms you need, based on your tax situation. Find all the canadian federal and provincial 2023 tax forms. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. You can get an income tax package online or by mail.

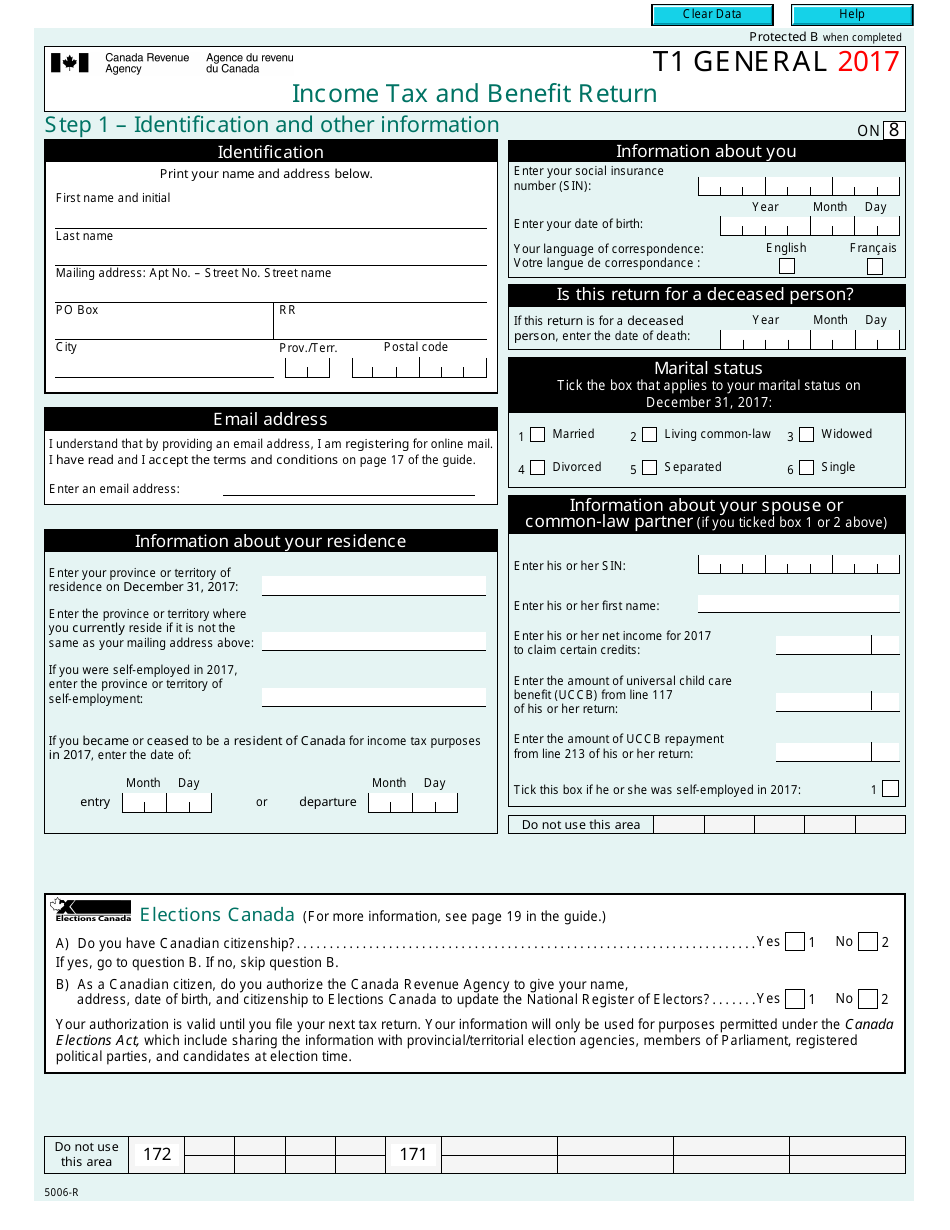

Form T1 GENERAL 2017 Fill Out, Sign Online and Download Fillable

As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. You can get an income tax package online or by mail. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Tax returns.

Alberta Tax Form 2023 Printable Forms Free Online

Turbotax® provides all the tax forms you need, based on your tax situation. Find all the canadian federal and provincial 2023 tax forms. You can get an income tax package online or by mail. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. As an employee, you complete.

Revenue Canada 2024 Tax Forms Ibbie Teressa

The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Turbotax® provides all the tax forms you need, based on your tax situation. Find all the canadian federal and provincial 2023 tax forms. Certain tax situations may require a specific return or form. These forms serve as the foundation.

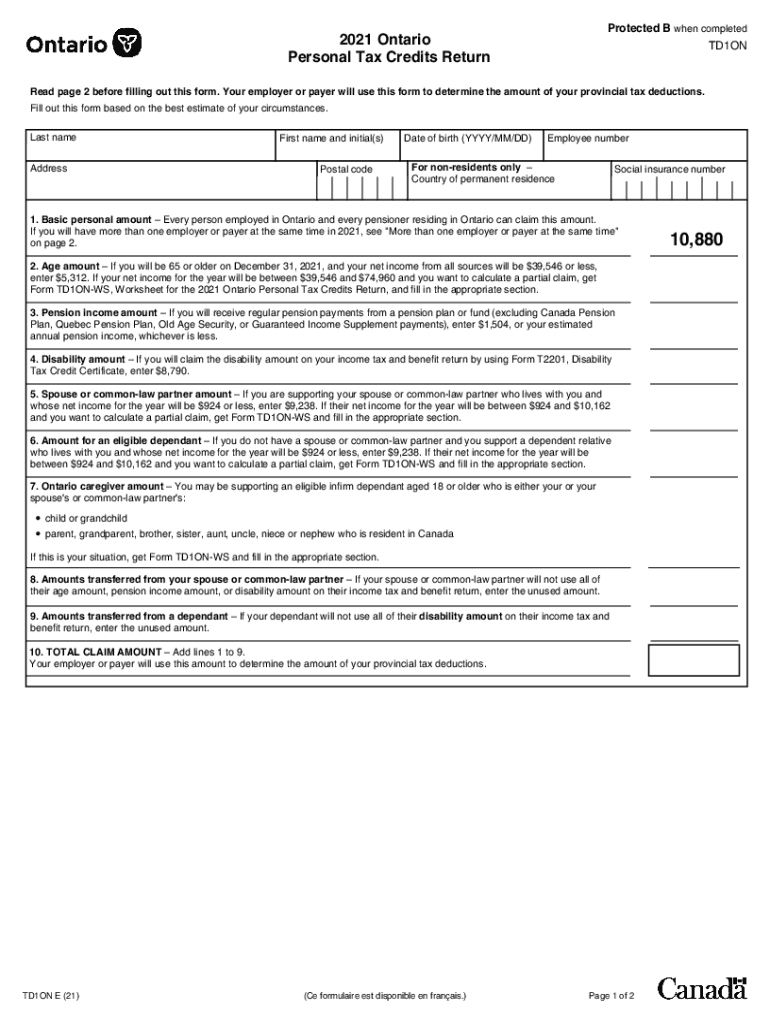

2023 Form Canada TD1 E Fill Online, Printable, Fillable, Blank pdfFiller

These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Find all the canadian federal and provincial 2023 tax forms. You can get an income tax package online or by mail. As an employee,.

Free Alberta Canada Tax and Benefit Return Form (T1 General

As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. You can get an income tax package online or by mail. Find all the canadian federal and provincial 2023 tax forms. These forms serve as the foundation for accurately reporting income, claiming deductions, and.

2021 Form Canada TD1ON Fill Online, Printable, Fillable, Blank pdfFiller

These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. Certain tax situations may require a specific return or form. Turbotax® provides all the tax forms you need, based on your tax situation. Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year.

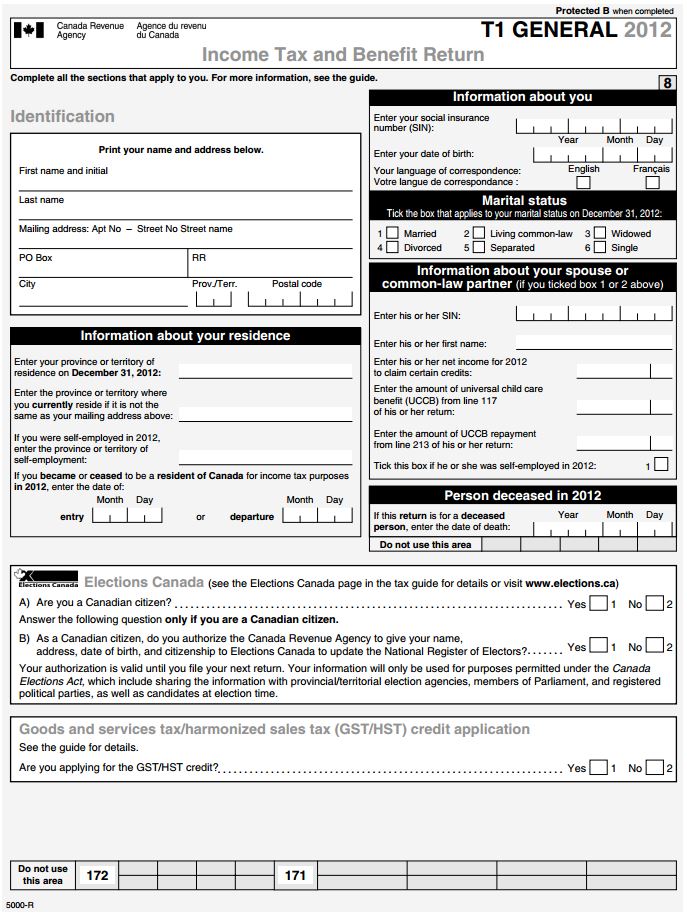

20152024 Form Canada T1 General Fill Online, Printable, Fillable

As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if. You can get an income tax package online or by mail. Certain tax situations may require a specific return or form. The primary document you need to file personal income taxes in canada is.

Fillable Online Canada Tax Forms TurboTax Fax Email Print

These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. Turbotax® provides all the tax forms you need, based on your tax situation. You can get an income tax package online or by mail. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or.

Tax Forms Tax Forms Canada 2017

Find all the canadian federal and provincial 2023 tax forms. Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals. Certain tax situations may require a specific return or form. These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. The.

Canada T2 Corporation Tax Return 20202022 Fill and Sign

Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals. Turbotax® provides all the tax forms you need, based on your tax situation. These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. As an employee, you complete this form if.

Find All The Canadian Federal And Provincial 2023 Tax Forms.

Turbotax® provides all the tax forms you need, based on your tax situation. You can get an income tax package online or by mail. These forms serve as the foundation for accurately reporting income, claiming deductions, and ensuring compliance. As an employee, you complete this form if you have a new employer or payer and will receive salary, wages, or any other remuneration, or if.

Certain Tax Situations May Require A Specific Return Or Form.

The primary document you need to file personal income taxes in canada is the income tax and benefit return form, better. Tax returns in canada refer to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals.