How To Calculate State And Local Income Tax Deduction

How To Calculate State And Local Income Tax Deduction - The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. Enter the state and local.

The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. Enter the state and local.

Enter the state and local. The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes.

TAX DEDUCTION 202324 Financesjungle

The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. Enter the state and local. The salt deduction allows taxpayers who itemize their deductions to reduce.

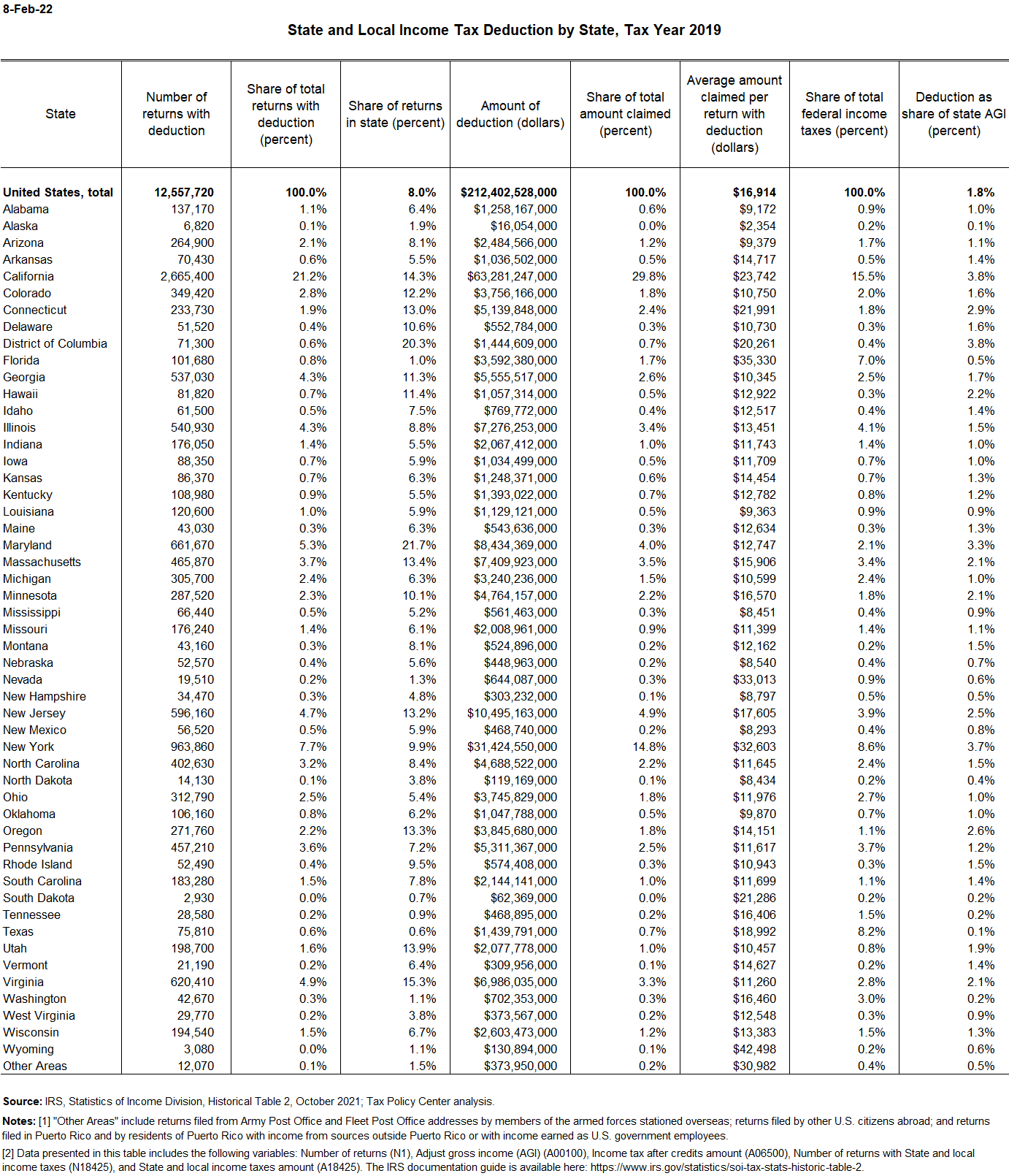

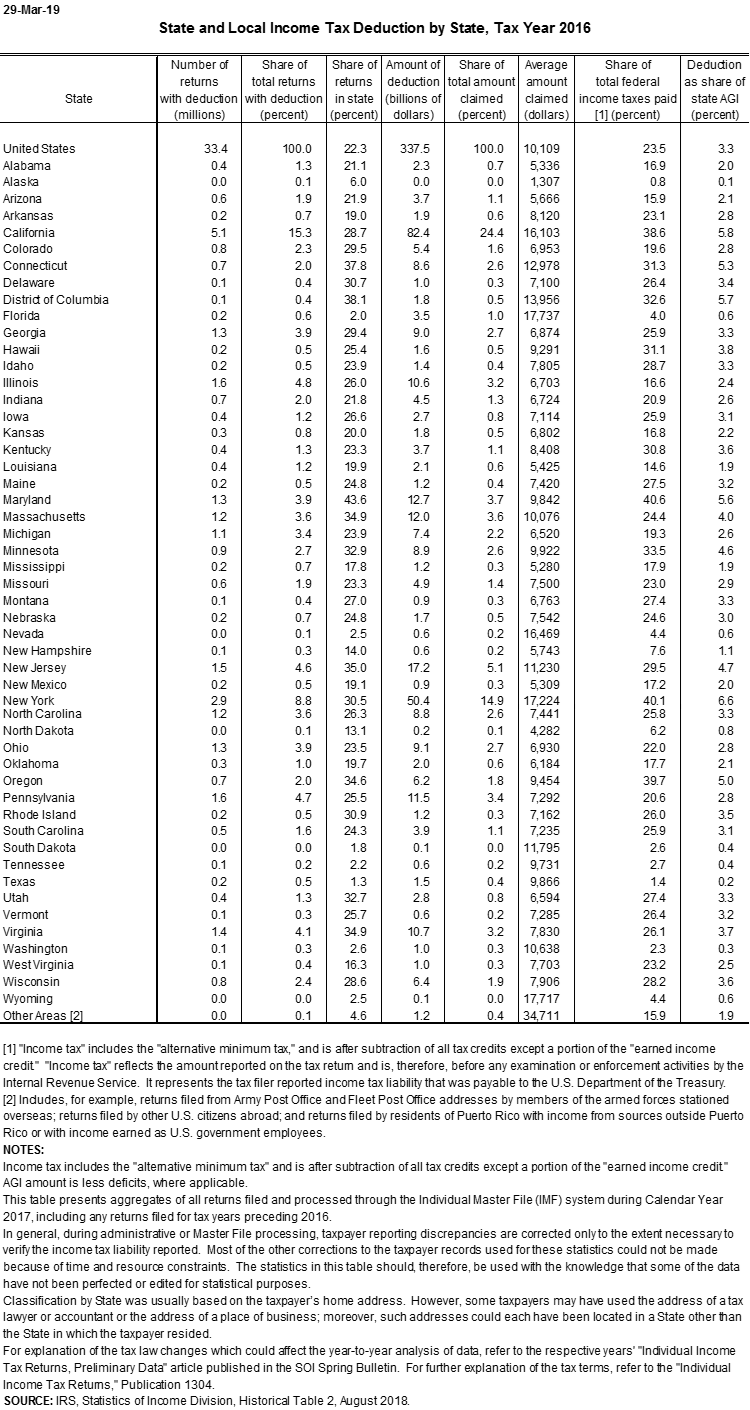

State and Local Tax Deduction by State Tax Policy Center

The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax.

State and Local Tax Deduction By State and AGI Tax Policy Center

Enter the state and local. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The salt (state and local tax) deduction allows taxpayers to.

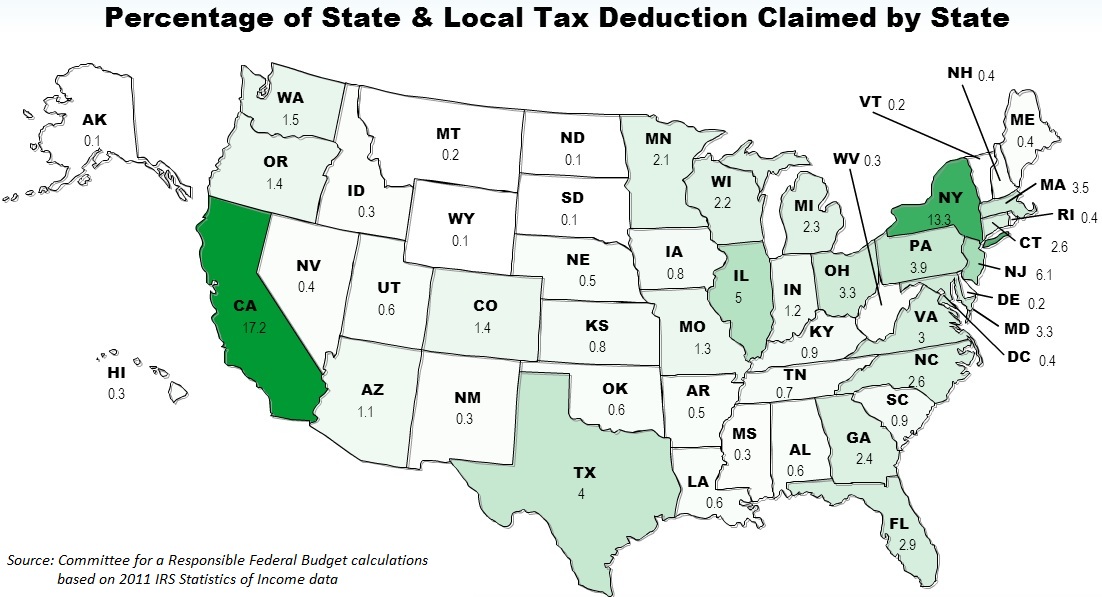

The State and Local Tax Deduction on Federal Taxes

The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax.

State and Local Tax Deduction by State Tax Policy Center

The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. Enter the state and local. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The sales tax deduction calculator helps you figure the amount of state.

Standard Deduction in Tax (With Examples) InstaFiling

Enter the state and local. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The sales tax deduction calculator helps you figure the amount of state.

The Tax BreakDown The State and Local Tax Deduction Committee for a

The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax.

State and Local Tax Deduction By State and AGI Tax Policy Center

The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. Enter the state and local. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The salt (state and local tax) deduction allows taxpayers to.

How Does the State and Local Tax Deduction Work? Ramsey

Enter the state and local. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income. The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state.

The State and Local Tax Deduction A Primer Tax Foundation

The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The sales tax deduction calculator helps you figure the amount of state and local general sales tax you can claim when you itemize. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local.

The Sales Tax Deduction Calculator Helps You Figure The Amount Of State And Local General Sales Tax You Can Claim When You Itemize.

The salt deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. Enter the state and local. The salt (state and local tax) deduction allows taxpayers to deduct certain state and local taxes from their federal taxable income.

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)