Hawaii Tax Form N 342

Hawaii Tax Form N 342 - This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d.

What is Hawaii’s general excise tax? Grassroot Institute of Hawaii

2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d.

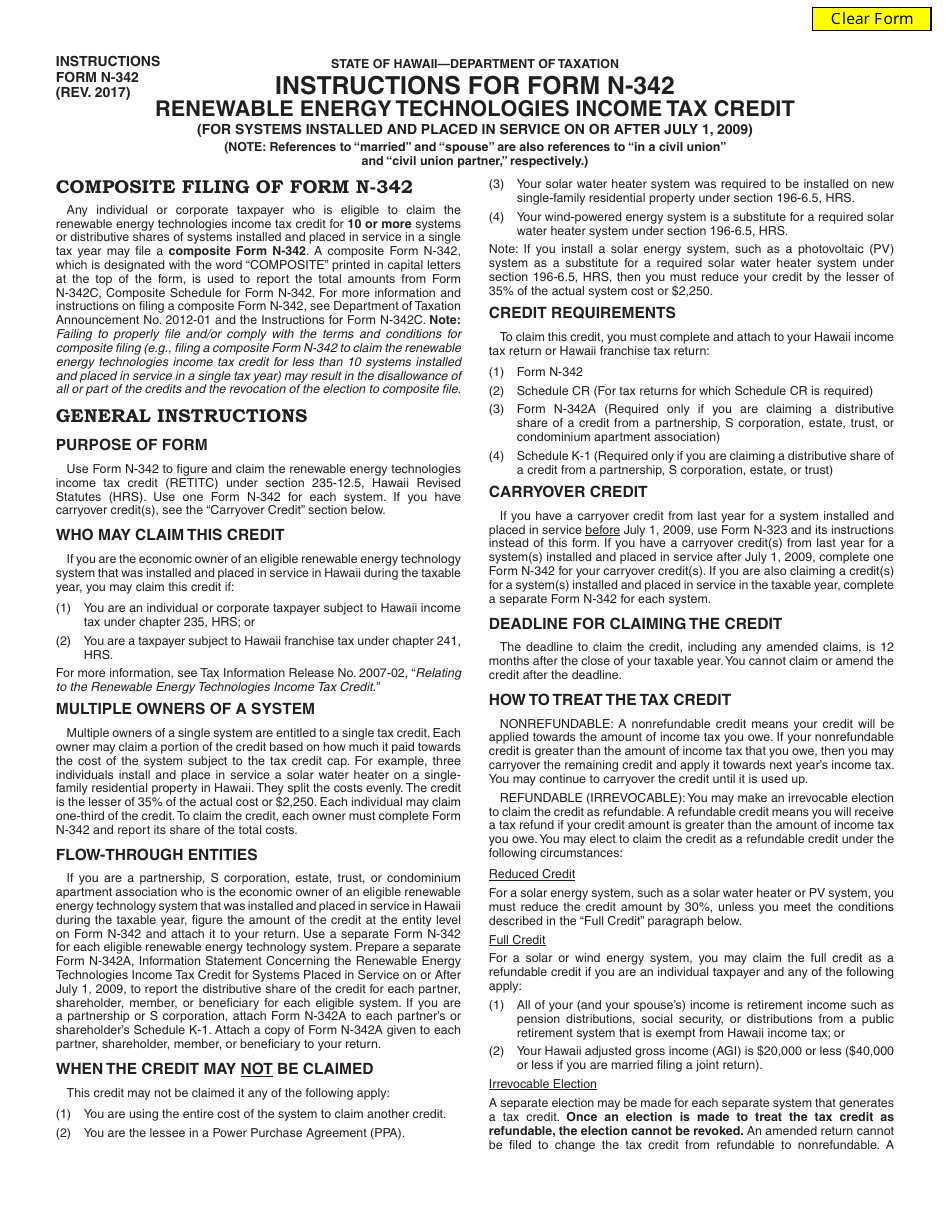

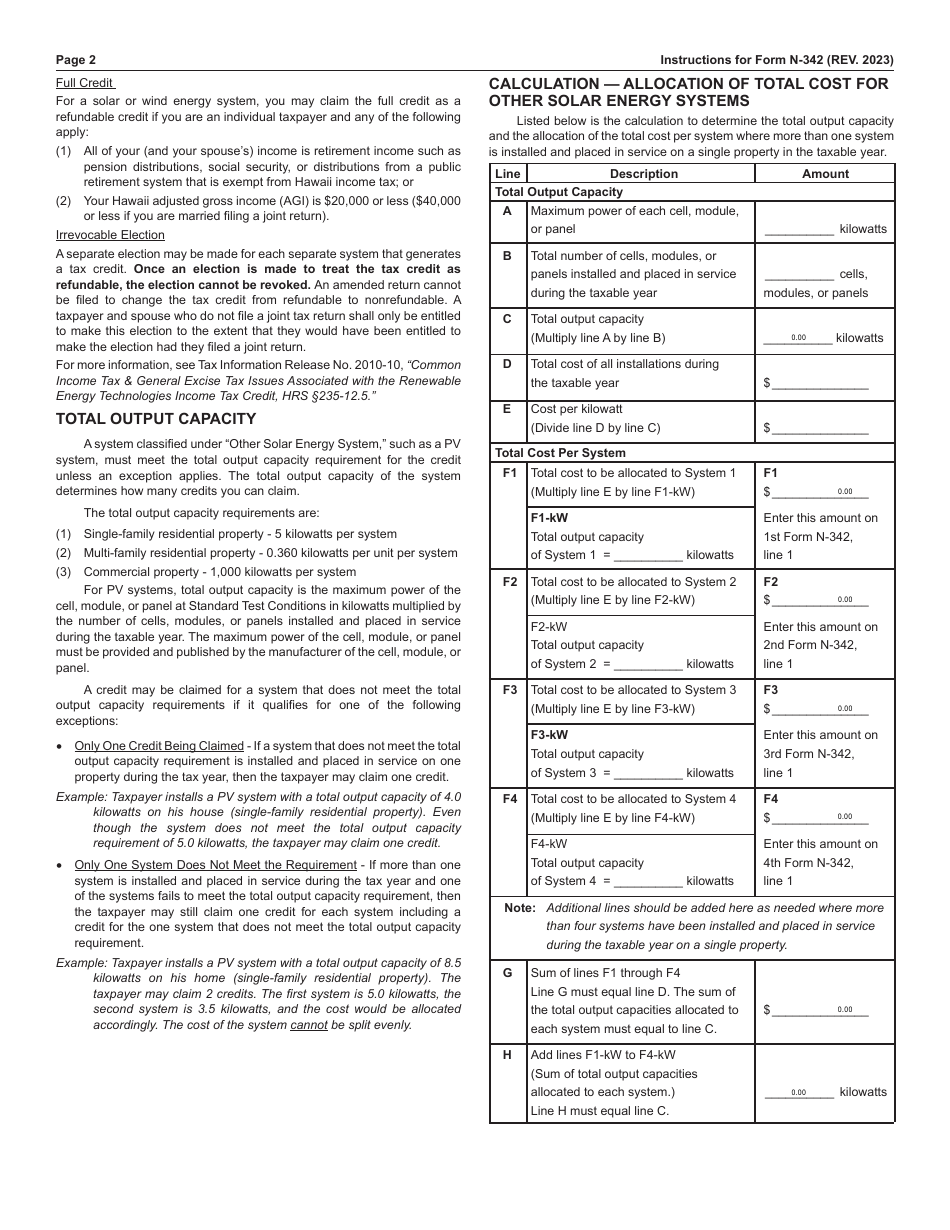

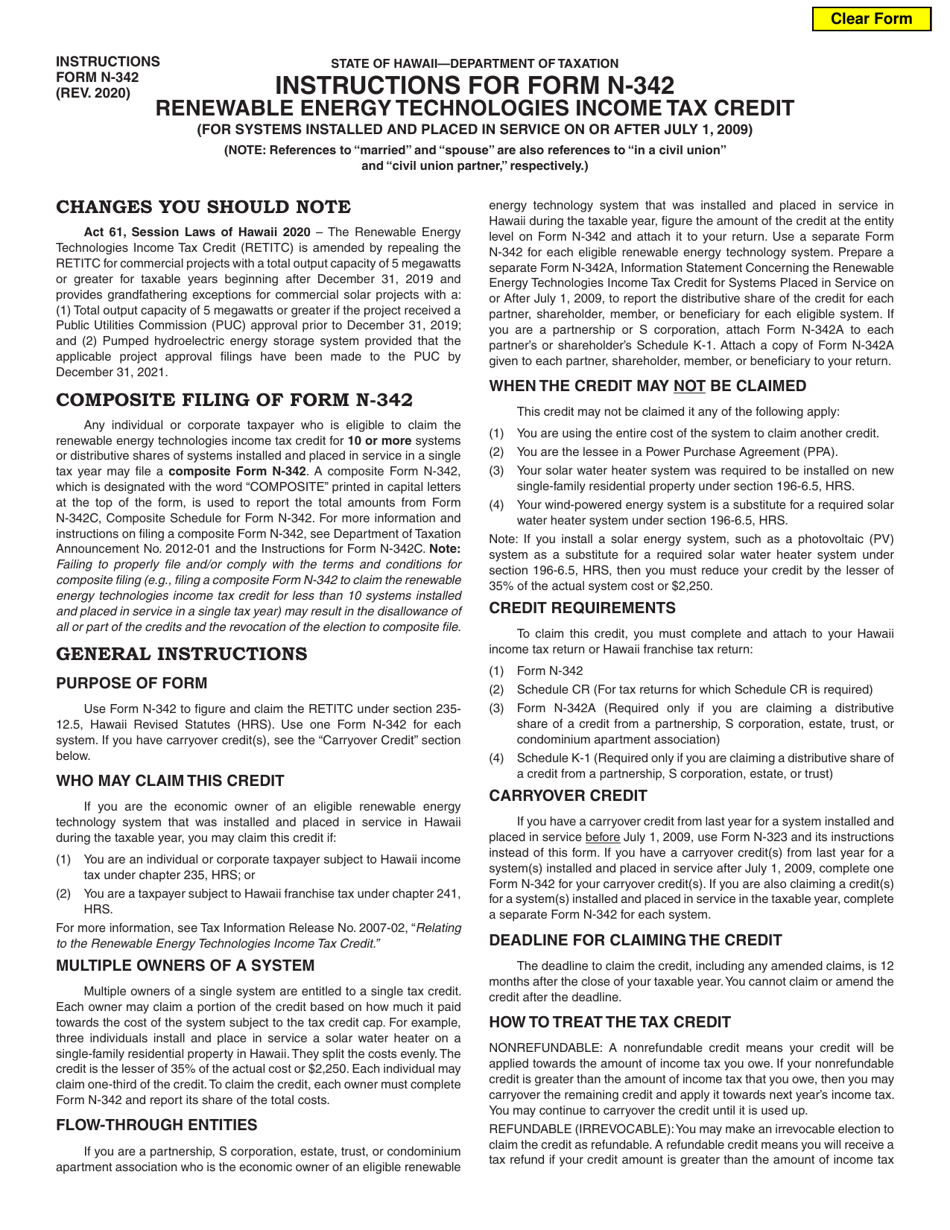

Download Instructions for Form N342 Renewable Energy Technologies

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.

Hawaii Form N 11 Fillable Printable Forms Free Online

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

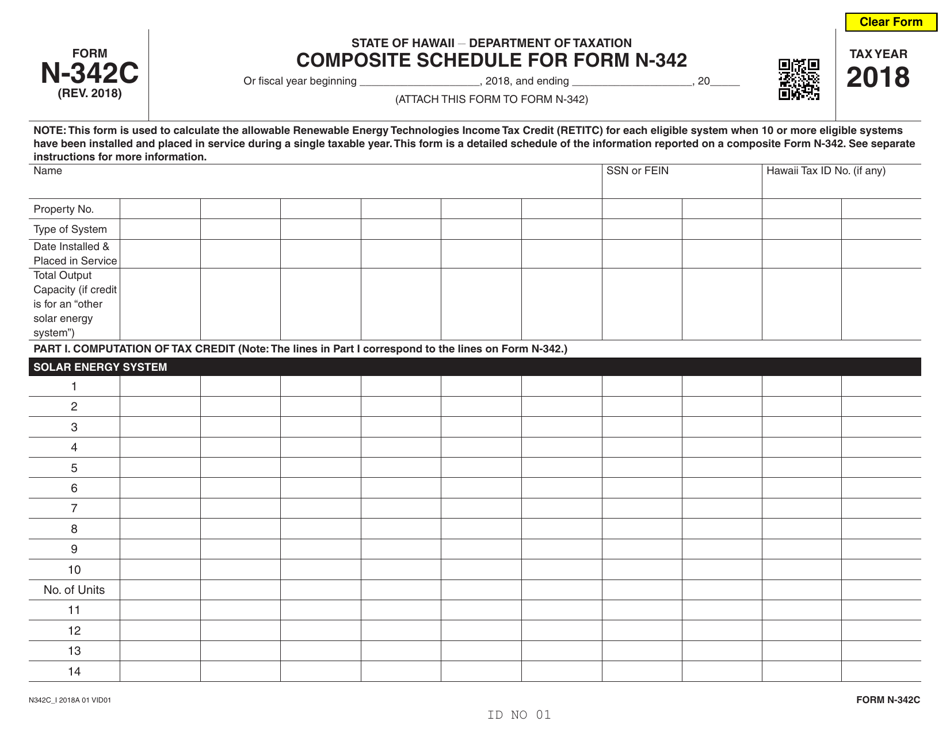

Form N342C Download Fillable PDF or Fill Online Composite Schedule for

Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on.

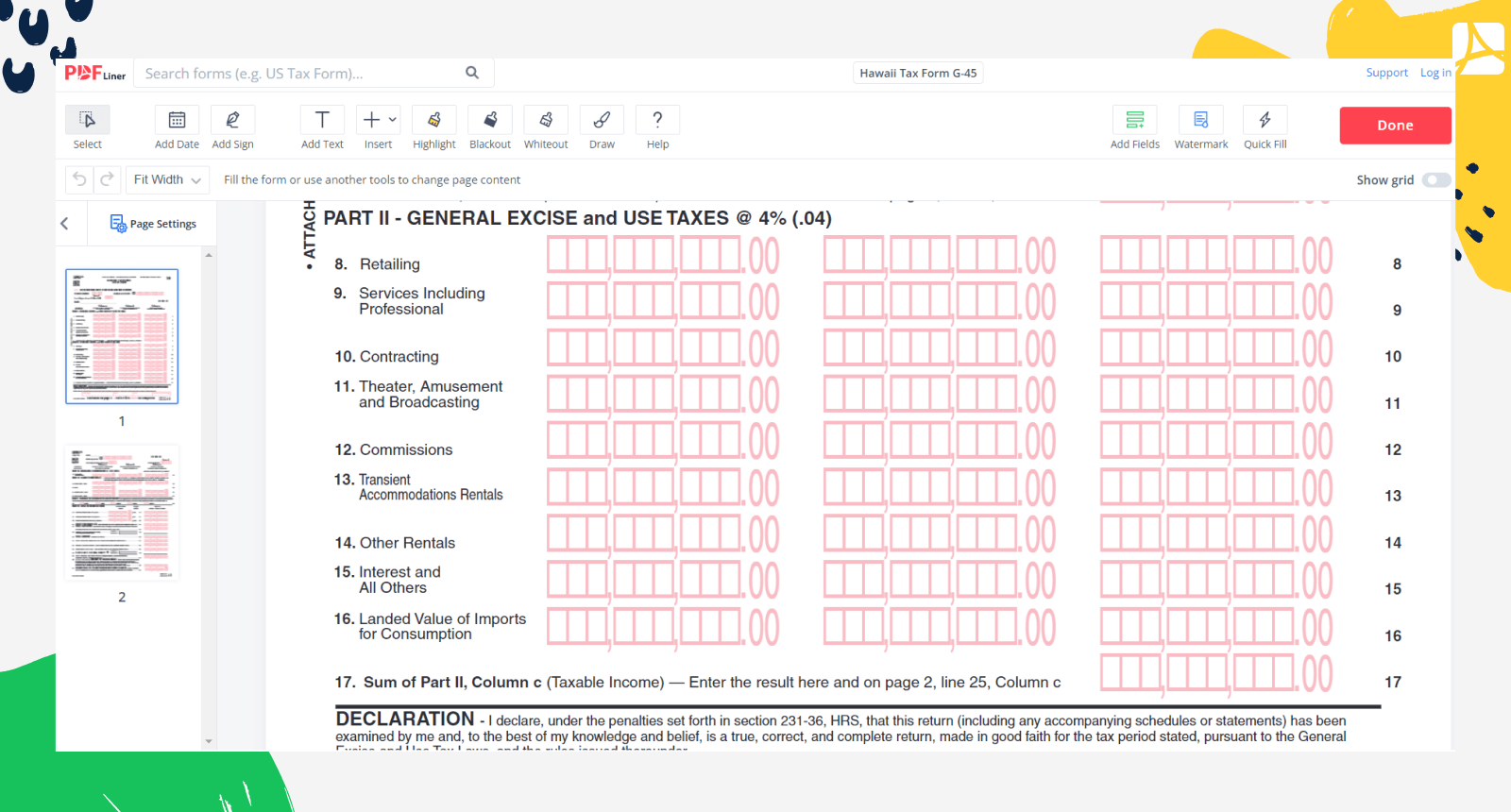

Fillable G 45 Form For Apple Computer Printable Forms Free Online

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

Download Instructions for Form N342 Renewable Energy Technologies

2023 form for taxable periods beginning on or after january 1, 2024. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d.

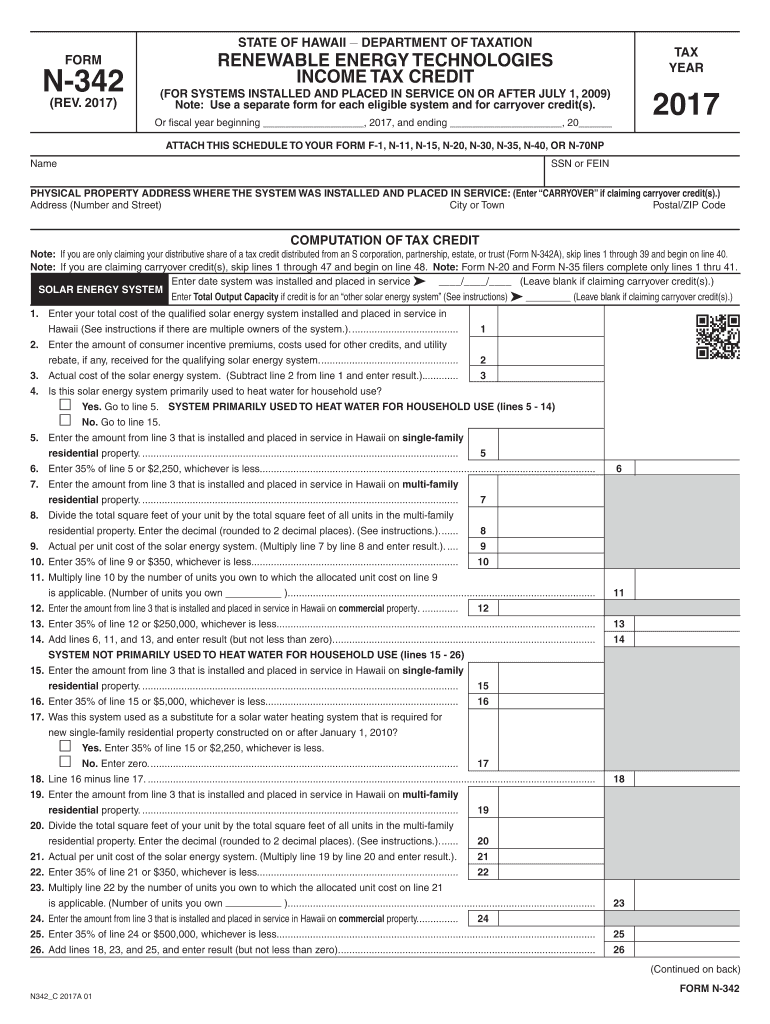

Hawaii State Tax S N342 20172024 Form Fill Out and Sign Printable

Fillable form generates a taxpayer specific 2d. This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024.

Download Instructions for Form N342 Renewable Energy Technologies

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d.

Hawaii Form N 11 ≡ Fill Out Printable PDF Forms Online

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.

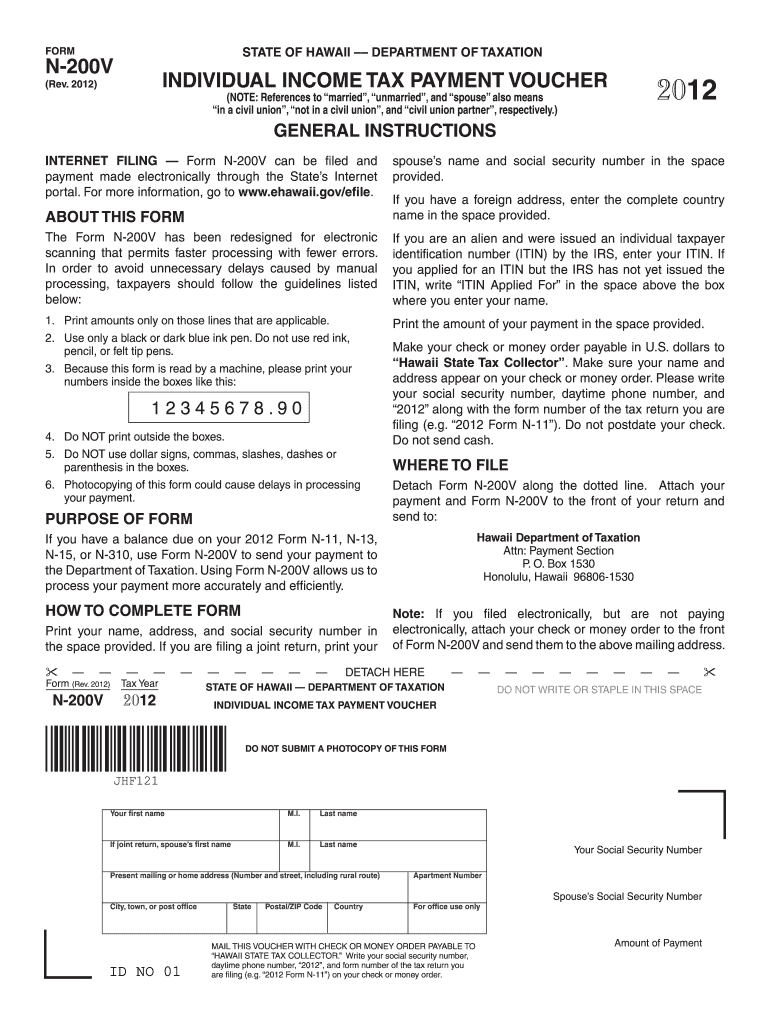

Form N200V, Rev. 2012, Individual Tax Hawaii.gov state

This is the official form for claiming the renewable energy technologies income tax credit in hawaii for systems installed and placed in service on. 2023 form for taxable periods beginning on or after january 1, 2024. Fillable form generates a taxpayer specific 2d.

This Is The Official Form For Claiming The Renewable Energy Technologies Income Tax Credit In Hawaii For Systems Installed And Placed In Service On.

Fillable form generates a taxpayer specific 2d. 2023 form for taxable periods beginning on or after january 1, 2024.