Invoice Factoring Small Business

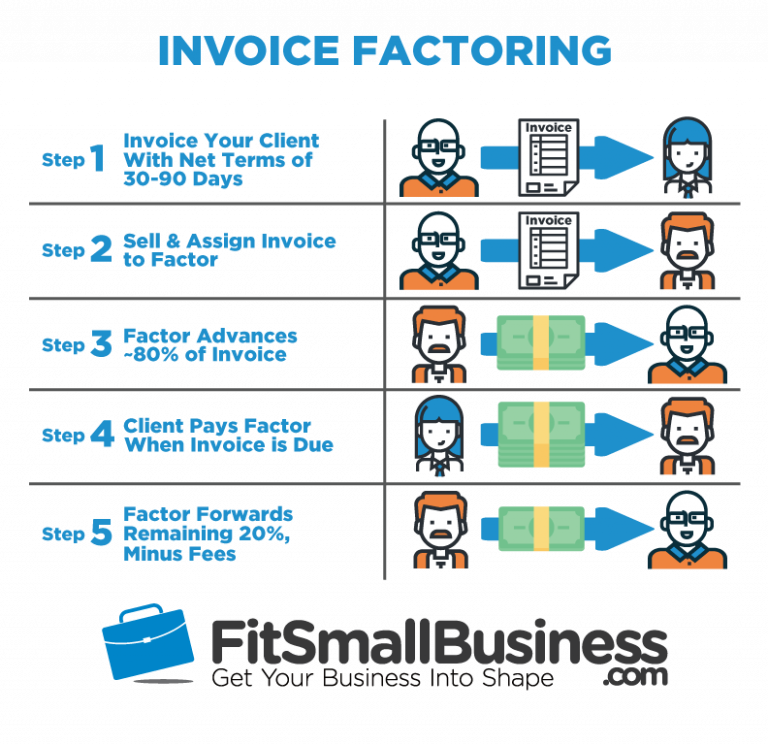

Invoice Factoring Small Business - If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Invoice factoring enables you to convert unpaid invoices into cash for your business. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. A basic introduction to invoice factoring for businesses. Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. This type of funding allows b2b.

If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Businesses can sell their outstanding invoices to an invoice factoring. This type of funding allows b2b. Invoice factoring enables you to convert unpaid invoices into cash for your business. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. A basic introduction to invoice factoring for businesses.

A basic introduction to invoice factoring for businesses. Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring enables you to convert unpaid invoices into cash for your business. This type of funding allows b2b. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track.

PPT How Small Business Invoice Factoring Improves Cash flow

Businesses can sell their outstanding invoices to an invoice factoring. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. A basic introduction to invoice factoring for businesses. Invoice factoring enables you to convert unpaid invoices into cash for your business. If unpaid.

Invoice Factoring How Factor Finance Works, Including Pros & Cons

A basic introduction to invoice factoring for businesses. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an.

Invoice Factoring altLINE by The Southern Bank

A basic introduction to invoice factoring for businesses. This type of funding allows b2b. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party.

Invoice Factoring Guide for Small Business ReliaBills

Businesses can sell their outstanding invoices to an invoice factoring. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Invoice factoring enables you to convert unpaid invoices into cash for your business. This type of funding allows b2b. A basic introduction to.

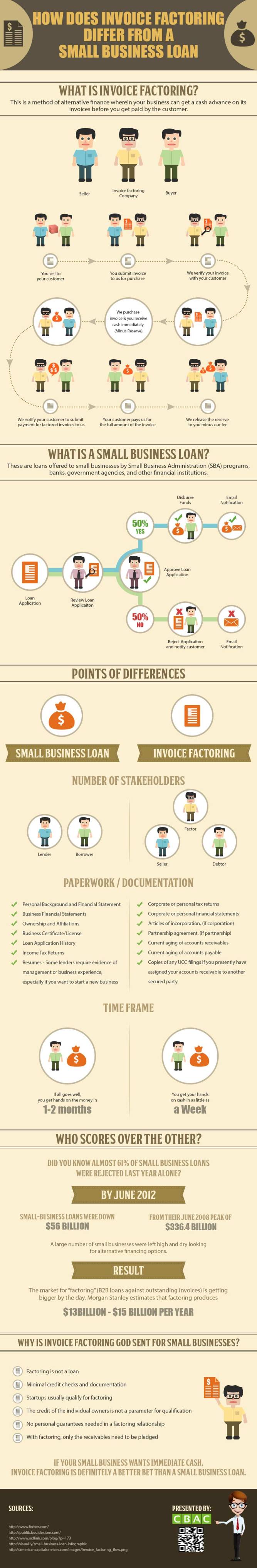

Invoice Factoring and Small Business Loans Know the Basic Difference

If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Businesses can sell their outstanding invoices to an invoice factoring. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. A basic introduction to.

Understanding Invoice Factoring A Guide for Small Business Owners

A basic introduction to invoice factoring for businesses. Invoice factoring enables you to convert unpaid invoices into cash for your business. Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. Businesses can sell their outstanding invoices to an invoice factoring. If unpaid.

Invoice Factoring Agreement Template

Use our guide to learn about how invoice factoring works, how it differs from other types of financing, and decide if it's right for your small business. A basic introduction to invoice factoring for businesses. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. This type of funding allows b2b. Invoice.

Invoice factoring is defined as an alternative method to the

Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. Businesses can sell their outstanding invoices to an invoice factoring. This type of funding allows b2b. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back.

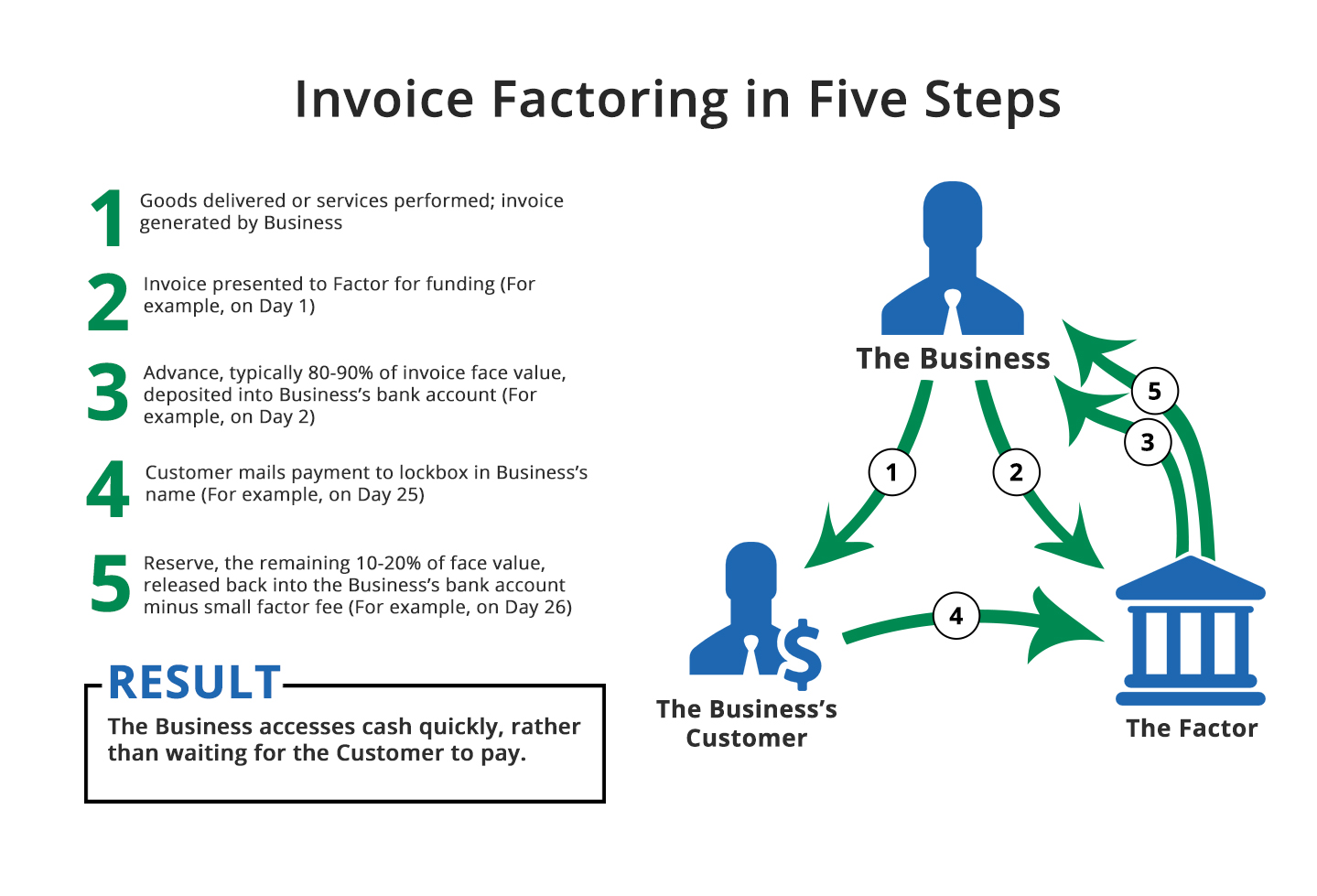

How Invoice Factoring Works

A basic introduction to invoice factoring for businesses. Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash. This type of funding allows b2b. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track..

How to Use Invoice Factoring for Small Business

Invoice factoring enables you to convert unpaid invoices into cash for your business. This type of funding allows b2b. A basic introduction to invoice factoring for businesses. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. Use our guide to learn about how invoice factoring works, how it differs from other.

This Type Of Funding Allows B2B.

Businesses can sell their outstanding invoices to an invoice factoring. If unpaid invoices are affecting your cash flow, invoice factoring may help get your finances back on track. A basic introduction to invoice factoring for businesses. Invoice factoring enables you to convert unpaid invoices into cash for your business.

Use Our Guide To Learn About How Invoice Factoring Works, How It Differs From Other Types Of Financing, And Decide If It's Right For Your Small Business.

Invoice factoring is a type of business financing that involves selling your unpaid invoices to a third party at a discount in exchange for an advance of cash.