Diaz Company Owns A Machine That Cost

Diaz Company Owns A Machine That Cost - A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. In order to record the. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. Prepare the entry to record the disposal of the. Prepare the entry to record the. Prepare the entry to record the disposal of the.

Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Prepare the entry to record the. In order to record the. Prepare the entry to record the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200.

Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Prepare the entry to record the. Prepare the entry to record the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. In order to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Prepare the entry to record the disposal of the.

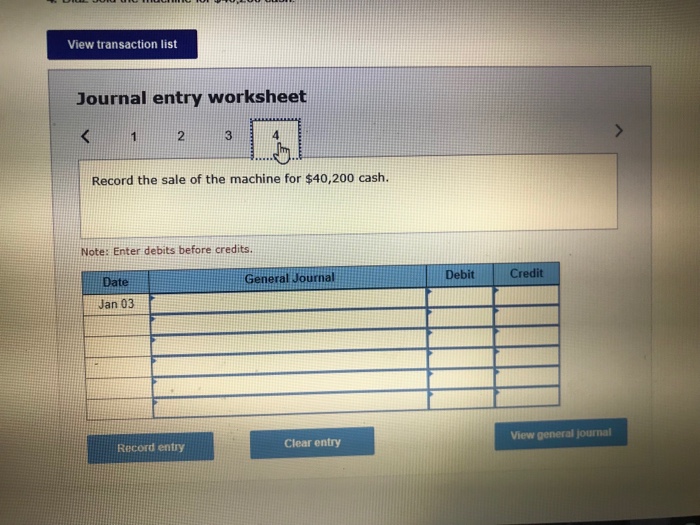

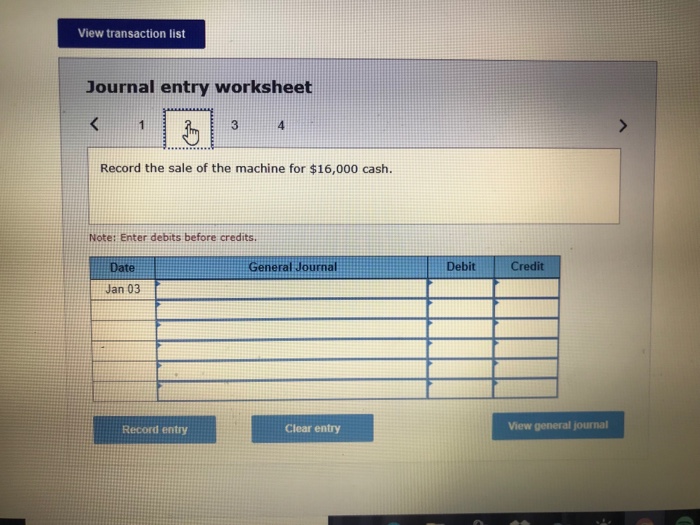

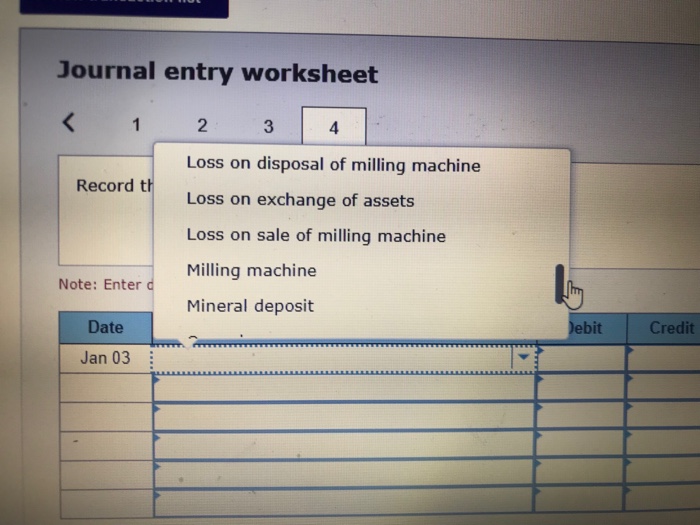

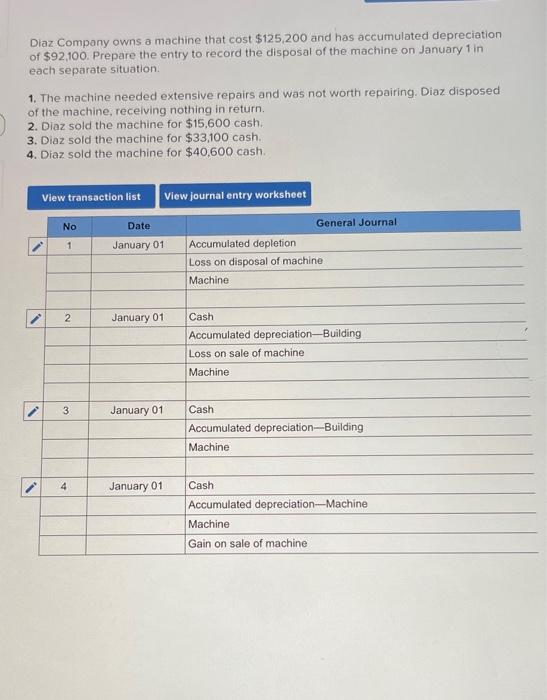

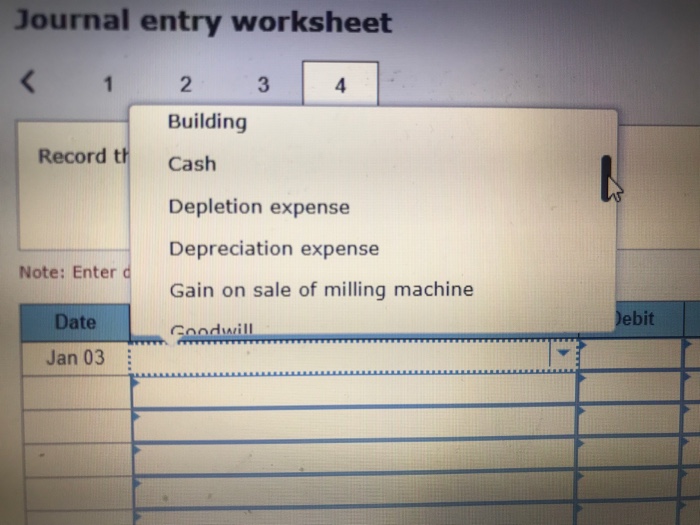

Solved Diaz Company owns a milling machine that cost

Prepare the entry to record the disposal of the. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. In order to record the.

Solved Diaz Company owns a miling machine that cost 125,900

A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. In order to record the. Diaz company owns a machine that cost $126,400 and has.

[Solved] . Diaz Company owns a machine that cost 126,300 and has

In order to record the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Prepare the entry to record the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having.

[Solved] Diaz Company owns a machine that cost ( 126,

Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000. Prepare the entry to record the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine with a cost of $250,000 and it.

Solved Diaz Company owns a machine that cost 125,200 and

Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Prepare the entry to record the disposal of the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new.

Solved Diaz Company owns a miling machine that cost 125,900

Prepare the entry to record the. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Prepare the entry to record the disposal of the. Prepare the entry to record the disposal of the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an.

[Solved] Diaz Company owns a machine that cost 126,300 an

Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. In order to record the. Prepare the entry to record the. Prepare the entry to record the disposal of the.

Solved Diaz Company owns a milling machine that cost

Prepare the entry to record the. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. Diaz company owns a machine.

Solved Diaz Company owns a miling machine that cost 125,900

Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. In order to record the. Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Prepare the entry to record the disposal of the. A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was.

Solved Diaz Company owns a miling machine that cost 125,900

Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200. Diaz company owns a machine that cost $250,000 and has accumulated depreciation of $182,000. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. In order to record the. Prepare the entry to record the.

Prepare The Entry To Record The.

A company's old machine that cost $59,000 and had accumulated depreciation of $47,100 was traded in on a new machine having an. Prepare the entry to record the disposal of the. In order to record the. Diaz company owns a machine that cost $126,400 and has accumulated depreciation of $91,200.

Prepare The Entry To Record The.

Diaz company owns a machine with a cost of $250,000 and it has a accumulated depreciation of $182,000. Diaz company owns a machine that costs $126,500 and has accumulated depreciation of $94,000. Prepare the entry to record the disposal of the. Diaz company owns a machine that cost $125,500 and has accumulated depreciation of $94,000.

![[Solved] Diaz Company owns a machine that cost ( 126,](https://media.cheggcdn.com/media/332/3324dc67-a9ce-4dab-96b7-4d78a4d1a559/phpFSy2iw)

![[Solved] Diaz Company owns a machine that cost 126,300 an](https://media.cheggcdn.com/media/3a9/3a98ced5-7da8-4b12-9577-e8430585131e/phpeK0K2B)