Florida Liens Survive Tax Deed

Florida Liens Survive Tax Deed - Should you have any questions concerning what liens &. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Additionally, florida statues provide that easements for public service, conservation, and drainage purposes survive tax sales and issuance. Governmental liens and judgments survive the issuance of a tax deed sale and are satisfied to the fullest extent possible with any. Liens of governmental units not satisfied in full survive the issuance of the tax deed. Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale.

Liens of governmental units not satisfied in full survive the issuance of the tax deed. Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale. Governmental liens and judgments survive the issuance of a tax deed sale and are satisfied to the fullest extent possible with any. Should you have any questions concerning what liens &. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Additionally, florida statues provide that easements for public service, conservation, and drainage purposes survive tax sales and issuance. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s.

Governmental liens and judgments survive the issuance of a tax deed sale and are satisfied to the fullest extent possible with any. Should you have any questions concerning what liens &. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Liens of governmental units not satisfied in full survive the issuance of the tax deed. Additionally, florida statues provide that easements for public service, conservation, and drainage purposes survive tax sales and issuance. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale.

Quit claim deed form alaska palmdrop

Liens of governmental units not satisfied in full survive the issuance of the tax deed. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed.

Florida Deed Forms & Templates (Free) [Word, PDF, ODT]

Governmental liens and judgments survive the issuance of a tax deed sale and are satisfied to the fullest extent possible with any. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. Additionally, florida statues provide that easements for public service, conservation, and drainage purposes survive tax.

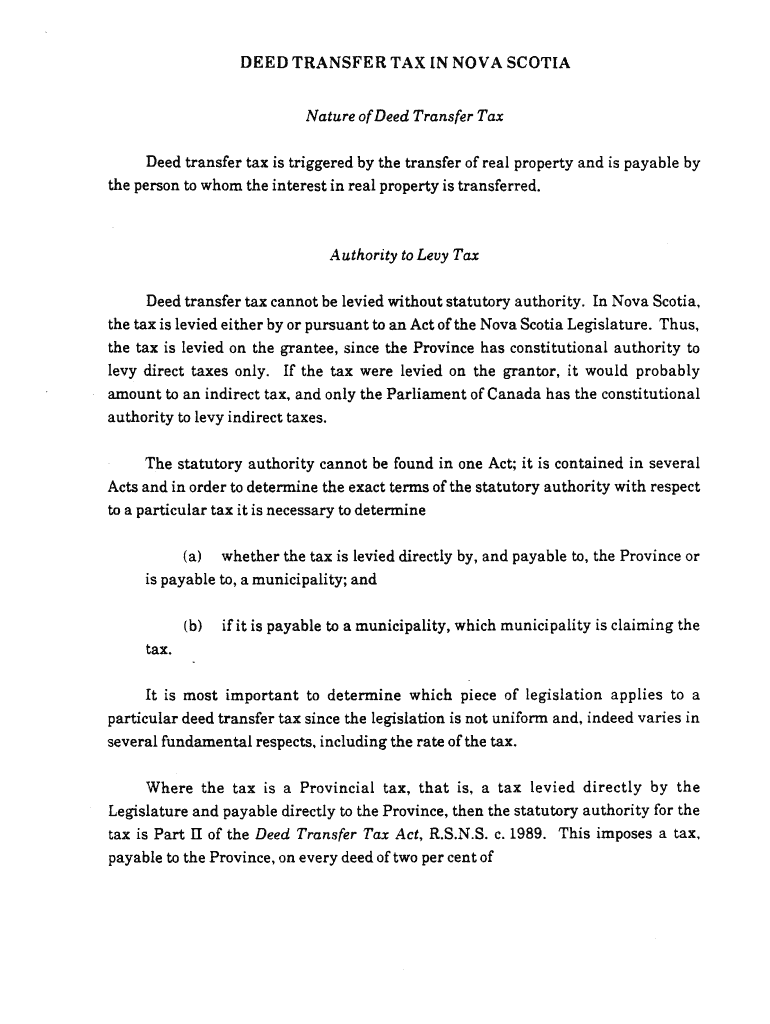

Fillable Online DEED TRANSFER TAX IN NOVA SCOTIA Fax Email Print

Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. Should you have any questions concerning what liens &. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Liens.

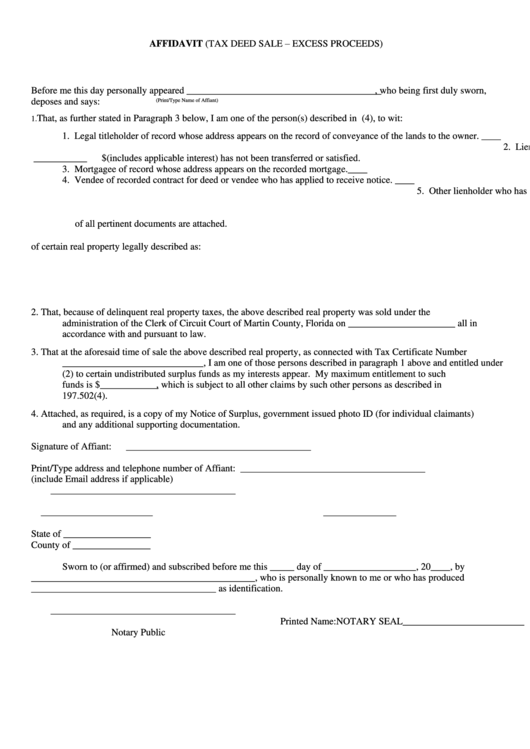

Fillable Affidavit Of Claim (Tax Deed Sale Excess Proceeds) Form

Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Governmental liens and judgments survive the issuance of.

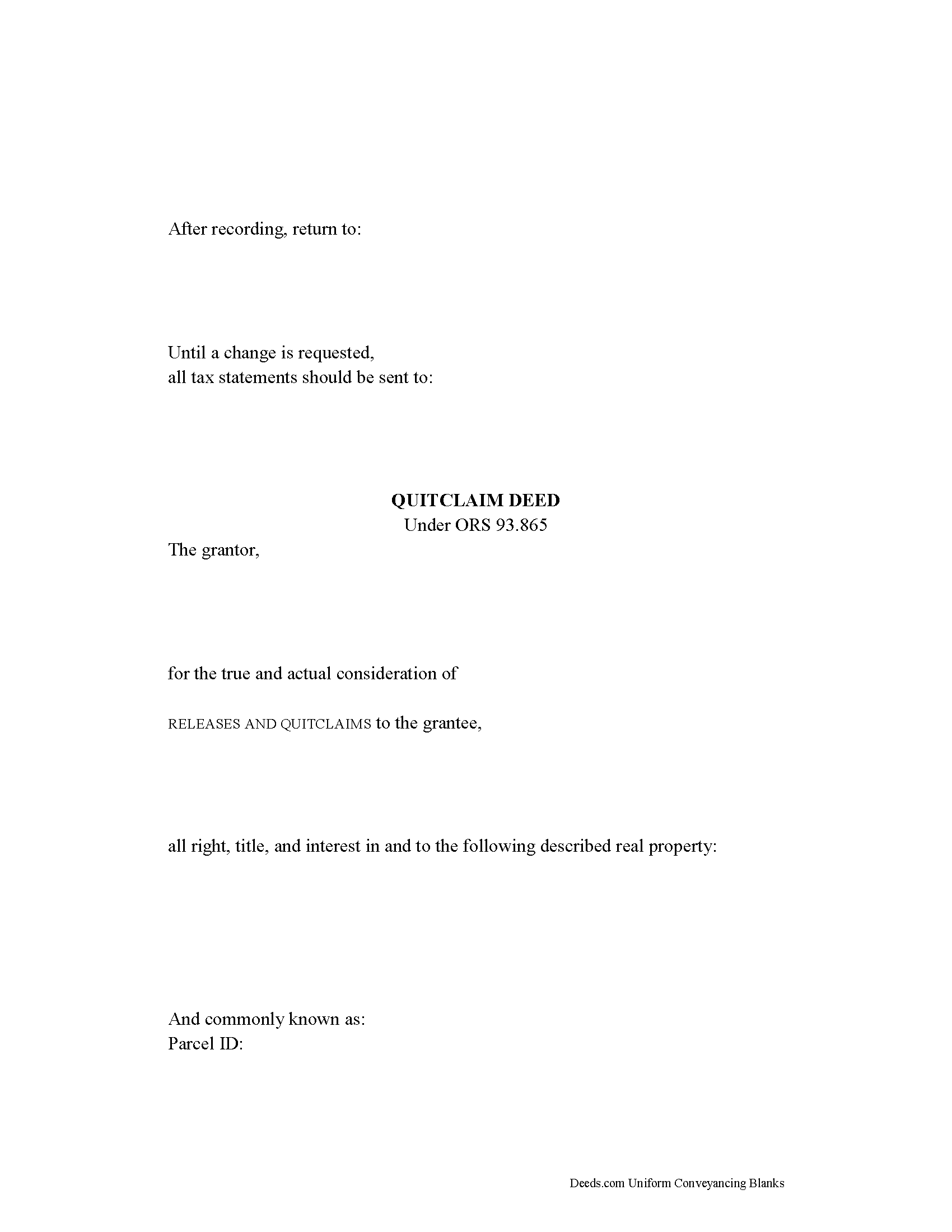

Quitclaim deed Fill out & sign online DocHub

All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale. Except as specifically provided in this chapter, no right,.

How Does a Tax Deed Sale Work in Florida? DeWitt Law

Liens of governmental units not satisfied in full survive the issuance of the tax deed. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the.

Redeemable Tax Deed State Dustin Hahn Buy Tax Liens and Deeds

Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Should you have any questions concerning what liens &. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or.

Multnomah County Quitclaim Deed Form Oregon

Additionally, florida statues provide that easements for public service, conservation, and drainage purposes survive tax sales and issuance. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Liens of governmental units not satisfied in full survive the issuance of the tax deed..

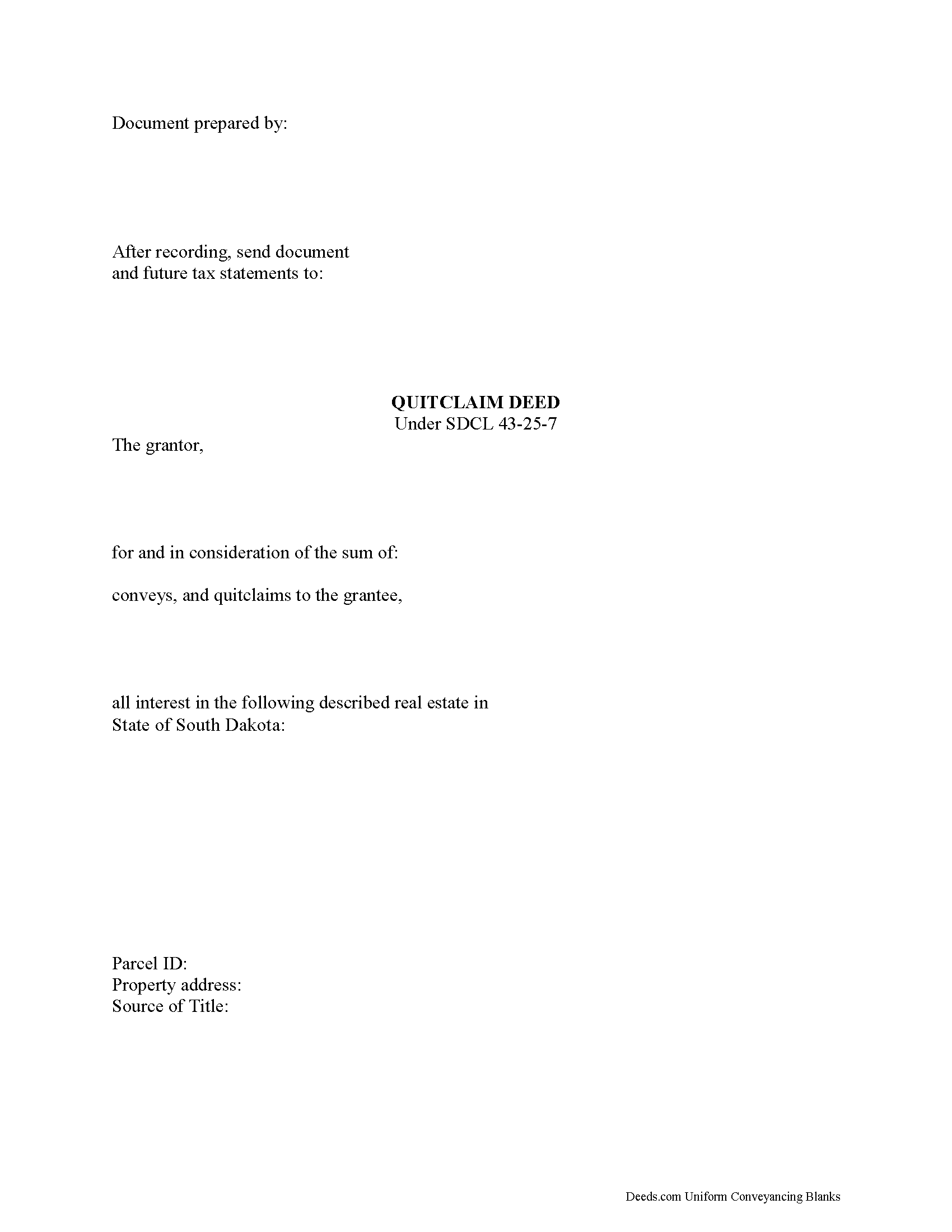

Hyde County Quitclaim Deed Form South Dakota

Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale. Should you have any questions concerning what liens &. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Liens of.

Tax Liens and Deeds Live Class Pips Path

Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a. Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. Additionally, florida statues provide that easements for public service, conservation, and drainage.

Additionally, Florida Statues Provide That Easements For Public Service, Conservation, And Drainage Purposes Survive Tax Sales And Issuance.

Governmental liens and judgments survive the issuance of a tax deed and are satisfied to the fullest extent possible with any surplus funds. All forfeitures, rights of reentry, and reverter rights shall be destroyed and shall not survive to the grantee in the tax deed or master’s deed or clerk’s. Liens of governmental units not satisfied in full survive the issuance of the tax deed. Except as specifically provided in this chapter, no right, interest, restriction, or other covenant shall survive the issuance of a tax deed, except that a.

Governmental Liens And Judgments Survive The Issuance Of A Tax Deed Sale And Are Satisfied To The Fullest Extent Possible With Any.

Governmental liens survive the issuance of a tax deed and are satisfied to the fullest extent possible with any overbid monies from the sale. Should you have any questions concerning what liens &.

![Florida Deed Forms & Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/11/Florida-Deed-of-Trust-Templates.Legal_.jpg)