Foreclosure Surplus

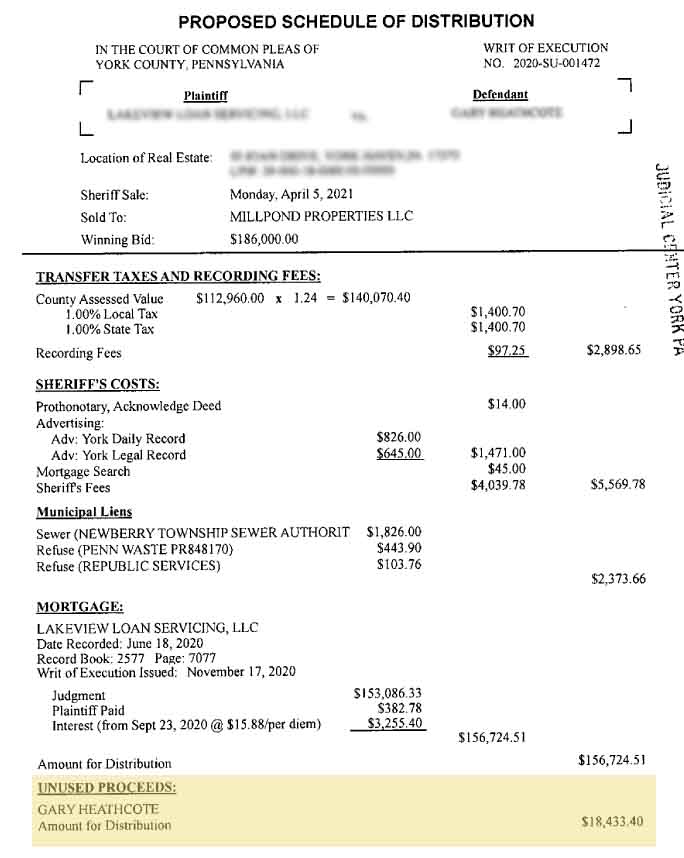

Foreclosure Surplus - If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant financial relief.

Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage.

Claiming surplus funds after a foreclosure can provide significant financial relief. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus.

Foreclosure Surplus Recovery in Texas

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Claiming surplus funds after a foreclosure can provide significant.

Sherralynn Arnold Preforeclosure Surplus Funds Method LOADCOURSE

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Claiming surplus funds after a foreclosure can provide significant.

How To Claim Surplus Funds From Foreclosure 3 best practice

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called.

Do I need a lawyer to claim foreclosure surplus funds? — Foreclosure

Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on.

Foreclosure Surplus Funds 101

If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant.

Foreclosure Surplus Specialists America’s 1 Rated Surplus Recovery

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called.

How To Claim Surplus Funds From Foreclosure Estavillo Law

If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant.

An expert guide How to claim surplus funds from a foreclosure

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called.

Foreclosure Surplus Specialists America’s 1 Rated Surplus Recovery

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. Claiming surplus funds after a foreclosure can provide significant financial relief. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called.

About Us Foreclosure Surplus Specialists™

Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage. If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Claiming surplus funds after a foreclosure can provide significant.

Claiming Surplus Funds After A Foreclosure Can Provide Significant Financial Relief.

If your property is in foreclosure and sells at a judicial sale for more than what you owed on the mortgage, the leftover money is called a surplus. Surplus funds, also known as excess proceeds, arise when a foreclosed property sells for more than the total amount owed on the mortgage.