Form 8833 Turbotax

Form 8833 Turbotax - If you need to include this form with your tax return and the return has. Tax return and form 8833 if claiming the following treaty benefits: A reduction or modification in the taxation of gain. This form can be crucial for reducing. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. The payee must file a u.s. As you stated, turbotax does not support irs form 8833.

If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. This form can be crucial for reducing. As you stated, turbotax does not support irs form 8833. The payee must file a u.s. A reduction or modification in the taxation of gain. If you need to include this form with your tax return and the return has. Tax return and form 8833 if claiming the following treaty benefits:

A reduction or modification in the taxation of gain. This form can be crucial for reducing. As you stated, turbotax does not support irs form 8833. Tax return and form 8833 if claiming the following treaty benefits: If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. If you need to include this form with your tax return and the return has. The payee must file a u.s.

Tax Treaty Benefits & Form 8833 What You Need to Know

This form can be crucial for reducing. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. As you stated, turbotax does not support irs form 8833. A reduction or modification in the taxation of gain. If you need to include this form with your tax return and the return.

Form 8833 & Tax Treaties Understanding Your US Tax Return

The payee must file a u.s. This form can be crucial for reducing. Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does not support irs form 8833. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns.

Video Form 8833 Tax Treaty Disclosure

Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does not support irs form 8833. If you need to include this form with your tax return and the return has. A reduction or modification in the taxation of gain. This form can be crucial for reducing.

Form 8833 & Tax Treaties Understanding Your US Tax Return

This form can be crucial for reducing. The payee must file a u.s. A reduction or modification in the taxation of gain. If you need to include this form with your tax return and the return has. As you stated, turbotax does not support irs form 8833.

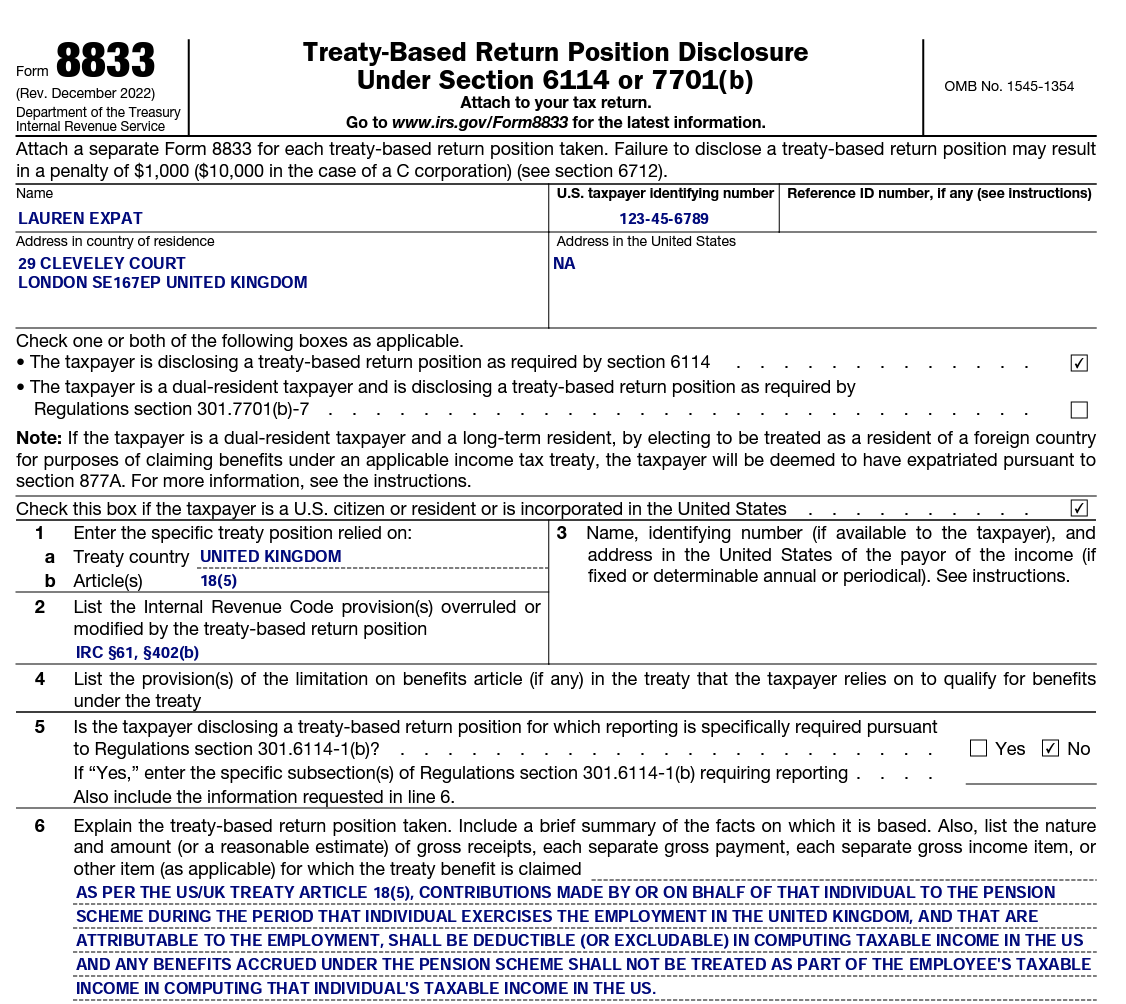

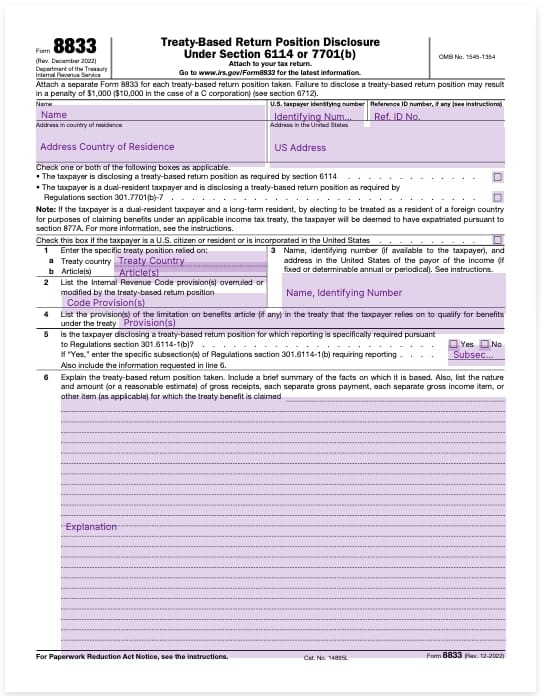

Form 8833 TreatyBased Return Position Disclosure — Bambridge

As you stated, turbotax does not support irs form 8833. The payee must file a u.s. This form can be crucial for reducing. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain.

A Beginner’s Guide to IRS Tax Treaty Benefits, Form 8833

Tax return and form 8833 if claiming the following treaty benefits: The payee must file a u.s. This form can be crucial for reducing. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain.

IRS Form 8833 Instructions TreatyBased Return Disclosures

The payee must file a u.s. As you stated, turbotax does not support irs form 8833. This form can be crucial for reducing. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. Tax return and form 8833 if claiming the following treaty benefits:

Irs Form 8833 Fillable Printable Forms Free Online

If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. The payee must file a u.s. Tax return and form 8833 if claiming the following treaty benefits: If you need to include this form with your tax return and the return has. This form can be crucial for reducing.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

If you need to include this form with your tax return and the return has. If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: As you stated, turbotax does.

Calaméo IRS FORM 8833 [TREATY BASED RETURN POSITION DISCLOSURE]

As you stated, turbotax does not support irs form 8833. The payee must file a u.s. If you need to include this form with your tax return and the return has. A reduction or modification in the taxation of gain. This form can be crucial for reducing.

This Form Can Be Crucial For Reducing.

If you're an expat in a treaty nation, you might need to file irs form 8833 with your tax returns. A reduction or modification in the taxation of gain. Tax return and form 8833 if claiming the following treaty benefits: The payee must file a u.s.

As You Stated, Turbotax Does Not Support Irs Form 8833.

If you need to include this form with your tax return and the return has.

![Calaméo IRS FORM 8833 [TREATY BASED RETURN POSITION DISCLOSURE]](https://p.calameoassets.com/200703182719-55c45f599c90efa5d4892cae327a07bd/p1.jpg)