Insurance Company Losses From Owning Treasuries

Insurance Company Losses From Owning Treasuries - Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Has lost around $890 million as it sold bonds with longer maturities in preparation.

Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

Insurance Claim Solutions Insurance Loss Assessors Rush

Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such.

Online insurance fraud types, techniques, prevention

Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Has lost around $890 million as it sold bonds with longer maturities in preparation.

Whole Life Insurance Explained Best Insurance for Life

Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such.

Grow your wealth with US Treasuries

The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Has lost around $890 million as it sold bonds with longer maturities in preparation. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

684,000,000,000 in Unrealized Losses Hammer US Banks As Fed Reveals

Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

Solved Subrogation in insurance means what?Losses must be

The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. Has lost around $890 million as it sold bonds with longer maturities in preparation.

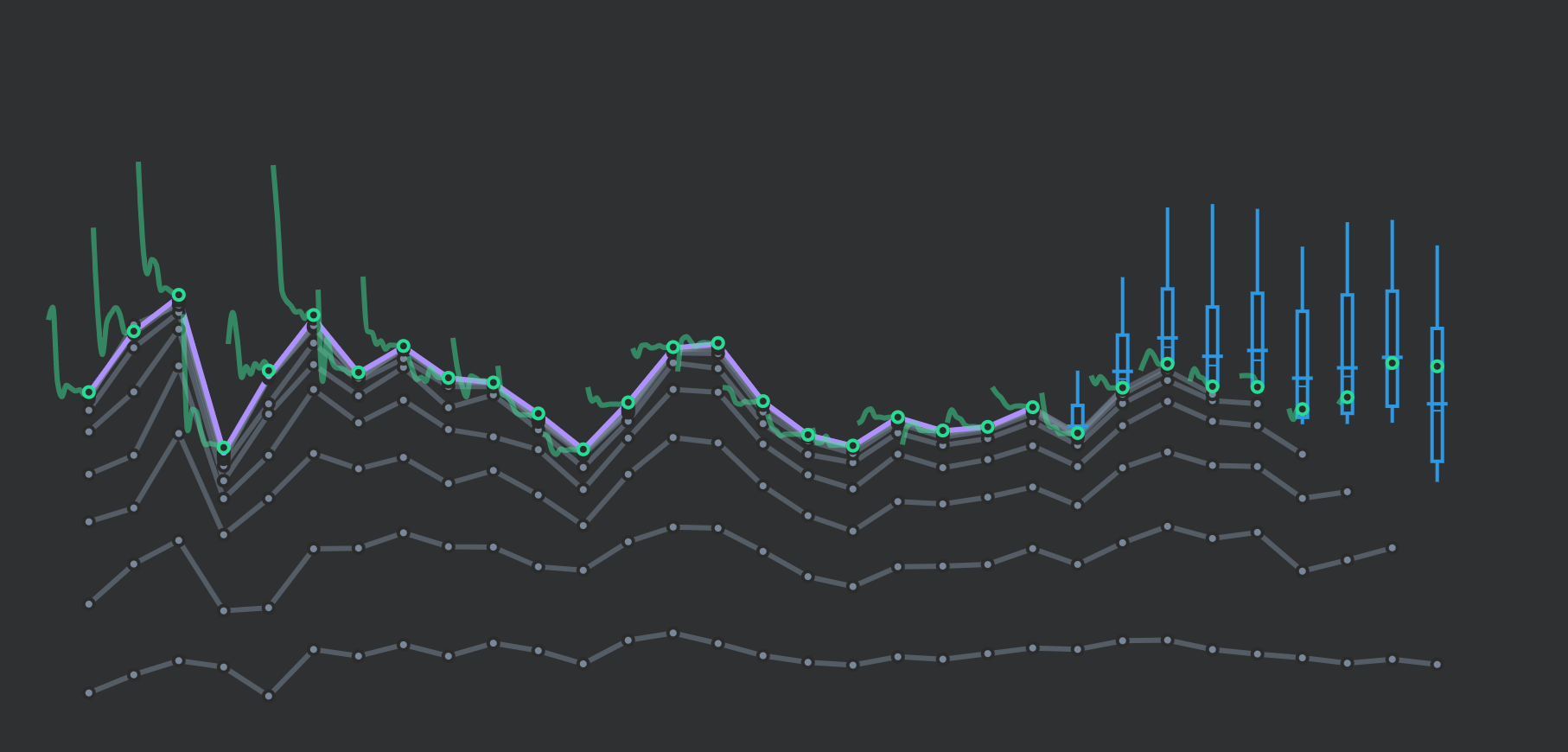

Visualizing Insurance Losses

The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Has lost around $890 million as it sold bonds with longer maturities in preparation. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

Health Insurance Losses per Enrollee for Different Samples Health

Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such.

Treasuries Look Like Insurance for a Crash Bloomberg

Has lost around $890 million as it sold bonds with longer maturities in preparation. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s.

Does an Insurance Company Cover All Losses?

Has lost around $890 million as it sold bonds with longer maturities in preparation. Dbrs morningstar published a commentary discussing the impact of unrealized investment losses on u.s. The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such.

Dbrs Morningstar Published A Commentary Discussing The Impact Of Unrealized Investment Losses On U.s.

The wildfires sweeping through los angeles are unlikely to trigger significant losses in catastrophe bonds designed to capture such. Has lost around $890 million as it sold bonds with longer maturities in preparation.