Georgia Tax Liens

Georgia Tax Liens - Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name.

The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Search the georgia consolidated lien indexes alphabetically by name. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to.

The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name.

tax liens in list Quite A State Binnacle Image Library

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Effective february 20, 2018, house bill 661 of 2018 (hb.

Tax Preparation Business Startup

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. Search the georgia consolidated lien indexes alphabetically.

Ketra's Tax Services Powered by Minority Tax Pros Fayetteville GA

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name. Effective.

Tax Residency Открыть ИП в Грузии Company

The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Effective february 20, 2018, house bill 661 of 2018 (hb 661).

Property Tax Liens Breyer Home Buyers

Search the georgia consolidated lien indexes alphabetically by name. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens stay in place until.

tax liens in list Quite A State Binnacle Image Library

Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law.

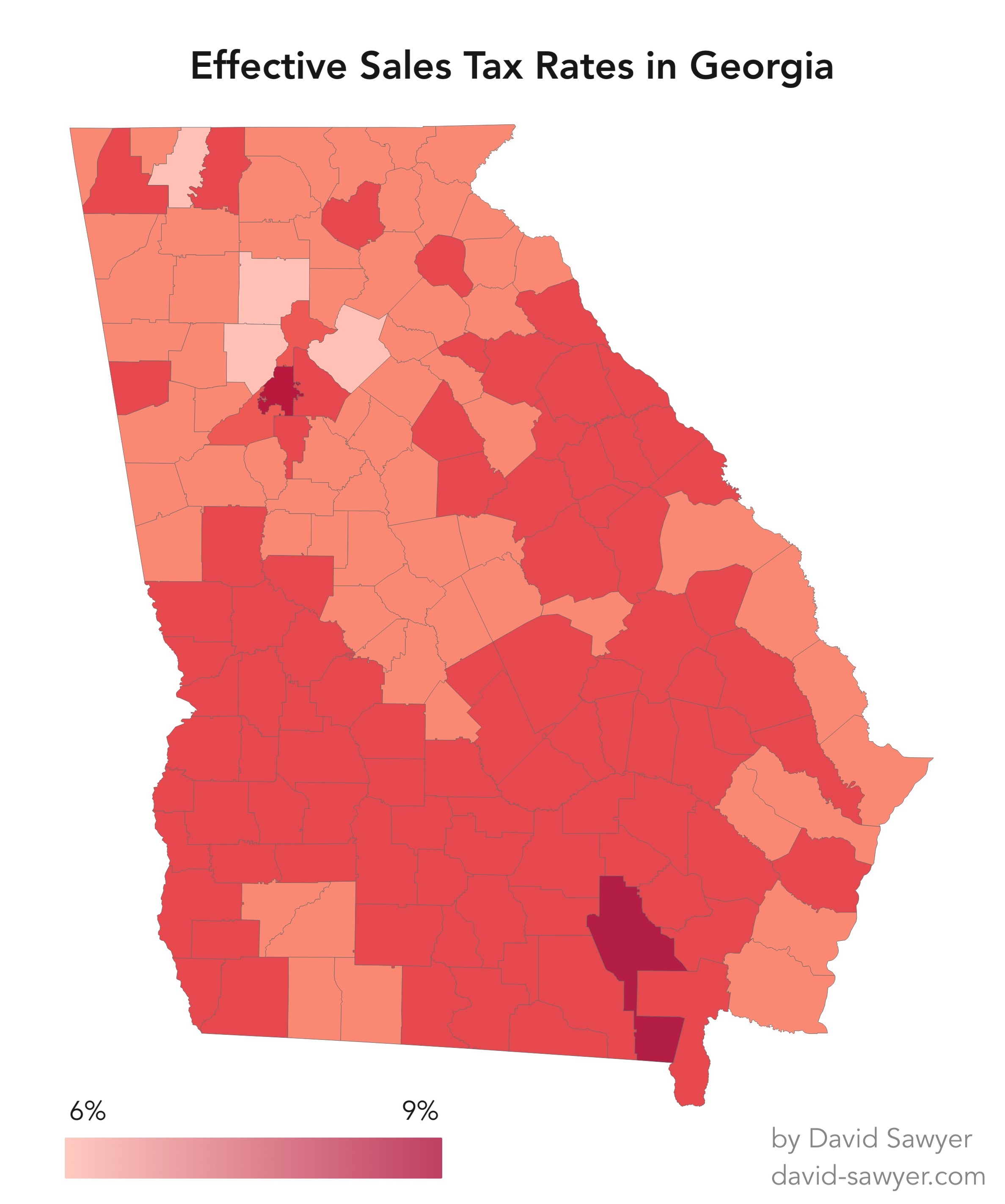

Data Visualization Effective Sales Tax Rates in David Sawyer

In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. Search the georgia consolidated lien indexes alphabetically by name. Effective.

Taxes Economy, Finance, Business Tax Rates, Tax updates

Search the georgia consolidated lien indexes alphabetically by name. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. In georgia, tax liens stay.

buying tax liens in Bobbie Stackhouse

Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Search the georgia consolidated lien indexes alphabetically by name. In georgia, tax liens stay.

TAX Consultancy Firm Gurugram

Search the georgia consolidated lien indexes alphabetically by name. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. Find state tax liens and related documents submitted by the georgia department of revenue for filing by a clerk of superior court. In georgia, tax liens stay in place until.

Find State Tax Liens And Related Documents Submitted By The Georgia Department Of Revenue For Filing By A Clerk Of Superior Court.

Effective february 20, 2018, house bill 661 of 2018 (hb 661) amends specific sections of georgia law that were put into place january 1, 2018. The georgia department of revenue (gador) can file a state tax lien to protect its interest in collecting delinquent tax debt. In georgia, tax liens stay in place until they expire, or you pay your tax debt in full, but in some cases, you can convince the dor to. Search the georgia consolidated lien indexes alphabetically by name.