How To Put A Lien On Property In Kentucky

How To Put A Lien On Property In Kentucky - (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. Here, we break down exactly what the state of kentucky requires for you to properly file a valid lien and bond claim. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of liens, common scenarios, and the legal. The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. You must send a notice. In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). How does a creditor go about getting a judgment.

In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. Here, we break down exactly what the state of kentucky requires for you to properly file a valid lien and bond claim. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of liens, common scenarios, and the legal. Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. You must send a notice. How does a creditor go about getting a judgment. (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of.

Here, we break down exactly what the state of kentucky requires for you to properly file a valid lien and bond claim. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of liens, common scenarios, and the legal. In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. You must send a notice. (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. How does a creditor go about getting a judgment.

Free Real Estate Lien Release Forms PDF eForms

How does a creditor go about getting a judgment. (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. You must send a notice. The notice of state tax lien is filed in the county where the taxpayer's business or residence.

StepbyStep Guide How to Set Up Your LLC in Kentucky Expert

You must send a notice. In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. The notice of state tax lien is filed in the county where the taxpayer's business.

Who can Put a Lien on a Property & What Happens When A Lien is Placed?

You must send a notice. Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. How does a creditor go.

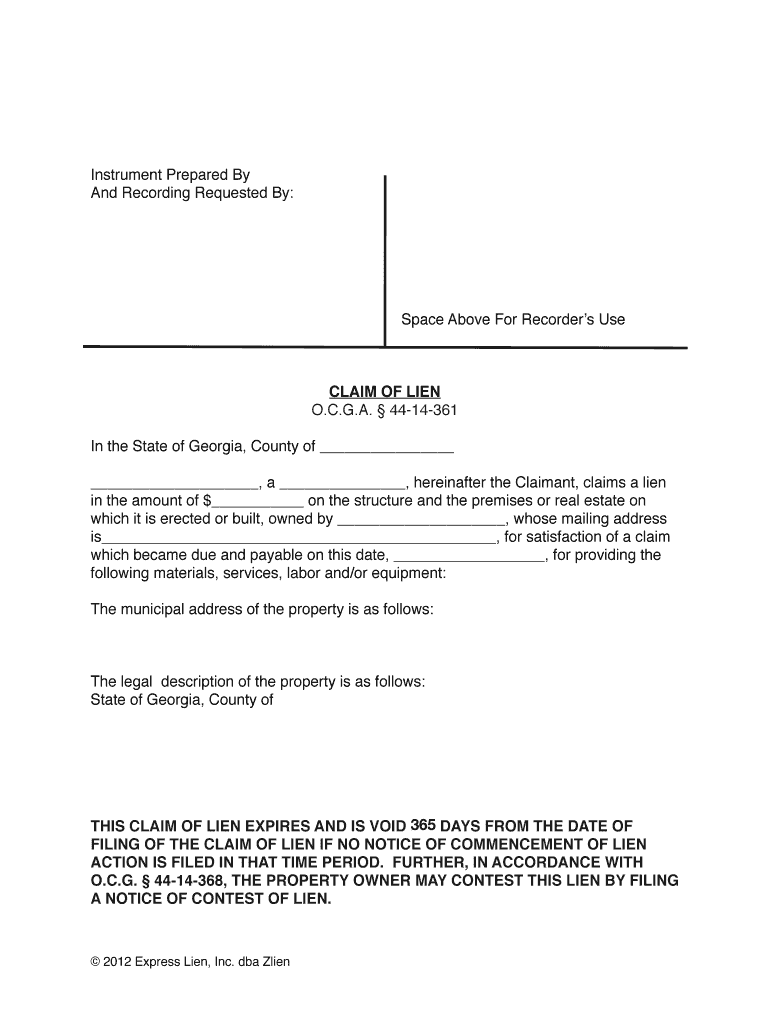

Property Lien Template

You must send a notice. How does a creditor go about getting a judgment. The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of.

Kentucky Construction or Mechanics Lien Package Individual

Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. How does a creditor go about getting a judgment. Here, we break.

What is a Property Lien and How to Get Out From One

In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). Here, we break down exactly what the state of kentucky requires for you to properly file a valid lien and bond claim. (3) no person who has not contracted directly with the owner or his agent shall acquire a lien under.

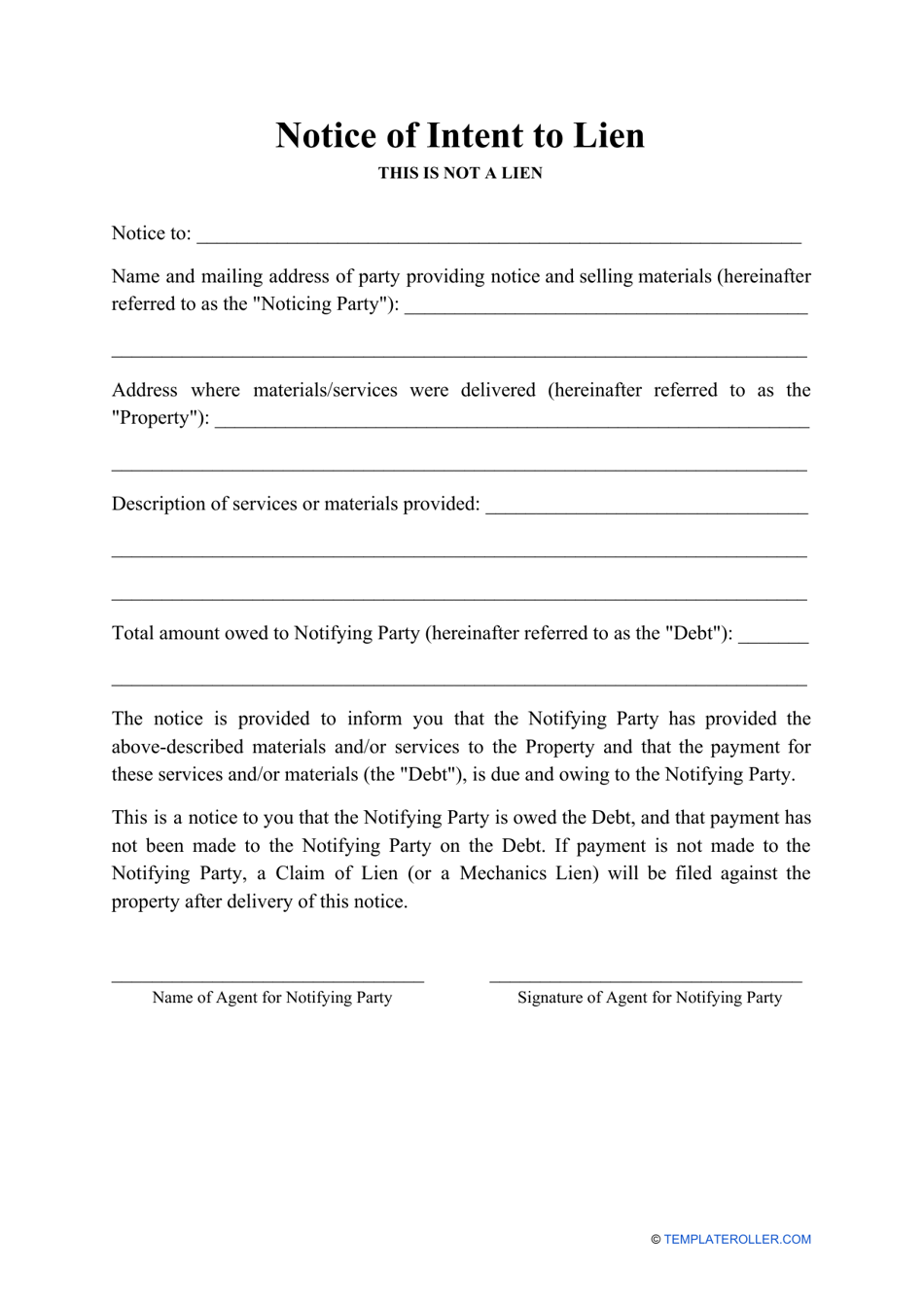

Lien letter Fill out & sign online DocHub

(3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. Here, we break down exactly what the state of kentucky requires for you to properly file a valid lien and bond claim. You must send a notice. The notice of state.

How to Put a Lien on a Property National Lien & Bond

In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has. Here, we break down exactly what the state of kentucky requires for you to.

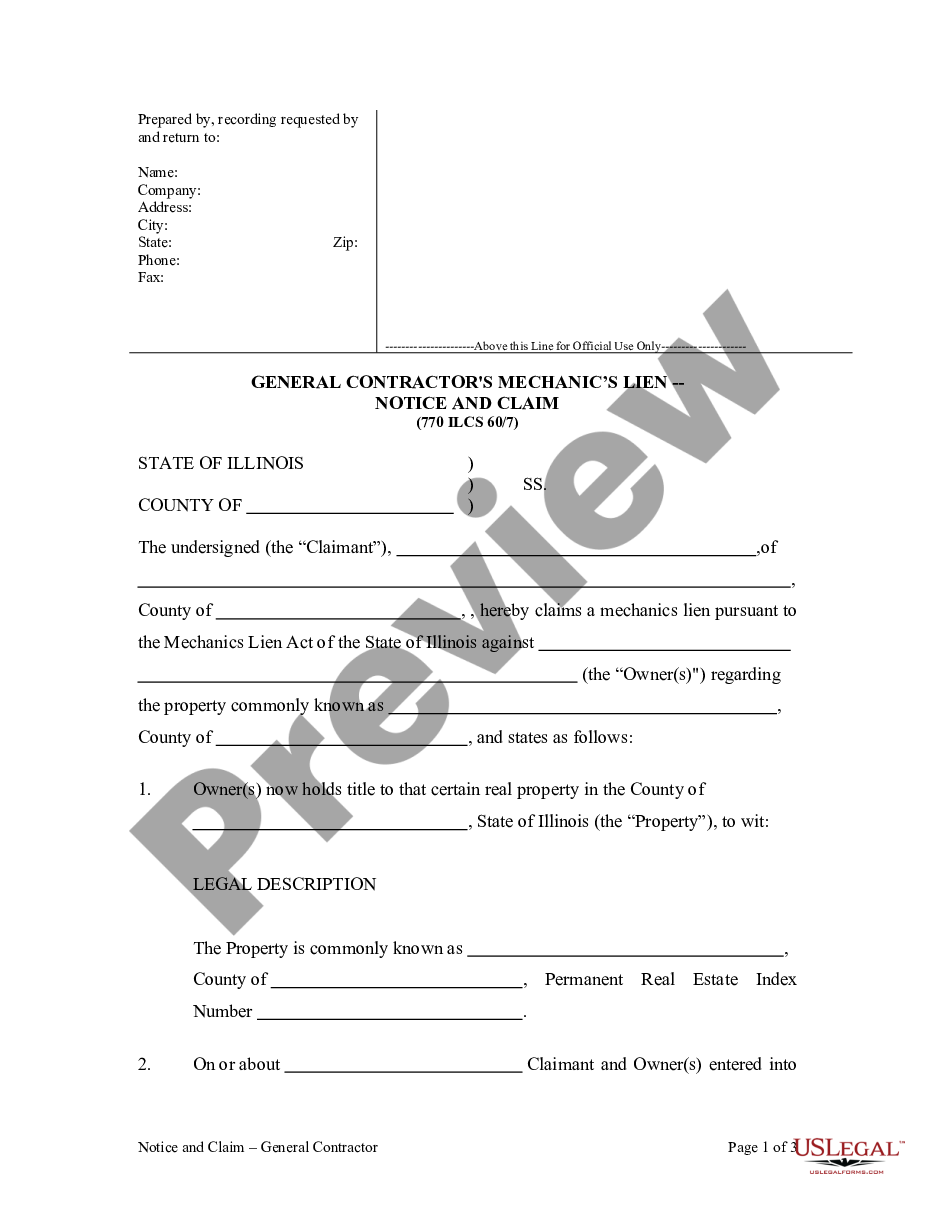

Illinois General Contractor's Lien Notice of Lien Mechanic Liens

(3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. In kentucky, a judgment lien can be attached to real.

Notice of Intent to Lien Fill Out, Sign Online and Download PDF

Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. You must send a notice. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of liens, common scenarios, and the legal. The notice of state tax lien is filed in.

How Does A Creditor Go About Getting A Judgment.

In kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest). You must send a notice. Governmental liens can be filed for unpaid property taxes, municipal utilities, child support, penal code offenses, state lottery fines and worker's. In this article, we’ll cover the steps to put a lien on property in kentucky, including the types of liens, common scenarios, and the legal.

Here, We Break Down Exactly What The State Of Kentucky Requires For You To Properly File A Valid Lien And Bond Claim.

(3) no person who has not contracted directly with the owner or his agent shall acquire a lien under this section unless he notifies in writing the owner of. The notice of state tax lien is filed in the county where the taxpayer's business or residence is located or in the county where the taxpayer has.