Ga Form 8453

Ga Form 8453 - It may also be used by the georgia. Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. We last updated georgia form ga. When you are preparing your own return, you do not need to print and sign the 8453. Income not taxable to ga; Georgia corporate net worth tax; That is only for people.

Georgia corporate net worth tax; Income not taxable to ga; We last updated georgia form ga. That is only for people. Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. It may also be used by the georgia. When you are preparing your own return, you do not need to print and sign the 8453.

We last updated georgia form ga. That is only for people. It may also be used by the georgia. When you are preparing your own return, you do not need to print and sign the 8453. Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. Georgia corporate net worth tax; Income not taxable to ga;

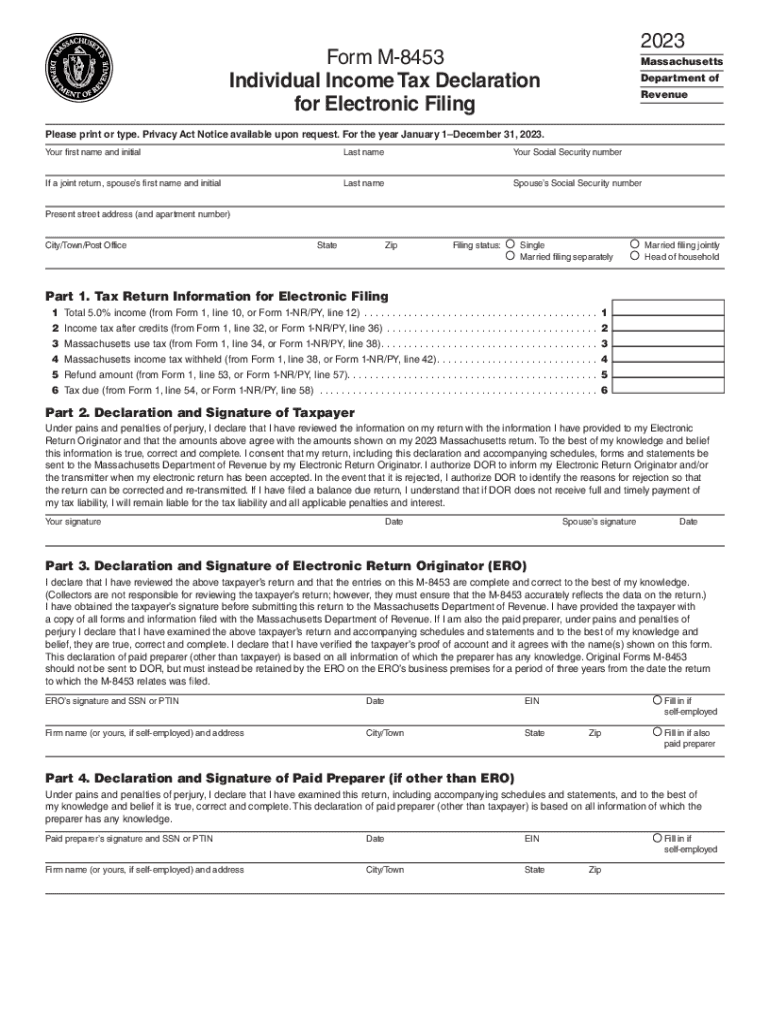

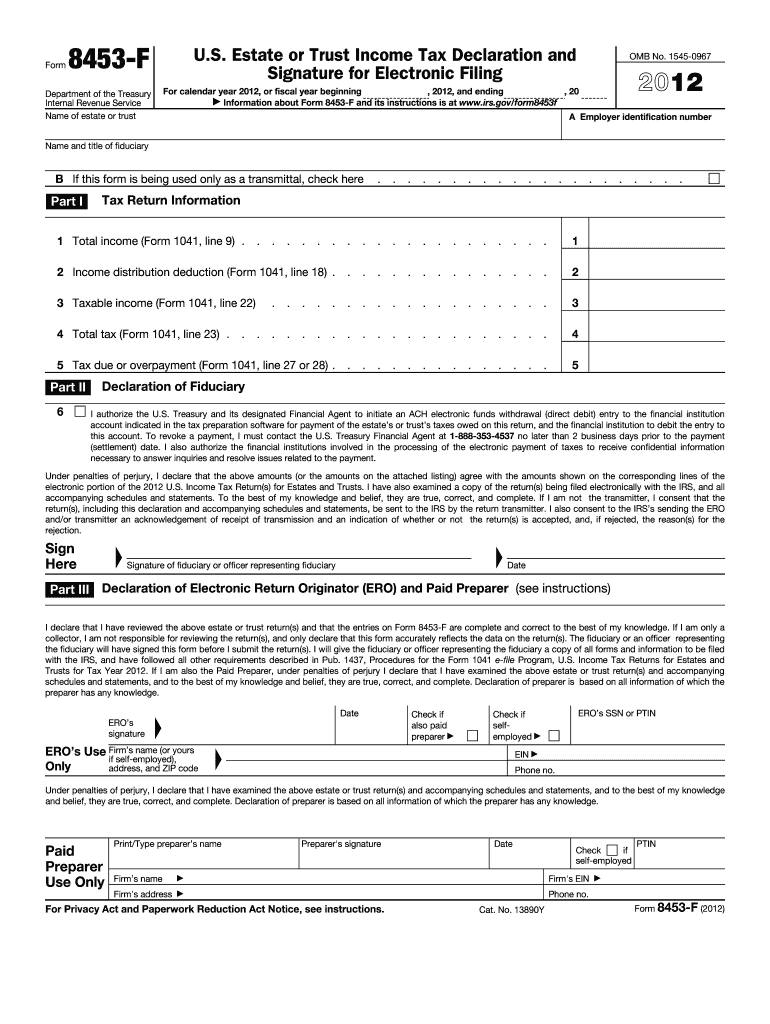

M 8453 Tax Filing Form Complete with ease airSlate SignNow

It may also be used by the georgia. When you are preparing your own return, you do not need to print and sign the 8453. That is only for people. Georgia corporate net worth tax; Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer.

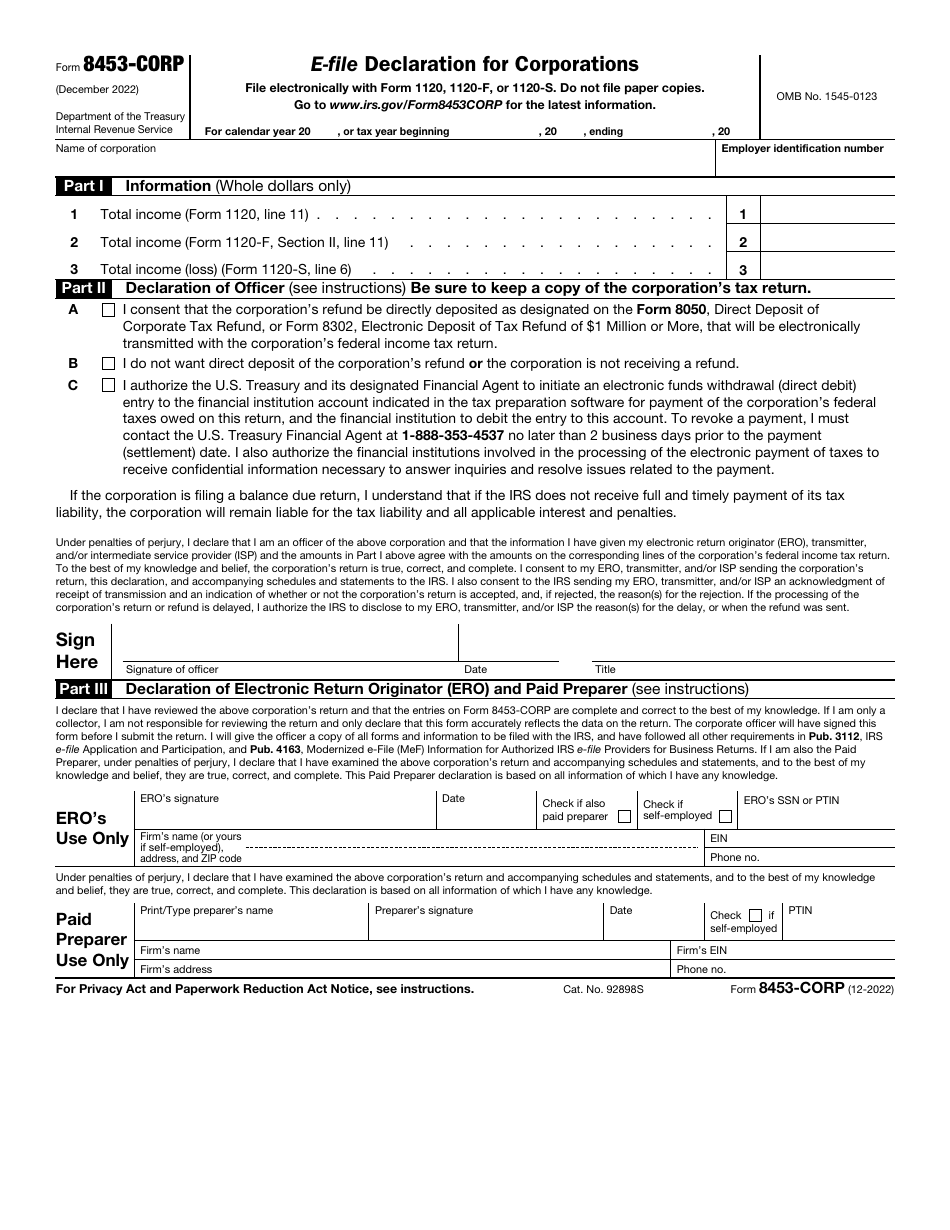

IRS Form 8453CORP Fill Out, Sign Online and Download Fillable PDF

Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. It may also be used by the georgia. Income not taxable to ga; That is only for people. Georgia corporate net worth tax;

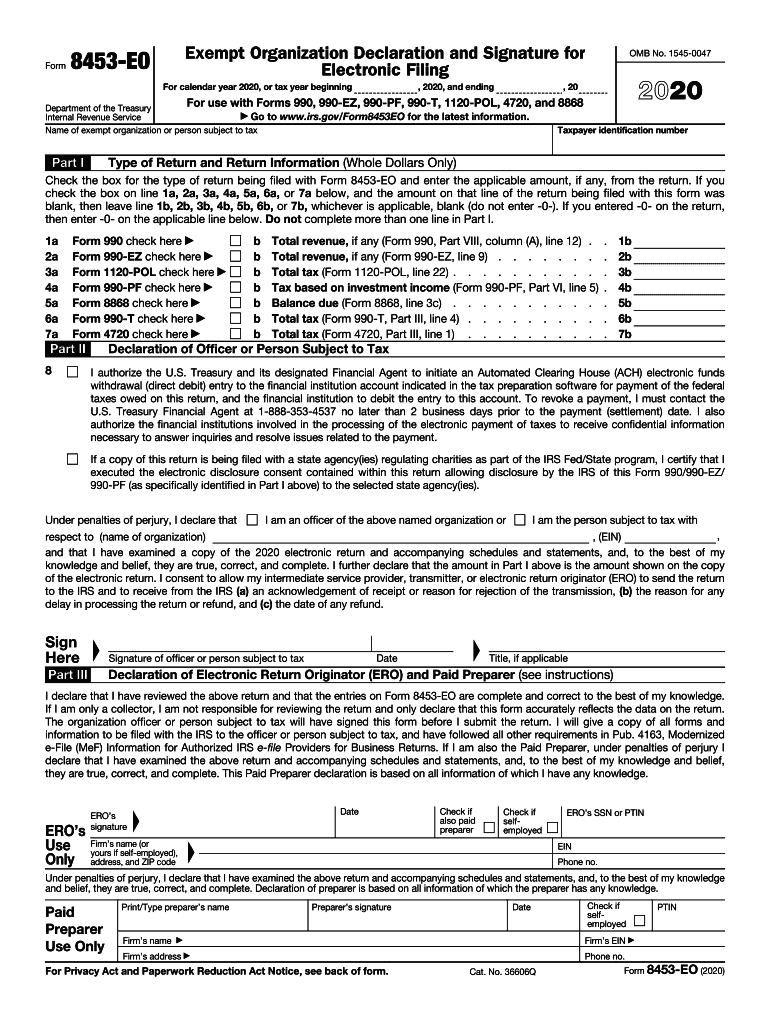

2003 Form IRS 8453S Fill Online, Printable, Fillable, Blank pdfFiller

That is only for people. Georgia corporate net worth tax; When you are preparing your own return, you do not need to print and sign the 8453. It may also be used by the georgia. Income not taxable to ga;

8453 20202024 Form Fill Out and Sign Printable PDF Template

Income not taxable to ga; Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. When you are preparing your own return, you do not need to print and sign the 8453. That is only for people. Georgia corporate net worth tax;

8453 pe Fill out & sign online DocHub

Income not taxable to ga; It may also be used by the georgia. Georgia corporate net worth tax; We last updated georgia form ga. When you are preparing your own return, you do not need to print and sign the 8453.

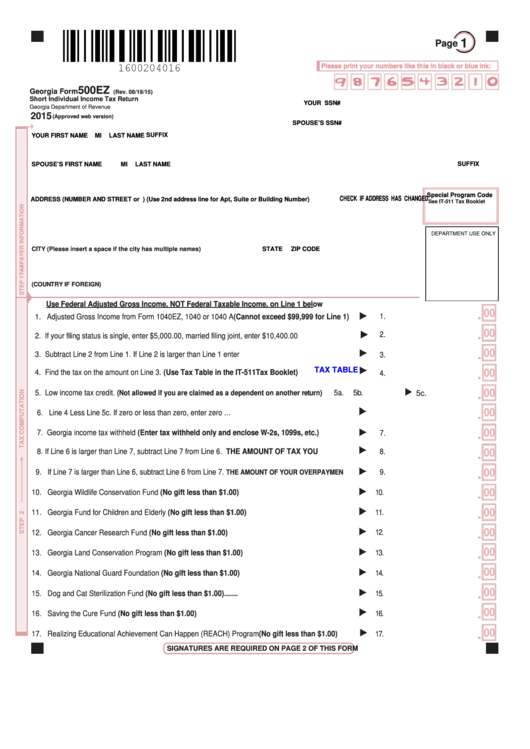

Printable Ga Tax Forms Printable Forms Free Online

It may also be used by the georgia. Income not taxable to ga; That is only for people. We last updated georgia form ga. When you are preparing your own return, you do not need to print and sign the 8453.

2012 Form IRS 8453FE Fill Online, Printable, Fillable, Blank pdfFiller

Georgia corporate net worth tax; It may also be used by the georgia. Income not taxable to ga; We last updated georgia form ga. Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer.

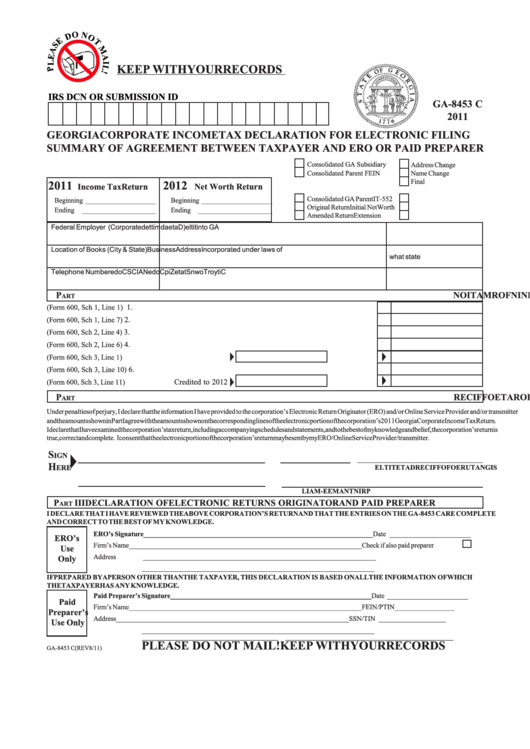

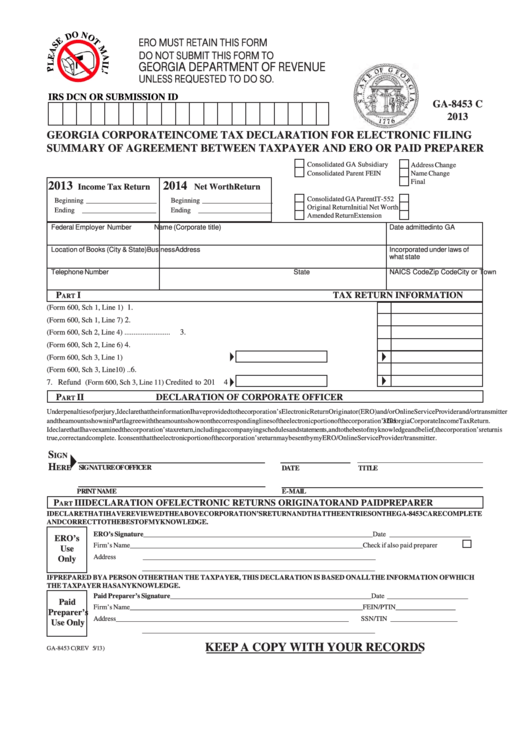

Form Ga8453 C Corporate Tax Declaration For Electronic

Georgia corporate net worth tax; We last updated georgia form ga. That is only for people. When you are preparing your own return, you do not need to print and sign the 8453. Income not taxable to ga;

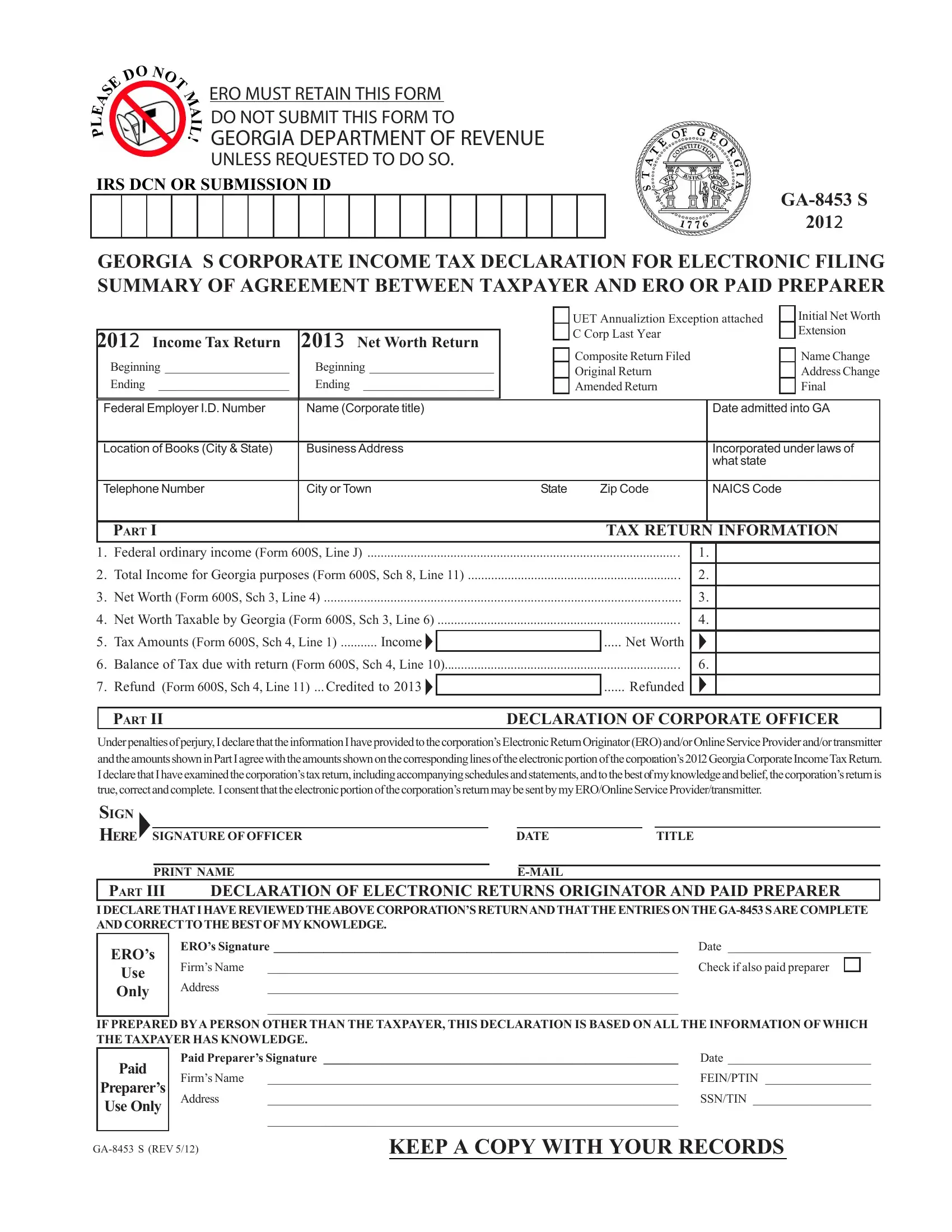

Form Ga 8453 S ≡ Fill Out Printable PDF Forms Online

When you are preparing your own return, you do not need to print and sign the 8453. That is only for people. Income not taxable to ga; Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. Georgia corporate net worth tax;

Fillable Form Ga8453 C Corporate Tax Declaration For

Income not taxable to ga; Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. When you are preparing your own return, you do not need to print and sign the 8453. That is only for people. We last updated georgia form ga.

We Last Updated Georgia Form Ga.

Income not taxable to ga; Georgia corporate net worth tax; Georgia partnership tax return declaration for electronic filing summary of agreement between taxpayer and ero or paid preparer. When you are preparing your own return, you do not need to print and sign the 8453.

It May Also Be Used By The Georgia.

That is only for people.