How Do Tax Liens Work In Arizona

How Do Tax Liens Work In Arizona - At the public auction conducted each february. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. First, to obtain ownership of a property through foreclosing the lien; Arizona revised statutes are central to understanding how these priorities work with tax liens. Tax liens take precedence over. The tax lien sale provides for the payment of delinquent property taxes by an bidder. People buy tax liens for two. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). How does someone acquire a tax lien? Or second, to obtain a.

The tax on the property is auctioned in open competitive. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Or second, to obtain a. At the public auction conducted each february. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. How does someone acquire a tax lien? The online auction is held by real auction on. Tax liens are generally purchased for two reasons: Tax liens take precedence over. Arizona revised statutes are central to understanding how these priorities work with tax liens.

How does someone acquire a tax lien? Tax liens are generally purchased for two reasons: First, to obtain ownership of a property through foreclosing the lien; Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. The tax lien sale provides for the payment of delinquent property taxes by an bidder. The tax on the property is auctioned in open competitive. At the public auction conducted each february. People buy tax liens for two. In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s).

Tax Liens An Overview CheckBook IRA LLC

At the public auction conducted each february. People buy tax liens for two. The tax on the property is auctioned in open competitive. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. The online auction is held by real auction on.

Tax liens arizona Fill out & sign online DocHub

How does someone acquire a tax lien? Tax liens take precedence over. The tax lien sale provides for the payment of delinquent property taxes by an bidder. Or second, to obtain a. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s).

Understanding Property Tax Liens in Arizona

The tax lien sale provides for the payment of delinquent property taxes by an bidder. Or second, to obtain a. The tax on the property is auctioned in open competitive. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Tax liens are generally purchased for two reasons:

How Do Tax Liens Work in Canada? Consolidated Credit Canada

Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Or second, to obtain a. Arizona revised statutes are central to understanding how these priorities work with tax liens. The online auction is held by real auction on. At the public auction conducted each february.

Arizona Tax Liens Primer Foreclosure Tax Lien

People buy tax liens for two. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Tax liens take precedence over. The online auction is held by real auction on. Tax liens are generally purchased for two reasons:

Do Tax Liens Expire? Levy & Associates

Or second, to obtain a. People buy tax liens for two. How does someone acquire a tax lien? At the public auction conducted each february. The online auction is held by real auction on.

Can Bankruptcy Stop Tax Liens in Arizona? Tax Lien Bankruptcy Arizona

In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. The online auction is held by real auction on. Tax liens take precedence over. The tax lien sale provides for the payment of delinquent property taxes by an bidder. Or second, to obtain a.

How Do Tax Liens and Levies Work?

Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government. Tax liens take precedence over. Arizona revised statutes are central to understanding how these priorities work with tax liens. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release.

Tax Liens Making it Work! CheckBook IRA LLC

In arizona, if property taxes are not paid, the county treasurer will sell the delinquent lien at public auction. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Tax liens are generally purchased for two reasons: The tax on the property is auctioned in.

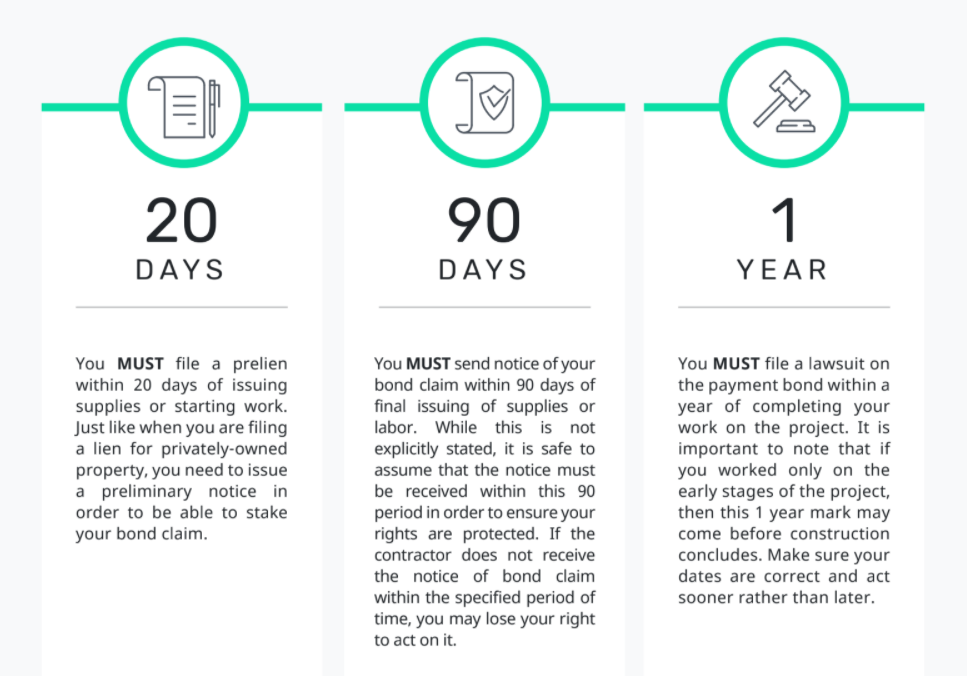

Arizona Mechanic’s Liens Everything You Need to Know Titan Lien

At the public auction conducted each february. Or second, to obtain a. First, to obtain ownership of a property through foreclosing the lien; People buy tax liens for two. Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government.

Tax Liens Take Precedence Over.

Arizona revised statutes are central to understanding how these priorities work with tax liens. Or second, to obtain a. Upon receipt of a cashier’s check or certified funds, the department of revenue will immediately provide a notice of intent to release state tax lien(s). Tax liens are a “hold” against your member’s property, superior to all liens except those held by the government.

In Arizona, If Property Taxes Are Not Paid, The County Treasurer Will Sell The Delinquent Lien At Public Auction.

At the public auction conducted each february. Tax liens are generally purchased for two reasons: The online auction is held by real auction on. How does someone acquire a tax lien?

The Tax Lien Sale Provides For The Payment Of Delinquent Property Taxes By An Bidder.

First, to obtain ownership of a property through foreclosing the lien; People buy tax liens for two. The tax on the property is auctioned in open competitive.