How To File Form 990 N

How To File Form 990 N - Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

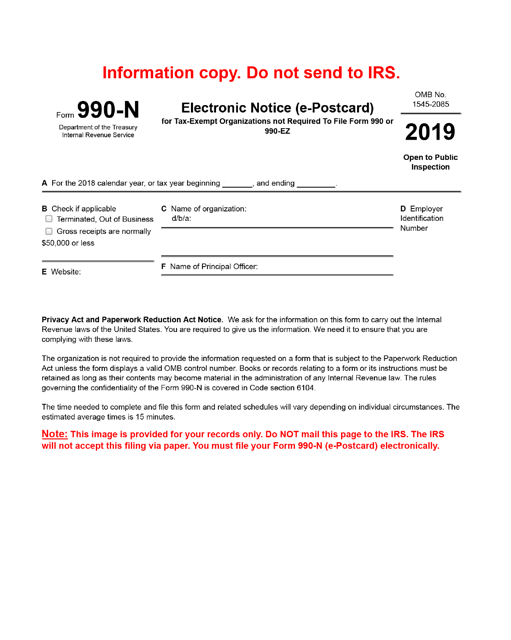

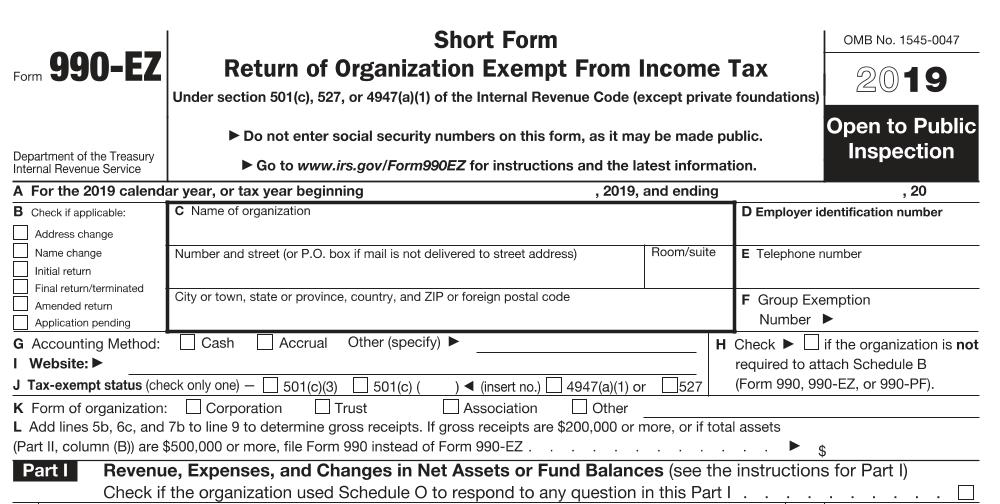

Form 990 Instructions 2024 Gayla Johanna

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

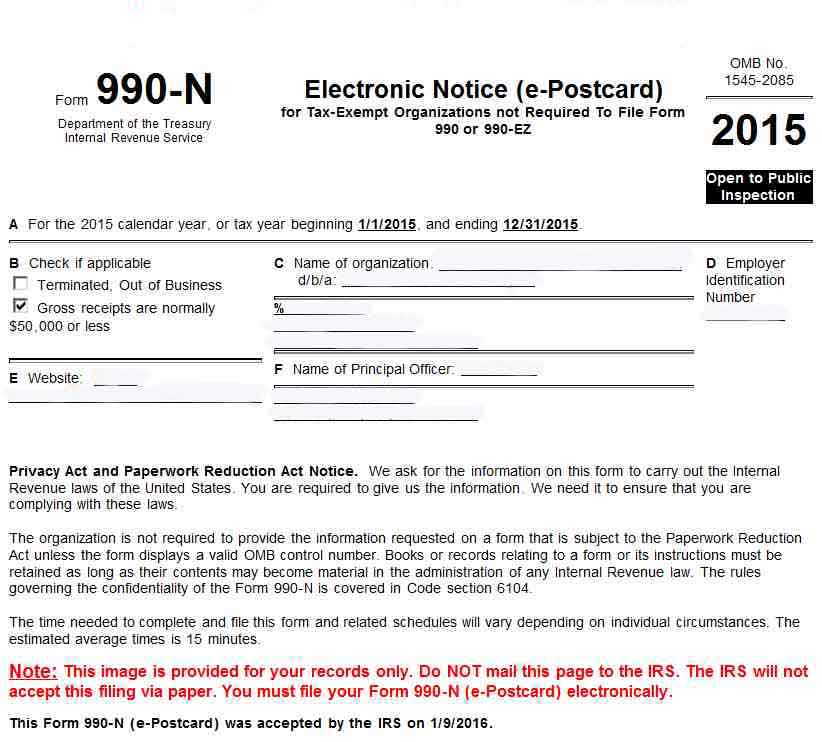

Form 990N EPostcard informacionpublica.svet.gob.gt

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

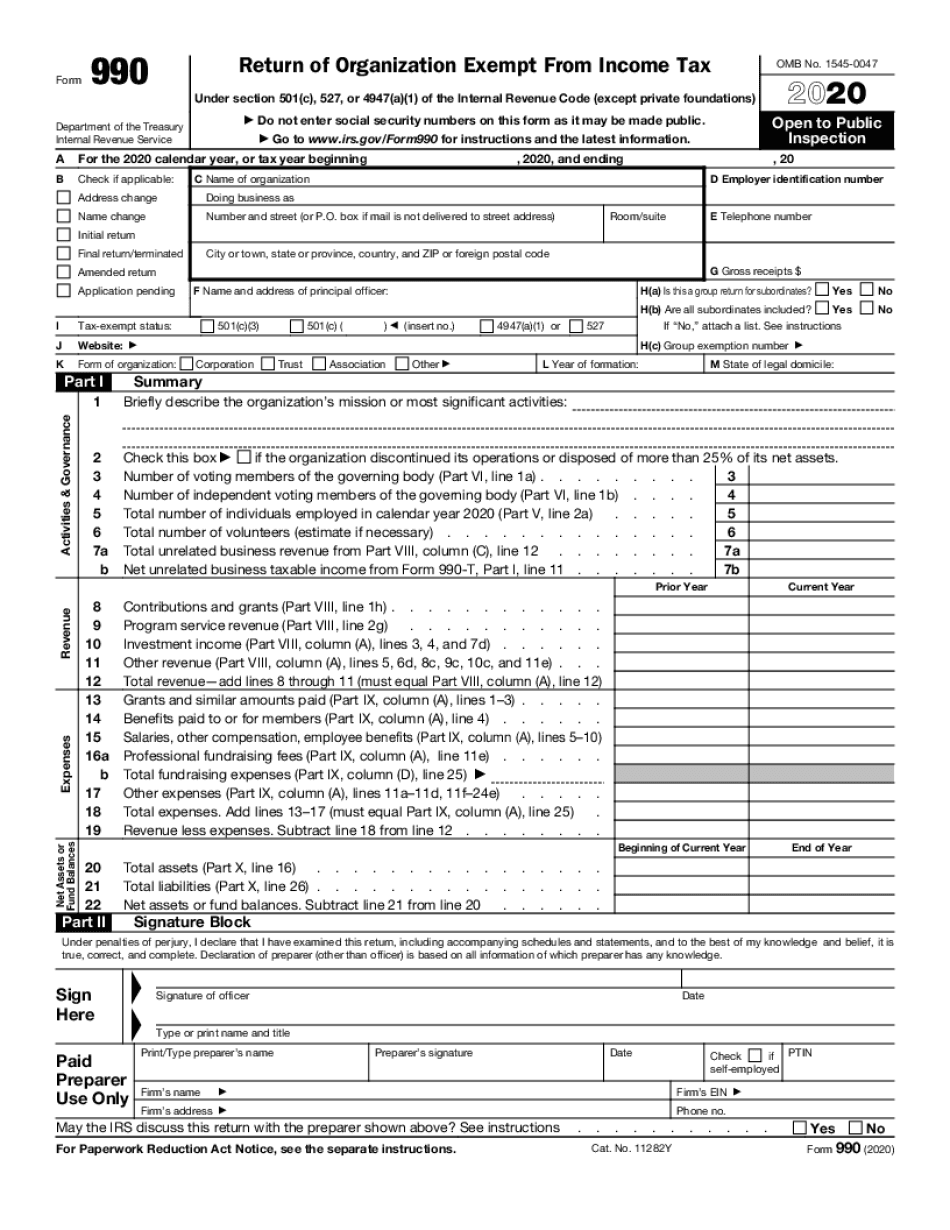

OCR 990 Form And Cope With Bureaucracy

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

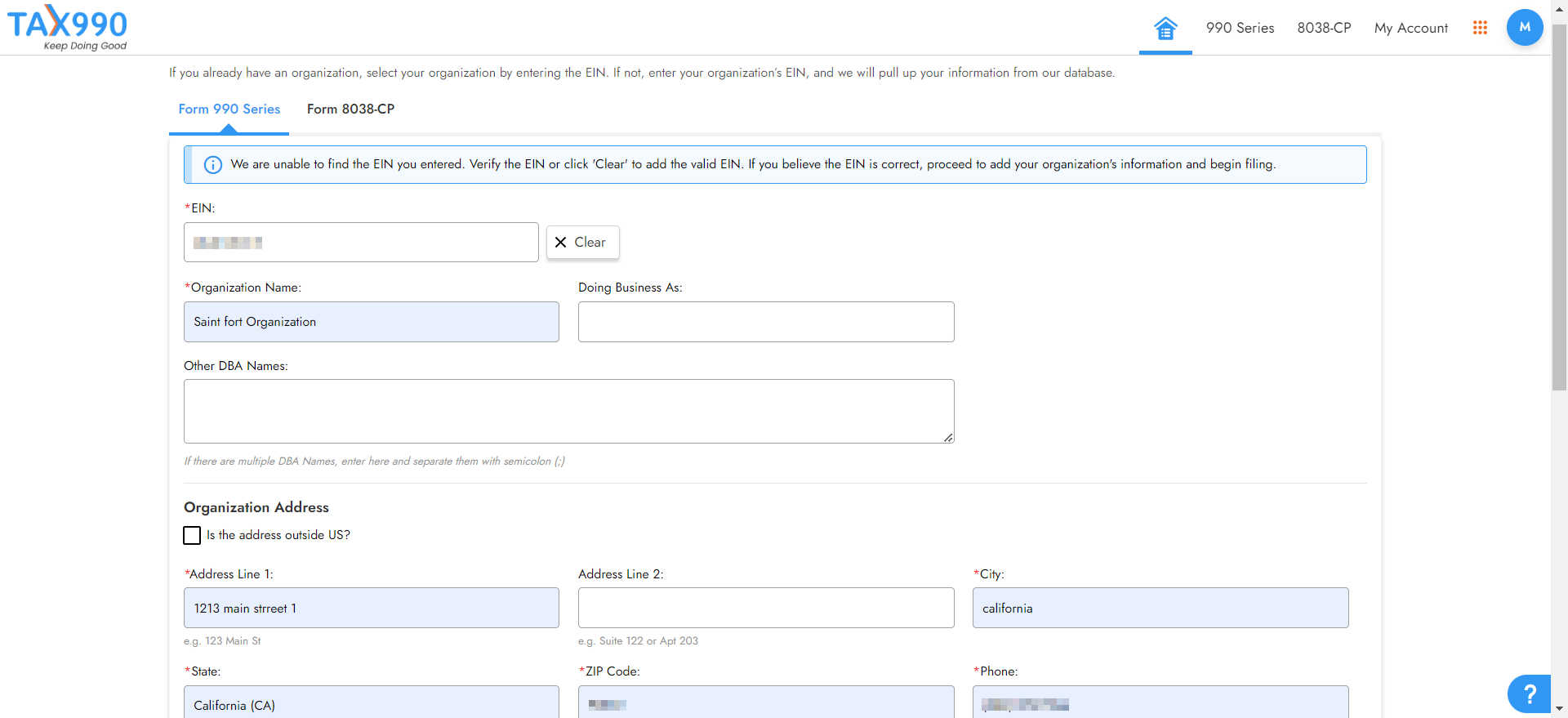

Efile Form 990N 2020 IRS Form 990N Online Filing

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

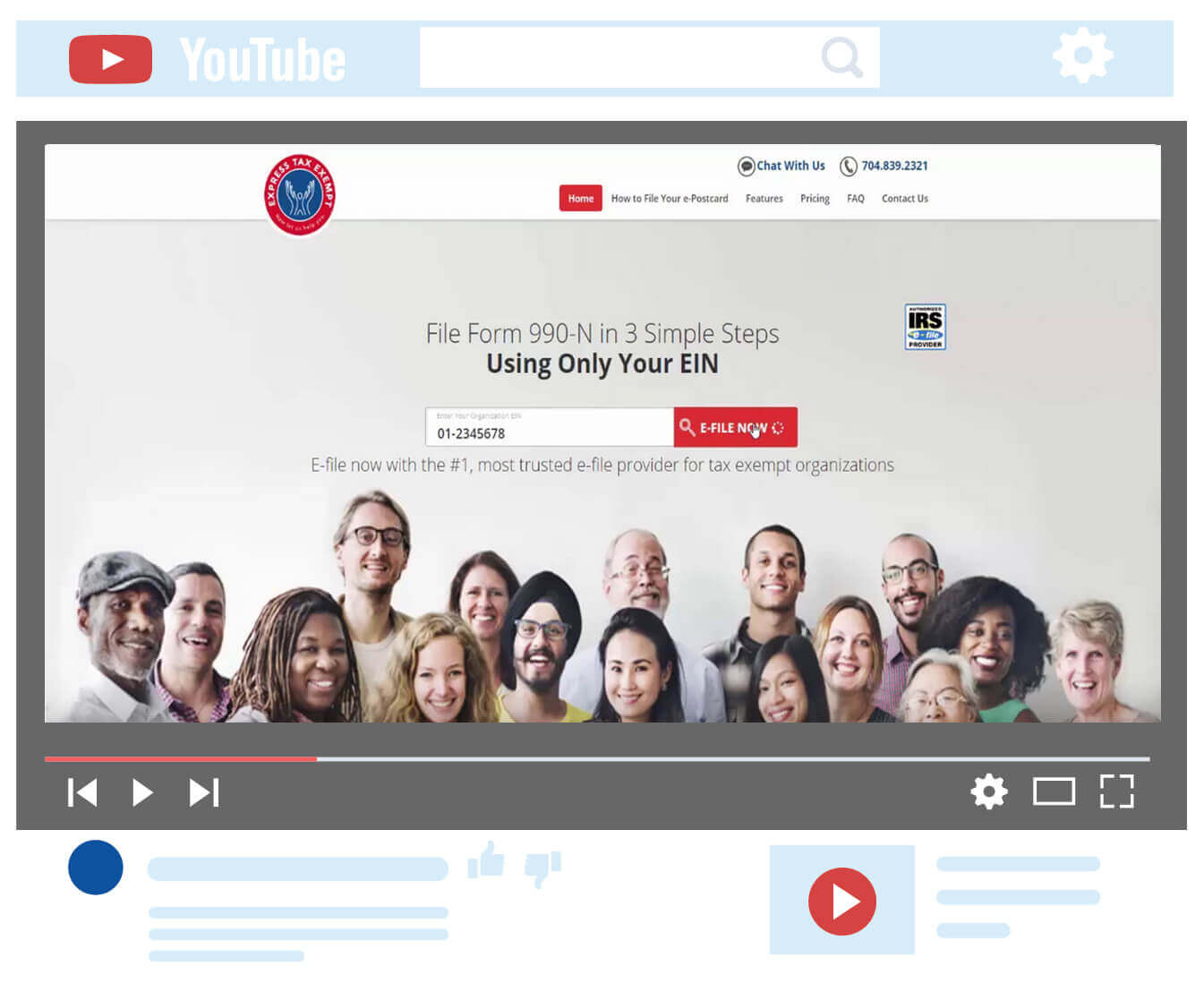

Steps to EFile Form 990N (ePostcard) Using ExpressTaxExempt YouTube

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

EFile 990N IRS Form 990N (ePostcard) Online 990N Electronic Filing

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

EFile 990N IRS Form 990N (ePostcard) Online 990N Electronic Filing

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

How to file IRS Form 990N( EPostcard) for your Nonprofit Organization

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n. For the filing link and.

Form 990 Due Date 2023 Printable Forms Free Online

For the filing link and. Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Small Public Charities With Annual Gross Receipts Of Normally $50,000 Or Less Must File The Electronic Form 990 N.

For the filing link and.