Columbus Local Tax

Columbus Local Tax - For individual filers, city income. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Municipal tax is paid first to the city where work is performed or income earned. It is quick, secure and convenient! We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Lookup your taxing jurisdiction on crisp.columbus.gov. You are responsible for paying additional tax if the tax rate where you. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. How are local taxes determined? Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax.

Lookup your taxing jurisdiction on crisp.columbus.gov. Municipal tax is paid first to the city where work is performed or income earned. Taxpayers may also have an. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). For individual filers, city income. It is quick, secure and convenient! How are local taxes determined? Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you.

The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. How are local taxes determined? For individual filers, city income. It is quick, secure and convenient! Taxpayers may also have an. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Lookup your taxing jurisdiction on crisp.columbus.gov. You are responsible for paying additional tax if the tax rate where you.

Columbus City Council approves warehouse tax break in busy session

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Municipal tax is paid first to the city where work is performed or income earned. You are responsible for paying additional tax if the tax rate where you. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses..

Columbus Council seeks citywide tax abatements for housing

It is quick, secure and convenient! How are local taxes determined? You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. The city of.

Local Projects Land Tax Credits Bank Renovation Moving Forward but

For individual filers, city income. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Lookup your taxing jurisdiction on crisp.columbus.gov. The city of.

How do I determine my Ohio local tax district? — Charitax

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Taxpayers may also have an. It is quick, secure and convenient! You are responsible for paying additional tax if the tax rate where you. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses.

Tax Preparer Columbus Tax and Law Research Inc

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Municipal tax is paid first to the city where work is performed or income earned. It is quick, secure and convenient! Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal.

COLUMBUS OHIO TAX REFUND YouTube

For individual filers, city income. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. You are responsible for paying additional tax if the tax rate where you. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). Municipal tax is paid first to the.

Find the Best Tax Preparation Services in Columbus, IN

Municipal tax is paid first to the city where work is performed or income earned. Lookup your taxing jurisdiction on crisp.columbus.gov. How are local taxes determined? You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Residents of columbus pay a flat city income tax of 2.50% on earned income,.

PPT Your premier tax service in Columbus, Ohio PowerPoint

How are local taxes determined? Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. Taxpayers may also have an. For individual filers, city income. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov).

After sweeping municipal tax rate increases across Ohio, where

We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). How are local taxes determined? Municipal tax is paid first to the city where work is performed or income earned. You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Taxpayers may also have an.

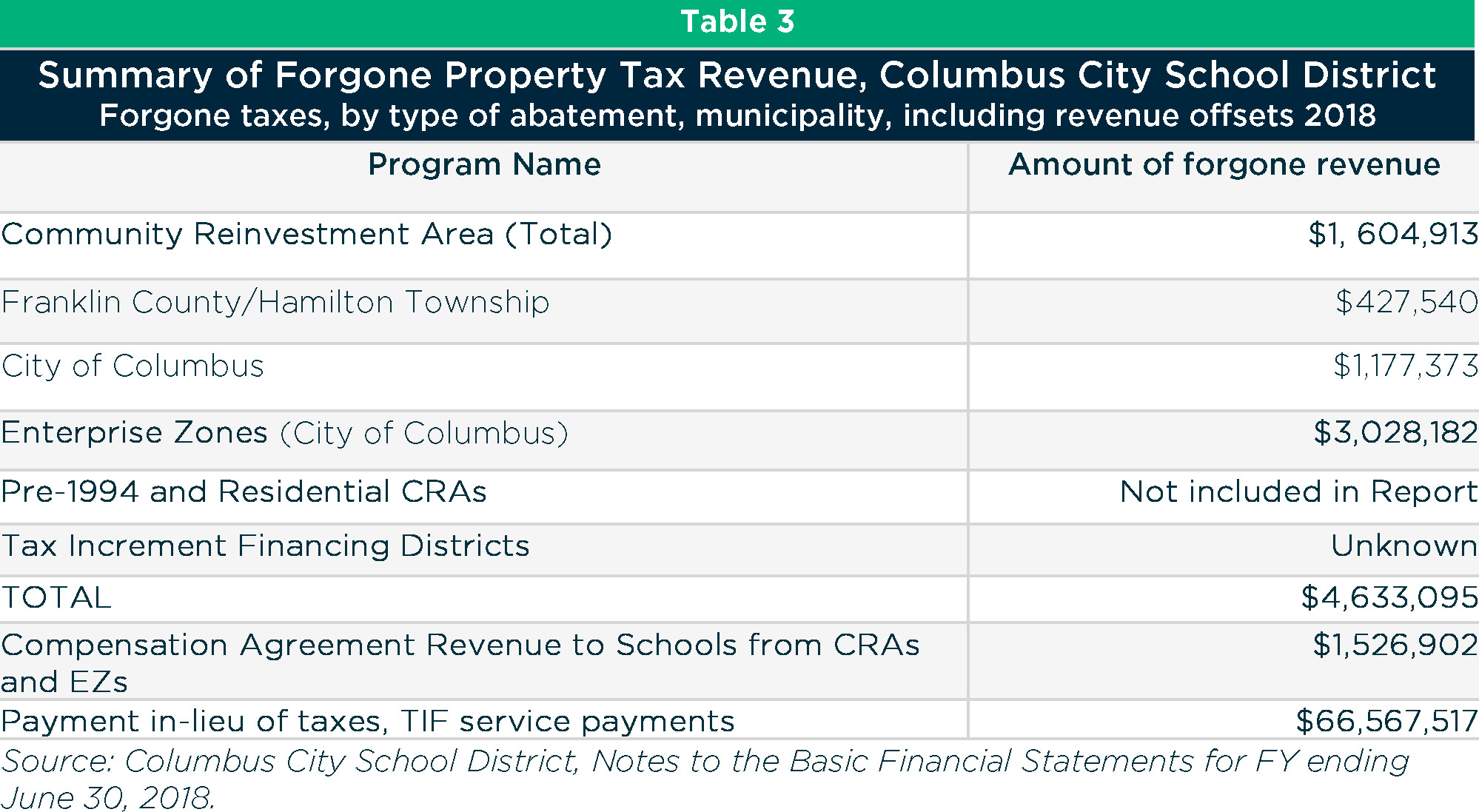

Columbus property tax abatements transparency and accountability to

The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses. Taxpayers may also have an. Residents of columbus pay a flat city income tax of 2.50% on earned income, in addition to the ohio income tax and the federal income tax. You will be able to register to file and pay local income.

Lookup Your Taxing Jurisdiction On Crisp.columbus.gov.

It is quick, secure and convenient! How are local taxes determined? Municipal tax is paid first to the city where work is performed or income earned. The city of columbus collects a 2.5% tax on the income of columbus residents, workers, and businesses.

Residents Of Columbus Pay A Flat City Income Tax Of 2.50% On Earned Income, In Addition To The Ohio Income Tax And The Federal Income Tax.

You are responsible for paying additional tax if the tax rate where you. We strongly recommend you file and pay with our new online tax portal crisp (crisp.columbus.gov). You will be able to register to file and pay local income taxes (individual/business/withholding) and check your refund status, estimated. Taxpayers may also have an.