How To Put A Lien On Property In Illinois

How To Put A Lien On Property In Illinois - The amount of the lien/claim will be equal to the amount of. How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own. Liens force property owners to settle their debts before they are able to sell their. A claim can be filed against your estate. The most common type of. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The illinois department of revenue can. These liens take precedence over most others,. Liens are financial debts attached to real estate.

In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. A claim can be filed against your estate. The amount of the lien/claim will be equal to the amount of. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. Liens force property owners to settle their debts before they are able to sell their. Liens are financial debts attached to real estate. The most common type of. A lien can be filed on any real property you own. These liens take precedence over most others,. In illinois, a judgment lien can be attached to real estate only, not to personal property.

In illinois, a judgment lien can be attached to real estate only, not to personal property. How does a creditor go about getting a judgment lien in. A claim can be filed against your estate. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. Liens force property owners to settle their debts before they are able to sell their. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. The most common type of. Mortgage lenders can place a lien on a property as collateral for a loan. These liens take precedence over most others,. The illinois department of revenue can.

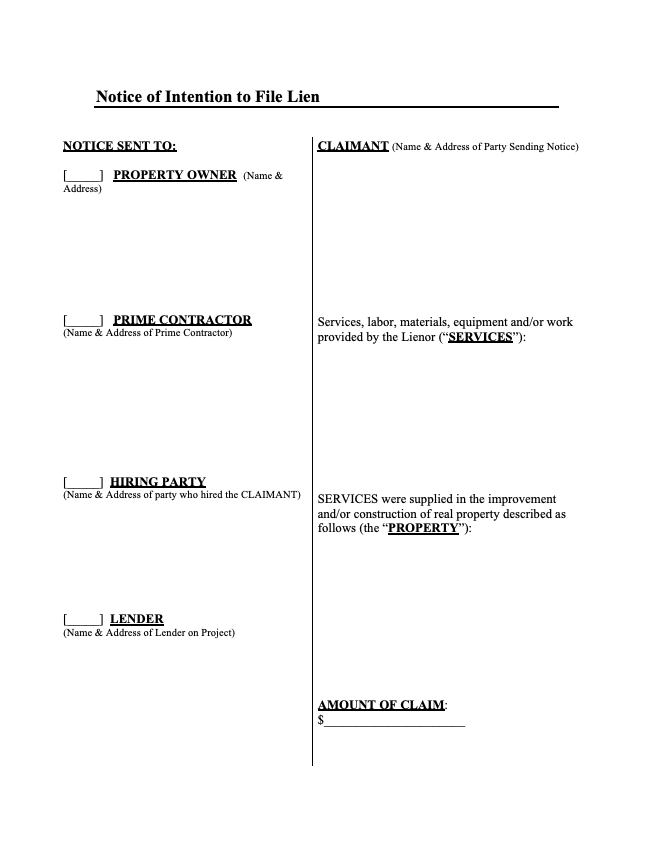

Illinois Notice of Intent to Lien Form Free Downloadable Template

In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens are financial debts attached to real estate. A lien can be filed on any real property you own. The most common type of. A claim can be filed against your estate.

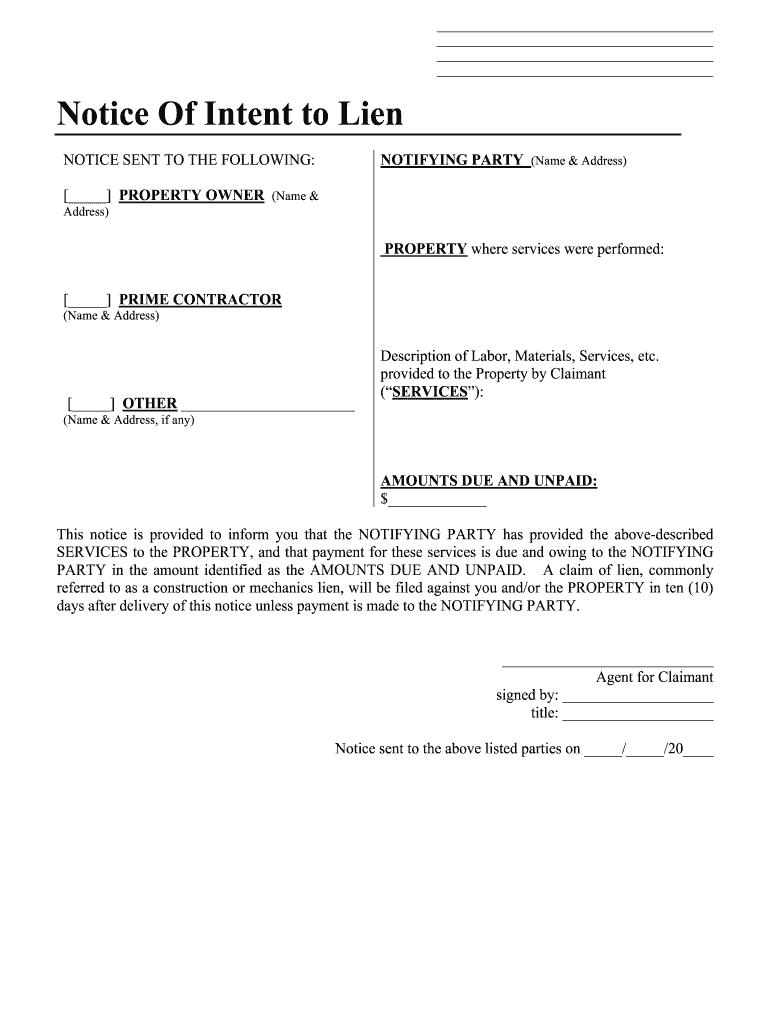

Notice of lien letter template Artofit

The most common type of. In illinois, a judgment lien can be attached to real estate only, not to personal property. These liens take precedence over most others,. How does a creditor go about getting a judgment lien in. Liens are financial debts attached to real estate.

Notice Of Intent To Lien Illinois Pdf Fill Online, Printable

How does a creditor go about getting a judgment lien in. Liens are financial debts attached to real estate. The illinois department of revenue can. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. A lien can be filed on any real property you own.

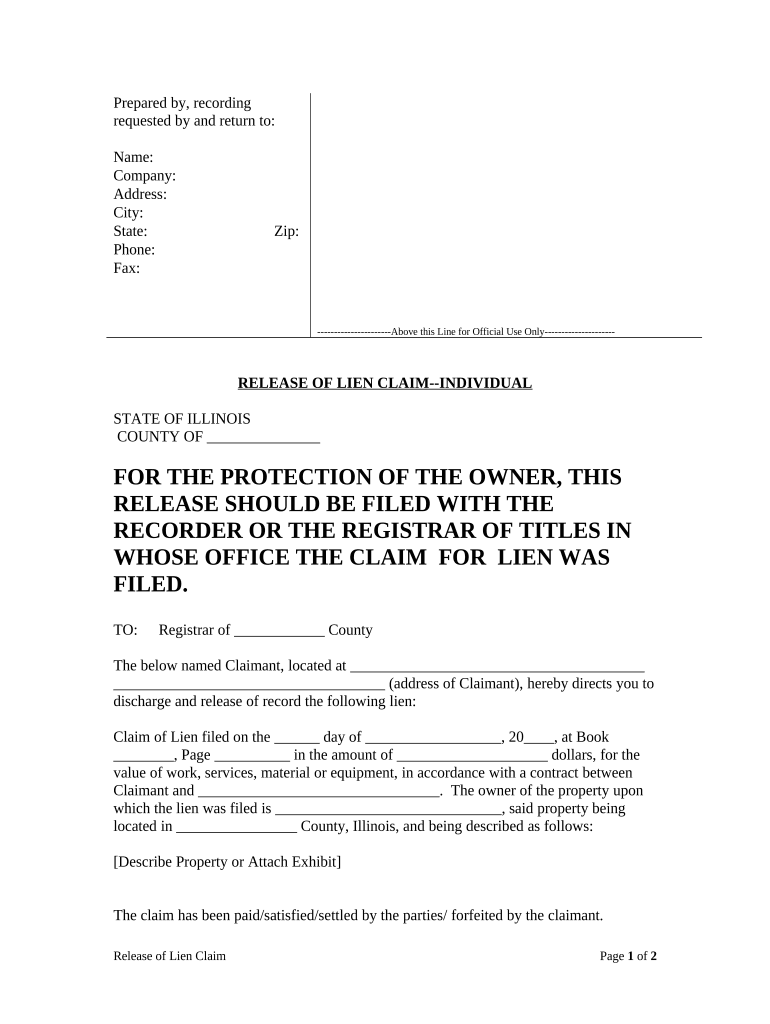

How to Remove a Property Lien from Your Home

A claim can be filed against your estate. Mortgage lenders can place a lien on a property as collateral for a loan. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. How does a creditor go about getting a judgment lien in. A lien can be filed on any real property you own.

Who Can Put a Lien on Your Property? Florida Land Network Leonard

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. The most common type of. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. A claim can be filed against your estate. A lien can be filed on any real property.

Lien clearance letter illinois Fill out & sign online DocHub

In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens are financial debts attached to real estate. How does a creditor go about getting a judgment lien in. A claim can be filed against your estate.

Federal tax lien on foreclosed property laderdriver

Mortgage lenders can place a lien on a property as collateral for a loan. Liens are financial debts attached to real estate. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. How does a creditor.

Right to lien the Nevada notice

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. The most common type of. In.

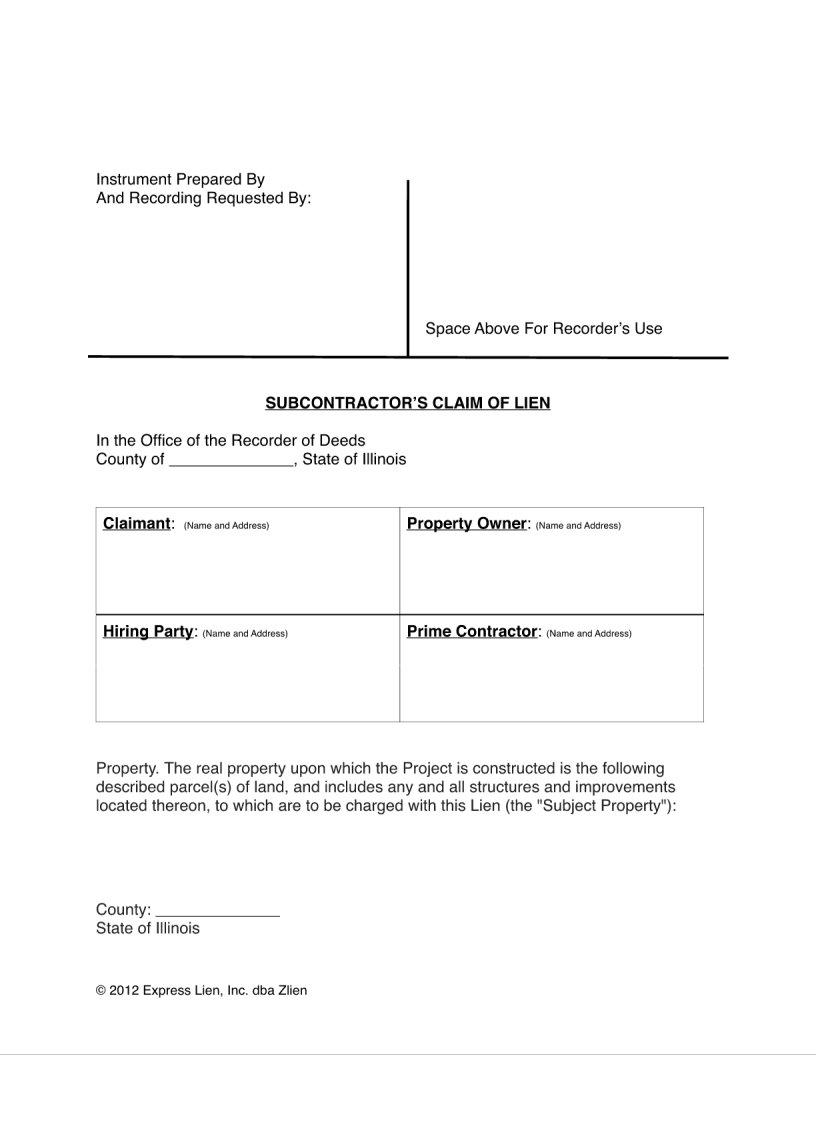

Illinois Notice Lien Form ≡ Fill Out Printable PDF Forms Online

A claim can be filed against your estate. In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. A lien can be filed on any real property you own. Liens force property owners to settle their debts before they are able to sell their. The most common type of.

How to Put a Lien on a Property National Lien & Bond

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. These liens take precedence over most others,. A claim can be filed against your estate. Liens force property owners to settle their debts before they are able to sell their. The most common type of.

Mortgage Lenders Can Place A Lien On A Property As Collateral For A Loan.

In illinois, several types of liens can affect real estate transactions, each serving distinct purposes and legal implications. In illinois, filing a lien is a simple process, but one that comes with specific time limits for legal action. How does a creditor go about getting a judgment lien in. In illinois, the department of revenue or local authorities can place a lien for unpaid taxes.

The Most Common Type Of.

The amount of the lien/claim will be equal to the amount of. In illinois, a judgment lien can be attached to real estate only, not to personal property. Liens force property owners to settle their debts before they are able to sell their. The illinois department of revenue can.

Liens Are Financial Debts Attached To Real Estate.

These liens take precedence over most others,. A lien can be filed on any real property you own. A claim can be filed against your estate.