Form It 2658 E

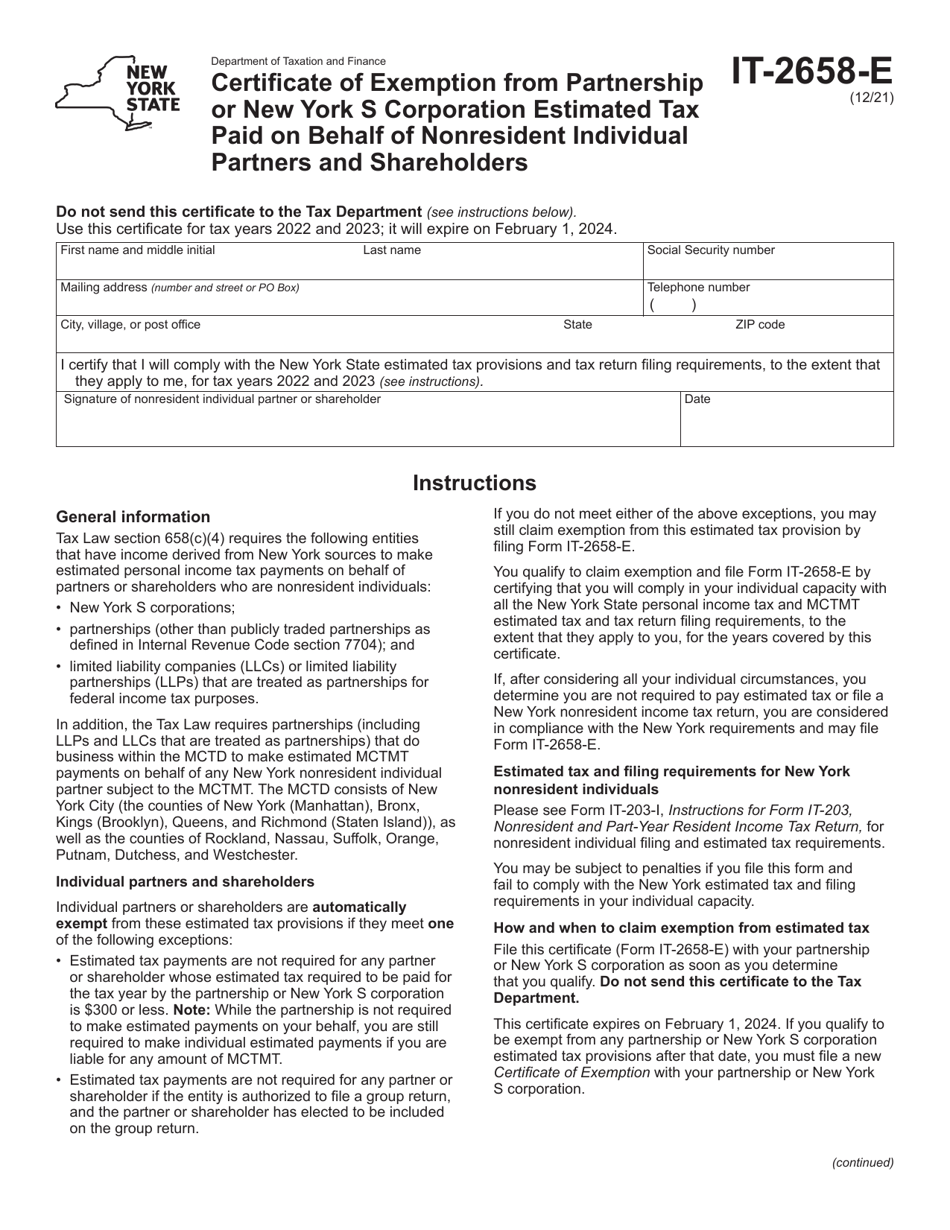

Form It 2658 E - Note a nonresident shareholder with tax less. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024.

This form is for income earned in tax year 2023, with tax returns due in april 2024. Note a nonresident shareholder with tax less. We will update this page with a new version of the form for. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of.

S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. Note a nonresident shareholder with tax less. We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024.

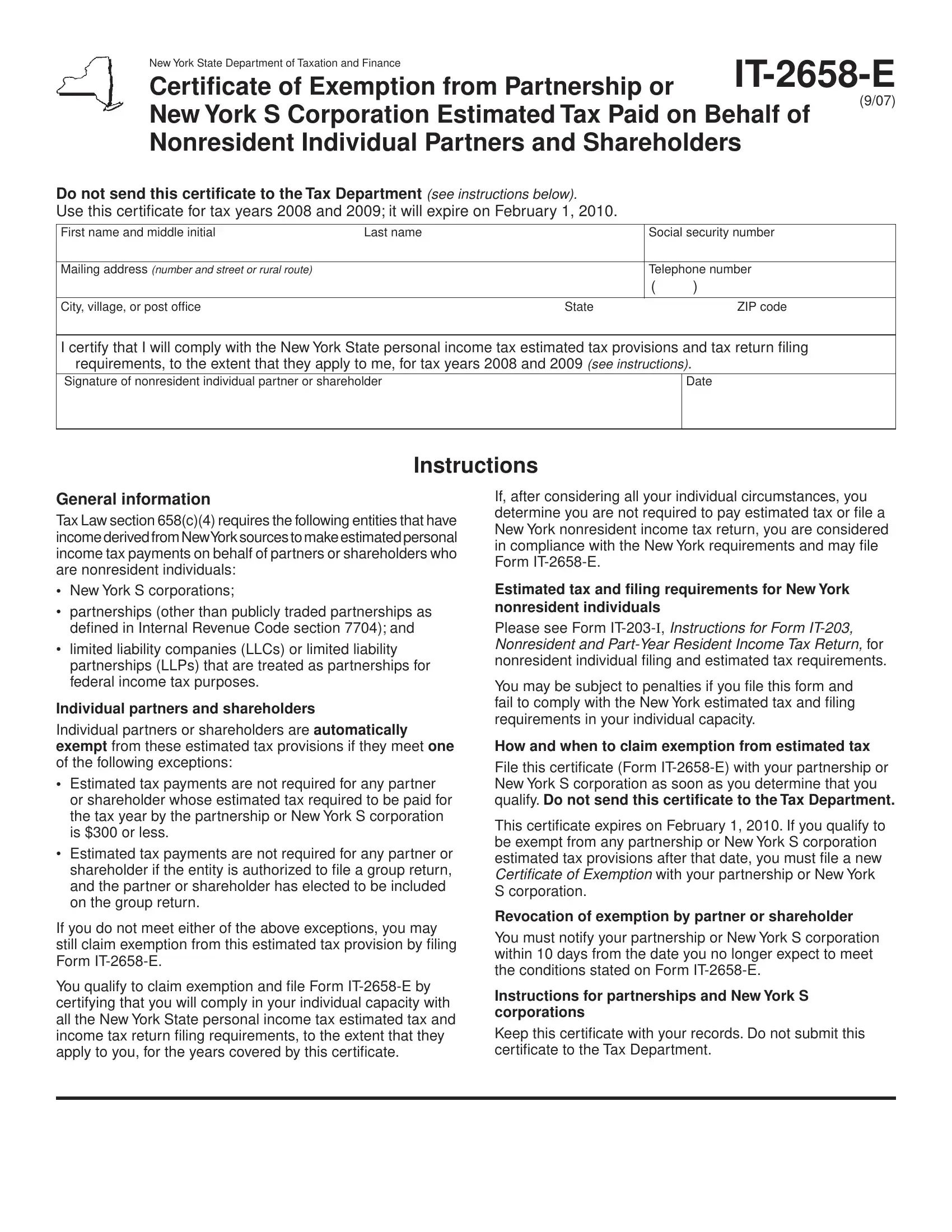

Fillable Online Form IT2658E Fax Email Print pdfFiller

S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. Note a nonresident shareholder with tax less. We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024.

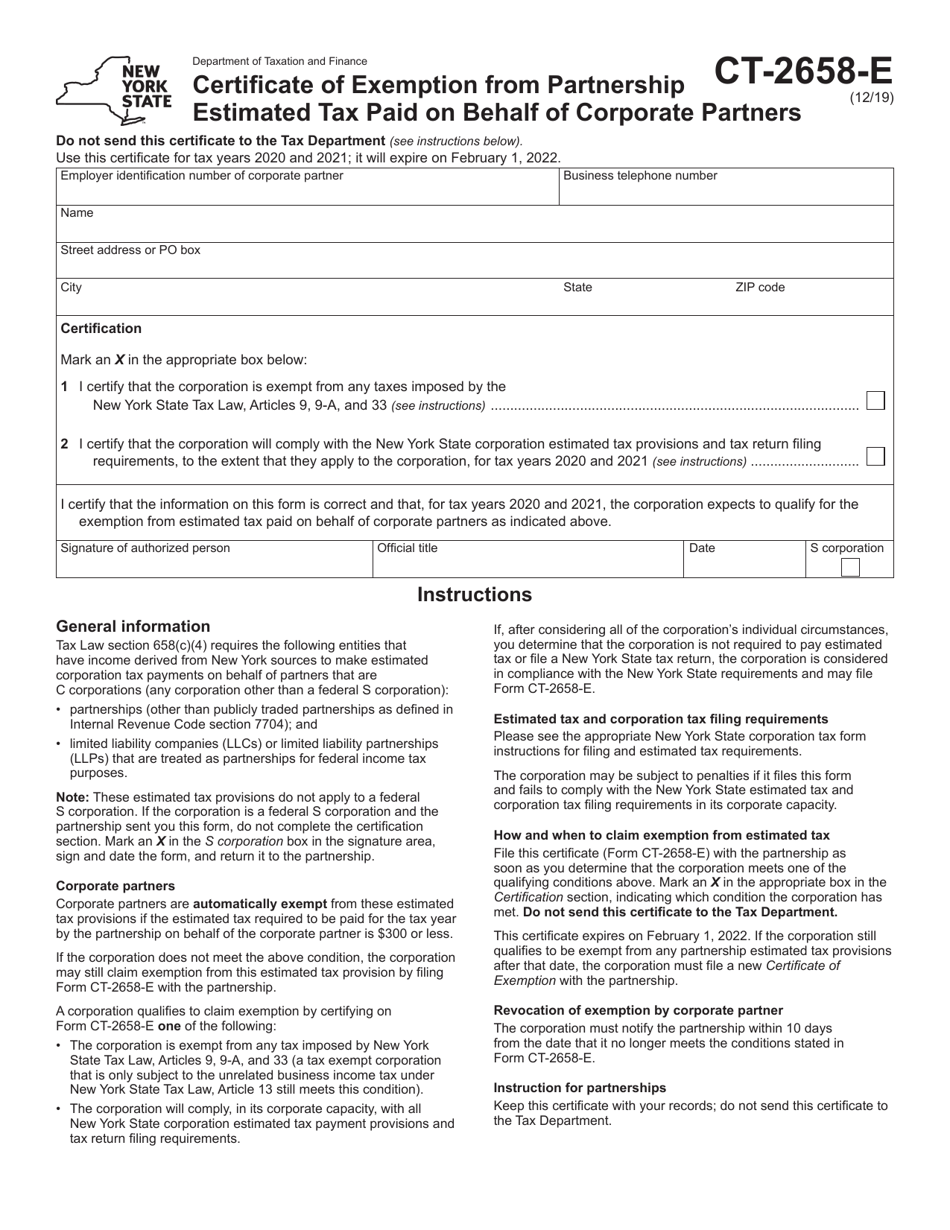

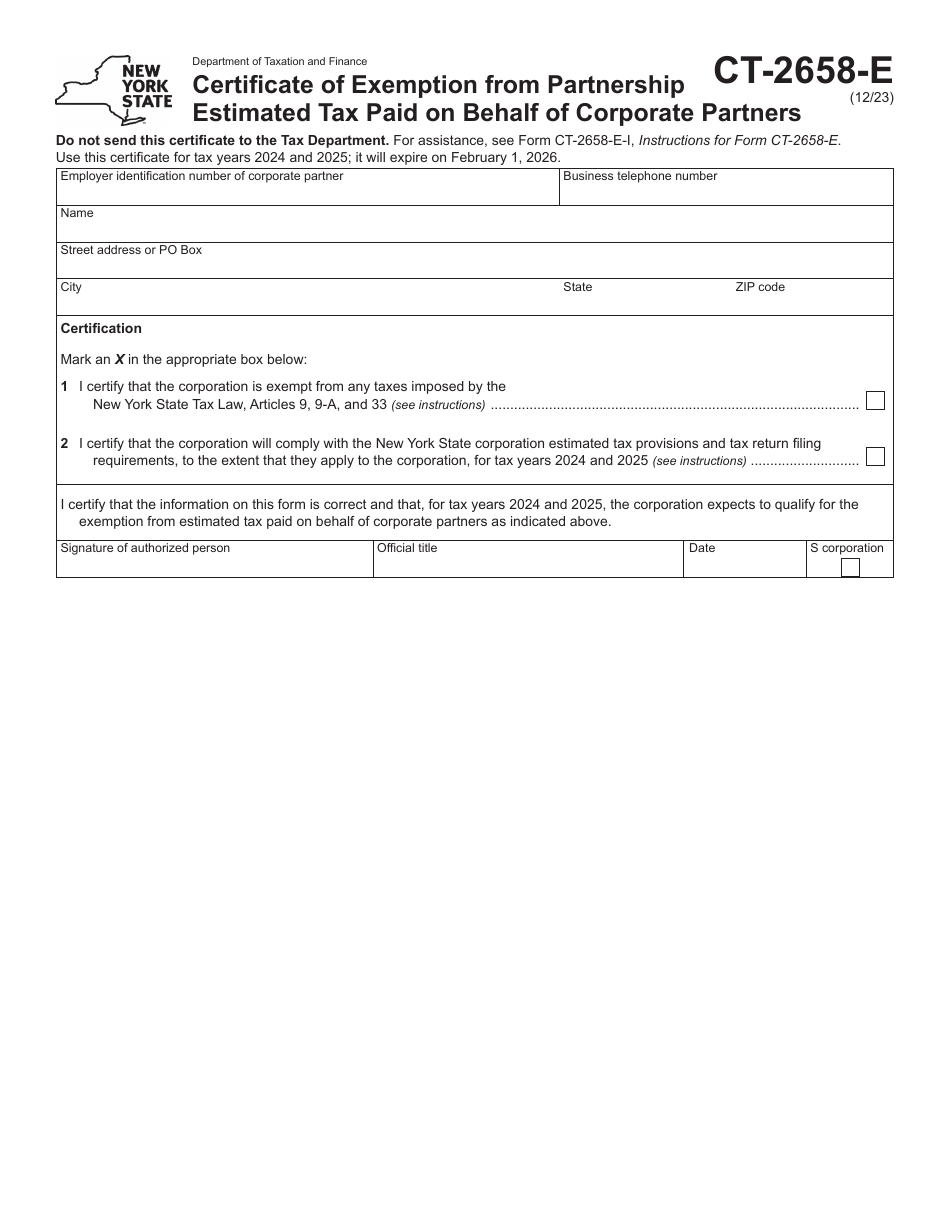

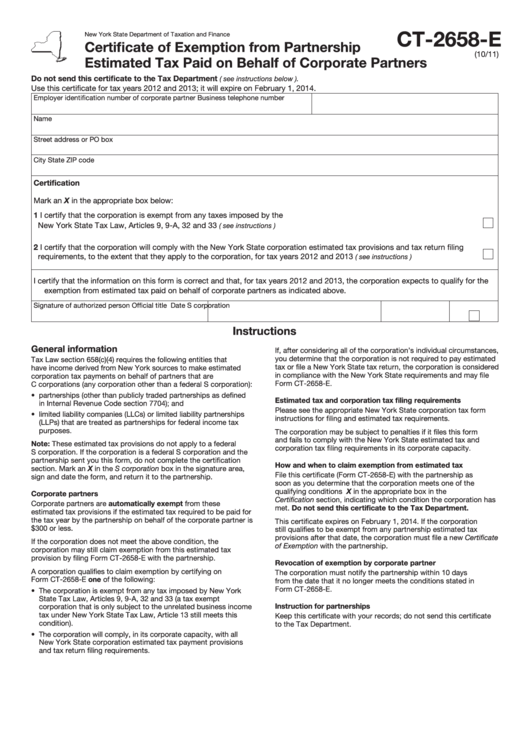

Form CT2658E Fill Out, Sign Online and Download Fillable PDF, New

Note a nonresident shareholder with tax less. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for.

Form CT2658E Download Fillable PDF or Fill Online Certificate of

Note a nonresident shareholder with tax less. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for. This form is for income earned in tax year 2023, with tax returns due in april 2024.

Form CT2658E Download Fillable PDF or Fill Online Certificate of

This form is for income earned in tax year 2023, with tax returns due in april 2024. Note a nonresident shareholder with tax less. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for.

Form It 2658 E ≡ Fill Out Printable PDF Forms Online

Note a nonresident shareholder with tax less. This form is for income earned in tax year 2023, with tax returns due in april 2024. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for.

Fillable Form Ct2658E Certificate Of Exemption From Partnership

Note a nonresident shareholder with tax less. This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of.

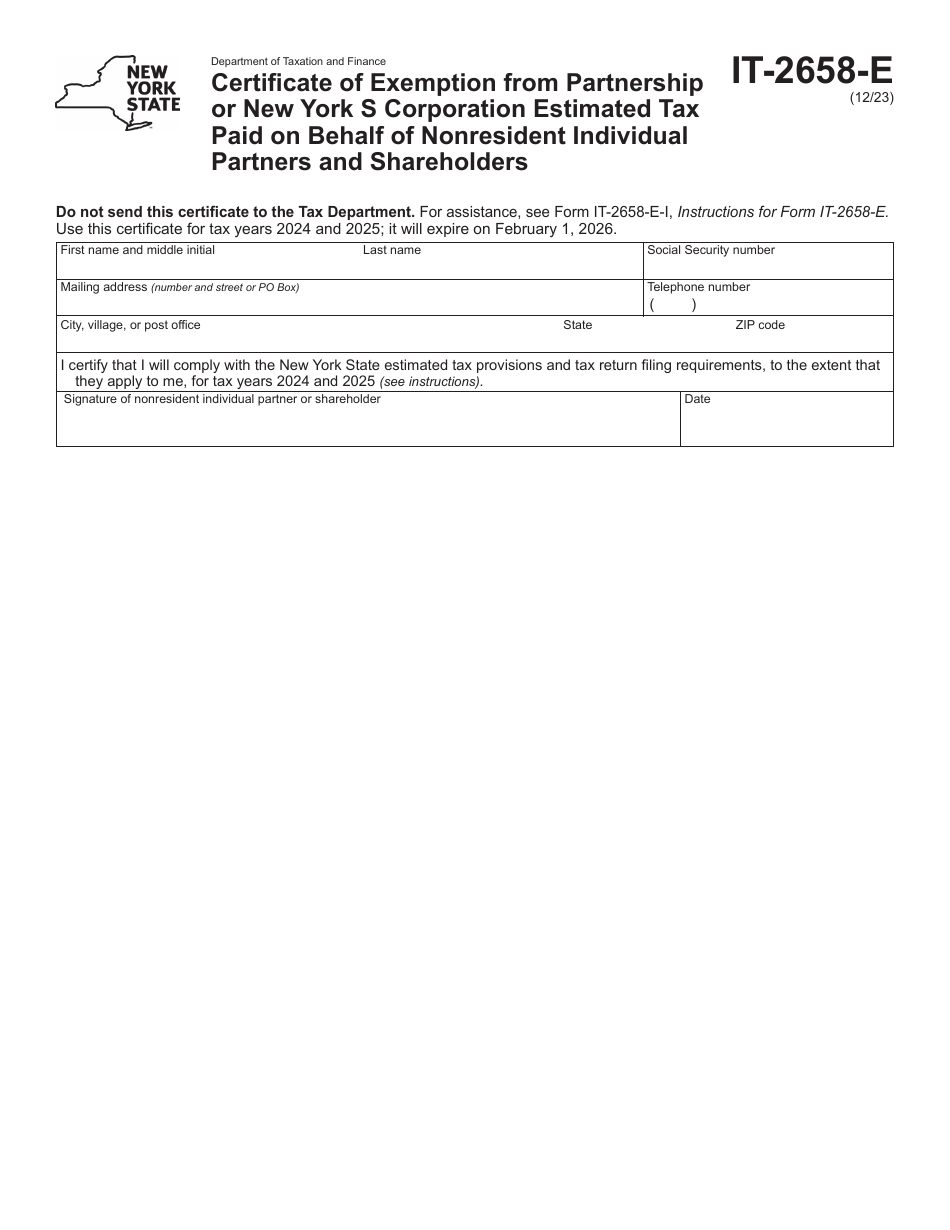

Form IT2658E 2025 Fill Out, Sign Online and Download Fillable PDF

We will update this page with a new version of the form for. Note a nonresident shareholder with tax less. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. This form is for income earned in tax year 2023, with tax returns due in april 2024.

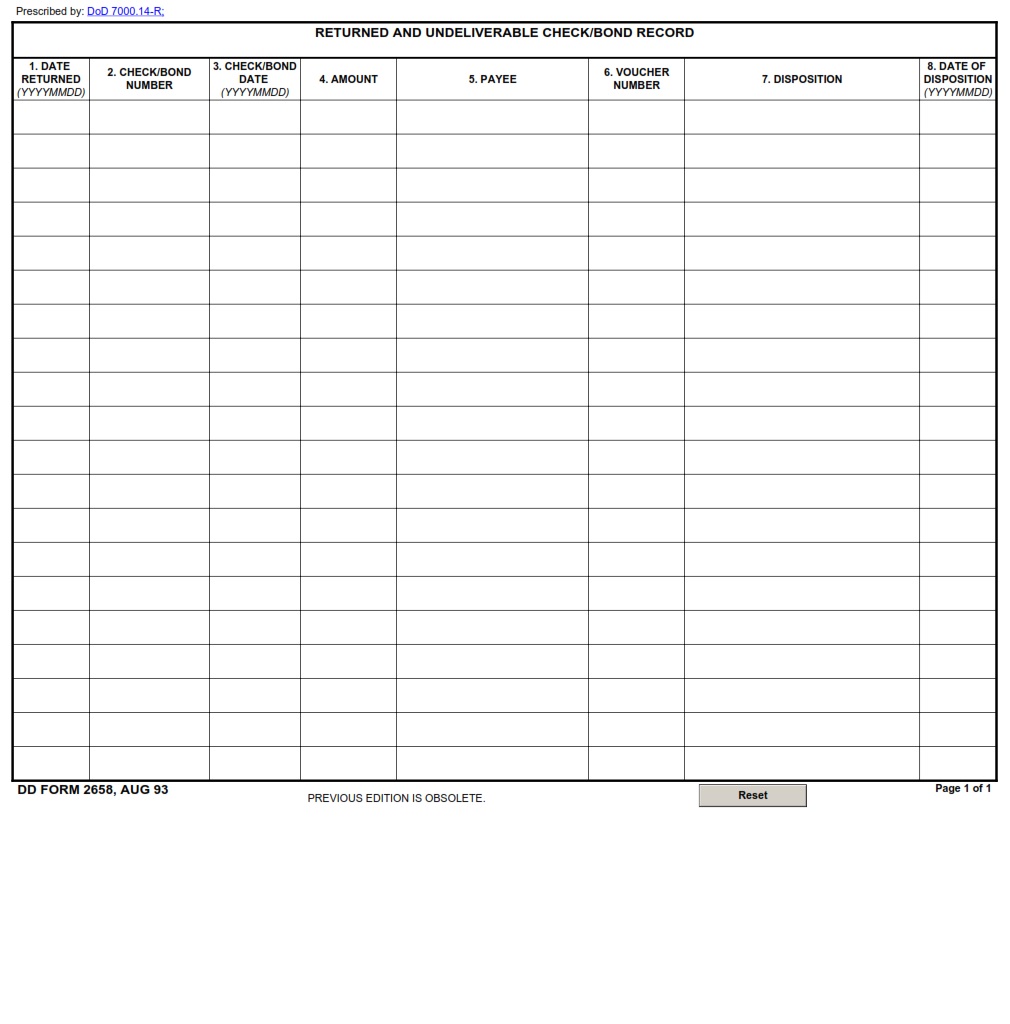

DD Form 2658 Returned and Undeliverable Check/Bond Record DD Forms

This form is for income earned in tax year 2023, with tax returns due in april 2024. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for. Note a nonresident shareholder with tax less.

Form It 2658 E ≡ Fill Out Printable PDF Forms Online

This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for. S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. Note a nonresident shareholder with tax less.

Form IT2658E Download Fillable PDF or Fill Online Certificate of

S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. This form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of the form for. Note a nonresident shareholder with tax less.

This Form Is For Income Earned In Tax Year 2023, With Tax Returns Due In April 2024.

S corporations and entities taxed as partnerships doing business in new york state are required to make estimated tax payments on behalf of. We will update this page with a new version of the form for. Note a nonresident shareholder with tax less.