Car Loan Tax Form

Car Loan Tax Form - Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the standard. You can deduct car loan interest on irs form 1040 schedule c. Credit card and installment interest incurred for personal expenses. While typically, deducting car loan interest is not allowed there is one. Interest paid on a loan to purchase a car for personal use. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes.

Credit card and installment interest incurred for personal expenses. Interest paid on a loan to purchase a car for personal use. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the standard. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. You can deduct car loan interest on irs form 1040 schedule c. While typically, deducting car loan interest is not allowed there is one.

You can deduct car loan interest on irs form 1040 schedule c. Enter the amount of the deduction — either using the standard. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Interest paid on a loan to purchase a car for personal use. While typically, deducting car loan interest is not allowed there is one. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. Credit card and installment interest incurred for personal expenses.

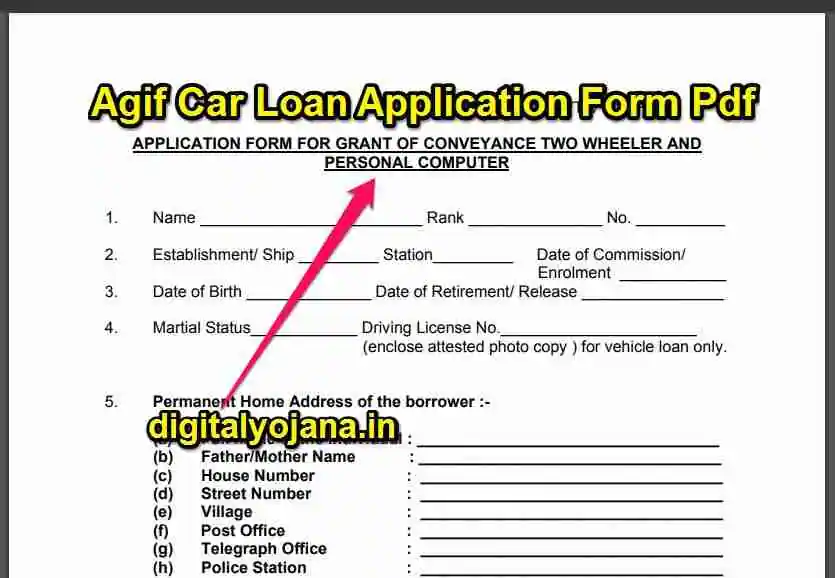

AGIF {All PDF Download} Agif Car Loan Application Form Pdf Army Group

You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the standard. While typically, deducting car loan interest is not allowed there is one. Interest paid on a loan to purchase a car for personal use. Deducting auto loan interest on your federal income tax return is not allowed for typical.

Car Loan Interest Rates 2024 Check EMI, Eligibility, Down Payment

While typically, deducting car loan interest is not allowed there is one. Enter the amount of the deduction — either using the standard. Credit card and installment interest incurred for personal expenses. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Interest paid on a loan.

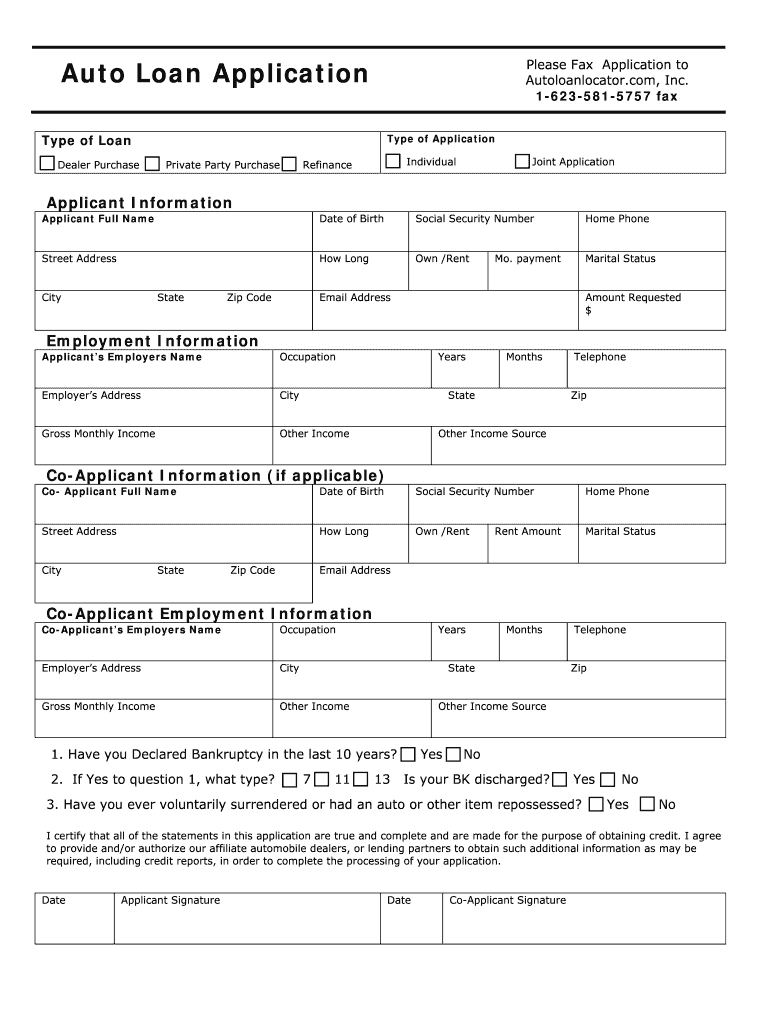

Printable Auto Credit Application Pdf Fill Online, Printable

While typically, deducting car loan interest is not allowed there is one. You can deduct car loan interest on irs form 1040 schedule c. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Enter the amount of the deduction — either using the standard. You cannot.

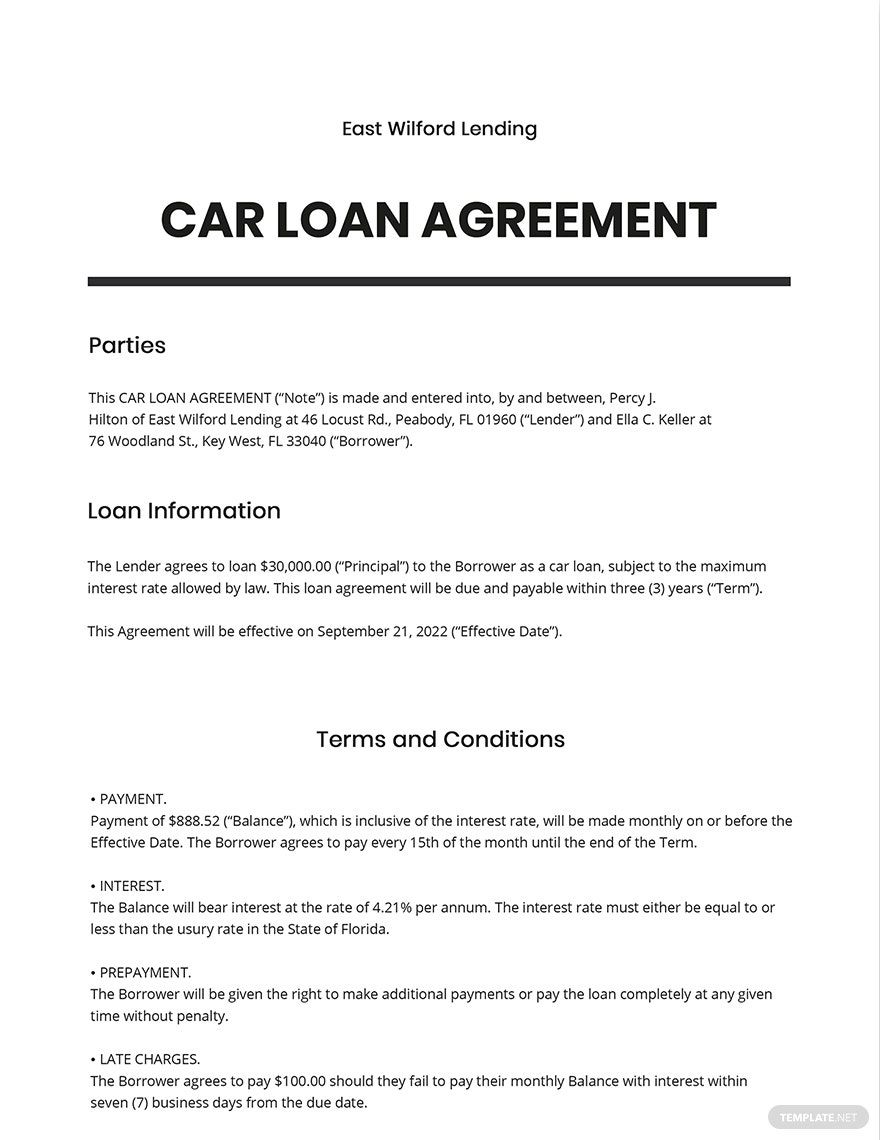

Car Loan Agreement Free Printable Documents

You cannot deduct a personal car loan or it's interest. Interest paid on a loan to purchase a car for personal use. You can deduct car loan interest on irs form 1040 schedule c. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Credit card and installment interest incurred for personal expenses.

Car Loan Agreement Form Template Google Docs, Word

Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the standard. Interest paid on a loan to purchase a car for personal use. You can deduct car loan interest on irs form 1040 schedule.

Car Loan Comparison Rate, Examples and Lenders in Australia

Interest paid on a loan to purchase a car for personal use. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. You can deduct car loan interest on irs form 1040 schedule c. Enter the amount of the deduction — either using the standard. You cannot deduct a personal car loan or it's.

Pin on Places to Visit

While typically, deducting car loan interest is not allowed there is one. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Interest paid on a loan to purchase a car for personal use. You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the.

Maximum Age for Car Loan Malaysia RuthfvDudley

You cannot deduct a personal car loan or it's interest. Credit card and installment interest incurred for personal expenses. You can deduct car loan interest on irs form 1040 schedule c. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Interest paid on a loan to purchase a car for personal use.

Printable Auto Credit Application PDF Edit & Share airSlate SignNow

Interest paid on a loan to purchase a car for personal use. You cannot deduct a personal car loan or it's interest. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. You can deduct car loan interest on irs form 1040 schedule c. Enter the amount.

Loan Options Need Money? Let's Take a Look at 7 Loans That Are

You cannot deduct a personal car loan or it's interest. Enter the amount of the deduction — either using the standard. While typically, deducting car loan interest is not allowed there is one. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes. Credit card and installment.

Enter The Amount Of The Deduction — Either Using The Standard.

You cannot deduct a personal car loan or it's interest. While typically, deducting car loan interest is not allowed there is one. Deducting auto loan interest on your federal income tax return is not allowed for typical borrowers. Credit card and installment interest incurred for personal expenses.

You Can Deduct Car Loan Interest On Irs Form 1040 Schedule C.

Interest paid on a loan to purchase a car for personal use. Learn if car loan interest is tax deductible, who can deduct car loan interest and how to claim this deduction on your taxes.