Converting C Corp To S Corp

Converting C Corp To S Corp - Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders.

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders.

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch.

What You Need To Know About Converting An S Corp To A C Corp

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Valuation experts for both the taxpayer and the..

WHAT YOU NEED TO KNOW ABOUT CONVERTING AN S CORP TO A C CORP

Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity.

What You Need to Know About Converting an S Corp to a C Corp

Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch..

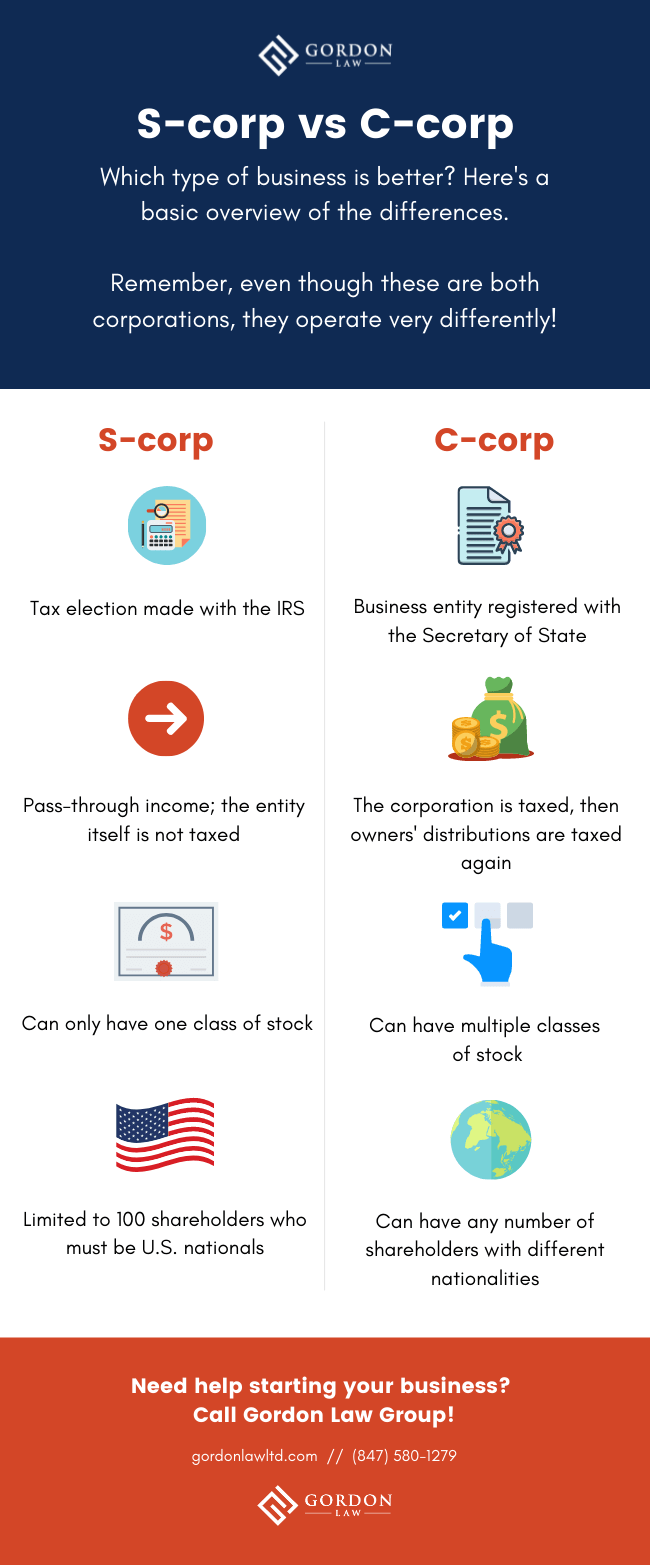

c corp and s corp, 7 Differences Between

Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes..

s corp vs c corpdifference between s corp and c corps corp and c corp

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Valuation experts for both the taxpayer and the. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes..

Delaware C Corp and S Corp How to determine? HazelNews

Valuation experts for both the taxpayer and the. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes..

LLC, Scorp, or Ccorp? Guide to Choosing a Business Structure

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the..

S Corp vs C Corp Differences & Benefits Wolters Kluwer

Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity.

Converting From an LLC to a Ccorp Tax Implications to Consider Shay CPA

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders..

Converting from a CCorp to an SCorp Northwest Registered Agent

Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders. Although s corporations may provide tax advantages over c corporations, there are some potentially costly tax issues that you should assess before making a decision to switch. The case involved a dispute between.

Although S Corporations May Provide Tax Advantages Over C Corporations, There Are Some Potentially Costly Tax Issues That You Should Assess Before Making A Decision To Switch.

The case involved a dispute between taxpayers and the irs over the fmv of shares of stock in an s corporation for gift tax purposes. Valuation experts for both the taxpayer and the. Before you convert a c corp to an s corp, understand how they differ, whether your company is eligible, and tax implications for the entity and shareholders.