Cincinnati Local Tax

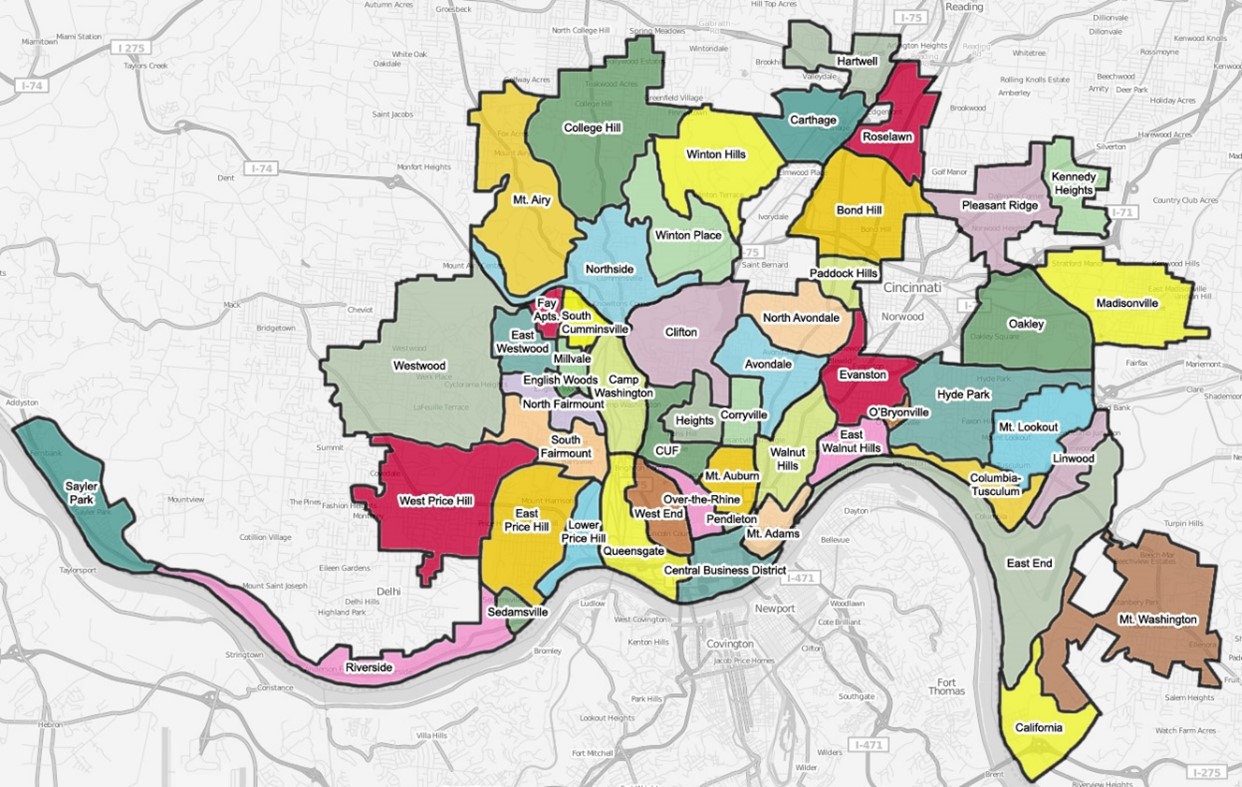

Cincinnati Local Tax - Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely by sending us this information with your tax form. They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all.

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Cincinnati, listing dates and location if applicable.

They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax.

These Cincinnati companies are in default of tax incentive promises

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Cincinnati, listing dates and location if applicable. Help us.

City of cincinnati business tax return Fill out & sign online DocHub

Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely by sending us this information with your tax form. The finder, from the ohio department of taxation, provides information.

Cincinnati City Council searches for Landsman’s replacement

They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the.

Cincinnati Sales Tax 2024 Kary Sarena

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your.

When are property taxes due in Cincinnati? How do I pay? What to know

They are intended to supplement cincinnati. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely by sending us this information with your tax form. The finder, from the.

10 Things to Do in Cincinnati on a Small Budget Holidays in

Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely.

Cincinnati City Council approves tax increase

Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely.

city of cincinnati tax dept Benita Tellez

They are intended to supplement cincinnati. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Cincinnati, listing dates and location if applicable. Help us to use your tax dollars wisely by sending us this information with your tax form. The finder, from the.

FullService Digital Marketing Agency Cincinnati LOCALiQ

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your.

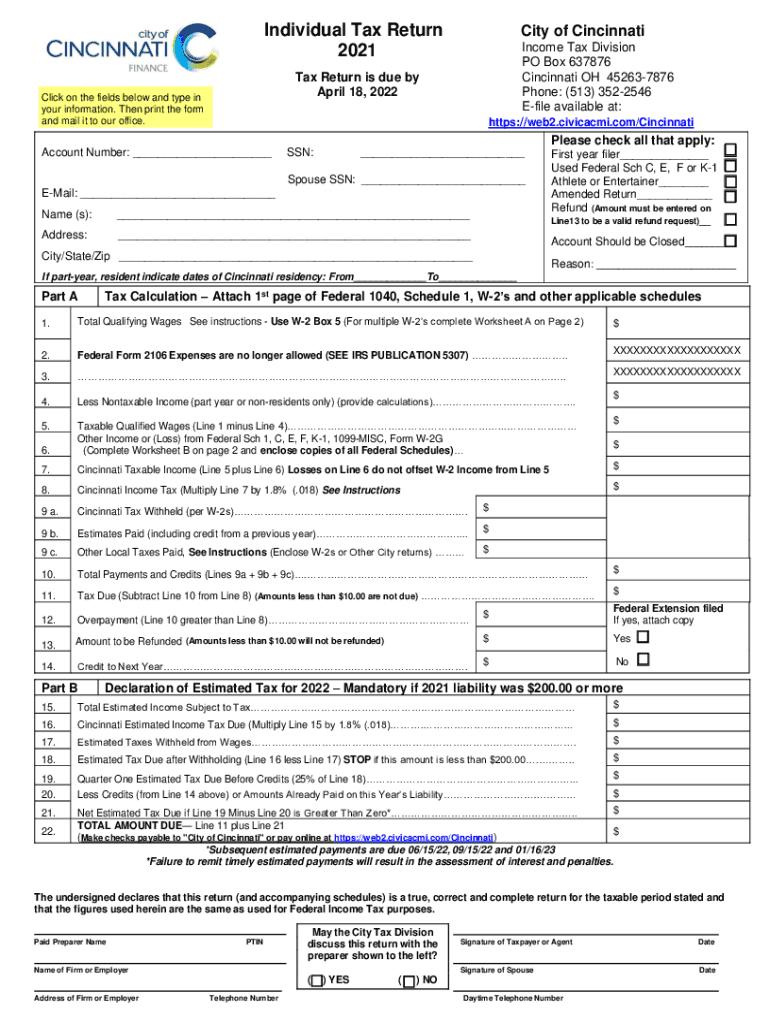

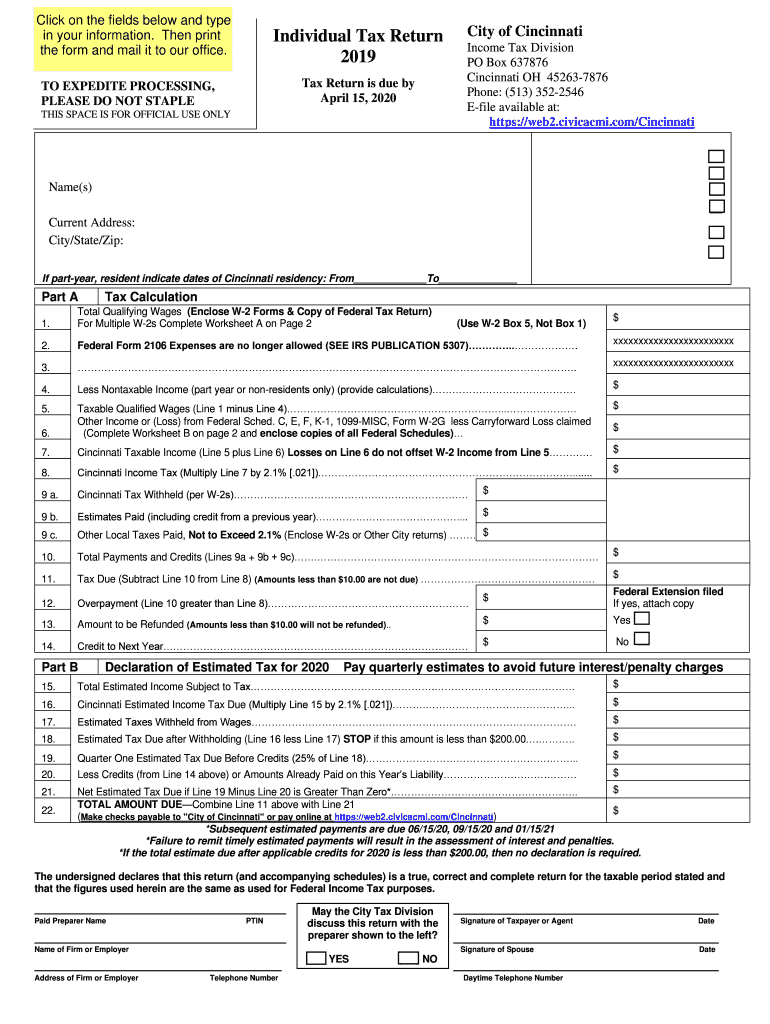

Cincinnati 2024 Tax Forms Microsoft Vikki Jerrilee

They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your tax form. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10%.

Help Us To Use Your Tax Dollars Wisely By Sending Us This Information With Your Tax Form.

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. They are intended to supplement cincinnati. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax.