How Do I Get My 401K Tax Form

How Do I Get My 401K Tax Form - Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue.

Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k). Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue.

Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue.

What Is a 401(k) and How Does It Work? (2022)

Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue.

solo 401k contribution limits and types

Tips on how to find, fix and avoid common errors in 401 (k). Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Helps you keep your 401 (k) plan in compliance with important tax rules.

How To Withdraw 401k After Retirement PELAJARAN

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k).

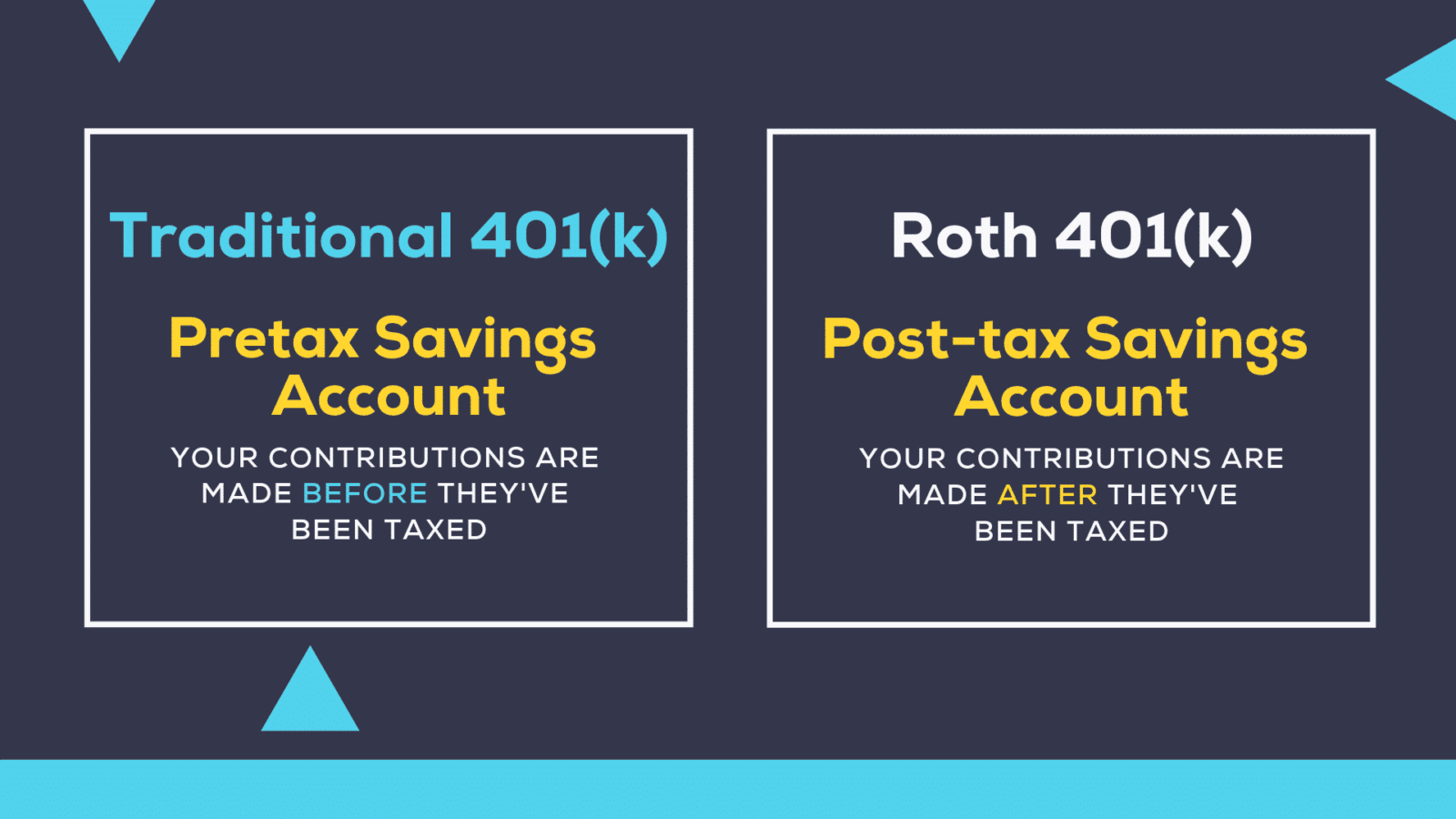

Pre Tax vs After Tax 401k Roth or Traditional Investdale

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k).

When can I get my 401k without paying taxes? Retirement News Daily

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k).

How to set up your Fidelity 401k full step by step YouTube

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k).

401k Highly Compensated Employee 2024 Siana Dorothea

Tips on how to find, fix and avoid common errors in 401 (k). Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Helps you keep your 401 (k) plan in compliance with important tax rules.

Do I Get A Tax Statement For 401k Tax Walls

Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k). Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue.

401(K) Cash Distributions Understanding The Taxes & Penalties

Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules.

What to do if you have to take an early withdrawal from your Solo 401k

Helps you keep your 401 (k) plan in compliance with important tax rules. Luckily, you typically don’t need to report your 401 (k) contributions, 401 (k) or ira balances, or even investment returns to the internal revenue. Tips on how to find, fix and avoid common errors in 401 (k).

Luckily, You Typically Don’t Need To Report Your 401 (K) Contributions, 401 (K) Or Ira Balances, Or Even Investment Returns To The Internal Revenue.

Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k).

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)