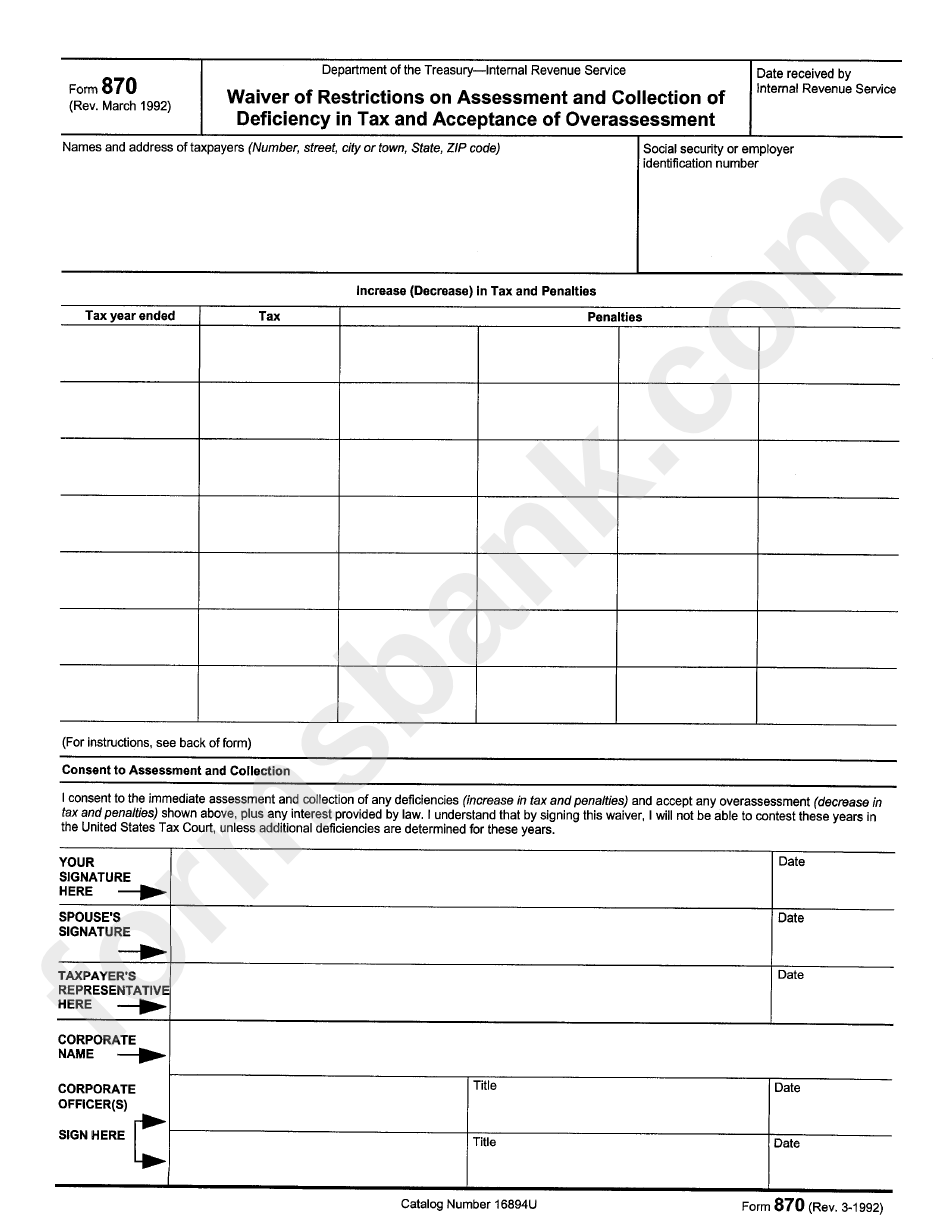

Form 870 Irs

Form 870 Irs - We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. The form 870 does not. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. The effect of each of these forms is different.

The effect of each of these forms is different. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. The form 870 does not. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and.

The effect of each of these forms is different. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. The form 870 does not. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue.

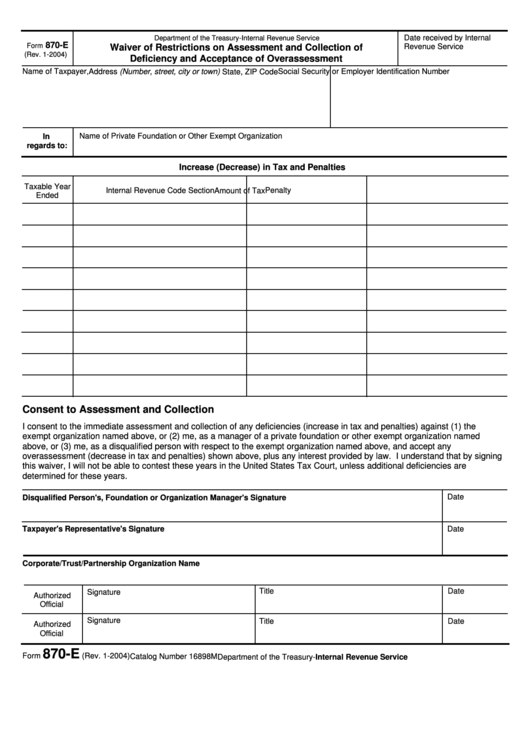

Form 870 Waiver Of Restrictions On Assessment And Collection Of

A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease.

Former IRS Agent Explains What To Do If You Got a Letter 3176c, Notice

A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. The form 870 does not. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before.

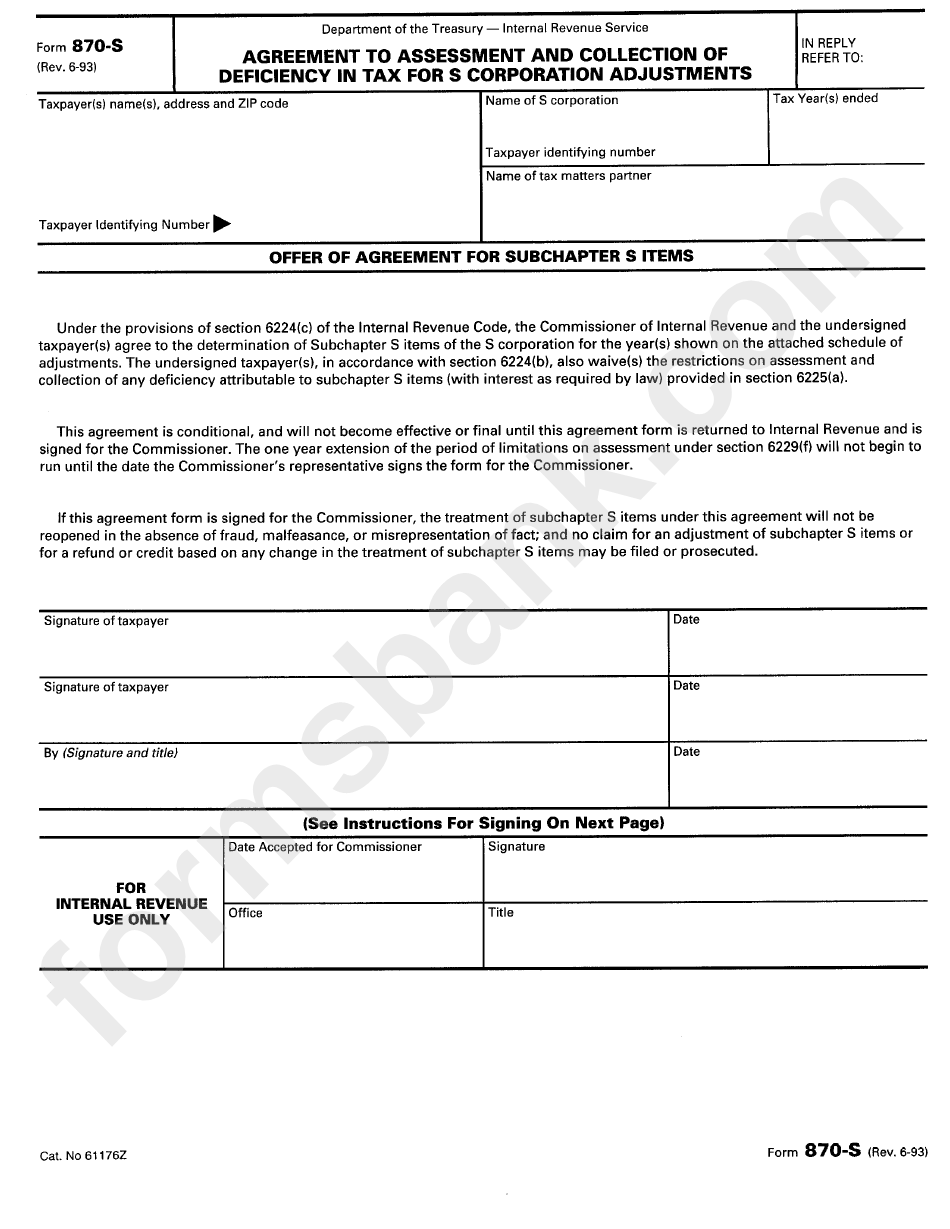

Form 870S Agreement To Assessment And Collection Of Deficiency In

The effect of each of these forms is different. The form 870 does not. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax.

Hardly Anyone Knows About This IRS Program That Lets You File Your

The effect of each of these forms is different. The form 870 does not. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. Irc 6212 and irc 6213 require.

IRS pledges more audits of wealthy, better customer service Metro US

The effect of each of these forms is different. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. Irc 6212 and irc 6213 require that the irs issue a.

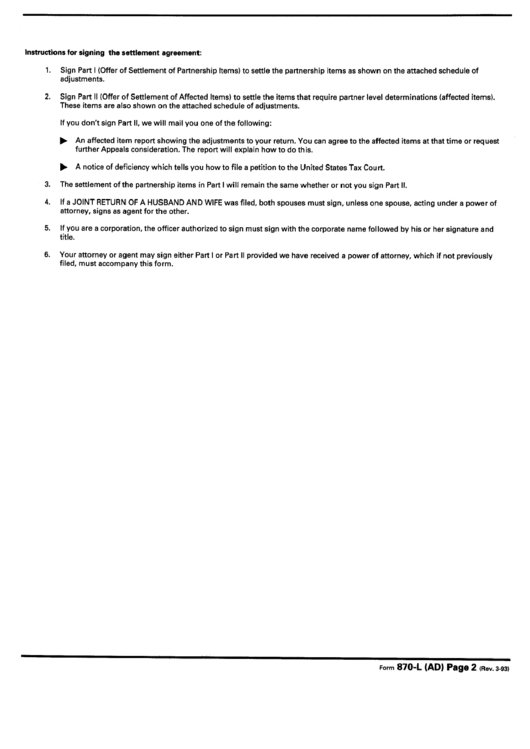

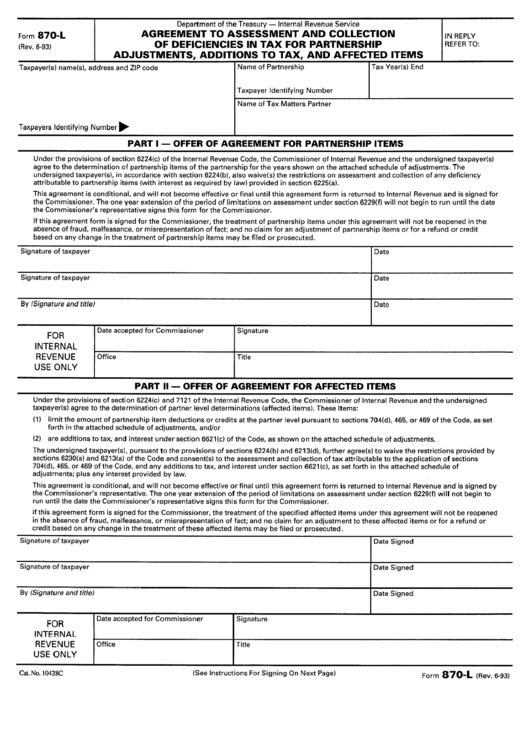

Instructions For Form 870L(Ad) 1993 printable pdf download

The effect of each of these forms is different. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. The form 870 does not. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax.

8.19.11 Agreed TEFRA Partnership Cases Internal Revenue Service

The effect of each of these forms is different. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. The form 870 does not. Irc 6212 and irc 6213 require.

How To Get A Copy Of Ss4 Form IRS LiveWell

We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. The form 870 does not. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before.

Fillable Form 870E Waiver Of Restrictions On Assessment And

Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. The form 870 does not. The effect of each of these forms is different. We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax.

Form 870L Agreement To Assessment And Collection June 1993 printable

The effect of each of these forms is different. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,. A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. The form 870 does not. We will consider this waiver a valid.

We Will Consider This Waiver A Valid Claim For Refund Or Credit Of Any Overpayment Due You Resulting From Any Decrease In Tax And.

A recent us tax court memorandum opinion held that a settlement agreement embodied in internal revenue. The form 870 does not. The effect of each of these forms is different. Irc 6212 and irc 6213 require that the irs issue a notice of deficiency before assessing additional income tax, estate tax, gift tax,.