Charlottesville Business License

Charlottesville Business License - If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. $50 if your projected gross receipts are between. If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. The cost is $35 if your projected gross receipts are $50,000 and under; Beginning in 2023 you may renew your business license online using our new online business portal. If this is your first year in business, your license tax is based on an estimate of your gross receipts. To determine the rate or fee applicable to your business activity, contact our business tax. Apply for a charlottesville business license application (pdf). A separate license is required for each business. City of charlottesville business license taxes.

Once your business has been in operation for a full calendar year, the. A separate license is required for each business. City of charlottesville business license taxes. Beginning in 2023 you may renew your business license online using our new online business portal. To determine the rate or fee applicable to your business activity, contact our business tax. The cost is $35 if your projected gross receipts are $50,000 and under; $50 if your projected gross receipts are between. If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. If this is your first year in business, your license tax is based on an estimate of your gross receipts.

If this is your first year in business, your license tax is based on an estimate of your gross receipts. City of charlottesville business license taxes. The cost is $35 if your projected gross receipts are $50,000 and under; Once your business has been in operation for a full calendar year, the. $50 if your projected gross receipts are between. To determine the rate or fee applicable to your business activity, contact our business tax. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. A separate license is required for each business. Apply for a charlottesville business license application (pdf). Beginning in 2023 you may renew your business license online using our new online business portal.

Online Business Tax Portal Charlottesville, VA

Beginning in 2023 you may renew your business license online using our new online business portal. Apply for a charlottesville business license application (pdf). If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. A separate license is required for each business. To determine the.

Business License Forms

Apply for a charlottesville business license application (pdf). A separate license is required for each business. $50 if your projected gross receipts are between. The cost is $35 if your projected gross receipts are $50,000 and under; Beginning in 2023 you may renew your business license online using our new online business portal.

Business license and Permits Acacia Business Solutions

Apply for a charlottesville business license application (pdf). The cost is $35 if your projected gross receipts are $50,000 and under; Beginning in 2023 you may renew your business license online using our new online business portal. If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource.

Do freelancers need a business license? r/Charlottesville

If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. $50 if your projected gross receipts are between. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. Apply for a.

Online Business Tax Portal Charlottesville, VA

$50 if your projected gross receipts are between. If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. The cost is $35 if your projected gross receipts are $50,000 and under; If this is your first year in business, your license tax is based on an.

BUSINESS LICENSE APPLICATION

The cost is $35 if your projected gross receipts are $50,000 and under; Once your business has been in operation for a full calendar year, the. If this is your first year in business, your license tax is based on an estimate of your gross receipts. $50 if your projected gross receipts are between. If you are conducting or plan.

Charlottesville Business Attorney Business Law Tremblay & Smith, PLLC

If this is your first year in business, your license tax is based on an estimate of your gross receipts. The cost is $35 if your projected gross receipts are $50,000 and under; $50 if your projected gross receipts are between. Beginning in 2023 you may renew your business license online using our new online business portal. Once your business.

Online Business Tax Portal Charlottesville, VA

If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. Once your business has been in operation for a full calendar year, the. $50 if your projected gross receipts are between. The cost is $35 if your projected gross receipts are $50,000 and under; If you.

Business License

A separate license is required for each business. Apply for a charlottesville business license application (pdf). Once your business has been in operation for a full calendar year, the. If this is your first year in business, your license tax is based on an estimate of your gross receipts.| see this resource on. Beginning in 2023 you may renew your.

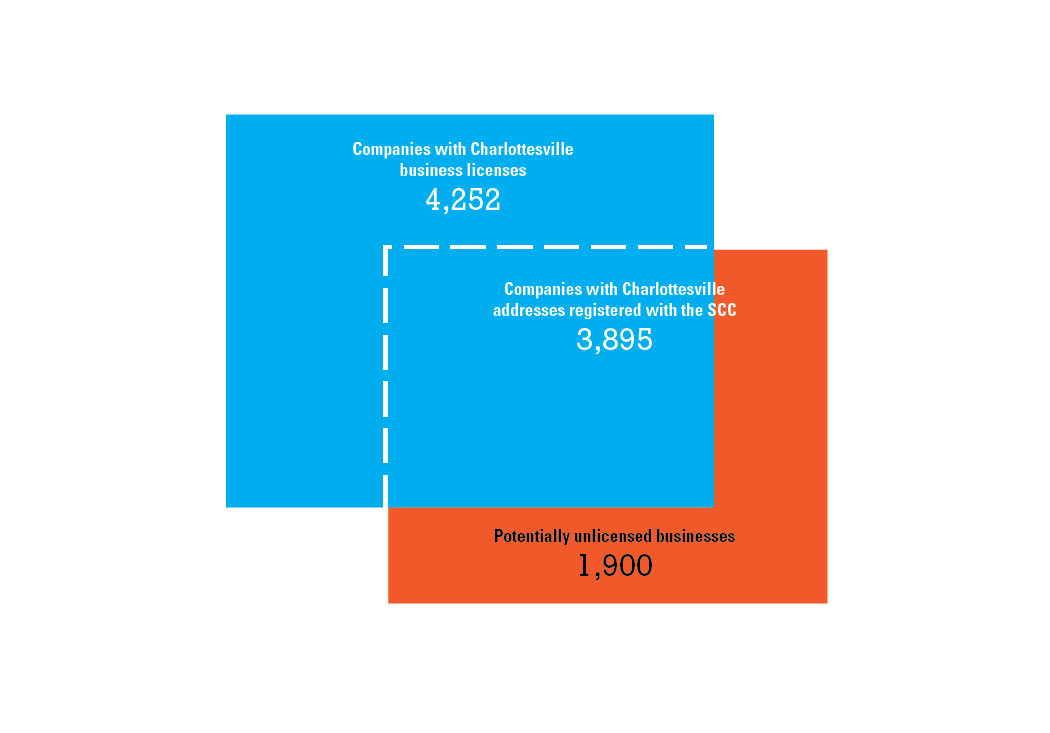

CVILLE Weekly Data dive Tracking untapped business tax revenue in

A separate license is required for each business. Beginning in 2023 you may renew your business license online using our new online business portal. Apply for a charlottesville business license application (pdf). Once your business has been in operation for a full calendar year, the. If this is your first year in business, your license tax is based on an.

City Of Charlottesville Business License Taxes.

To determine the rate or fee applicable to your business activity, contact our business tax. If you are conducting or plan to conduct business within the county, you will need to register for a business license and other applicable taxes. Once your business has been in operation for a full calendar year, the. Beginning in 2023 you may renew your business license online using our new online business portal.

A Separate License Is Required For Each Business.

Apply for a charlottesville business license application (pdf). If this is your first year in business, your license tax is based on an estimate of your gross receipts. The cost is $35 if your projected gross receipts are $50,000 and under; $50 if your projected gross receipts are between.