Deed In Lieu Foreclosure Tax Implications

Deed In Lieu Foreclosure Tax Implications - Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. (1) the amount the lender.

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. (1) the amount the lender. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu.

(1) the amount the lender. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu.

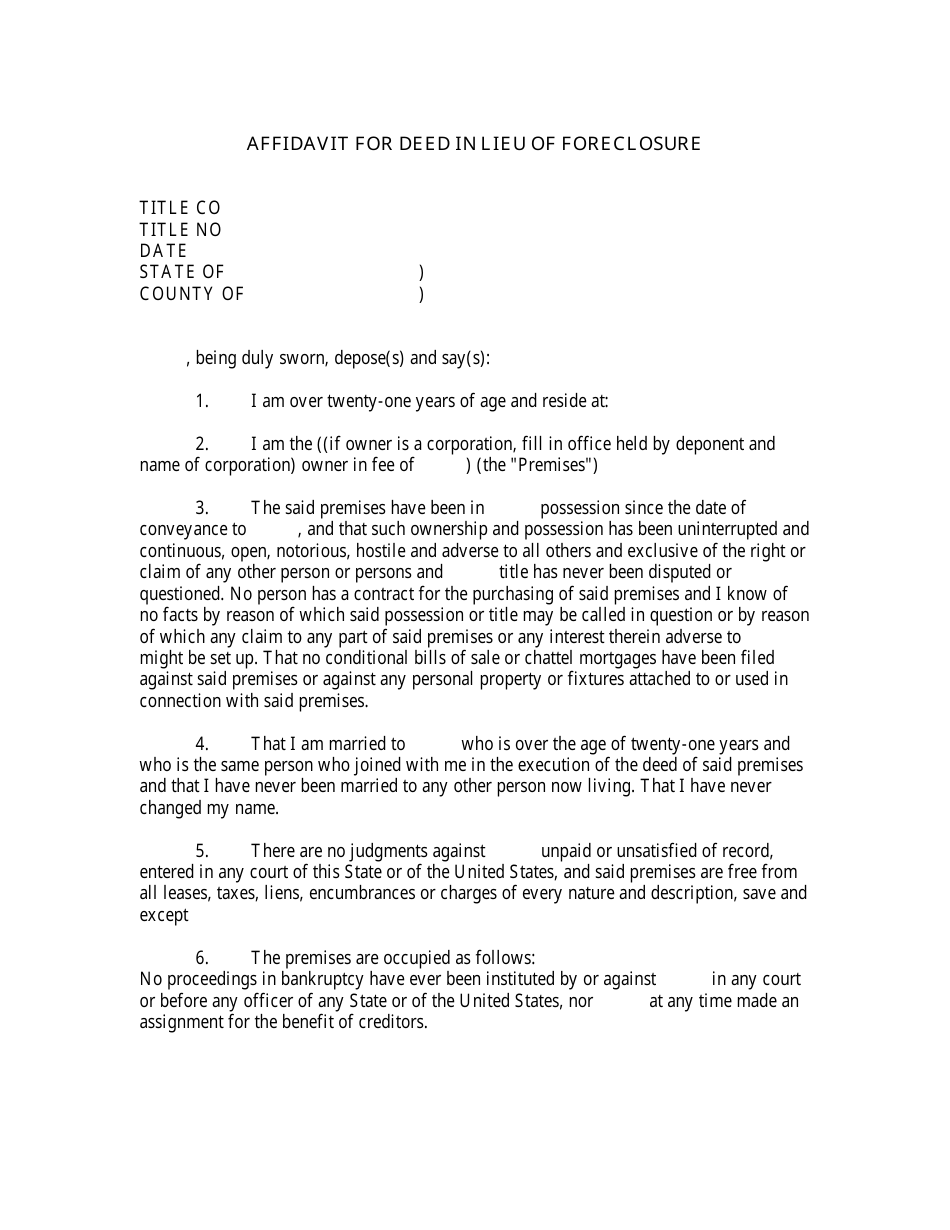

Affidavit for Deed in Lieu of Foreclosure New York Free Download

(1) the amount the lender. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu.

What is a Deed in Lieu of Foreclosure?

Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.

Affidavit for Deed in Lieu of Foreclosure Fill Out, Sign Online and

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender.

A Deed in Lieu of Foreclosure Cashflow Chick

(1) the amount the lender. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.

Deed in Lieu of Foreclosure LA Foreclosure Attorneys

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender.

deed lieu Doc Template pdfFiller

Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.

Deed In Lieu Of Foreclosure Template

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender.

Understanding Deed in Lieu of Foreclosure in California A Complete Guide

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. (1) the amount the lender.

Deed In Lieu Process Broward 954.237.7740 Florida Foreclosure

(1) the amount the lender. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.

Deed Lieu Foreclosure Complete with ease airSlate SignNow

Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face. (1) the amount the lender. Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu.

(1) The Amount The Lender.

Reporting cancellation of debt income on your tax return is a crucial step in managing the tax implications of a deed in lieu. Fortunately, at least through 2025, most people who lose their homes through a foreclosure, short sale, or deed in lieu of foreclosure won't face.