Definition Of Local Tax

Definition Of Local Tax - A tax paid to the government in a particular area: The revenue from local taxes is. A tax paid to the government in a particular area: The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. Localities that define income and collect the tax on their own increase administration costs for themselves and the. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. It means that you don't have to pay. A local tax is a tax imposed by a local government, such as a city, county, or school district.

A tax paid to the government in a particular area: Localities that define income and collect the tax on their own increase administration costs for themselves and the. The revenue from local taxes is. The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. It means that you don't have to pay. A tax paid to the government in a particular area: A local tax is a tax imposed by a local government, such as a city, county, or school district. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

A tax paid to the government in a particular area: It means that you don't have to pay. A tax paid to the government in a particular area: The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. The revenue from local taxes is. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A local tax is a tax imposed by a local government, such as a city, county, or school district. Localities that define income and collect the tax on their own increase administration costs for themselves and the.

Sparks Tax and Accounting Services Topeka KS

Localities that define income and collect the tax on their own increase administration costs for themselves and the. It means that you don't have to pay. A tax paid to the government in a particular area: The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. The revenue from local.

Tax Preparation Business Startup

A tax paid to the government in a particular area: The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. Localities that define income and collect the tax on their own increase administration costs for themselves and the. A tax paid to the government in a particular area: It means.

Moore Tax & Financial Services Goose Creek SC

The revenue from local taxes is. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. Localities that define income and collect the tax on their own increase administration costs for themselves and the. It means that you don't have to pay. A tax paid to the government in a particular area:

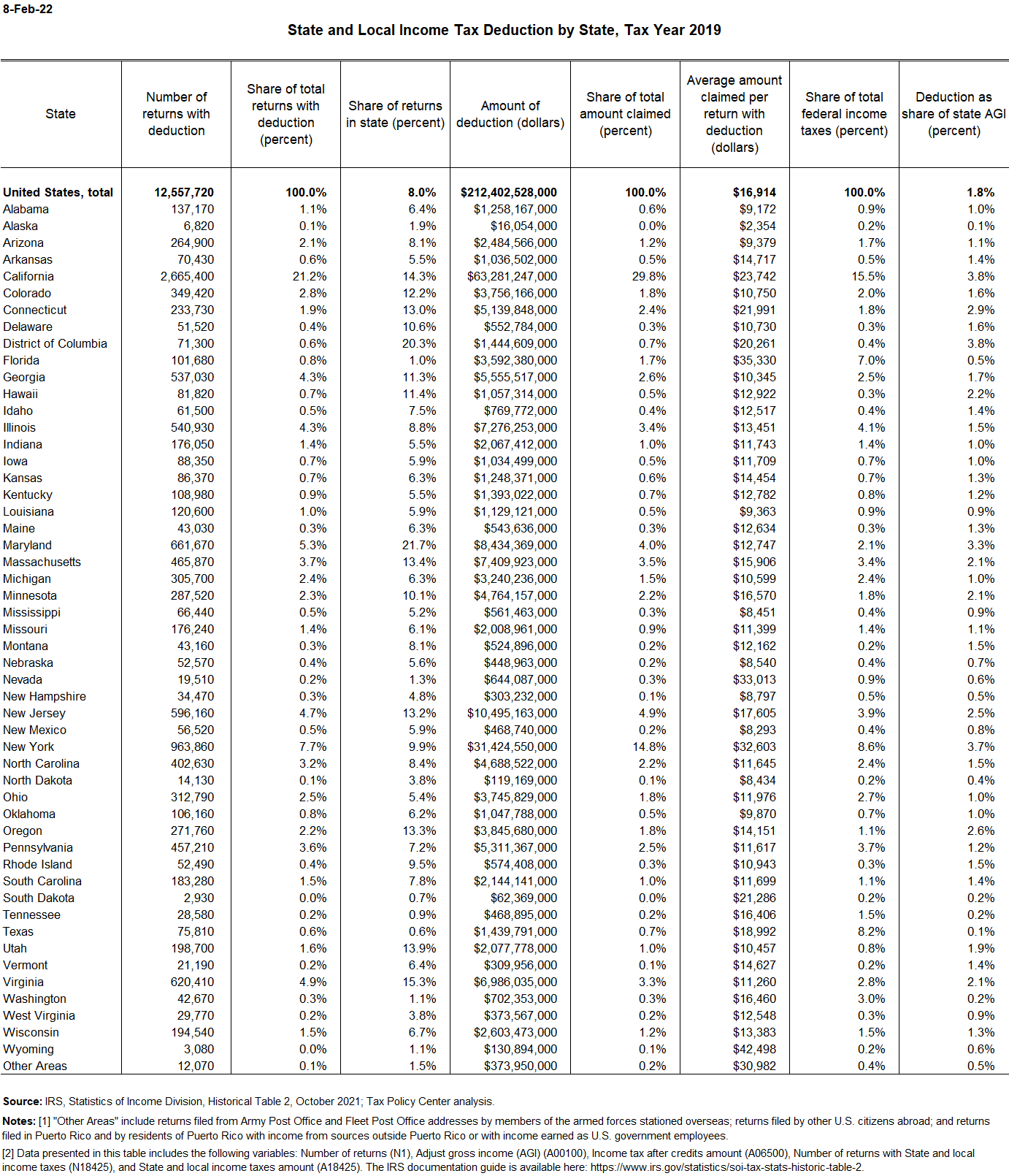

State and Local Tax Deduction by State Tax Policy Center

The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. Localities that define income and collect the tax on their own increase administration costs for themselves and the. Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A local tax is a tax.

Entrepreneur's Tax Guide

A tax paid to the government in a particular area: It means that you don't have to pay. The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. The revenue from local taxes is. Localities that define income and collect the tax on their own increase administration costs for themselves.

Tax Source Group Inc. Southfield MI

The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. It means that you don't have to pay. A local tax is a tax imposed by a local government, such as a city, county, or school district. The revenue from local taxes is. A tax paid to the government in.

TAX Consultancy Firm Gurugram

A tax paid to the government in a particular area: Localities that define income and collect the tax on their own increase administration costs for themselves and the. A tax paid to the government in a particular area: The revenue from local taxes is. A local tax is a tax imposed by a local government, such as a city, county,.

What is tax? Definition and meaning Market Business News

A tax paid to the government in a particular area: Localities that define income and collect the tax on their own increase administration costs for themselves and the. A tax paid to the government in a particular area: A local tax is a tax imposed by a local government, such as a city, county, or school district. The revenue from.

Perbandingan Local Tax Berbagai Negara PDF Taxes Property Tax

Localities that define income and collect the tax on their own increase administration costs for themselves and the. A tax paid to the government in a particular area: The revenue from local taxes is. A tax paid to the government in a particular area: Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities.

Elevated Tax and Accounting

A local tax is a tax imposed by a local government, such as a city, county, or school district. A tax paid to the government in a particular area: The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. It means that you don't have to pay. Localities that define.

A Tax Paid To The Government In A Particular Area:

A local tax is a tax imposed by a local government, such as a city, county, or school district. The local bodies impose the local tax on residents living under their jurisdiction as of january 1st of each year. The revenue from local taxes is. Localities that define income and collect the tax on their own increase administration costs for themselves and the.

It Means That You Don't Have To Pay.

Local tax refers to taxes imposed by local government entities such as counties, cities, and municipalities. A tax paid to the government in a particular area: