How To Report Canadian Form Nr4 On U S Tax Return

How To Report Canadian Form Nr4 On U S Tax Return - See @patriciar’s answer at how do i. Enter your canada nr4 (income code 11) income in the section for us social security. Where on the 1040 do i report this. To enter any foreign tax you already paid to canada, follow these steps: Enter the amounts on your nr4 converted to u.s. Reporting canadian form nr4 on your u.s. Tax return is an important step for individuals who receive income from canadian sources.

Where on the 1040 do i report this. Enter the amounts on your nr4 converted to u.s. Enter your canada nr4 (income code 11) income in the section for us social security. See @patriciar’s answer at how do i. To enter any foreign tax you already paid to canada, follow these steps: Tax return is an important step for individuals who receive income from canadian sources. Reporting canadian form nr4 on your u.s.

Enter the amounts on your nr4 converted to u.s. See @patriciar’s answer at how do i. Reporting canadian form nr4 on your u.s. To enter any foreign tax you already paid to canada, follow these steps: Where on the 1040 do i report this. Tax return is an important step for individuals who receive income from canadian sources. Enter your canada nr4 (income code 11) income in the section for us social security.

Tax Requirements for NonResidents of Canada Earning Rental

Reporting canadian form nr4 on your u.s. To enter any foreign tax you already paid to canada, follow these steps: Enter your canada nr4 (income code 11) income in the section for us social security. See @patriciar’s answer at how do i. Tax return is an important step for individuals who receive income from canadian sources.

Nr4 Slip Fillable Form Printable Forms Free Online

To enter any foreign tax you already paid to canada, follow these steps: Enter the amounts on your nr4 converted to u.s. Where on the 1040 do i report this. Reporting canadian form nr4 on your u.s. Tax return is an important step for individuals who receive income from canadian sources.

Canada Form Nr4 Fill Online, Printable, Fillable, Blank pdfFiller

Enter the amounts on your nr4 converted to u.s. Enter your canada nr4 (income code 11) income in the section for us social security. Where on the 1040 do i report this. Reporting canadian form nr4 on your u.s. Tax return is an important step for individuals who receive income from canadian sources.

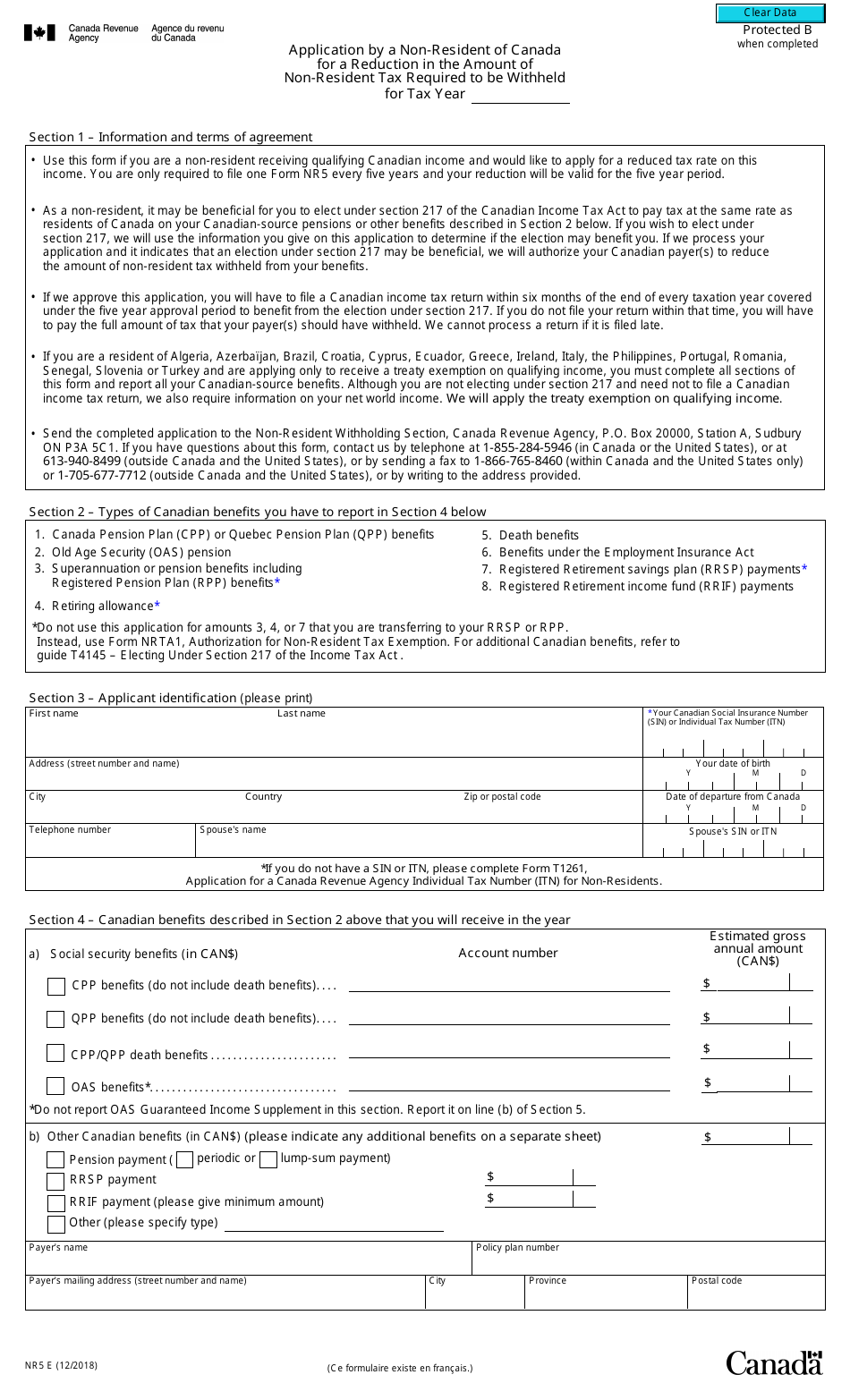

Form NR5 Fill Out, Sign Online and Download Fillable PDF, Canada

To enter any foreign tax you already paid to canada, follow these steps: See @patriciar’s answer at how do i. Where on the 1040 do i report this. Reporting canadian form nr4 on your u.s. Enter your canada nr4 (income code 11) income in the section for us social security.

NR4 Form and Withholding Taxes YouTube

Reporting canadian form nr4 on your u.s. See @patriciar’s answer at how do i. Where on the 1040 do i report this. Tax return is an important step for individuals who receive income from canadian sources. Enter your canada nr4 (income code 11) income in the section for us social security.

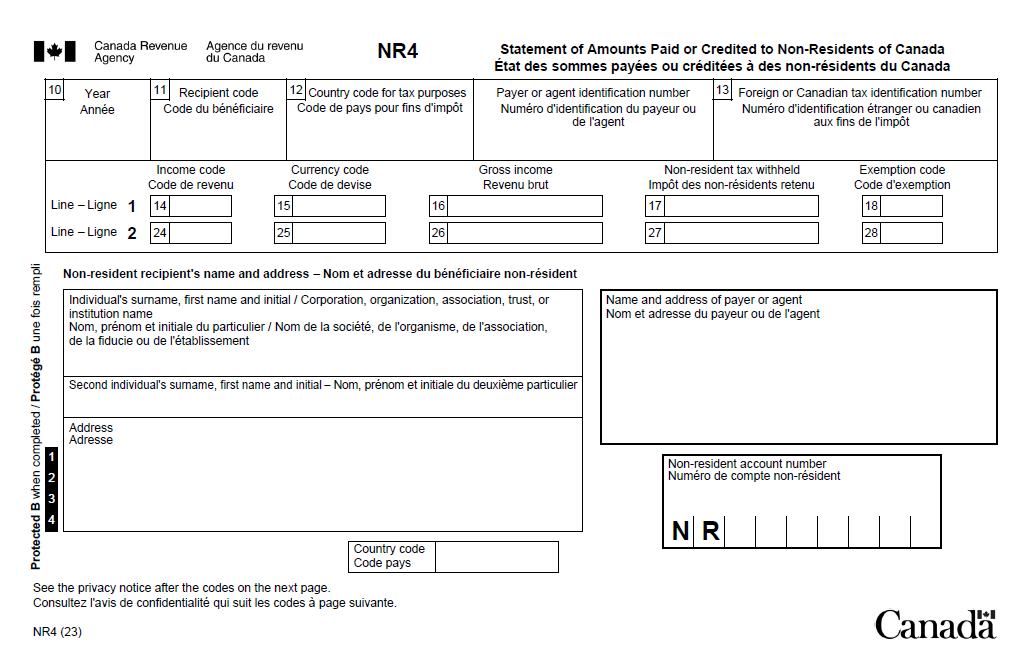

NR4 Statement of Amounts Paid or Credited to NonResidents of Canada

Enter the amounts on your nr4 converted to u.s. See @patriciar’s answer at how do i. Enter your canada nr4 (income code 11) income in the section for us social security. Reporting canadian form nr4 on your u.s. To enter any foreign tax you already paid to canada, follow these steps:

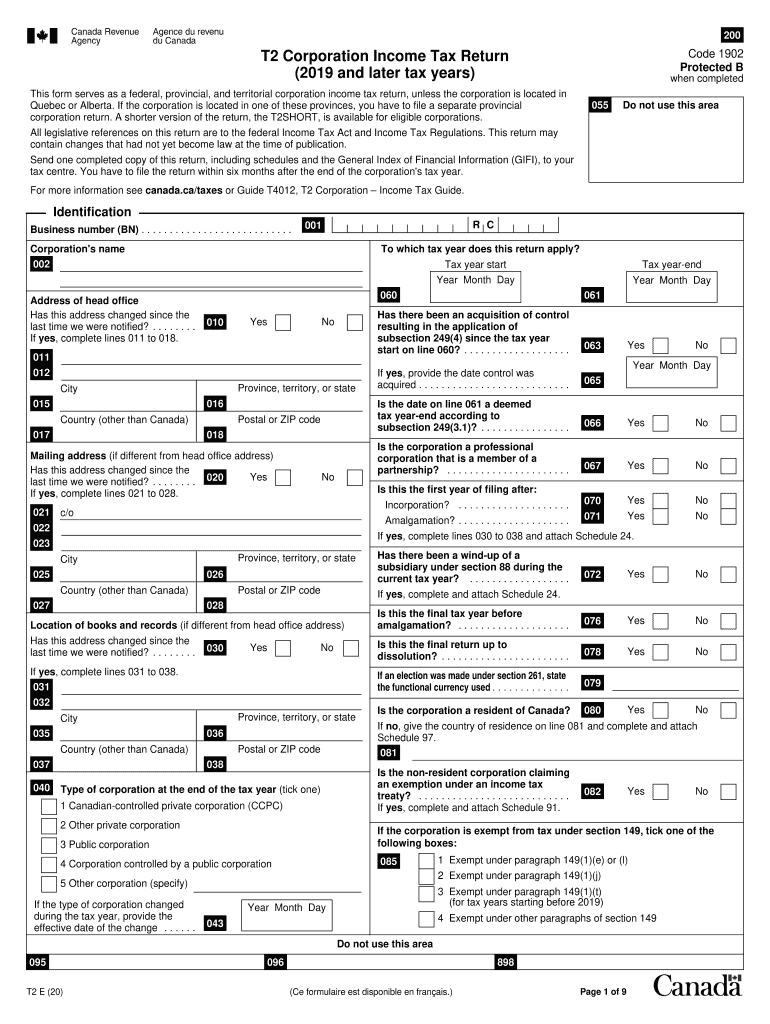

T 2 20202024 Form Fill Out and Sign Printable PDF Template

Enter the amounts on your nr4 converted to u.s. Tax return is an important step for individuals who receive income from canadian sources. Reporting canadian form nr4 on your u.s. To enter any foreign tax you already paid to canada, follow these steps: See @patriciar’s answer at how do i.

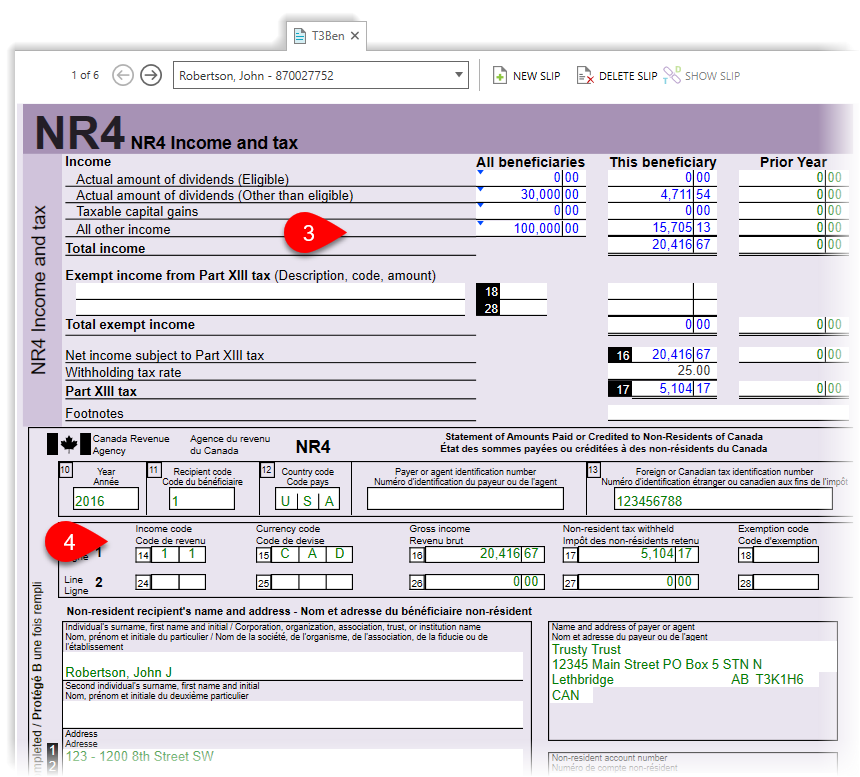

T1 module does not have a form related to NR4 (NonResident)

Reporting canadian form nr4 on your u.s. Where on the 1040 do i report this. Tax return is an important step for individuals who receive income from canadian sources. To enter any foreign tax you already paid to canada, follow these steps: See @patriciar’s answer at how do i.

T5013 A Simple Guide to Canadian Partnership Tax Forms

To enter any foreign tax you already paid to canada, follow these steps: See @patriciar’s answer at how do i. Enter the amounts on your nr4 converted to u.s. Where on the 1040 do i report this. Tax return is an important step for individuals who receive income from canadian sources.

Section 216 Checklist (With NR4) Madan CA

Where on the 1040 do i report this. Enter your canada nr4 (income code 11) income in the section for us social security. Reporting canadian form nr4 on your u.s. Tax return is an important step for individuals who receive income from canadian sources. Enter the amounts on your nr4 converted to u.s.

Reporting Canadian Form Nr4 On Your U.s.

See @patriciar’s answer at how do i. Enter the amounts on your nr4 converted to u.s. Tax return is an important step for individuals who receive income from canadian sources. To enter any foreign tax you already paid to canada, follow these steps:

Where On The 1040 Do I Report This.

Enter your canada nr4 (income code 11) income in the section for us social security.