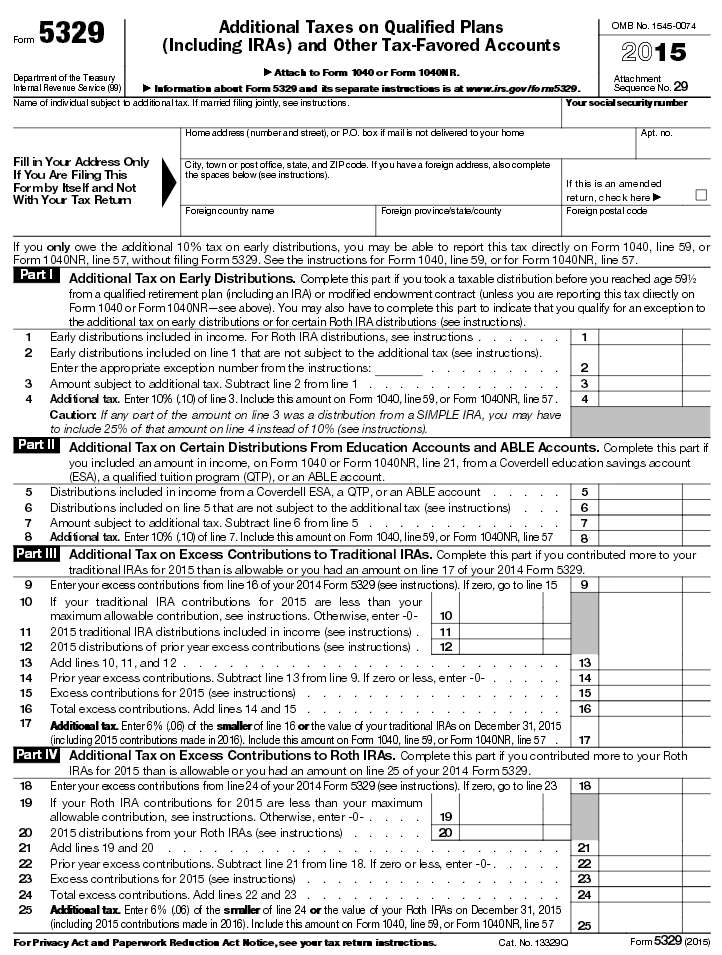

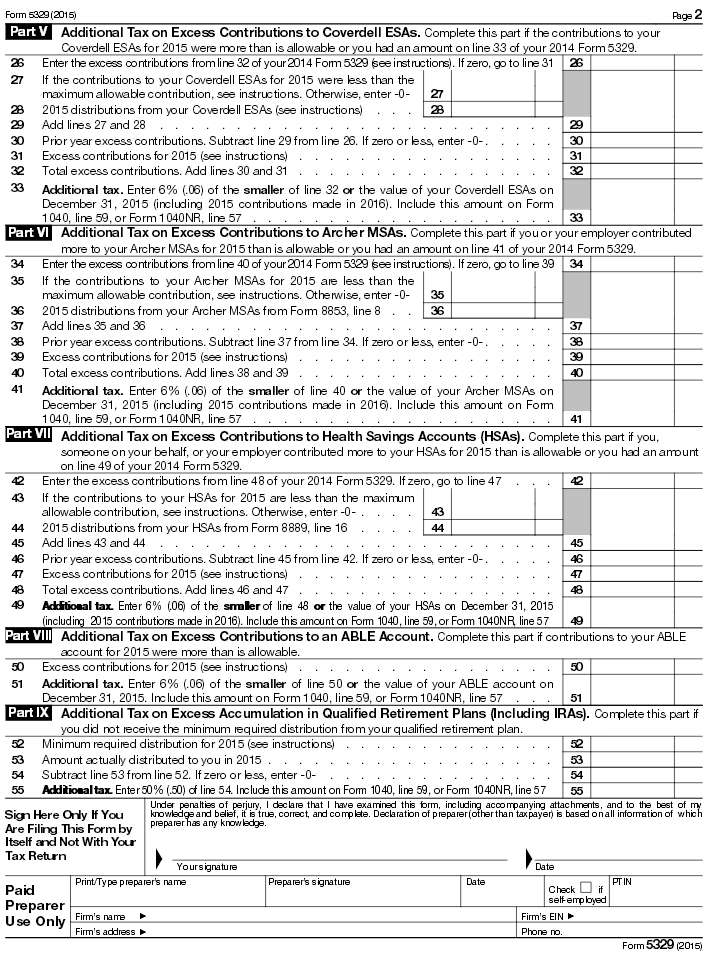

Form 5329 Is Used For Which Of The Following Purposes

Form 5329 Is Used For Which Of The Following Purposes - Form 5329 must be filed if any of the following apply: For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from a roth ira and either (a) the amount on form.

Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from a roth ira and either (a) the amount on form. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 must be filed if any of the following apply:

Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from a roth ira and either (a) the amount on form. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 must be filed if any of the following apply:

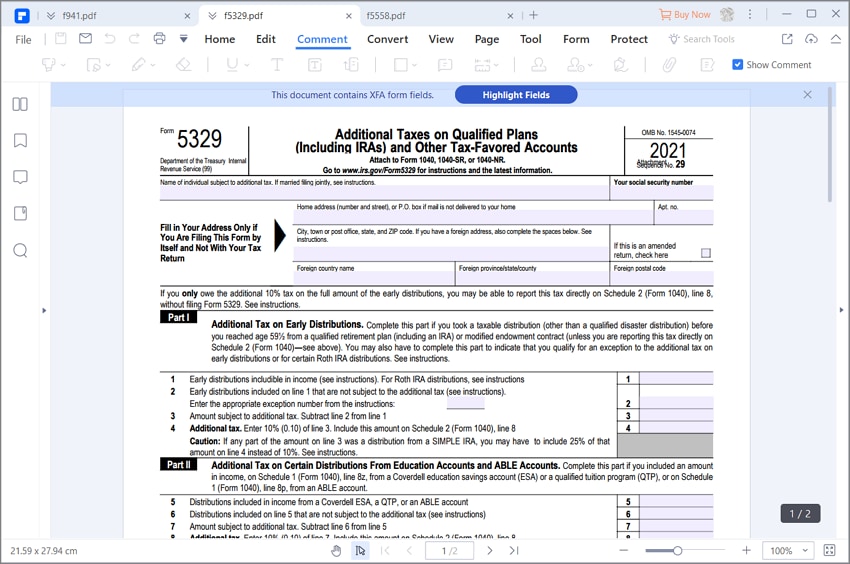

IRS Form 5329 walkthrough (Additional Taxes on Qualified Plans and

The taxpayer received a distribution from a roth ira and either (a) the amount on form. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 must be filed if any of the following apply: Form 5329 is used by any individual.

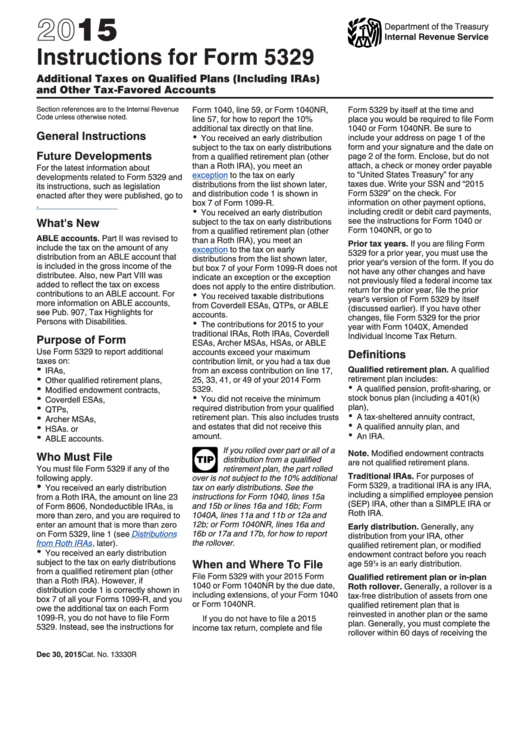

Instructions For Form 5329 (2015) printable pdf download

Form 5329 must be filed if any of the following apply: For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from.

TaxSlayer Changes Tax Year ppt download

Form 5329 must be filed if any of the following apply: For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from.

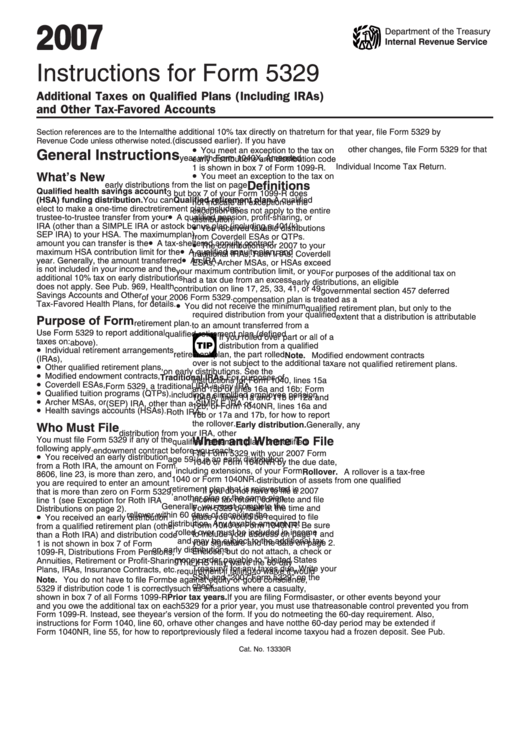

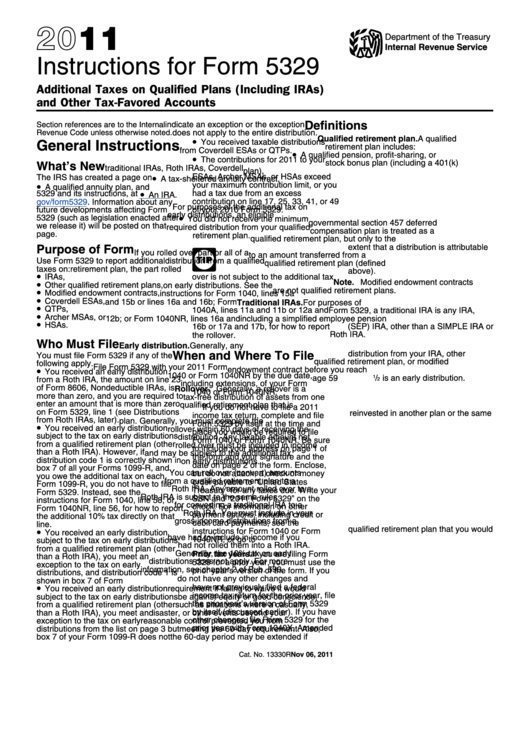

Instructions For Form 5329 Additional Taxes On Qualified Plans And

The taxpayer received a distribution from a roth ira and either (a) the amount on form. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

The taxpayer received a distribution from a roth ira and either (a) the amount on form. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form.

How to Fill in IRS Form 5329

Form 5329 must be filed if any of the following apply: Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from a roth ira and either (a) the amount on form. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension.

Form 5329 Is Used for Which of the Following Purposes

For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 must be filed if any of the following apply: Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from.

Who must file the 2015 Form 5329?

Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. Form 5329 must be filed if any of the following apply: The taxpayer received a distribution from a roth ira and either (a) the amount on form. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension.

2012 Instructions for Form 5329

Form 5329 must be filed if any of the following apply: The taxpayer received a distribution from a roth ira and either (a) the amount on form. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension.

W9 Form 2024 Printable Free Irs Daffy Drucill

The taxpayer received a distribution from a roth ira and either (a) the amount on form. Form 5329 must be filed if any of the following apply: Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension.

Form 5329 Must Be Filed If Any Of The Following Apply:

For purposes of form 5329, a traditional ira is any ira, including a simplified employee pension (sep) ira, other than a simple ira or roth ira. Form 5329 is used by any individual who has established a retirement account, annuity or retirement bond. The taxpayer received a distribution from a roth ira and either (a) the amount on form.