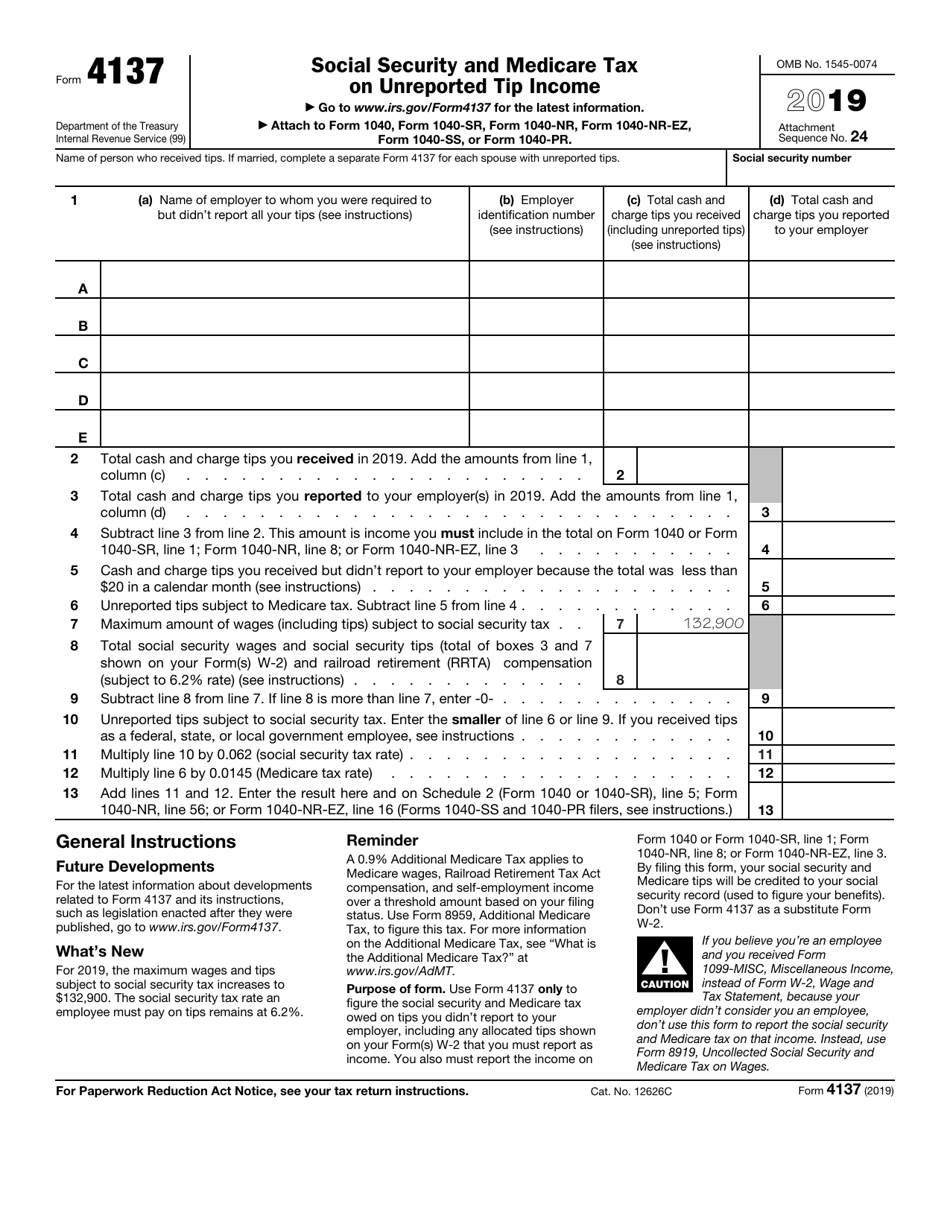

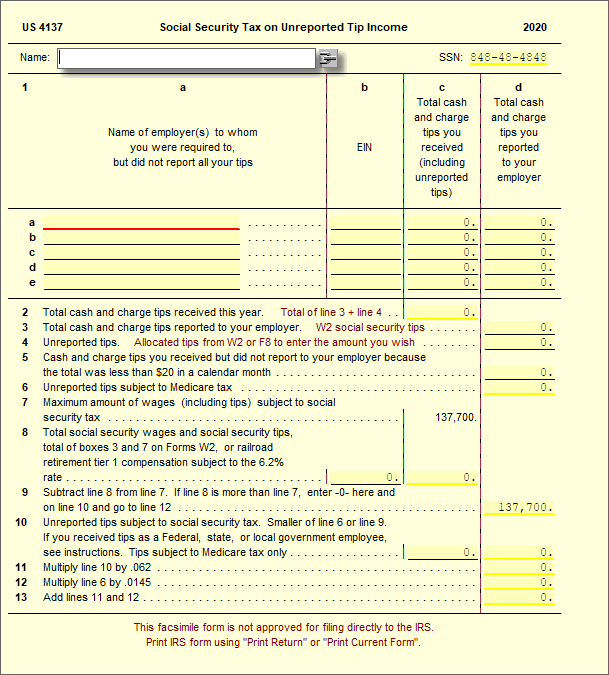

Irs Form 4137

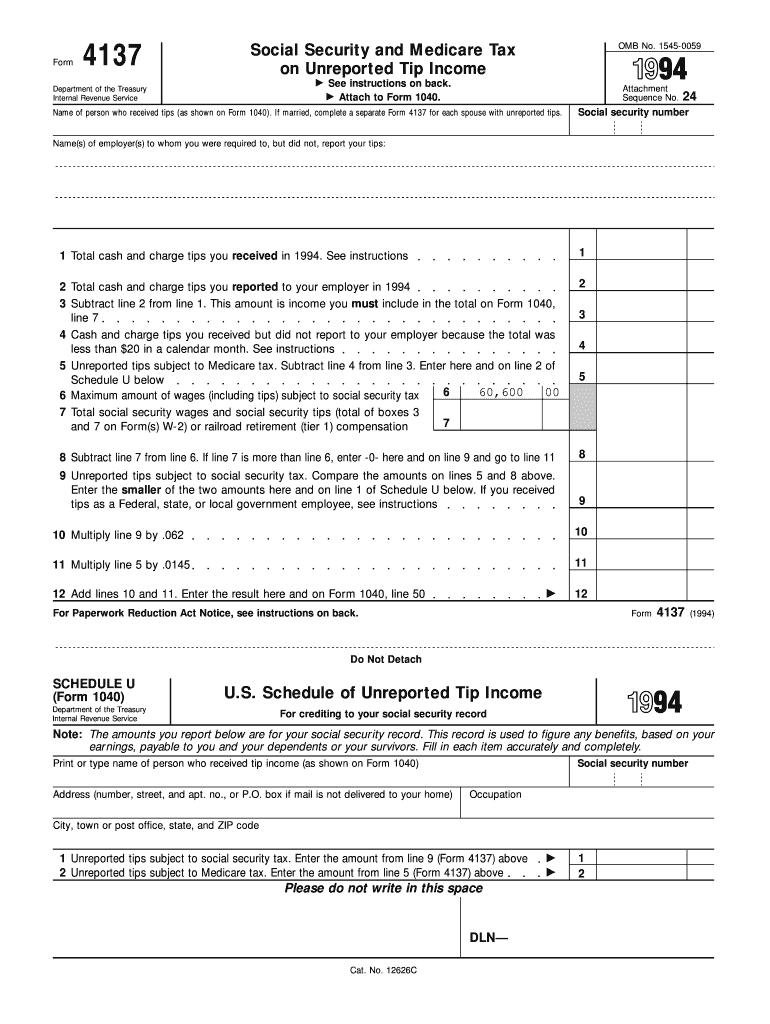

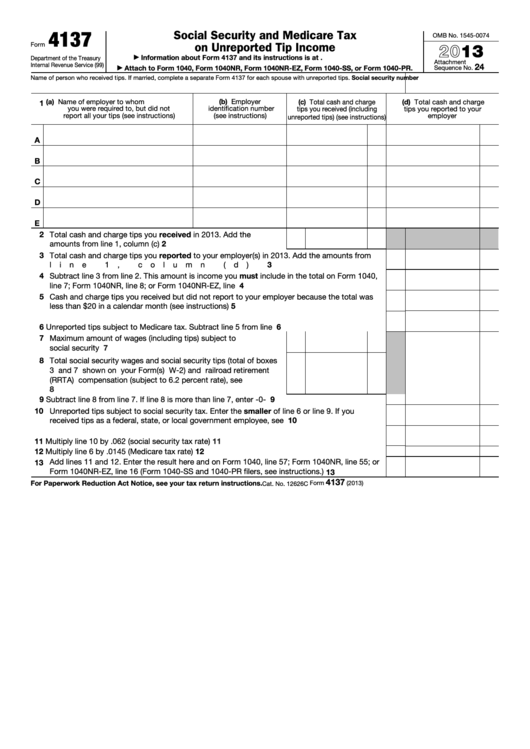

Irs Form 4137 - You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form.

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs.

Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form.

Form 4137

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. Learn how to report unreported tip income with form 4137 and pay.

IRS Form 4137 Download Fillable PDF or Fill Online Social Security and

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. You must file form 4137 if you received cash and charge tips.

Form 4137 Edit, Fill, Sign Online Handypdf

You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. Information about form 4137, social security and medicare tax on.

Form 4137

Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Information about form 4137, social security and medicare.

Fillable Online irs Form 4137 OMB No irs Fax Email Print pdfFiller

Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. You must file form 4137 if you received cash and charge tips of $20 or more.

Fillable Form 4137 Social Security And Medicare Tax On Unreported Tip

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. Information about form 4137, social security and medicare.

IRS Form 4137 Instructions Unreported Tip

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. You must file form 4137 if you received cash and charge tips.

IRS Form 4137 Instructions Unreported Tip

You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Learn how to report unreported tip.

Form 4137

Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Information about form 4137, social security.

U.S. TREAS Form treasirs41371992

Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions. Form 4137 is used to figure the social security and medicare tax owed on tips you did not report to your employer or allocated tips shown on form. Learn how to report unreported tip income with form 4137 and pay.

Form 4137 Is Used To Figure The Social Security And Medicare Tax Owed On Tips You Did Not Report To Your Employer Or Allocated Tips Shown On Form.

Learn how to report unreported tip income with form 4137 and pay the required social security and medicare taxes to stay compliant with irs. You must file form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those. Information about form 4137, social security and medicare tax on unreported tip income, including recent updates, related forms, and instructions.