Federal Tax Lien Database

Federal Tax Lien Database - See sources to check your lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. Search by name, document number, or assessor’s parcel number (apn). It is also possible to search for a federal tax lien on your secretary. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. The government also may file a notice of. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill.

A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. It is also possible to search for a federal tax lien on your secretary. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. See sources to check your lien. Search by name, document number, or assessor’s parcel number (apn). Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice of.

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice of. It is also possible to search for a federal tax lien on your secretary. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Search by name, document number, or assessor’s parcel number (apn). You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. See sources to check your lien.

Federal Tax Lien Steps to Eliminate a Tax Lien Legal Tax Defense

See sources to check your lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice of. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and.

State Tax Lien vs. Federal Tax Lien How to Remove Them

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. Search by name, document number, or assessor’s parcel number (apn). See sources to check your lien. It is also possible to search for a federal tax lien on your secretary. If a property owner fails to pay.

Federal Tax Lien Federal Tax Lien Payment

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill. Search by name, document number, or assessor’s parcel number (apn). If a property owner fails to pay federal taxes,.

Tax Lien Sale PDF Tax Lien Taxes

It is also possible to search for a federal tax lien on your secretary. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. Learn what a federal tax lien is, how it affects your credit and assets, and how to find.

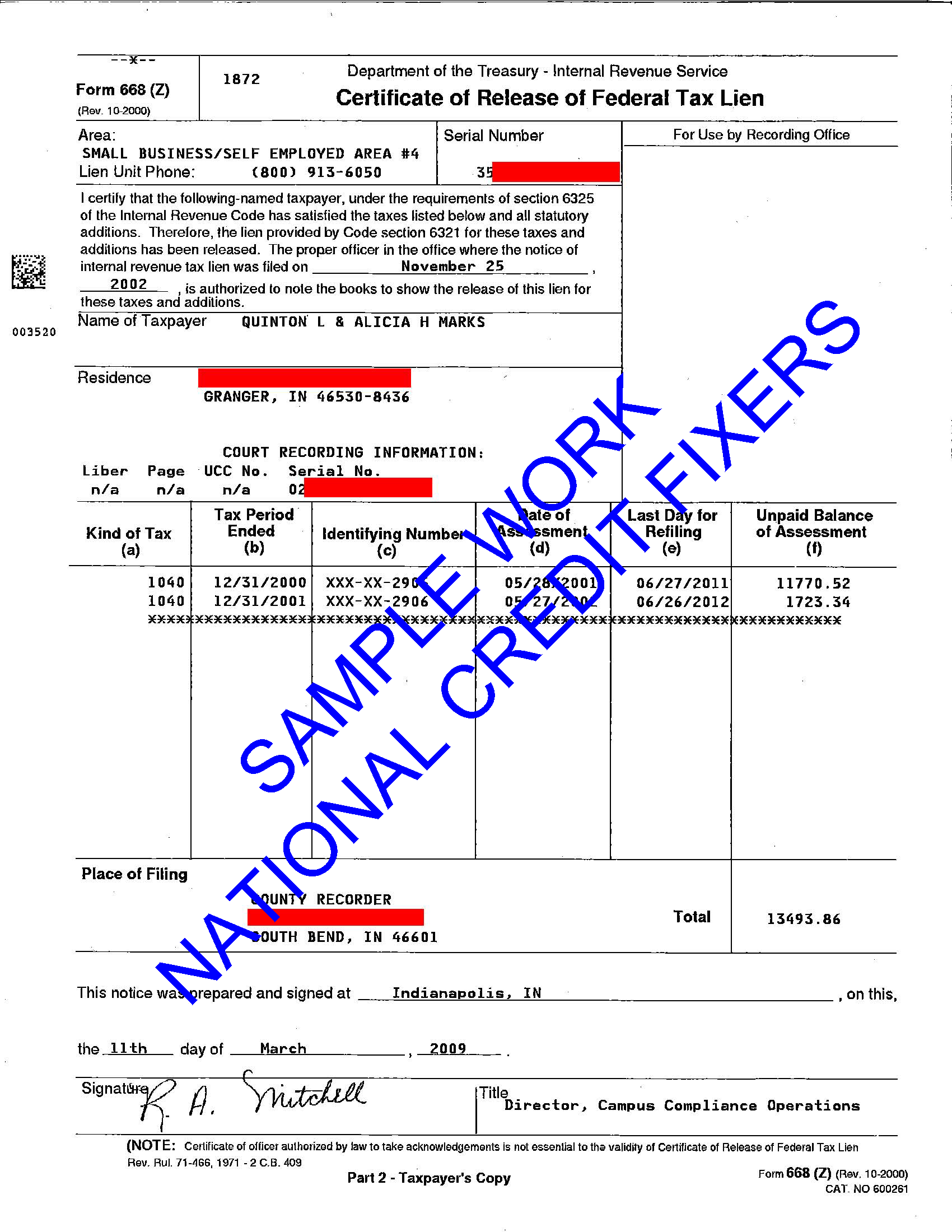

Understanding a Federal Tax Lien Release Traxion Tax

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. A federal tax lien arises automatically if you don’t.

Federal tax lien on foreclosed property laderdriver

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice.

Federal Tax Lien Federal Tax Lien On Foreclosed Property

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. The government also may file a notice.

Title Basics of the Federal Tax Lien SnapClose

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. See sources to check your lien. The government also may file a notice of. Search by name, document number, or assessor’s parcel number (apn). A federal tax lien arises automatically if you.

State Tax Lien vs. Federal Tax Lien How to Remove Them

Search by name, document number, or assessor’s parcel number (apn). The government also may file a notice of. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. A federal tax lien arises automatically if you don’t pay the amount due after.

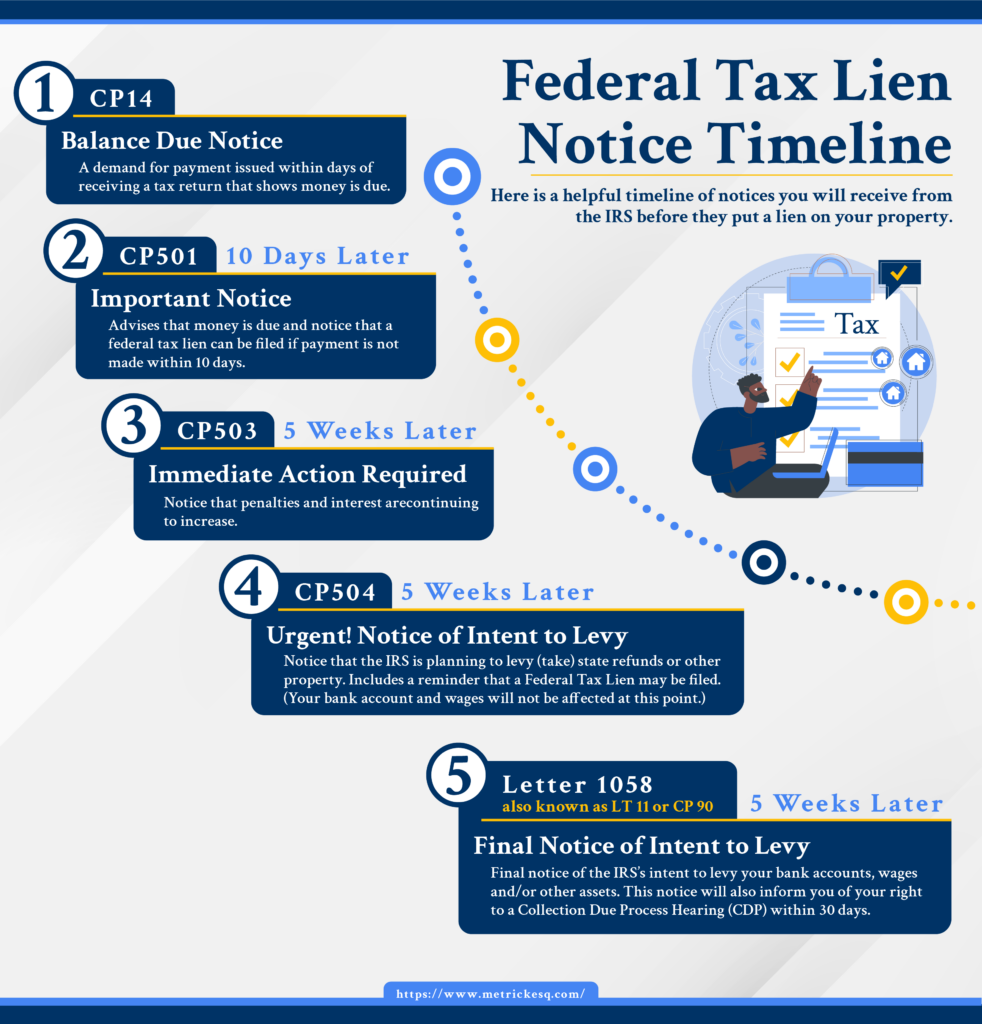

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

See sources to check your lien. Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and. Search by name,.

The Government Also May File A Notice Of.

See sources to check your lien. It is also possible to search for a federal tax lien on your secretary. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. A federal tax lien arises automatically if you don’t pay the amount due after receiving your first bill.

Search By Name, Document Number, Or Assessor’s Parcel Number (Apn).

Learn what a federal tax lien is, how it affects your credit and assets, and how to find out if you have one. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure the debt and.