Illinois Tax Lien Sale

Illinois Tax Lien Sale - By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Meyer & associates collects unwanted tax liens for 80. In the state of illinois, the sale of property tax liens goes through the following steps. What is a tax sale? The state tax lien registration act also provided for the sale. How tax liens work in illinois. Iltaxsale.com advertises tax deed auctions for joseph e. To purchase a catalog of the properties, click here. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only.

The state tax lien registration act also provided for the sale. What is a tax sale? In the state of illinois, the sale of property tax liens goes through the following steps. How tax liens work in illinois. Meyer & associates collects unwanted tax liens for 80. To purchase a catalog of the properties, click here. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Iltaxsale.com advertises tax deed auctions for joseph e.

How tax liens work in illinois. Meyer & associates collects unwanted tax liens for 80. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. In the state of illinois, the sale of property tax liens goes through the following steps. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. To purchase a catalog of the properties, click here. What is a tax sale? Iltaxsale.com advertises tax deed auctions for joseph e. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. The state tax lien registration act also provided for the sale.

Tax Lien Sale San Juan County

What is a tax sale? Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. To purchase a catalog of the properties, click here. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. How tax.

tax lien PDF Free Download

In the state of illinois, the sale of property tax liens goes through the following steps. The state tax lien registration act also provided for the sale. What is a tax sale? Meyer & associates collects unwanted tax liens for 80. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october.

Tax Lien Training Special Expired — Financial Freedom University

Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. To purchase a catalog of the properties, click here. What is a tax sale?

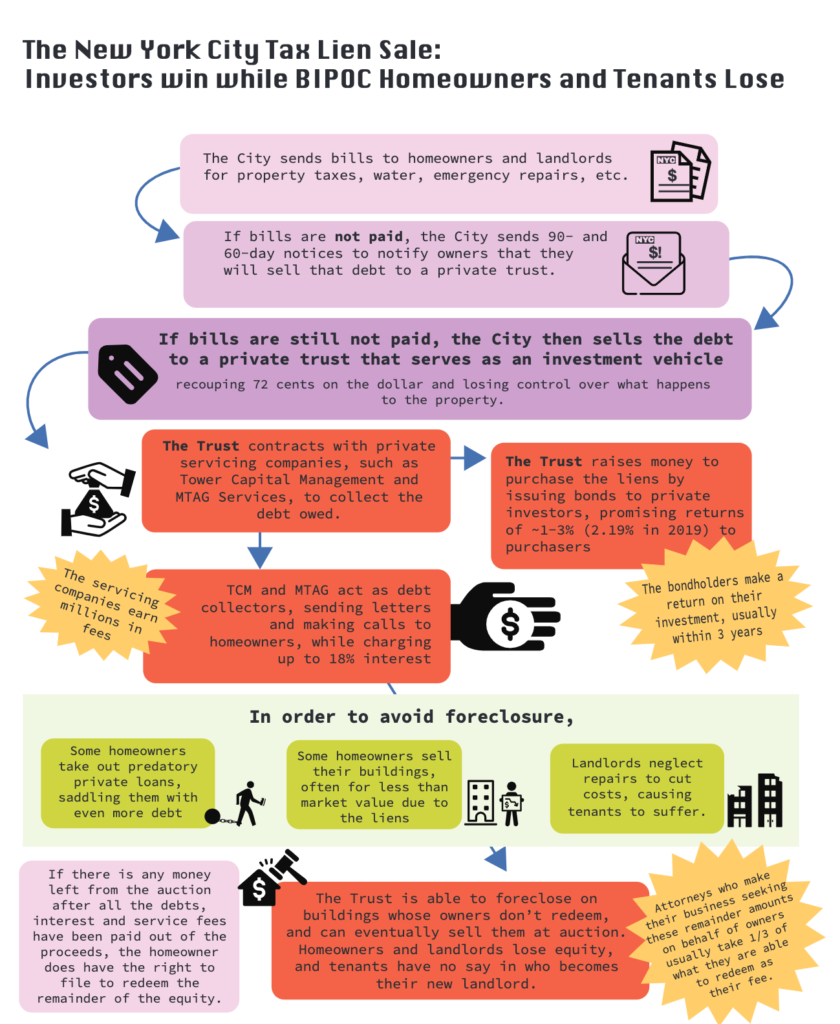

Informational Brochure About the Tax Lien Sale EastNewYorkCLT

What is a tax sale? To purchase a catalog of the properties, click here. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale.

NYC Tax Lien Sale Information Session Jamaica311

How tax liens work in illinois. To purchase a catalog of the properties, click here. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. Meyer & associates collects unwanted tax liens for 80. What is a tax sale?

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. To purchase a catalog of the properties, click here. By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. The state tax lien registration act also.

What are Tax Lien Properties and Tax Lien Investments? — Tax Sales

The state tax lien registration act also provided for the sale. How tax liens work in illinois. Iltaxsale.com advertises tax deed auctions for joseph e. Meyer & associates collects unwanted tax liens for 80. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024.

Property Tax Lien Sale Program Extended by City Council CityLand CityLand

To purchase a catalog of the properties, click here. Iltaxsale.com advertises tax deed auctions for joseph e. How tax liens work in illinois. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. For this year’s sale, all tax buyer registration forms must be.

Abolish The Tax Lien Sale EastNewYorkCLT

To purchase a catalog of the properties, click here. Iltaxsale.com advertises tax deed auctions for joseph e. What is a tax sale? Meyer & associates collects unwanted tax liens for 80. How tax liens work in illinois.

Nyc Tax Lien Sale 2024 Kanya Maritsa

What is a tax sale? How tax liens work in illinois. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Meyer & associates collects unwanted tax liens for 80. The state tax lien registration act also provided for the sale.

To Purchase A Catalog Of The Properties, Click Here.

In the state of illinois, the sale of property tax liens goes through the following steps. Under illinois law, there are two types of tax sales to sell delinquent property taxes — the required annual tax sale and the scavenger sale (only. For this year’s sale, all tax buyer registration forms must be turned in to the treasurer’s office by october 11, 2024. Meyer & associates collects unwanted tax liens for 80.

The State Tax Lien Registration Act Also Provided For The Sale.

By illinois state statutes (35ilcs200) the county collector/treasurer is required to sell any taxes that have not been. How tax liens work in illinois. What is a tax sale? Iltaxsale.com advertises tax deed auctions for joseph e.