Certificate Of Release Of Federal Tax Lien

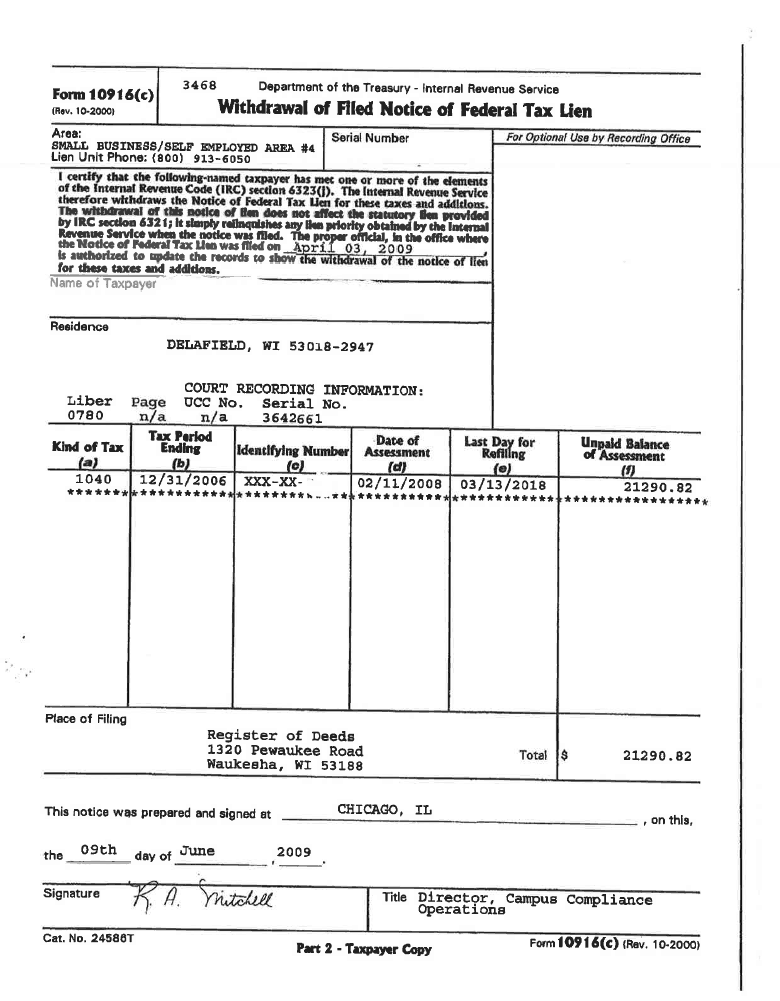

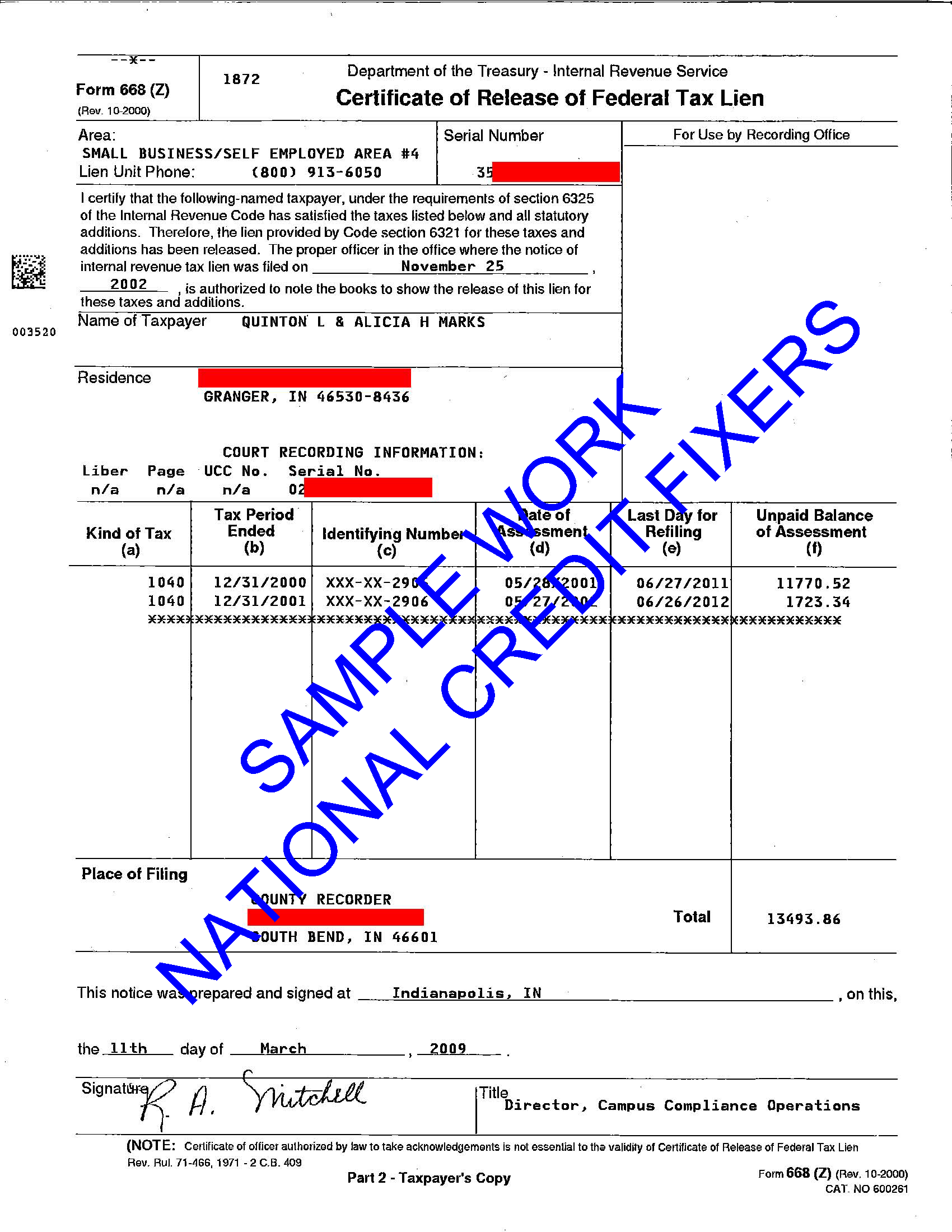

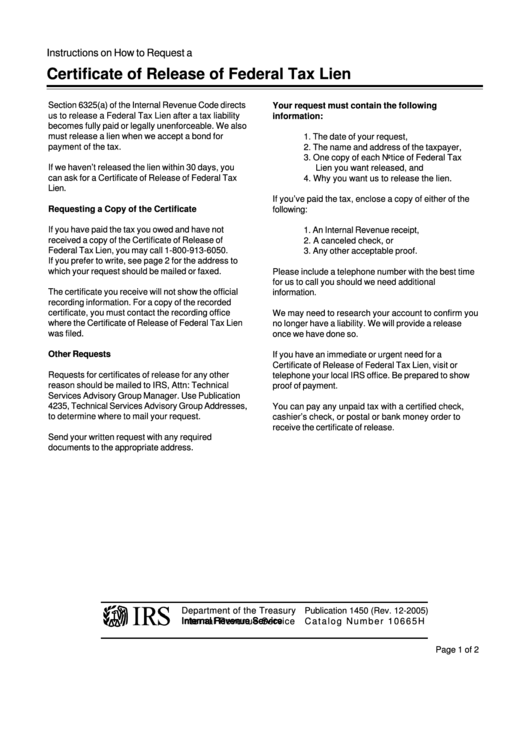

Certificate Of Release Of Federal Tax Lien - The request must be in writing and should be mailed. The irs is required to issue a release within 30. The document used to release a lien is form 668(z),certificate of release of federal tax lien. Subordination does not remove the lien, but. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien.

Subordination does not remove the lien, but. The document used to release a lien is form 668(z),certificate of release of federal tax lien. The request must be in writing and should be mailed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. The irs is required to issue a release within 30.

The document used to release a lien is form 668(z),certificate of release of federal tax lien. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. The request must be in writing and should be mailed. Subordination does not remove the lien, but. The irs is required to issue a release within 30. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf.

Federal Tax Lien IRS Lien Call the best tax lawyer!

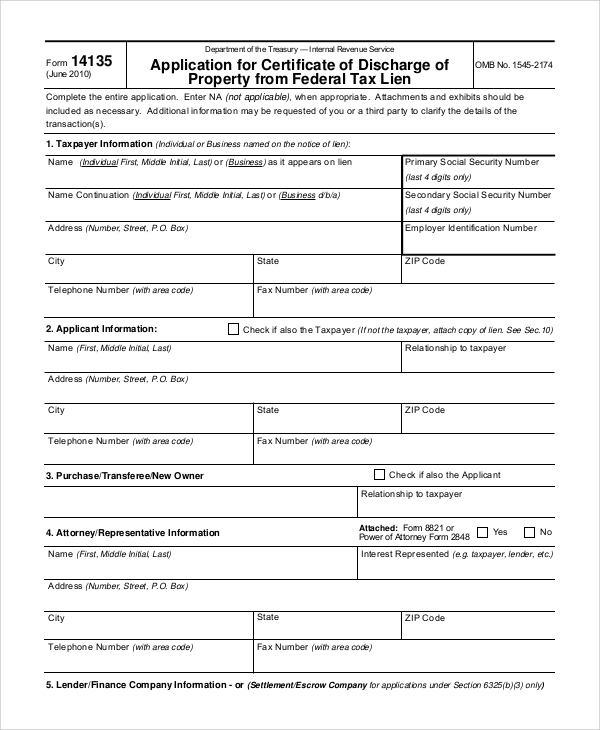

The document used to release a lien is form 668(z),certificate of release of federal tax lien. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. The request must be in writing and should be mailed. If the federal tax lien has not been released within 30 days of.

IRS Leins 9 Ways to Resolve Tax Leins IRS Tax Lien Help Faith Firm

Subordination does not remove the lien, but. The request must be in writing and should be mailed. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the.

Federal Tax Lien February 2017

If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. The irs is required to issue a release within 30. The document used to release a lien is form 668(z),certificate of release of federal tax lien..

Success Stories Samples Of Our Work Federal Tax Lien Release

The request must be in writing and should be mailed. Subordination does not remove the lien, but. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. If the federal tax lien has not been released.

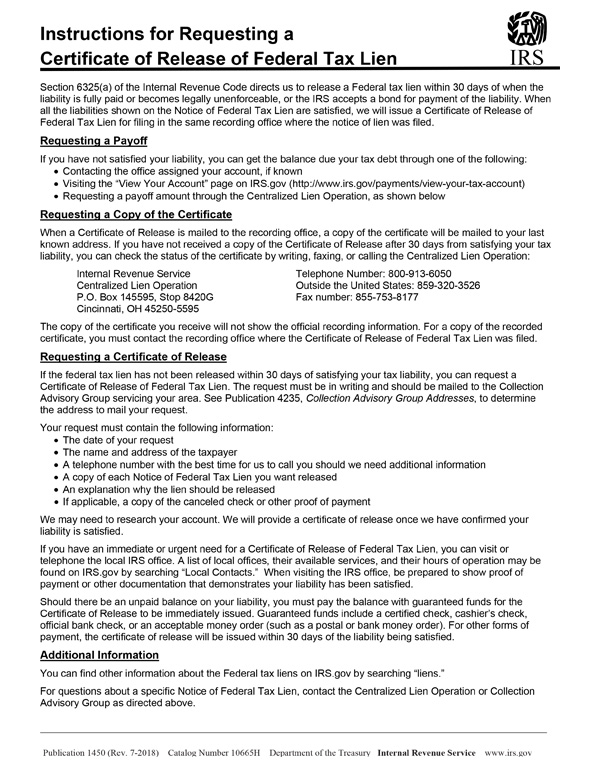

Instructions On How To Request A Certificate Of Release Of Federal Tax

The irs is required to issue a release within 30. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. The request must be in writing and should be mailed. The document used to release a lien is form 668(z),certificate of release.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. The irs is required to.

IRS Notice 1450, Certificate of Release Instructions

The request must be in writing and should be mailed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the.

FREE 8+ Sample Release of Lien in PDF MS Word

If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. The request must be in writing and should be mailed. Subordination does not remove the lien, but. For more information, refer to publication 783, instructions on how to apply for certificate of.

The Tax Times Procedures for Withdrawals and Releases of Notices of

Subordination does not remove the lien, but. The document used to release a lien is form 668(z),certificate of release of federal tax lien. The request must be in writing and should be mailed. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate.

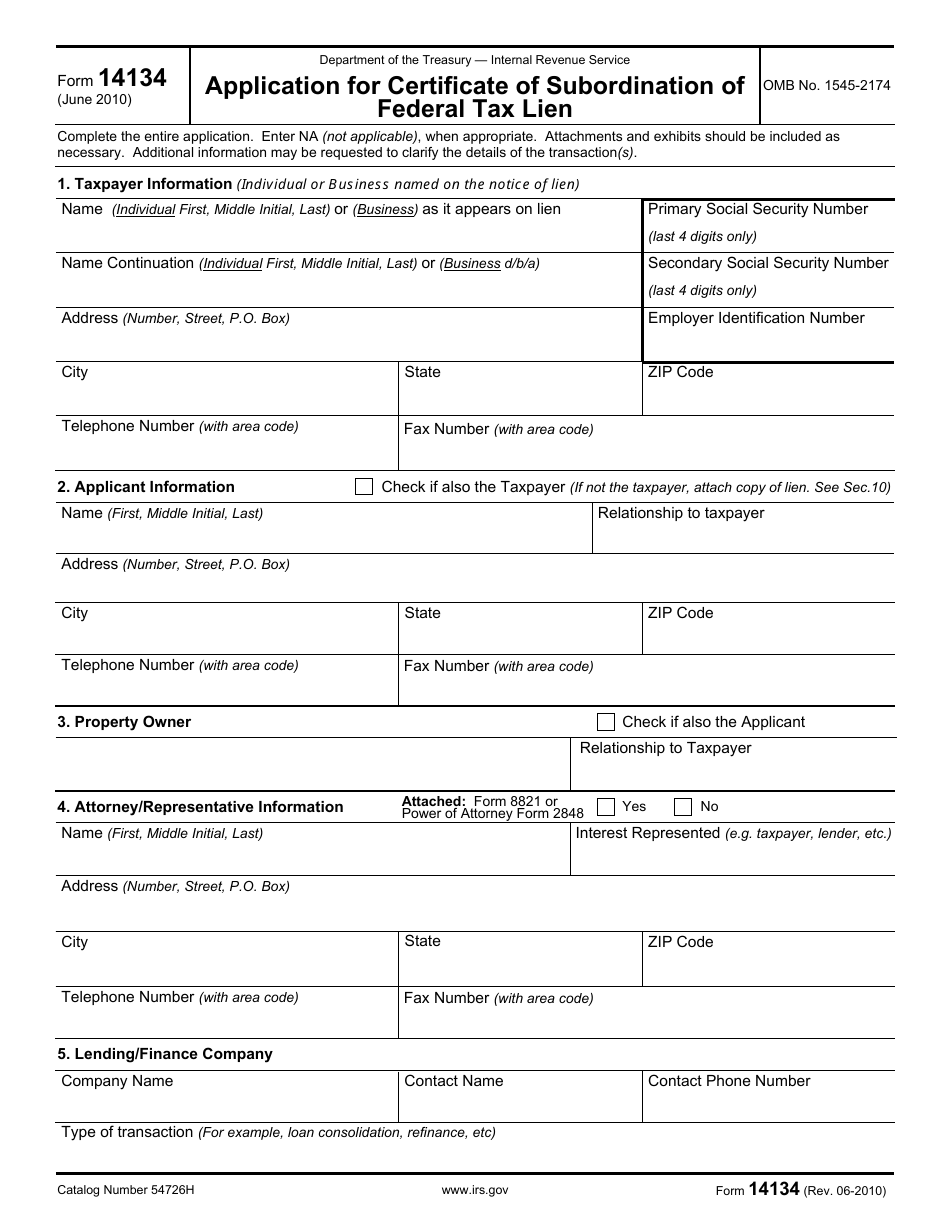

IRS Form 14134 Download Fillable PDF or Fill Online Application for

For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. If the lien still appears active after 30 days have passed, irs notice 1450 provides detailed instructions on how to contact the irs and request a certificate of release showing that the federal tax. The irs is required to.

If The Lien Still Appears Active After 30 Days Have Passed, Irs Notice 1450 Provides Detailed Instructions On How To Contact The Irs And Request A Certificate Of Release Showing That The Federal Tax.

If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a certificate of release of federal tax lien. For more information, refer to publication 783, instructions on how to apply for certificate of discharge from federal tax lien pdf. The request must be in writing and should be mailed. The irs is required to issue a release within 30.

Subordination Does Not Remove The Lien, But.

The document used to release a lien is form 668(z),certificate of release of federal tax lien.