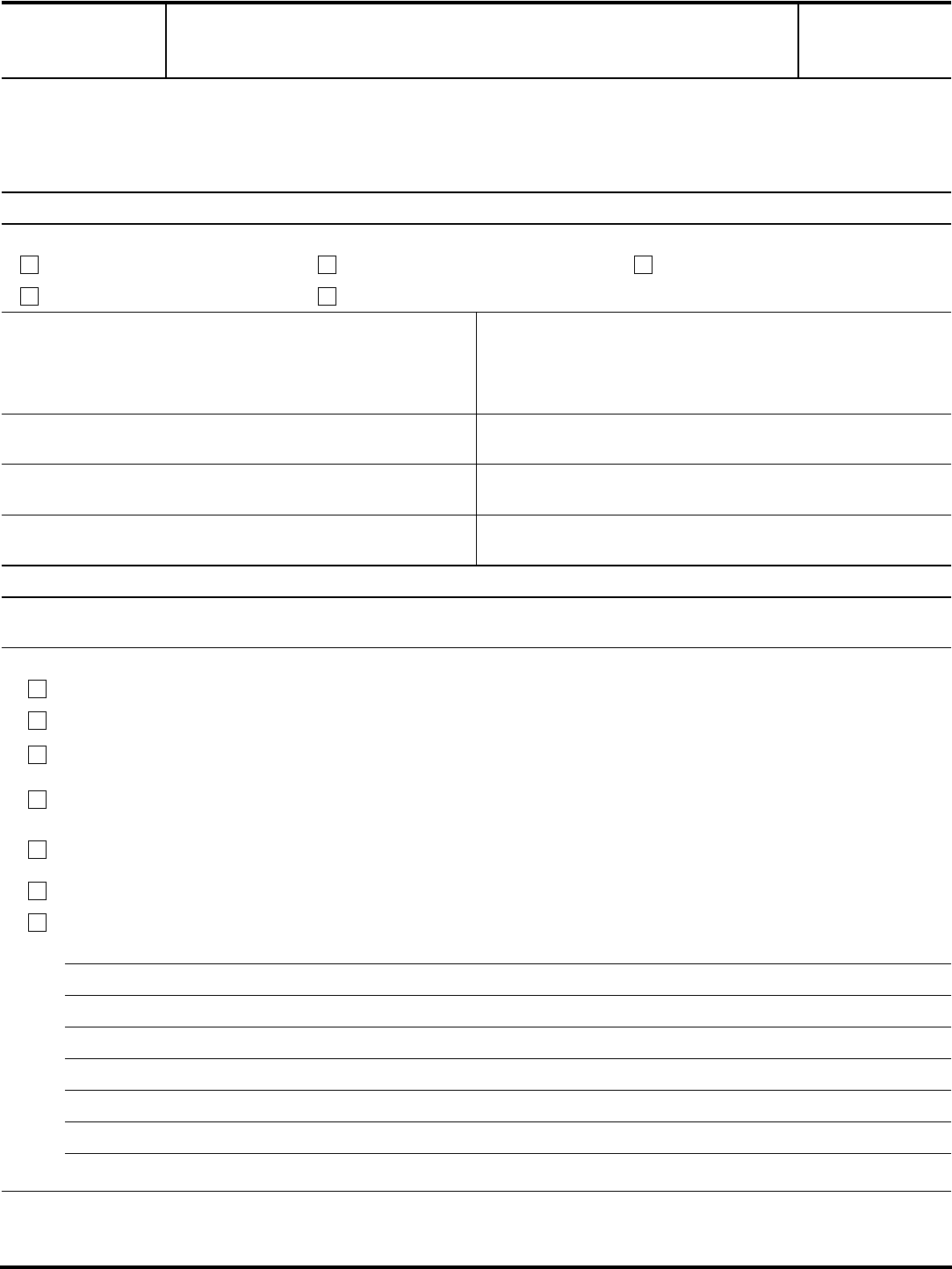

Form 14157 A

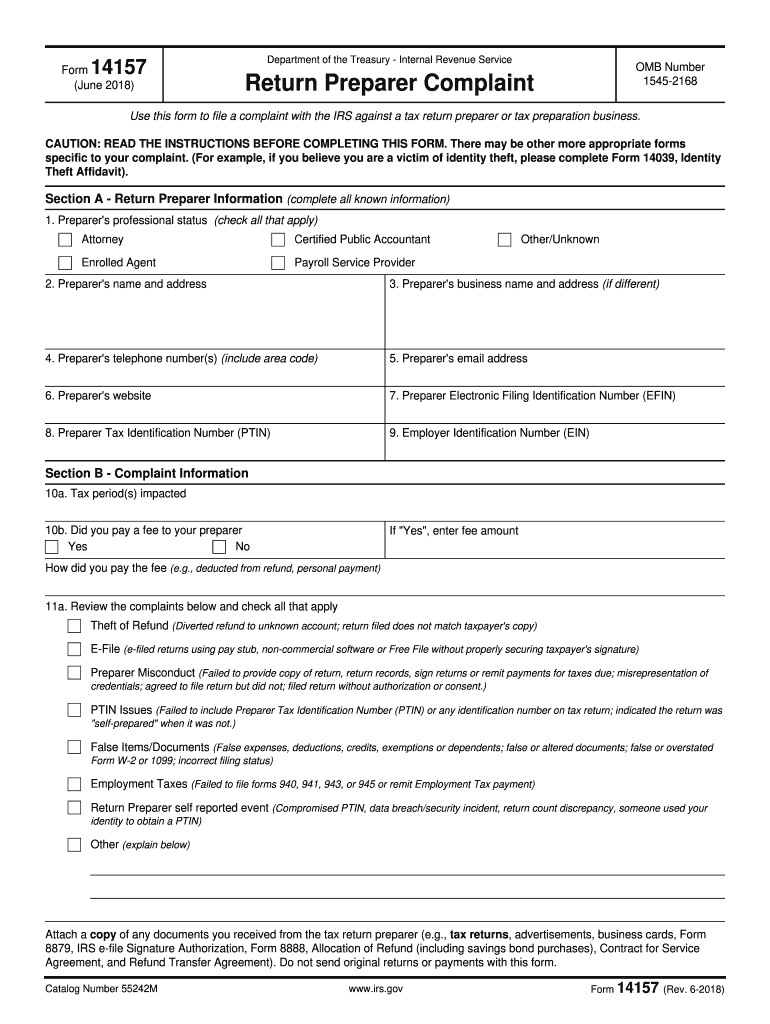

Form 14157 A - Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account.

Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Use form 14157 to file a complaint against a tax return preparer or tax preparation business. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Tax professionals can use this form to report.

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Tax professionals can use this form to report.

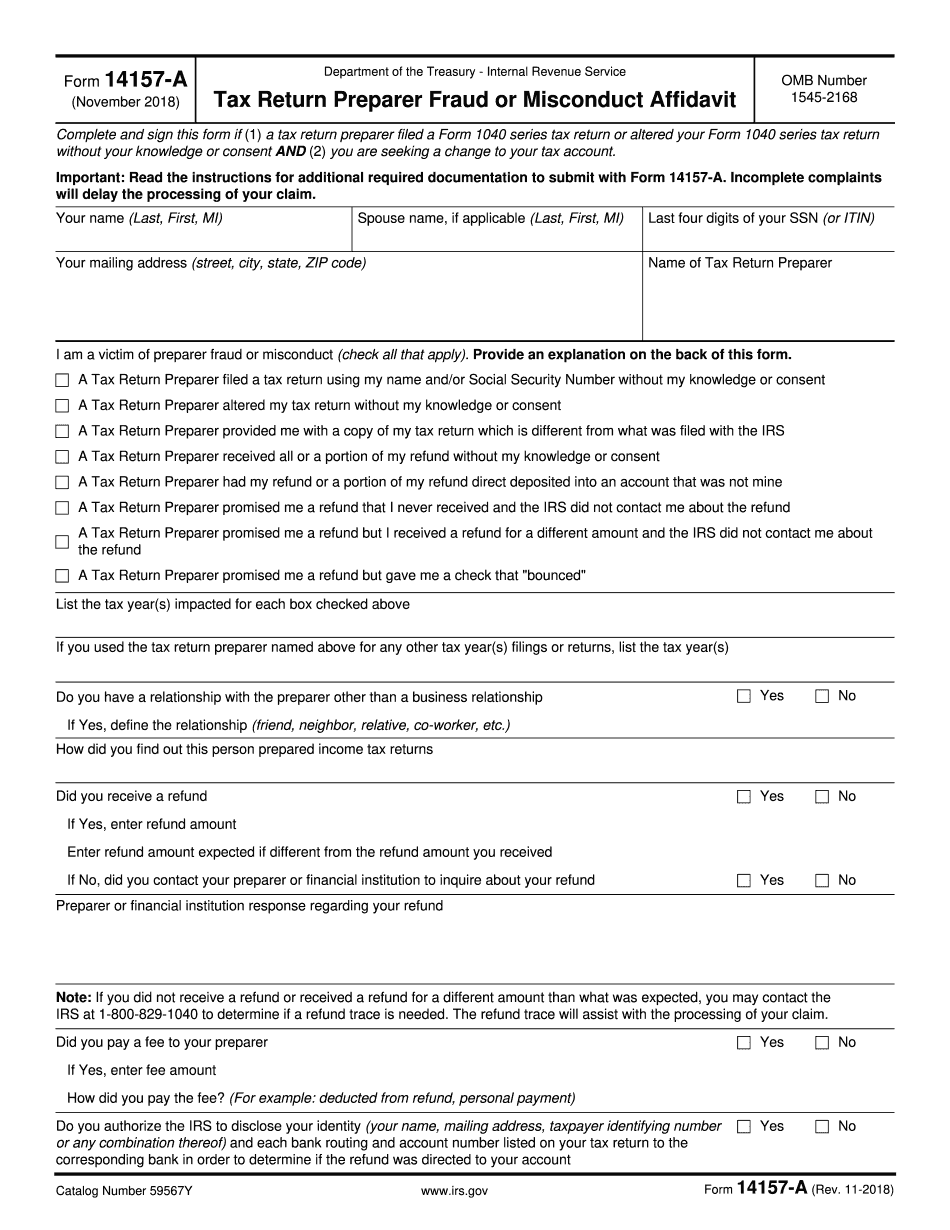

Form 14157A Tax Return Preparer Fraud or Misconduct Affidavit (2012

Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Tax professionals can use this form to report. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use.

IRS Form 14157A Instructions Preparer Fraud or Misconduct

If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you.

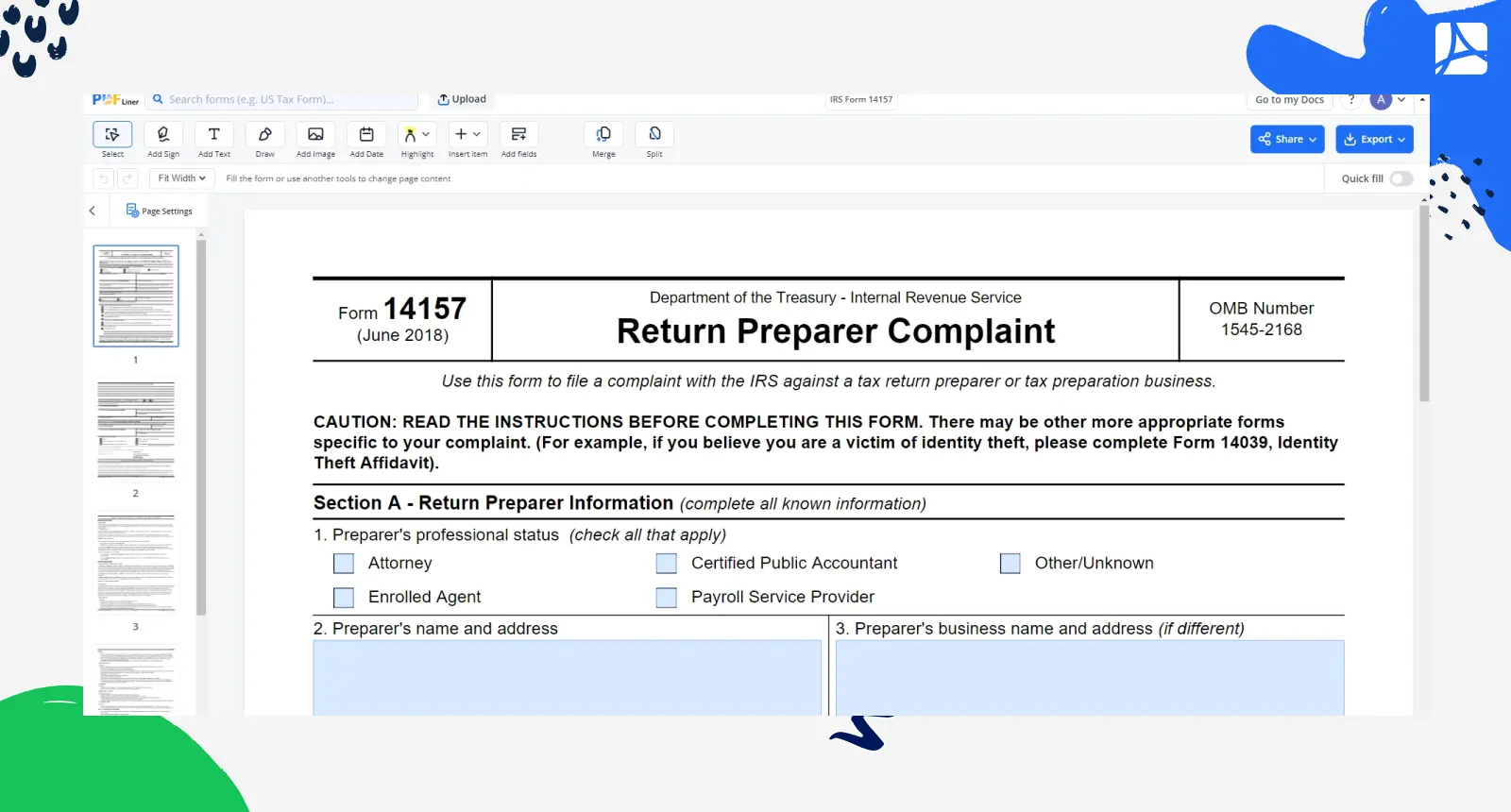

IRS Form 14157 Printable Form 14157 blank, sign online — PDFliner

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Tax professionals can use this form to report. If a tax return preparer filed a return or.

Form 14157 Edit, Fill, Sign Online Handypdf

If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you.

Form 14157 Complaint Tax Return Preparer (2014) Free Download

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. If a tax return preparer filed a return or altered your return without your consent and you.

Form 14157 Fill out & sign online DocHub

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Tax professionals can use this form to report. Use this form if a tax return preparer filed a return or.

Printable Form 14157 Printable Forms Free Online

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use this form if a tax return preparer filed a return or altered your return without your consent and you.

14157 A Irs Printable & Fillable Sample in PDF

If a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account,. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Tax professionals can use this form to report. Use.

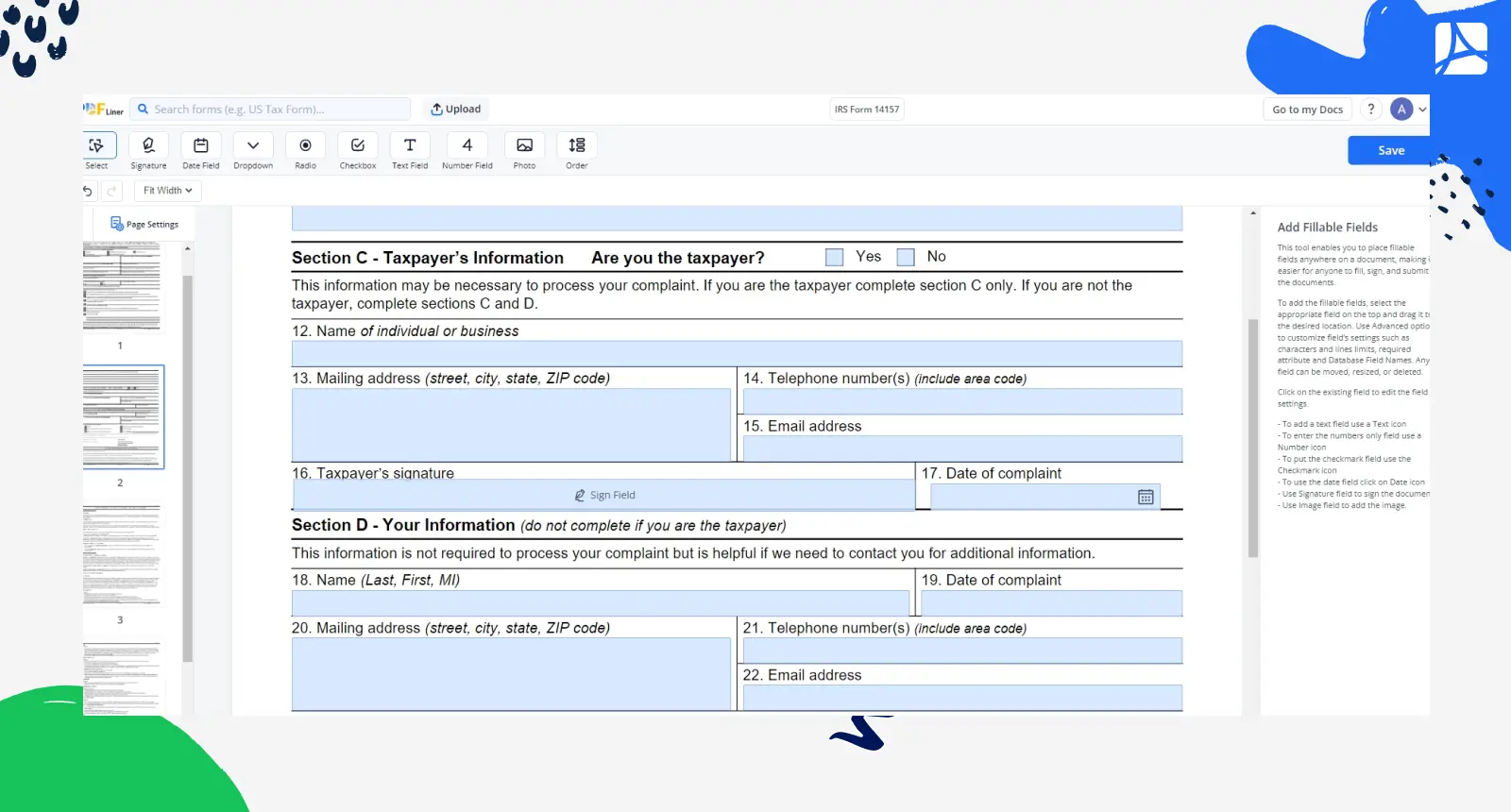

IRS Form 14157 Printable Form 14157 blank, sign online — PDFliner

Tax professionals can use this form to report. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Use form 14157 to file a complaint against a tax return preparer or tax preparation business. If a tax return preparer filed a return or.

Form 14157 Edit, Fill, Sign Online Handypdf

Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. If a tax return preparer filed a return or altered your return without your consent and you.

If A Tax Return Preparer Filed A Return Or Altered Your Return Without Your Consent And You Are Seeking A Change To Your Account,.

Use this form if a tax return preparer filed a return or altered your return without your consent and you are seeking a change to your account. Use form 14157 to file a complaint against a tax return preparer or tax preparation business. Tax professionals can use this form to report.