Illinois Tax Lien

Illinois Tax Lien - The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. To search for a certificate of tax lien, you may search by case number or debtor name. Meyer & associates collects unwanted tax liens for 80. Iltaxsale.com advertises tax deed auctions for joseph e. What is the state tax lien registry? The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search, you may use either the. The registry will be an online, statewide system for maintaining notices of tax liens filed or.

Iltaxsale.com advertises tax deed auctions for joseph e. To search for a certificate of tax lien, you may search by case number or debtor name. With the case number search, you may use either the. What is the state tax lien registry? Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. Meyer & associates collects unwanted tax liens for 80. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois.

Meyer & associates collects unwanted tax liens for 80. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The registry will be an online, statewide system for maintaining notices of tax liens filed or. What is the state tax lien registry? To search for a certificate of tax lien, you may search by case number or debtor name. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Iltaxsale.com advertises tax deed auctions for joseph e.

Investing in Tax Lien Seminars and Courses

To search for a certificate of tax lien, you may search by case number or debtor name. The registry will be an online, statewide system for maintaining notices of tax liens filed or. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed.

Tax Lien Sale Download Free PDF Tax Lien Taxes

The registry will be an online, statewide system for maintaining notices of tax liens filed or. Iltaxsale.com advertises tax deed auctions for joseph e. To search for a certificate of tax lien, you may search by case number or debtor name. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay.

Illinois’ New State Tax Lien Registry Gensburg Calandriello & Kanter

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. With the case number search, you may use either the. Meyer & associates collects unwanted tax liens for 80. What is the state tax lien registry? To search for a certificate of tax lien, you may search by.

Tax Lien Properties In Montana Brightside Tax Relief

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. Meyer & associates collects unwanted tax liens for 80. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The state tax lien registry is an.

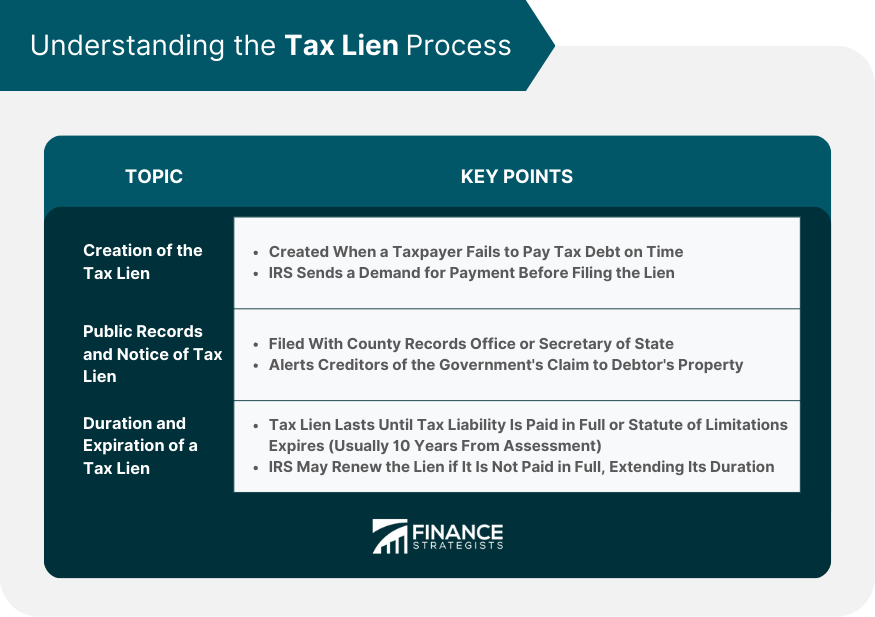

Tax Lien Definition, Process, Consequences, How to Handle

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. To search for a certificate of tax lien, you may search by case number or debtor name. Meyer & associates collects unwanted tax liens for 80. What is the state tax lien registry? Iltaxsale.com advertises tax deed auctions.

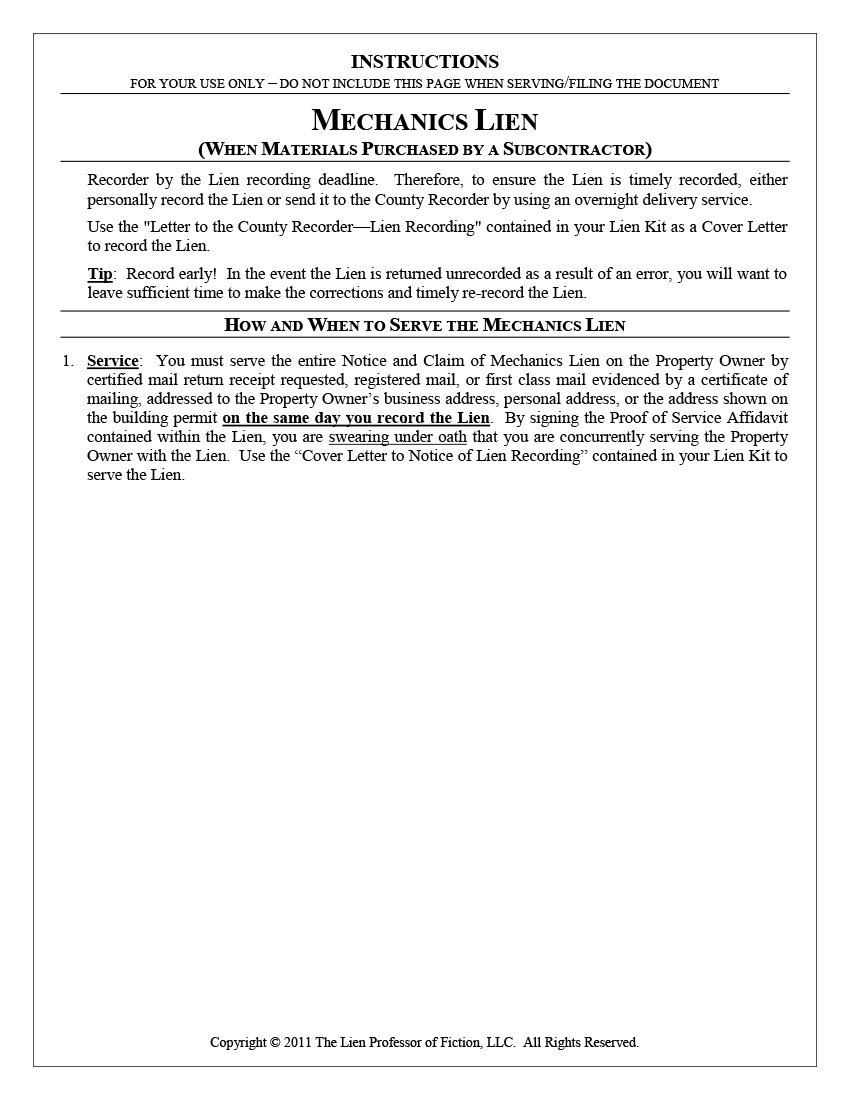

Residential Subcontractor Illinois Mechanic Lien Documents and Packages

What is the state tax lien registry? Iltaxsale.com advertises tax deed auctions for joseph e. Meyer & associates collects unwanted tax liens for 80. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. To search for a certificate of tax lien, you may search by case number.

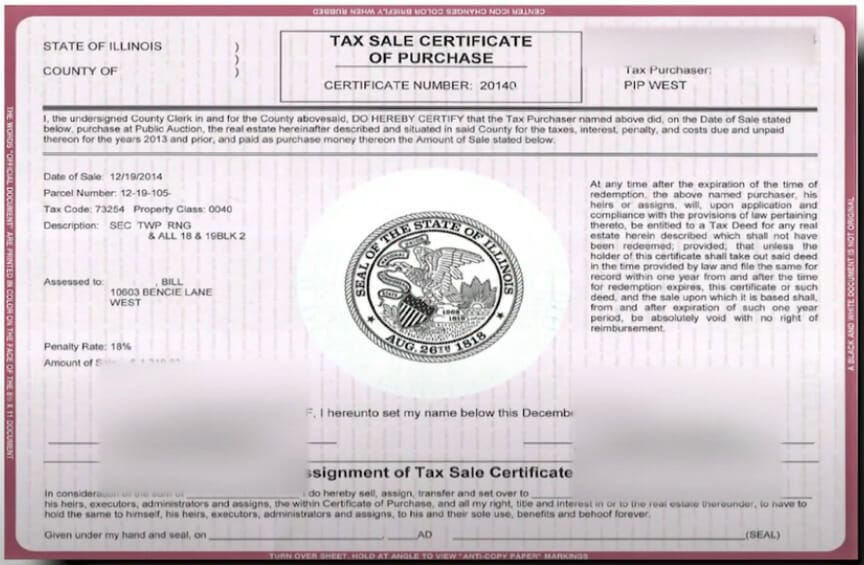

Is Illinois a Tax Lien or Tax Deed State, and Why Is It a 1 Choice

The registry will be an online, statewide system for maintaining notices of tax liens filed or. Meyer & associates collects unwanted tax liens for 80. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. What is the state tax lien registry? To search for.

How to file a mechanics lien in Illinois and get paid National Lien

Meyer & associates collects unwanted tax liens for 80. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. With the case number search, you may use either the. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released.

tax lien PDF Free Download

The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. What is the state tax lien registry? Meyer & associates collects unwanted tax liens for 80. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is.

EasytoUnderstand Tax Lien Code Certificates Posteezy

What is the state tax lien registry? The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. With the case number search, you.

With The Case Number Search, You May Use Either The.

Iltaxsale.com advertises tax deed auctions for joseph e. To search for a certificate of tax lien, you may search by case number or debtor name. Each year, thousands of cook county property owners pay their real estate property taxes late or neglect to pay them at all. The registry will be an online, statewide system for maintaining notices of tax liens filed or.

What Is The State Tax Lien Registry?

Meyer & associates collects unwanted tax liens for 80. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The lien remains until the debt is fully satisfied or becomes unenforceable due to the statute of limitations, generally 20 years from.