Does A Nonprofit Need A Business License

Does A Nonprofit Need A Business License - In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. In general, nonprofits are exempt from obtaining a business license. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. Then, a business license is obtained to allow a. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate.

In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. Most places require nonprofits to get a business license, known as a business occupational tax certificate. Then, a business license is obtained to allow a. In general, nonprofits are exempt from obtaining a business license. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is because nonprofits are considered charitable organizations.

Then, a business license is obtained to allow a. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. In general, nonprofits are exempt from obtaining a business license. This is needed if the organization has. A nonprofit is typically incorporated in its home state as a separate and unique legal entity.

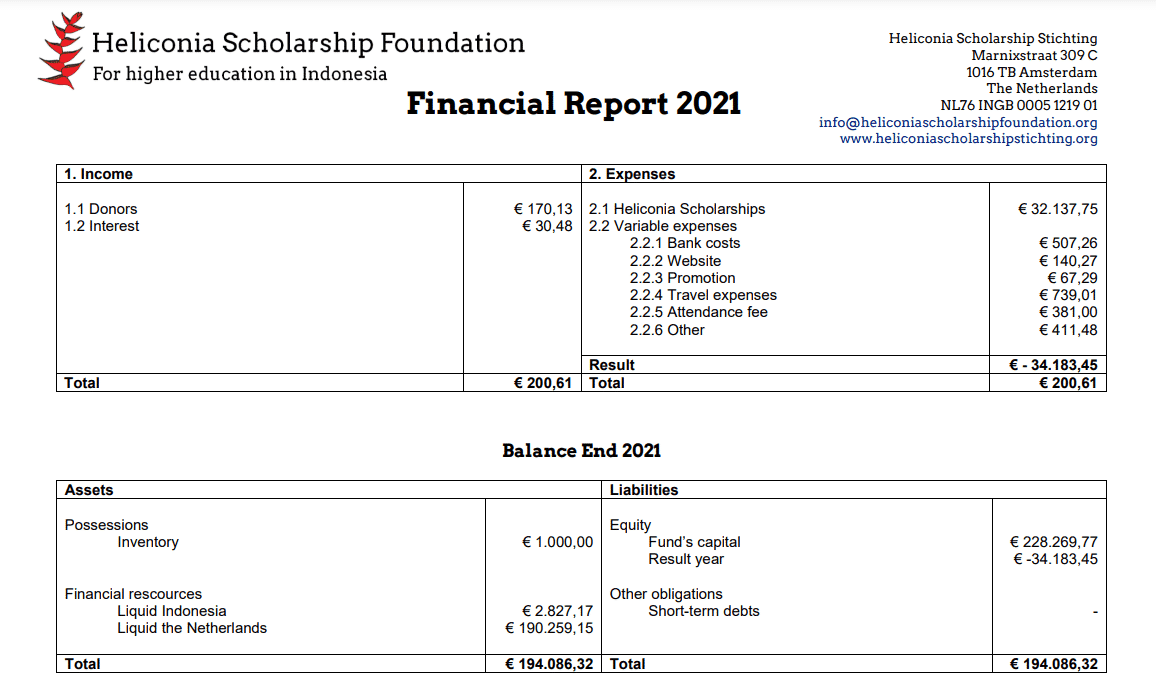

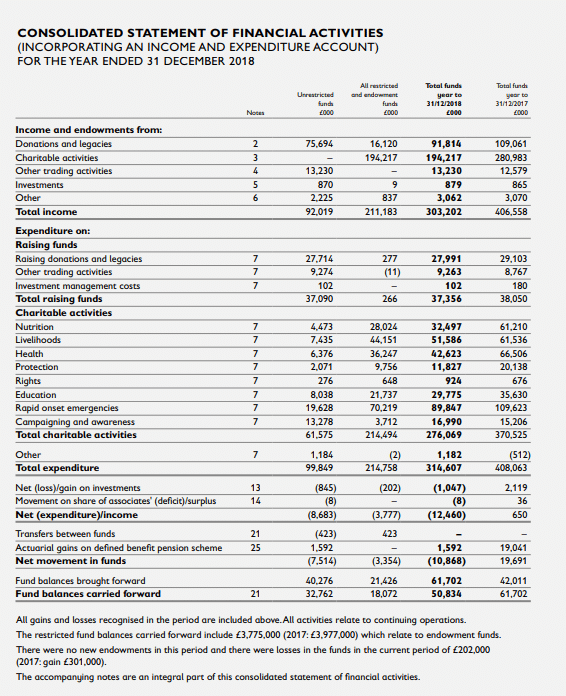

Nonprofit Financial Statements The Complete Guide with Examples

Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license. This is needed if the organization has. This is because nonprofits are considered charitable organizations. Then, a business license is obtained to allow a.

What Reports does my Nonprofit Need to File?

In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Then, a business license is obtained to allow a. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is needed if the organization has. This is because nonprofits are considered charitable organizations.

What Types of Insurance Does a Nonprofit Need

This is needed if the organization has. This is because nonprofits are considered charitable organizations. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license.

Does nonprofit need a board fundraising committee?

Then, a business license is obtained to allow a. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. Most places require nonprofits to get a business license, known as a business occupational tax certificate. A nonprofit is typically incorporated in its home.

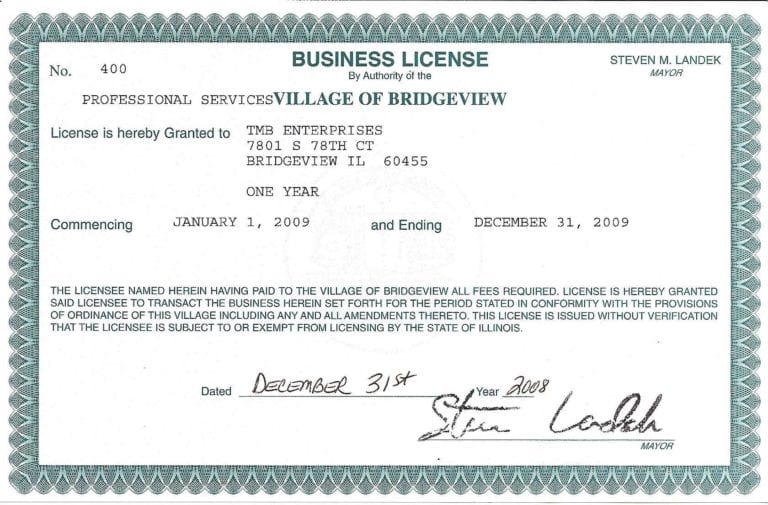

Sample For Master Business License Business Registration Center

A nonprofit is typically incorporated in its home state as a separate and unique legal entity. In general, nonprofits are exempt from obtaining a business license. This is because nonprofits are considered charitable organizations. Then, a business license is obtained to allow a. Most places require nonprofits to get a business license, known as a business occupational tax certificate.

Business Plan For A Nonprofit Templates How To Write & Examples

This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. In general, nonprofits are exempt from obtaining a business.

Nonprofit Financial Statements The Complete Guide with Examples

This is needed if the organization has. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In.

Do You Need a Business License to Sell on Etsy? Marketer

In general, nonprofits are exempt from obtaining a business license. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. Then, a business license is obtained to allow a. This is needed if the organization has.

do i need a business license —

This is needed if the organization has. This is because nonprofits are considered charitable organizations. In general, nonprofits are exempt from obtaining a business license. Then, a business license is obtained to allow a. A nonprofit is typically incorporated in its home state as a separate and unique legal entity.

Business License

Then, a business license is obtained to allow a. Most places require nonprofits to get a business license, known as a business occupational tax certificate. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is needed if the organization has. This is because nonprofits are considered charitable organizations.

This Is Because Nonprofits Are Considered Charitable Organizations.

This is needed if the organization has. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license.

In Most Cases, A Nonprofit Organization Must Register With The Secretary Of State And In Many, The Organization Must File.

Then, a business license is obtained to allow a.