Irs Form 2290 Due Date

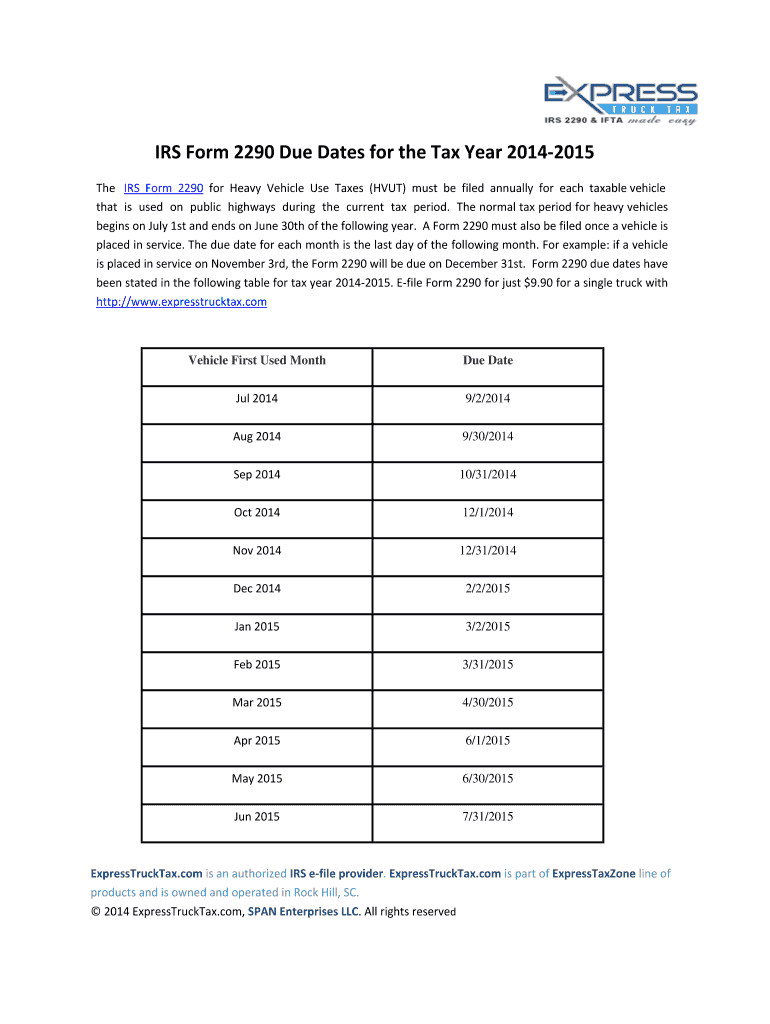

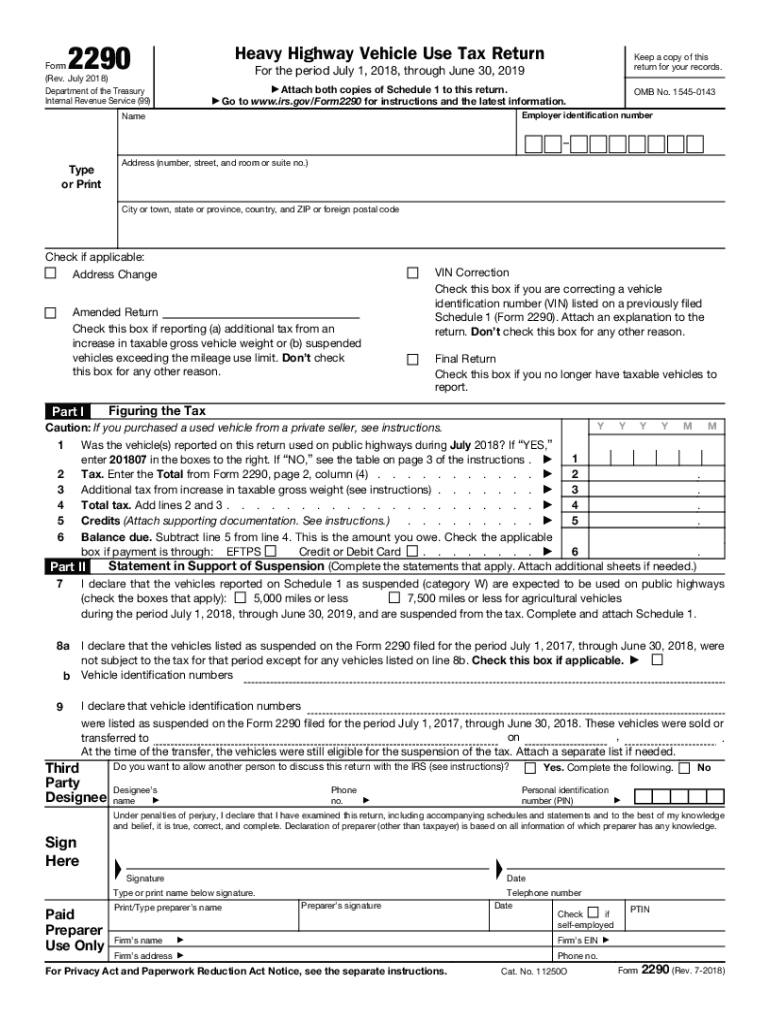

Irs Form 2290 Due Date - In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. If the due date falls on a saturday, sunday, or legal holiday, file by the next. The due date of form 2290 doesn’t change. Use the table below to determine your filing deadline. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. What is the irs form 2290 due date? The buyer should enter the month after the sale on form 2290, line 1 (example: November 2024 is entered as “202411”). If you have vehicles with a combined gross weight of 55,000 pounds or. Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form.

In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Use the table below to determine your filing deadline. November 2024 is entered as “202411”). If the due date falls on a saturday, sunday, or legal holiday, file by the next. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. The due date of form 2290 doesn’t change. If you have vehicles with a combined gross weight of 55,000 pounds or. What is the irs form 2290 due date? The buyer should enter the month after the sale on form 2290, line 1 (example:

Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. November 2024 is entered as “202411”). If you have vehicles with a combined gross weight of 55,000 pounds or. If the due date falls on a saturday, sunday, or legal holiday, file by the next. The buyer should enter the month after the sale on form 2290, line 1 (example: The due date of form 2290 doesn’t change. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. What is the irs form 2290 due date? In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. Use the table below to determine your filing deadline.

IRS Form 2290 due date for the year 202223 by trucktax online Issuu

What is the irs form 2290 due date? If the due date falls on a saturday, sunday, or legal holiday, file by the next. If you have vehicles with a combined gross weight of 55,000 pounds or. The due date of form 2290 doesn’t change. You must file form 2290 for these trucks by the last day of the month.

Form 2290 Due Date Heavy Vehicle Use Tax (HVUT) Deadline IRS

The due date of form 2290 doesn’t change. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. If the due date falls on a saturday, sunday, or legal holiday, file by the next. If you have vehicles with a combined gross weight of 55,000 pounds or. The buyer.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

November 2024 is entered as “202411”). What is the irs form 2290 due date? The buyer should enter the month after the sale on form 2290, line 1 (example: In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. The due date of form 2290 doesn’t change.

File IRS 2290 Form Online for 20232024 Tax Period

The buyer should enter the month after the sale on form 2290, line 1 (example: November 2024 is entered as “202411”). Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. What is the irs form 2290 due date? You must file form 2290 for these trucks by the.

IRS 2290 Due Dates 2014 Fill and Sign Printable Template Online US

You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. November 2024 is entered as “202411”). The buyer should enter the month after the sale on form 2290, line 1 (example: If the due date falls on a saturday, sunday, or legal holiday, file.

Get Form 2290 Schedule 1 in Minutes Efile Form 2290 Online

If the due date falls on a saturday, sunday, or legal holiday, file by the next. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. The due date of form 2290 doesn’t change. Note that as with all irs tax returns, if the.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

Use the table below to determine your filing deadline. In this case, the answer to the question, ‘when is the 2290 due’ is august 31st. If the due date falls on a saturday, sunday, or legal holiday, file by the next. You must file form 2290 for these trucks by the last day of the month following the month the.

Irs Form 2290 Due Date Form Resume Examples

The buyer should enter the month after the sale on form 2290, line 1 (example: If the due date falls on a saturday, sunday, or legal holiday, file by the next. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. In this case,.

Irs Gov 2290 20182024 Form Fill Out and Sign Printable PDF Template

Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. November 2024 is entered as “202411”). The buyer should enter the month after the sale on form 2290, line 1 (example: File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid.

Irs Form 2290 Due Date 2017 Form Resume Examples AjYdnDb2l0

Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. If you have vehicles with a combined gross weight of 55,000 pounds or. The due date of form 2290 doesn’t change. The buyer should enter the month after the sale on form 2290, line 1 (example: File form 2290.

The Buyer Should Enter The Month After The Sale On Form 2290, Line 1 (Example:

The due date of form 2290 doesn’t change. You must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Use the table below to determine your filing deadline. What is the irs form 2290 due date?

If You Have Vehicles With A Combined Gross Weight Of 55,000 Pounds Or.

November 2024 is entered as “202411”). Note that as with all irs tax returns, if the due date happens to fall on a weekend or holiday, form. File form 2290 and submit your 2290 payment for your heavy vehicle use tax on time to avoid penalties and interest. If the due date falls on a saturday, sunday, or legal holiday, file by the next.