Form 3115 Cash To Accrual Sample

Form 3115 Cash To Accrual Sample - Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. Information about form 3115, application for change in accounting method, including recent updates, related forms and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev.

Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Information about form 3115, application for change in accounting method, including recent updates, related forms and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any.

Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. Information about form 3115, application for change in accounting method, including recent updates, related forms and. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev.

Form 3115 Applying a Cost Segregation Study on a Tax Return

The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. Information about form 3115, application for change in accounting method, including recent updates, related forms and. Requires one form.

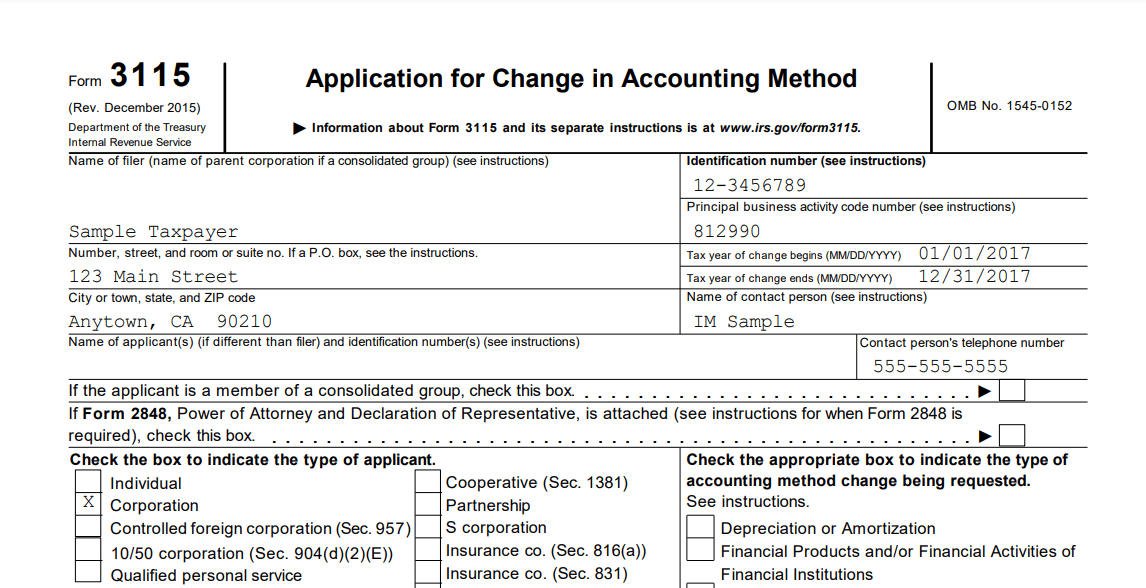

Fillable Online Form 3115 Application for Change in Accounting Method

Information about form 3115, application for change in accounting method, including recent updates, related forms and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under.

Automatic Change to Cash Method of Accounting for Tax

Information about form 3115, application for change in accounting method, including recent updates, related forms and. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of.

Irs Form 3115 Fillable Printable Forms Free Online

Information about form 3115, application for change in accounting method, including recent updates, related forms and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Requires one form.

Form 3115 Instructions (Application for Change in Accounting Method)

The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting.

Form 3115 Change in accounting method

The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Information about form 3115, application for change in accounting method, including recent updates, related forms and. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is.

Form 3115 for a Cash to Accrual Method for Small Businesses Lex Legal

The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Information about form 3115, application for change in accounting method, including recent updates, related forms and. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is.

Form 3115 Applying a Cost Segregation Study on a Tax Return The

Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method.

Form 3115 Source Advisors

Information about form 3115, application for change in accounting method, including recent updates, related forms and. Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of.

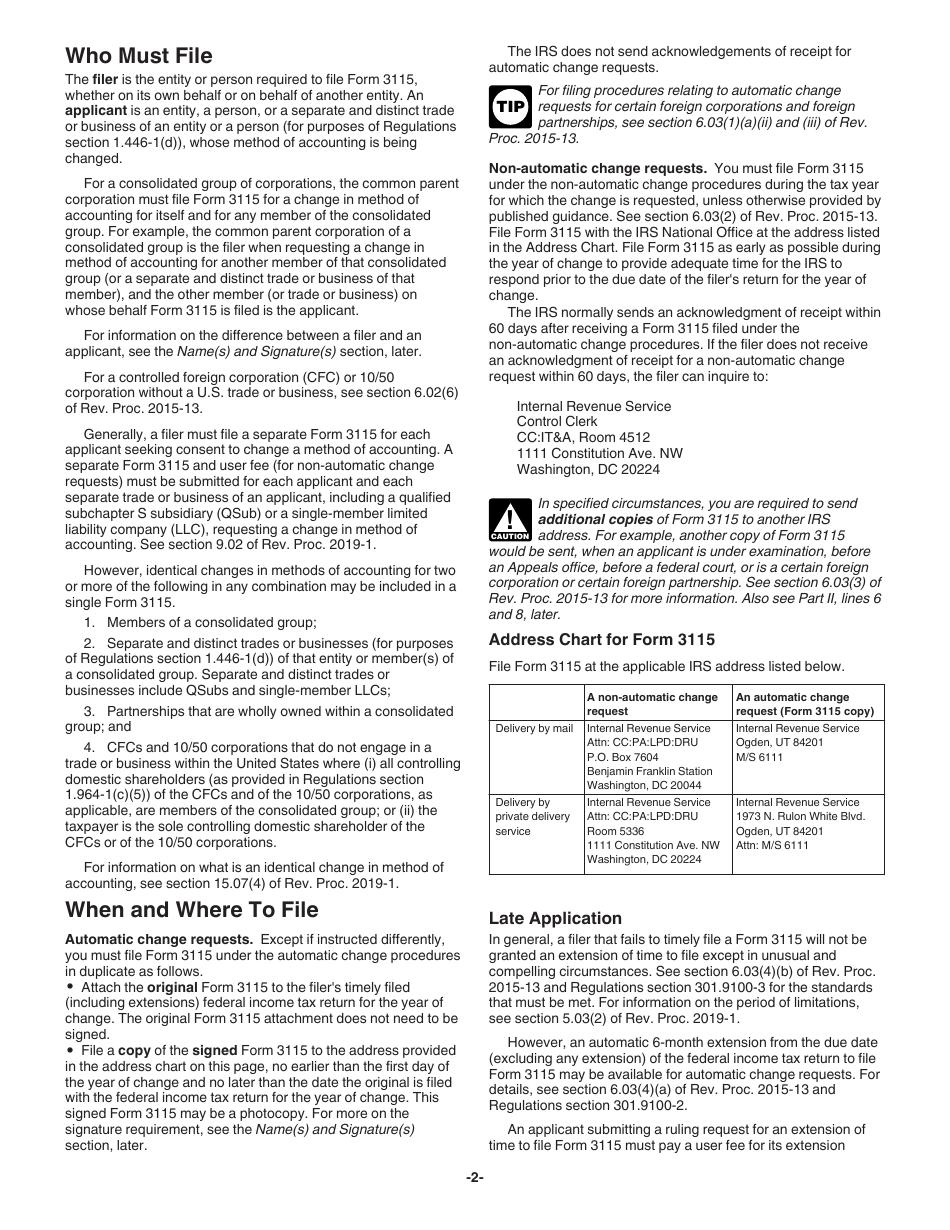

Download Instructions for IRS Form 3115 Application for Change in

Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. If the applicant is changing to either the overall cash method, an overall accrual method, or is changing its method of accounting for any. Information about form 3115, application for change in accounting method, including recent updates,.

If The Applicant Is Changing To Either The Overall Cash Method, An Overall Accrual Method, Or Is Changing Its Method Of Accounting For Any.

Requires one form 3115 for an automatic change to, from, or within a nonaccrual experience (nae) method of accounting under section 15.04 and. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Information about form 3115, application for change in accounting method, including recent updates, related forms and.